I recently heard someone refer to MMT as “dangerous.” It is upsetting to those who prefer to stay nestled in the conventional discourse, where it is acceptable to change one’s answers to age-old questions but not to challenge the questions themselves. 1/4

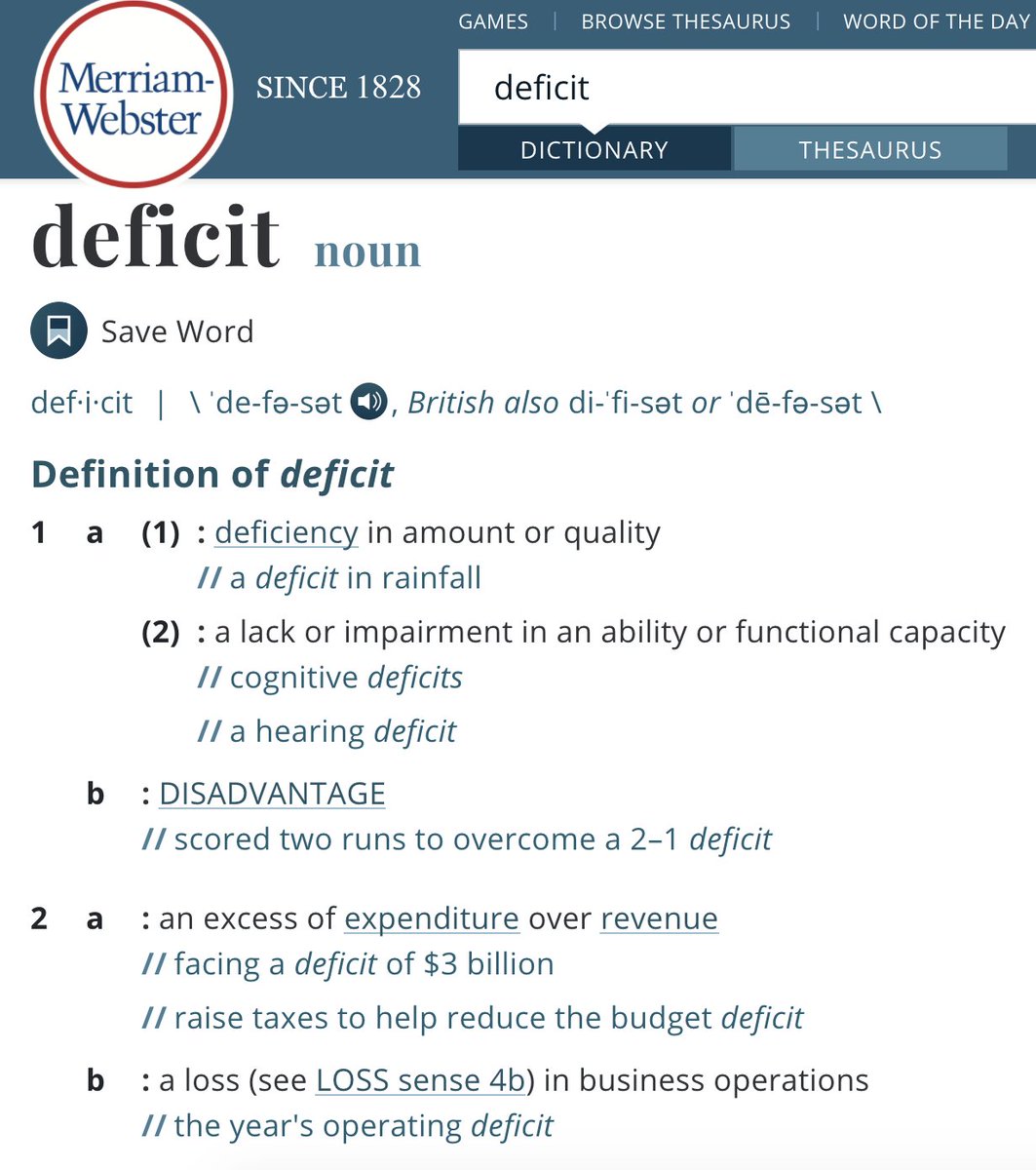

Thus, “How much does the government *need* to tax vs borrow to pay for its spending?” can be answered differently by “reasonable” people. 2/4

Dangerous people change the questions: “What is the purpose of taxing and borrowing, and when/why should a currency-issuing government *choose* to do more of either?” 3/4

Paradigms shift (and science makes progress) when we are willing to challenge our priors by changing the questions we ask. 4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh