1. Huge thanks to @digitalbrock and his team at @Round_Block for supporting me with some very useful #BTC @CMEGroup options data for research! I've been focused mostly on @DeribitExchange in the past but CME seems to target institutional folks which should lead to new insights.

2. Given I had access to historical time-series options data, one of my first thoughts was to implement @SqueezeMetrics's paper on Gamma Exposure (GEX) and see whether this metric is relevant to crypto markets. This will be a longer and more involved post!

squeezemetrics.com/download/white…

squeezemetrics.com/download/white…

3. Market-makers generally do not like to have exposure to the price of the underlying as their business is focused on collecting the bid-ask spread. To stay in business, option market-makers hedge their delta exposures when buying or selling options.

4. Recall gamma is the change in delta for a change in the spot price. If we are able to determine the aggregate gamma position for market-makers across all options, we can determine when they will need to delta-hedge and evaluate their impact on the market accordingly.

5. Below are a few examples to help understand the impact of gamma and delta-hedging from the perspective of a market-maker (MM). Please note Δ = delta.

6. Ex. 1 - Trader Short Call Option and Market-Maker Long Call Option:

- Trader SELL BTC call w/ Δ of +0.40

- Trader Δ exposure = -1 x (+0.40) = -0.40

- MM BUY BTC call w/ Δ of +0.40

- MM Δ exposure = +1 x (+0.40) = +0.40

- MM Δ hedge with spot = -0.40

- MM total Δ = 0

- Trader SELL BTC call w/ Δ of +0.40

- Trader Δ exposure = -1 x (+0.40) = -0.40

- MM BUY BTC call w/ Δ of +0.40

- MM Δ exposure = +1 x (+0.40) = +0.40

- MM Δ hedge with spot = -0.40

- MM total Δ = 0

7. In Ex. 1, suppose BTC falls and call delta declines to 0.30. The MM's delta exposure to the call is now +0.30 but the spot exposure is -0.40, resulting in a net exposure of +0.30 - 0.40 = -0.10. As a result, the MM must *buy* 0.10 BTC to remain delta neutral.

8. Ex. 2 - Trader Short Put Option and Market-Maker Long Put Option:

- Trader SELL BTC put w/ Δ of -0.30

- Trader Δ exposure = -1 x (-0.30) = +0.30

- MM BUY BTC put w/ Δ of -0.30

- MM Δ exposure = +1 x (-0.30) = -0.30

- MM Δ hedge with spot = +0.30

- MM total Δ = 0

- Trader SELL BTC put w/ Δ of -0.30

- Trader Δ exposure = -1 x (-0.30) = +0.30

- MM BUY BTC put w/ Δ of -0.30

- MM Δ exposure = +1 x (-0.30) = -0.30

- MM Δ hedge with spot = +0.30

- MM total Δ = 0

9. In Ex. 2, suppose BTC rises and put delta increases to -0.25. The MM's delta exposure to the put is now -0.25 but the spot exposure is +0.30, resulting in a net exposure of 0.30 - 0.25 = +0.05. As a result, the MM must *sell* 0.05 BTC to remain delta neutral.

10. In the cases above when the MM is long options they are long gamma. This means their delta hedging activities will go directly against the trend of the market. This lowers volatility and "pins" the spot price. As a result, when MMs have +gamma exposure we can expect low vol.

11. Now things get interesting when the MM is short gamma...

12. Ex. 3 - Trader Long Call Option and Market-Maker Short Call Option

- Trader BUY BTC call w/ Δ of +0.40

- Trader Δ exposure = 1 x (+0.40) = 0.40

- MM SELL BTC call w/ Δ of +0.40

- MM Δ exposure = -1 x (+0.40) = -0.40

- MM Δ hedge with spot = +0.40

- MM total Δ = 0

- Trader BUY BTC call w/ Δ of +0.40

- Trader Δ exposure = 1 x (+0.40) = 0.40

- MM SELL BTC call w/ Δ of +0.40

- MM Δ exposure = -1 x (+0.40) = -0.40

- MM Δ hedge with spot = +0.40

- MM total Δ = 0

13. Suppose BTC were to drop moving the call delta to 0.30. The MM's delta exposure to the call option is -0.30 but the spot exposure is +0.40, resulting in a net exposure of -0.30 + 0.40 = 0.10. As a result, the MM must *sell* 0.10 BTC to remain delta neutral.

14. Ex. 4 - Trader Long Put Option and Market-Maker Short Put Option

- Trader BUY BTC put w/ Δ of -0.30

- Trader Δ exposure = 1 x (-0.30) = -0.30

- MM SELL BTC put w/ Δ of -0.30

- MM Δ exposure = -1 x (-0.30) = +0.30

- MM Δ hedge with spot = -0.30

- MM total Δ = 0

- Trader BUY BTC put w/ Δ of -0.30

- Trader Δ exposure = 1 x (-0.30) = -0.30

- MM SELL BTC put w/ Δ of -0.30

- MM Δ exposure = -1 x (-0.30) = +0.30

- MM Δ hedge with spot = -0.30

- MM total Δ = 0

15. In Ex.4, suppose BTC were to rise moving the put delta to -0.25. In this case, the MM's delta exposure to the put is +0.25 but the spot exposure is -0.30, resulting in a net exposure of 0.25 - 0.30 = -0.05. As a result, the MM must *buy* 0.05 BTC to remain delta neutral.

16. In these 2 cases above, when the MM is short an option they have negative gamma exposure. Consequentially, their delta-hedging will now go directly with the trend of the market. When prices go down they must sell and when prices go up they must buy to remain delta neutral.

17. Negative gamma exposure at an aggregate MM level can have a cascading effect where a drop or increase in price will further accelerate moves. MMs with large negative gamma exposures "add fuel to the fire" which magnify price moves and increase volatility.

18. Now let's get to the key GEX assumptions:

- Investors only sell calls and purchase puts

- MMs remain long calls and short puts

This is somewhat reasonable in traditional markets but harder to justify in crypto. Nonetheless, we'll stick with it and see what happens.

- Investors only sell calls and purchase puts

- MMs remain long calls and short puts

This is somewhat reasonable in traditional markets but harder to justify in crypto. Nonetheless, we'll stick with it and see what happens.

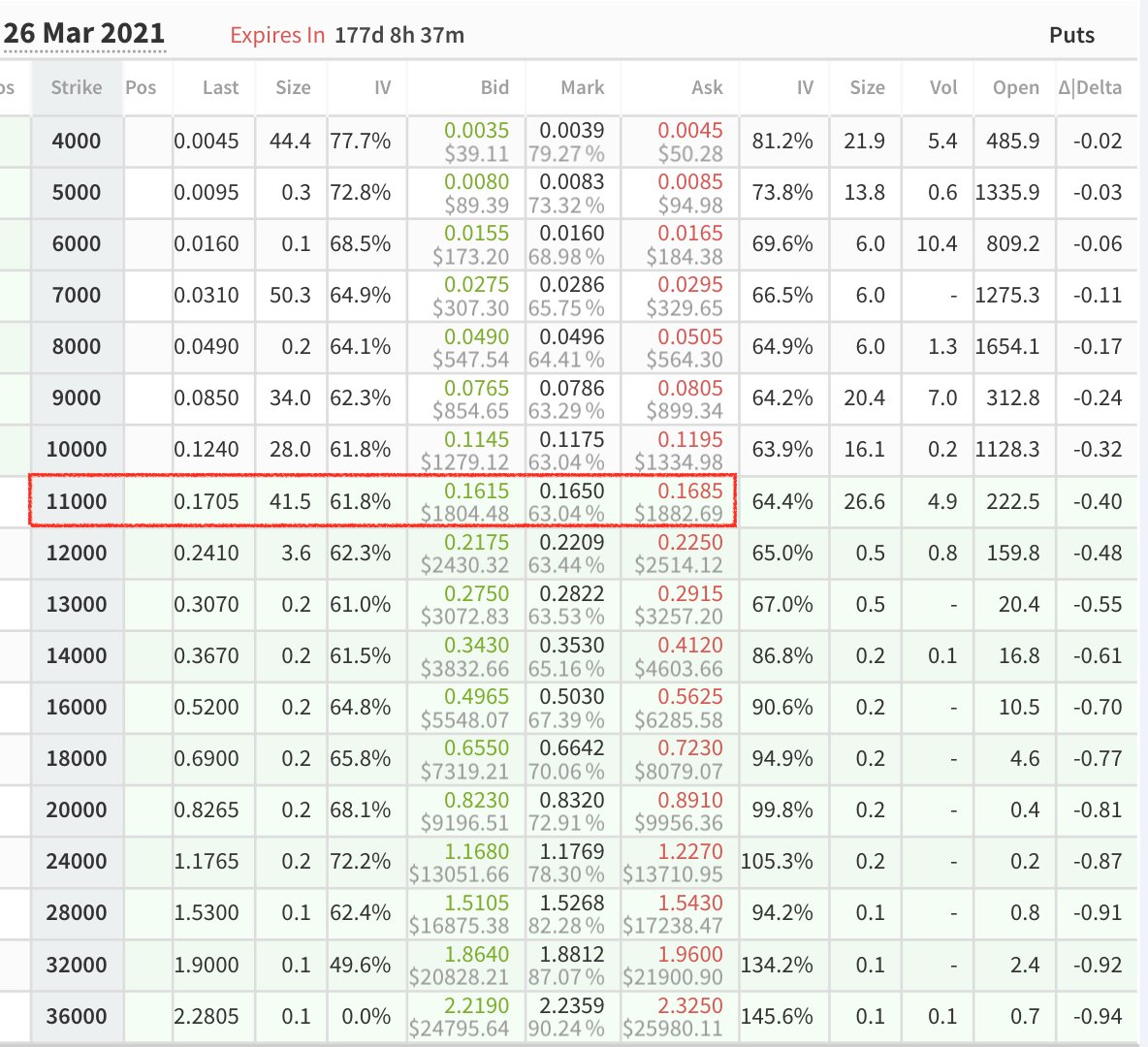

19. The formula is as follows (OI = Open interest):

GEX = SUM[(Call OI x Gamma) - (Put OI x Gamma)]

This is done across all strikes for every single maturity. With the comprehensive CME data we can calculate a GEX figure everyday and see how trends emerge over time.

GEX = SUM[(Call OI x Gamma) - (Put OI x Gamma)]

This is done across all strikes for every single maturity. With the comprehensive CME data we can calculate a GEX figure everyday and see how trends emerge over time.

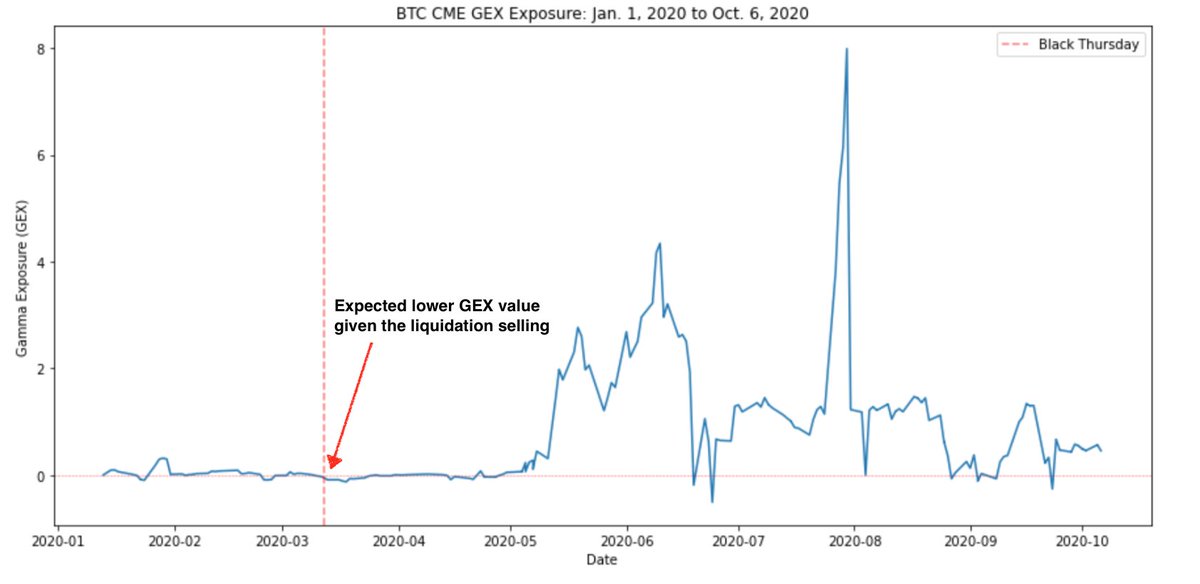

20. Recall from above, GEX < 0 indicates higher market volatility given negative MM gamma exposure. We can see from this chart below of 1 day lagged daily returns and the current GEX where "large moves" (+/- 10% daily) tend to occur mostly at low or sub-zero GEX values.

21. The crypto GEX somewhat resembles @SqueezeMetrics's findings but given our limited data in crypto options (< 1 year), it's likely not enough to come up with a conclusive statement - at least yet!

22. We can also look at the aggregate GEX exposure across time. Surprisingly, despite the Black Thursday crash the GEX value was only slightly negative. I would have expected a more negative GEX given the cascading liquidations during this time.

23. The crypto GEX in its current form is not yet a fully reliable signal. I expect GEX to be more accurate as we include more historical data and see new institutional players enter this space. Nonetheless, I find this framework a useful guide to think about market positioning.

Would love to get some thoughts on this approach: @fb_gravitysucks , @ConvexMonster, @JSterz, @SqueezeMetrics, @ambergroup_io , @digitalbrock, @kyled116

• • •

Missing some Tweet in this thread? You can try to

force a refresh