The world's largest investor in #RenewableEnergy, @NextEraEnergy, sees US wind costs declining by 10% annually for the next four years, so even as subsidies cease, #wind will be the low cost source of new supply. #coal can't compete. 🇺🇸✅

investor.nexteraenergy.com/~/media/Files/…

investor.nexteraenergy.com/~/media/Files/…

And @NextEraEnergy expects ~10% annual solar deflation to continue as well, remaining the second lowest source of new electricity in the US.

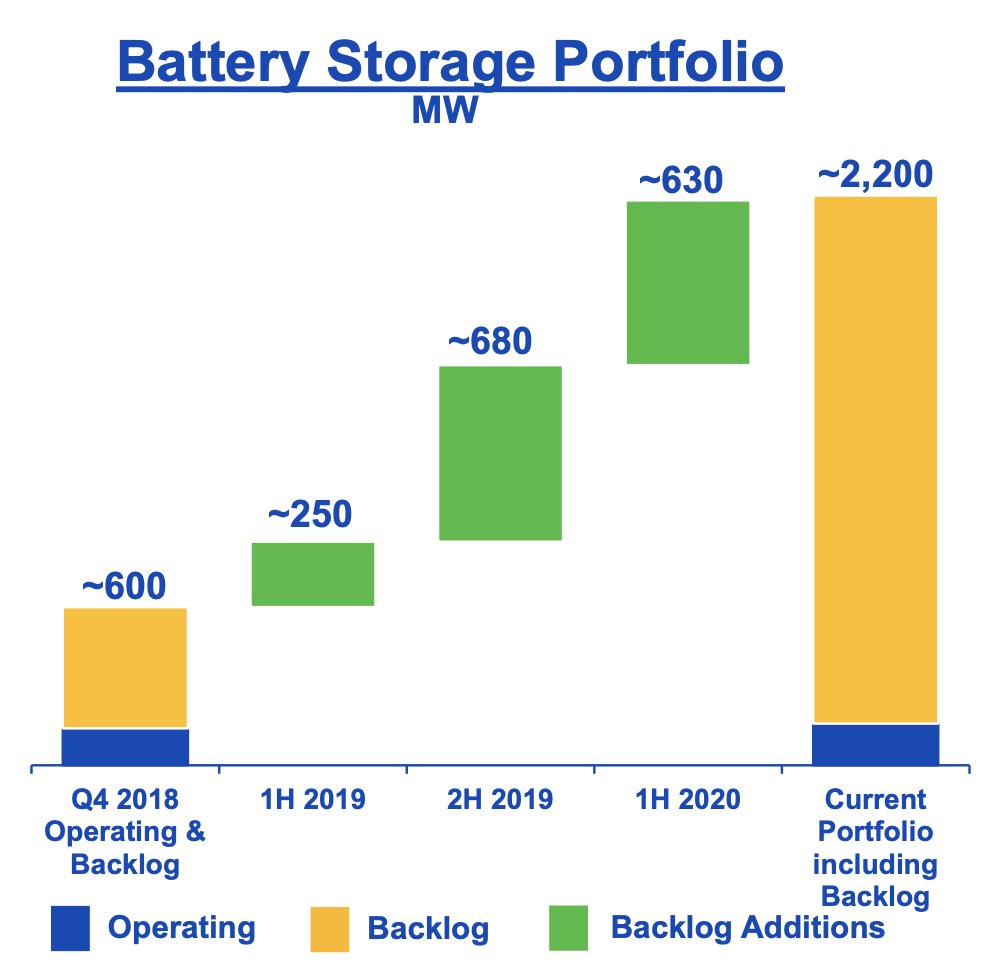

And batteries are seeing deflation of ~16% pa, meaning 4 hour storage will cost ~US$4-9/MWh by 2022, challenging peaking applications for fossil gas (solar already destroys that antiquated idea of gas base-load).

Other than @ScottMorrisonMP, who thinks a gaslit recovery works?!

Other than @ScottMorrisonMP, who thinks a gaslit recovery works?!

And @nexteraenergy is building 2.2GW of batteries as we speak, the world's largest investor in RE is now the world's largest investor in batteries. And one of the new investors in green hydrogen, set to be the next big electricity / manufacturing sector disruptor by 2030.

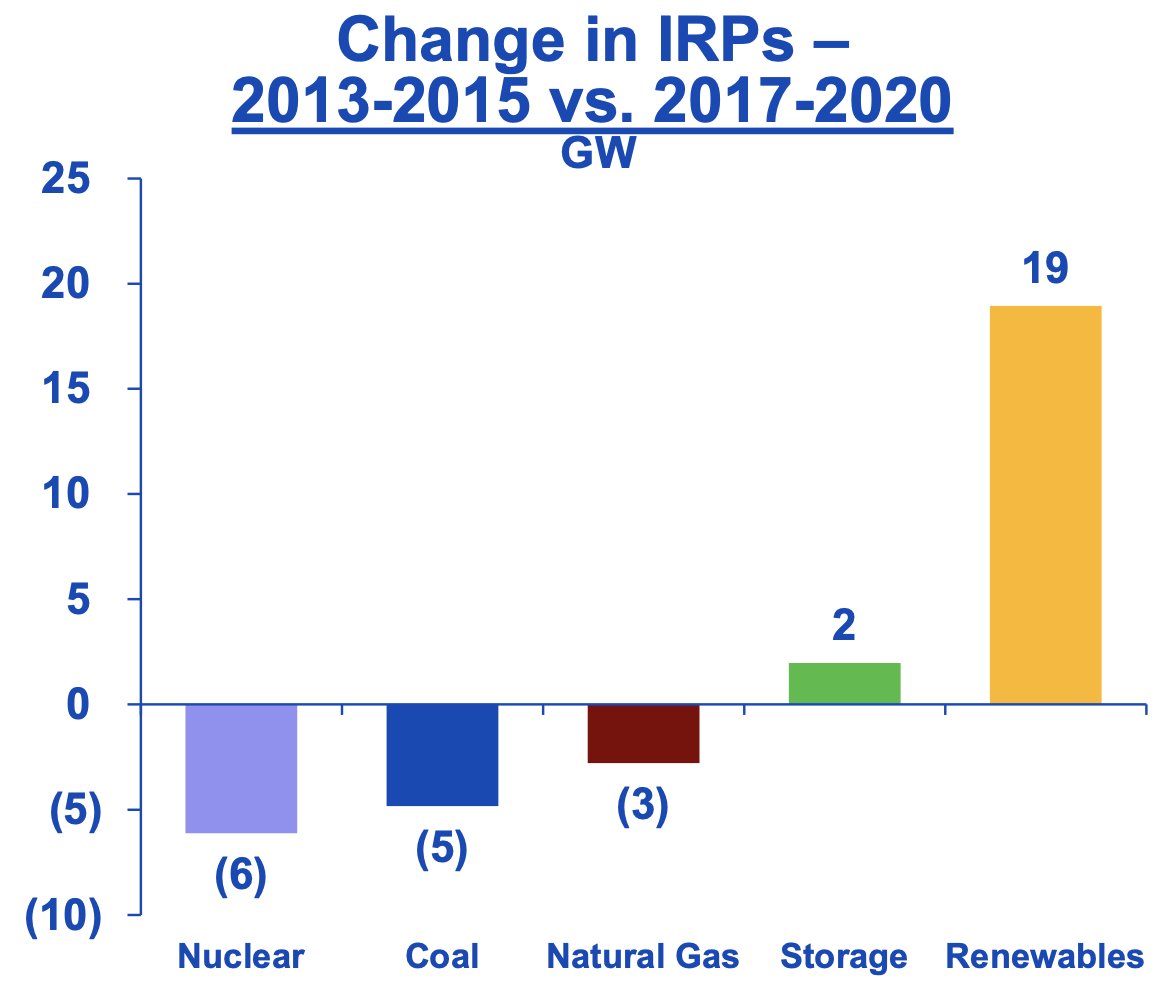

Forget the political spin, what are US investors betting on? Not nuclear, not coal, less gas and a lot more batteries and RE! 🇺🇸✅

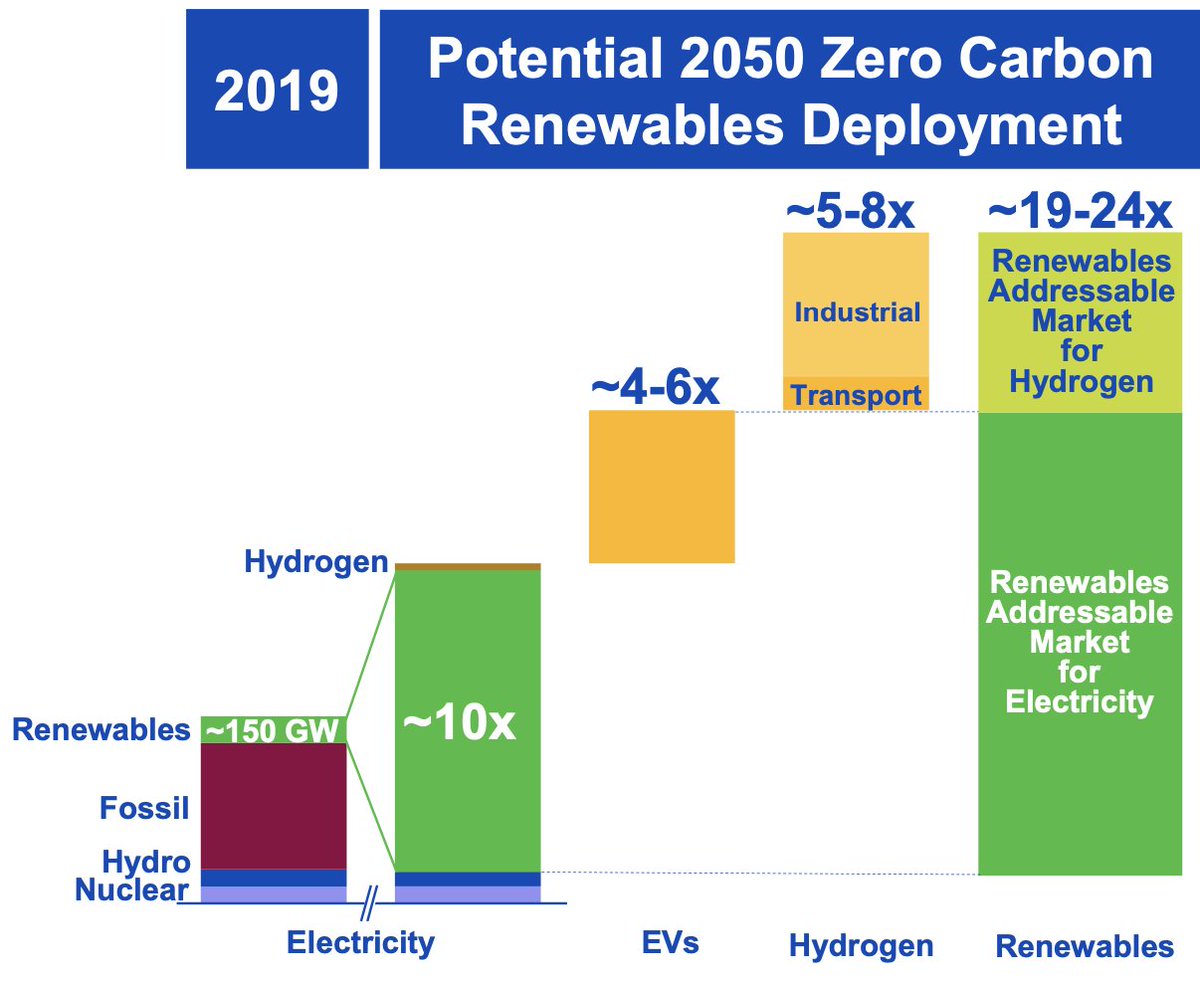

And @nexteraenergy sees #GreenHydrogen as a game changer, driving a twentyfold increase in US VRE deployments by 2050 vs 2019 levels.

NREL expects 500GW of new VRE to be installed this decade in the US, reaching ~40% share of generation (way deeper than the @IEABirol's SDS 32%).

