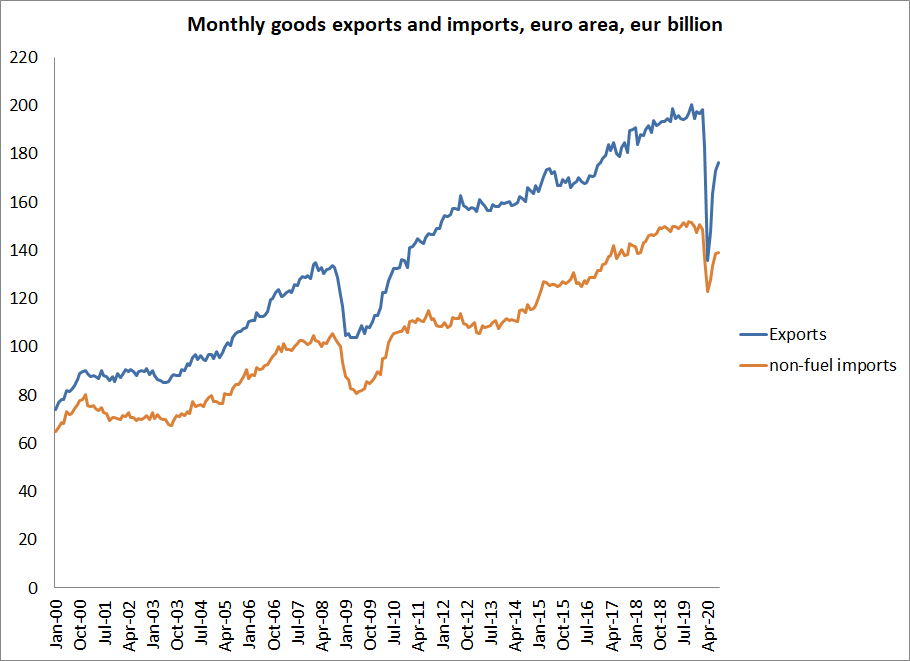

A thread on the euro area's August trade data.

The overall trade surplus (goods only, but the services balance is hugely distorted by Ireland) is almost back to its pre COVID-19 shock levels

That tho misleads, as lower oil imports offset a much lower non-petrol surplus

1/x

The overall trade surplus (goods only, but the services balance is hugely distorted by Ireland) is almost back to its pre COVID-19 shock levels

That tho misleads, as lower oil imports offset a much lower non-petrol surplus

1/x

Excluding oil, overall goods trade hadn't fully recovered in August (Europe here differs from China)

2/x

2/x

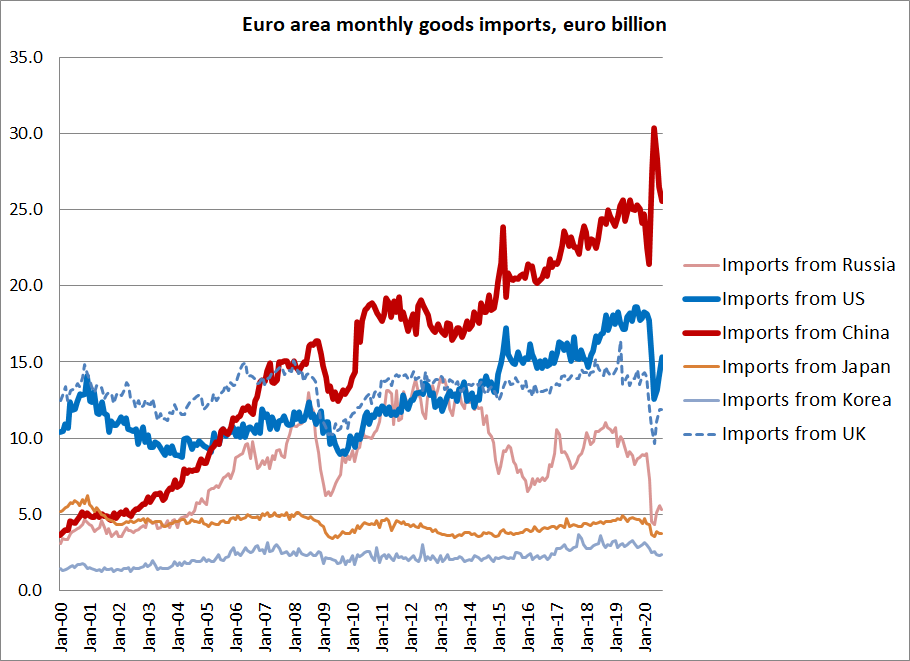

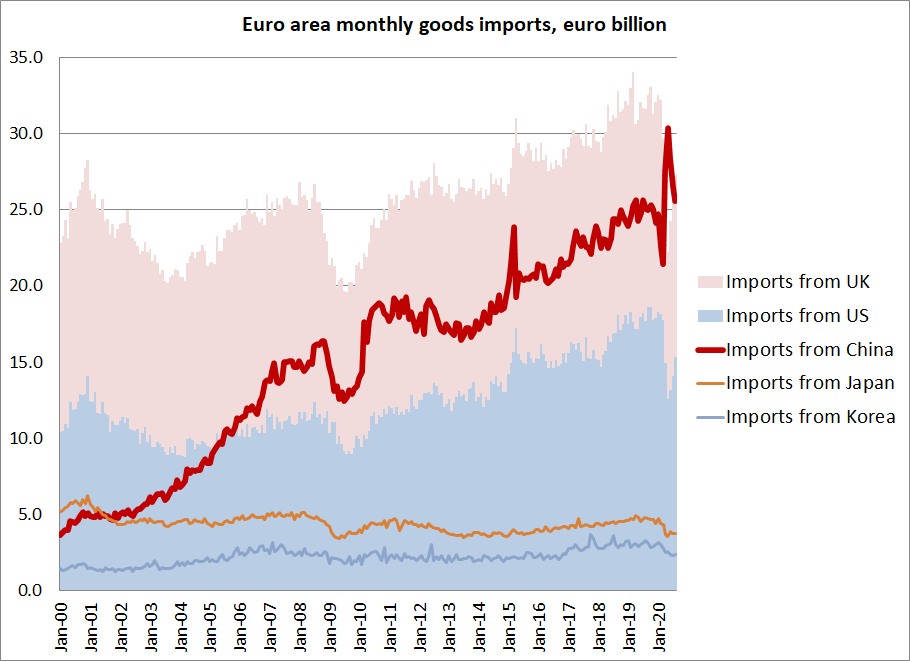

Euro area imports from China have returned to more or less normal (after a huge spike in May, no doubt linked to medical supplies). But China is clearly doing better at selling to Europe than the EA's other trading partners (relative outperformance remains)

3/x

3/x

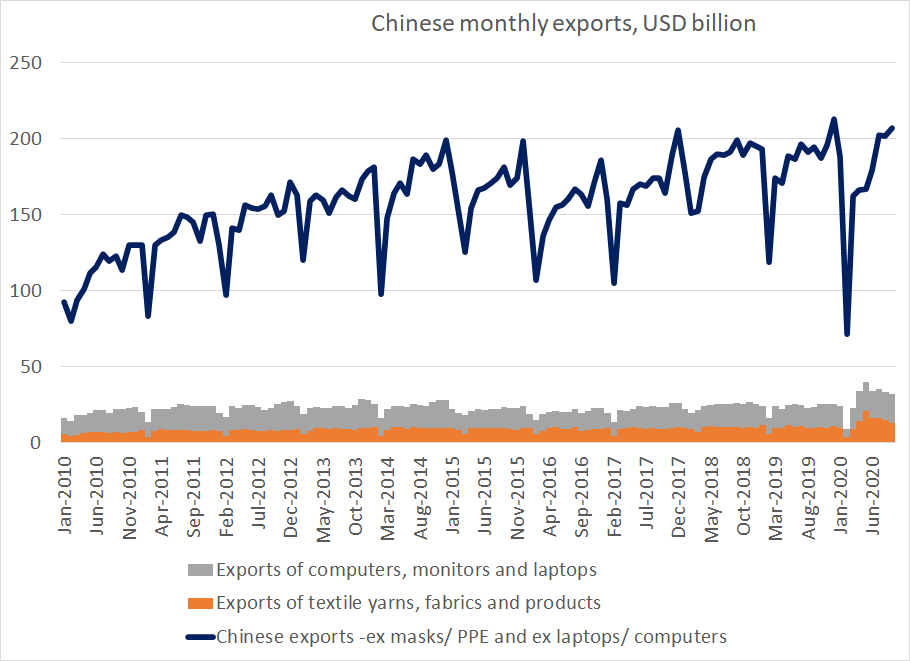

Interesting factoid, that runs a bit against the notion that the pandemic would lead to supply chain reshoring (or at least more production in allied countries) --

the EA now imports as much from China as from the US and the UK combined ...

4/x

the EA now imports as much from China as from the US and the UK combined ...

4/x

Euro area exports to the US and UK haven't fully recovered -- the big recent boom in US goods imports is going to Asia, not Europe.

5/x

5/x

The euro area data lags a bit (all those different national data sets that have to be combined) but the basic story here is consistent with the US and Chinese numbers.

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh