IEX- Beating Inefficiencies of the Indian Power Sector!

Power market in India is skewed towards the long-term market i.e power purchase sale/purchase agreements are done for a period > 7 yrs, whereas short-term market i.e the agreement for < 1 yr comprises 12% of the power market

Power market in India is skewed towards the long-term market i.e power purchase sale/purchase agreements are done for a period > 7 yrs, whereas short-term market i.e the agreement for < 1 yr comprises 12% of the power market

Power Market Share: Long-Term Transactions or Power Purchase agreement(PPA) dominates the power market with a 90% market share, whereas Power Exchanges are also picking up from 0.4% to 4.3% over the last 11 years.

The Short Term market is still in the nascent stage as compared to other countries e.g. in India just 4% of the total electricity transacted is done through exchanges whereas it is around 20-30% on an average in European countries. In India still there is huge headroom for growth

Let's look at IEX business model: It connects both the buyers and sellers of electricity, in a similar way as NSE which connects the buyers and sellers for security.

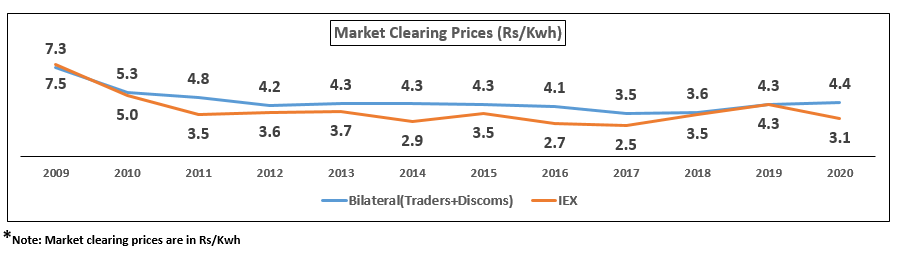

Bilateral volumes have grown at a CAGR of 9% over the last 11 years whereas IEX volumes have grown at a CAGR of 32% during the same period. And if we look at the last 5 years IEX volumes have grown at a CAGR of 14% whereas Bilateral Volumes have grown at 5% during the same period

Majority of times, IEX has delivered market-clearing prices lower than the traders meaning if you buy one kwh of electricity through a trader in 2020 it would cost you Rs 4.4 whereas the same kwh from IEX would have cost Rs 3.1, and this has been the trend since last many years

Near Term Growth Driver: Now as Real-Time Market is launched, Deviation Settlement Mechanism transaction will occur through Exchange.

With some uncertainties prevailing in the Energy Exchange market, IEX seems to have huge headroom to grow in terms of gaining market share in short term market as well as stealing it from traditional power purchase agreements

@amey_candor @Dhruvapandey @safiranand @nirvanatrails @Gautam__Baid @PPFAS @oraunak @RajeevThakkar @IEX_India_

• • •

Missing some Tweet in this thread? You can try to

force a refresh