NREL expects 500GW of new VRE to be installed this decade in the US, reaching ~40% share of generation (way deeper than the @IEABirol's SDS 32%).

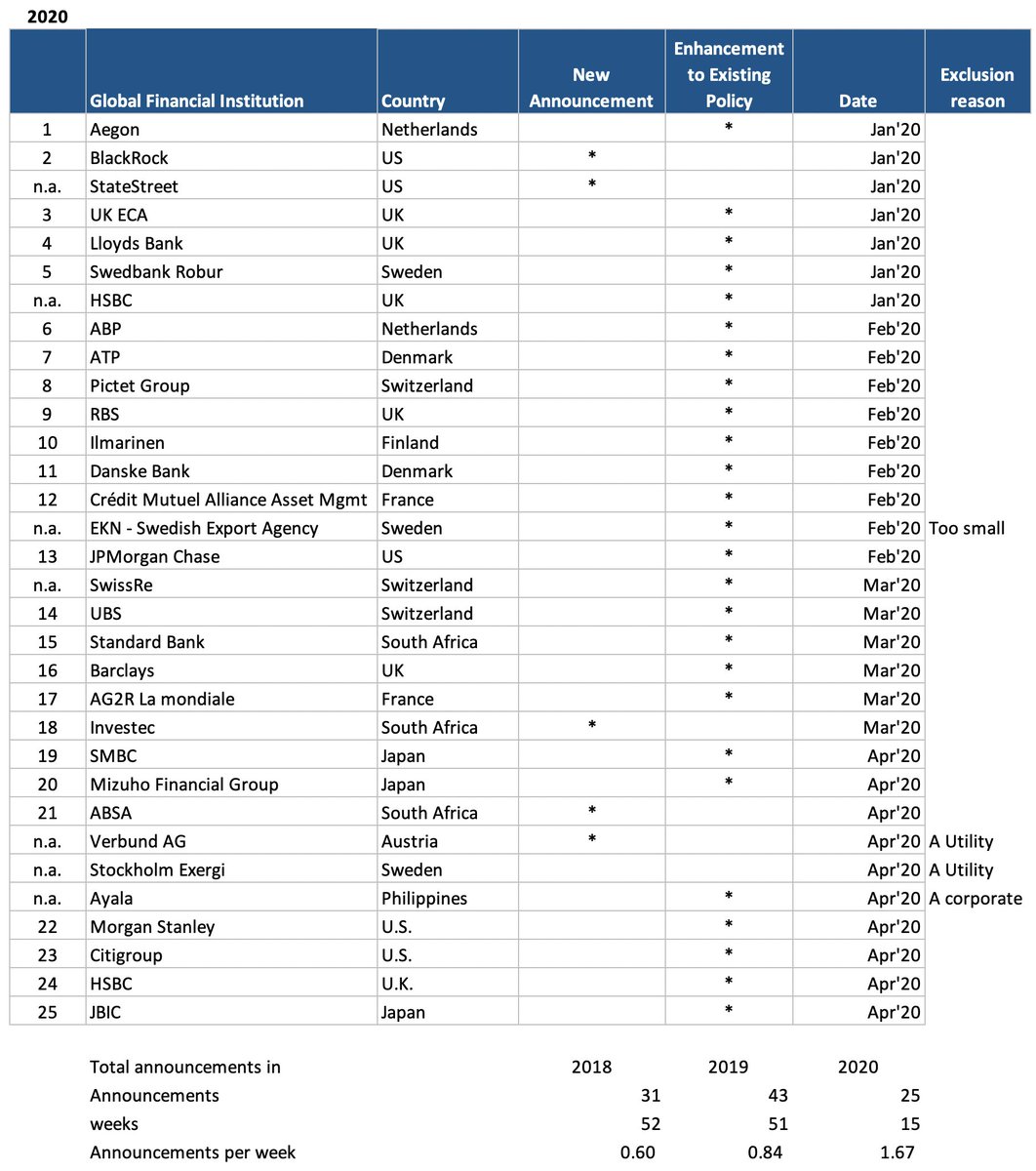

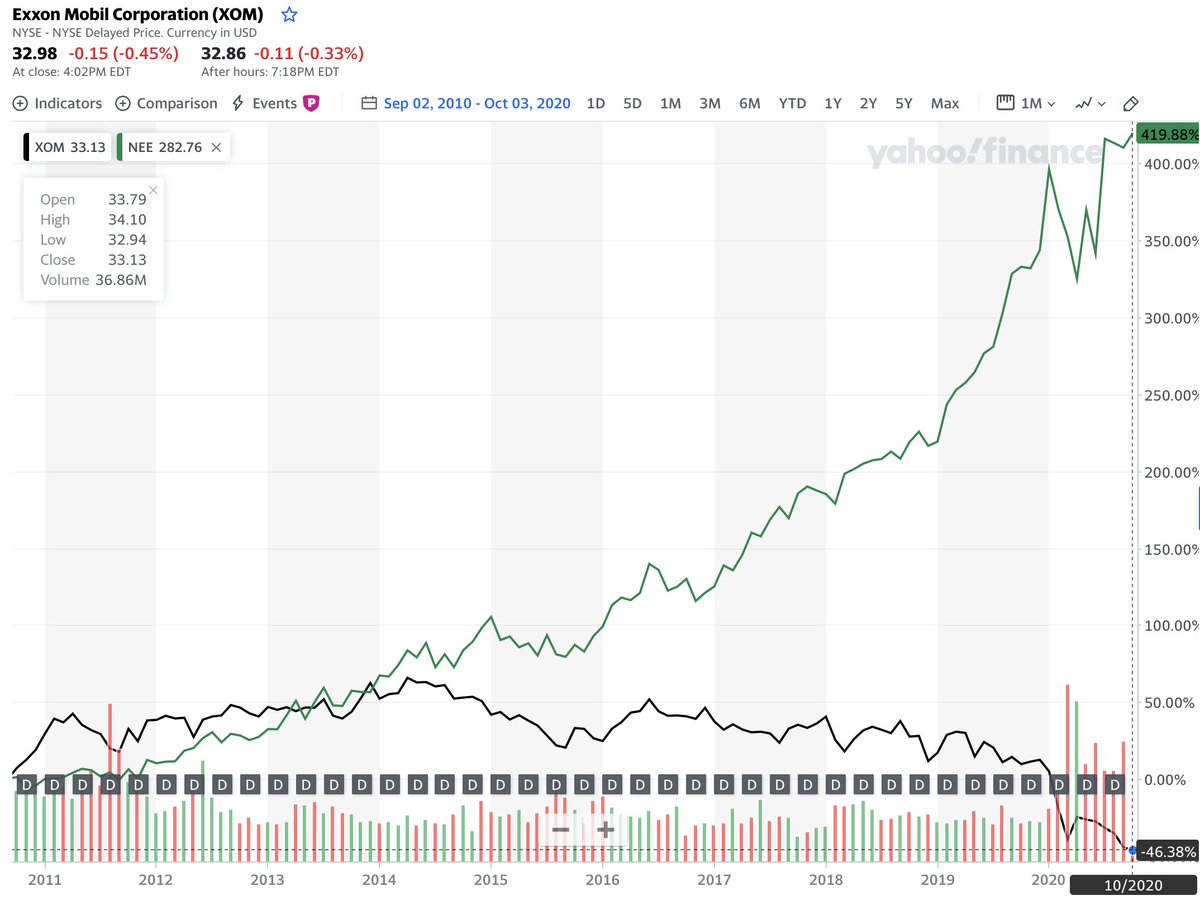

And because it is a defining moment in US energy market transition, I'll re-tweet that @nexteraenergy overtook the climate science denying @Exxonmobil in terms of market capitalisation last week, highlighting fossil fuels are proving a total wealth hazard, right @blackrock!

And Norway's US$1 trillion Sovereign Wealth Fund CEO Nicolai Tangen agrees - a strong ESG focus means a better long term risk-return profile for investors: “It’s been very profitable, very good for the fund in reducing risk.”

ft.com/content/39e5f8… by @rmilneNordic

ft.com/content/39e5f8… by @rmilneNordic

• • •

Missing some Tweet in this thread? You can try to

force a refresh