Even with the unusually strong (and unlikely to be sustained) September rise in imports, the y/y rise in China's manufacturing surplus in the third quarter looks to be around $150b (~1% of China's GDP)

1/x

1/x

That's in line with biggest (in dollar terms) y/y rises before COVID-19 --

But it is striking because it comes at a time when overall trade is down

2/x

But it is striking because it comes at a time when overall trade is down

2/x

I think with hindsight there is a case that China's manufacturing surplus has been on an upswing since 2016 (i.e. after the big CNY depreciation), though the impact of the tariffs masked that upswing in 2019

(and some will argue that 2020 is a one off ...)

3/x

(and some will argue that 2020 is a one off ...)

3/x

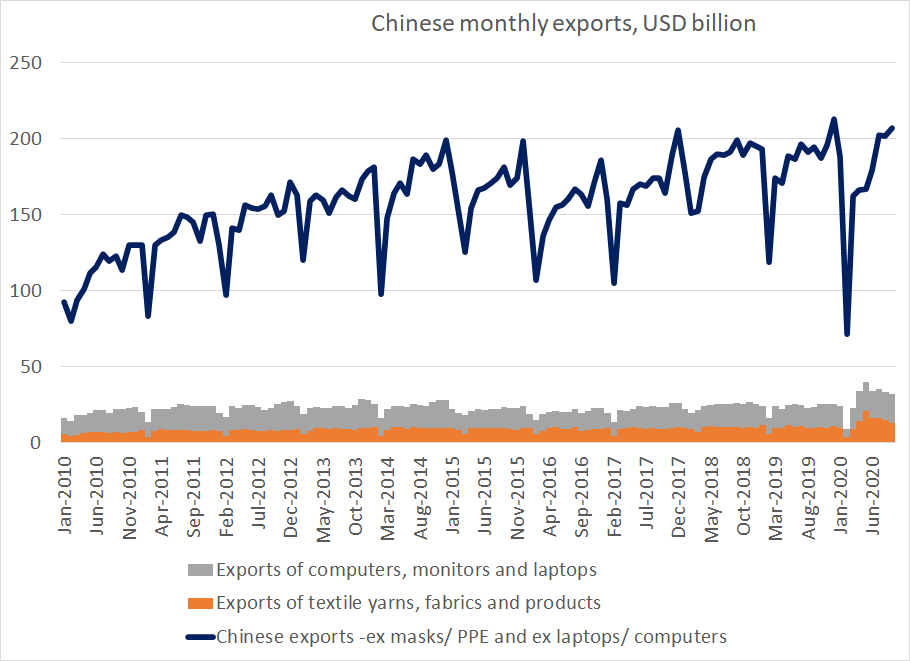

and China's q3 export strength isn't actually driven just by PPE (PPE export peaked in q2) or even by PPE and laptops ...

even if those categories are excluded, exports are up y/y

4/x

even if those categories are excluded, exports are up y/y

4/x

the commodity balance was roughly unchanged y/y in q3 in dollar terms, which implies that the deficit rose in real terms -- so the reported y/y contribution from net exports isn't entirely unreasonable.

5/x

5/x

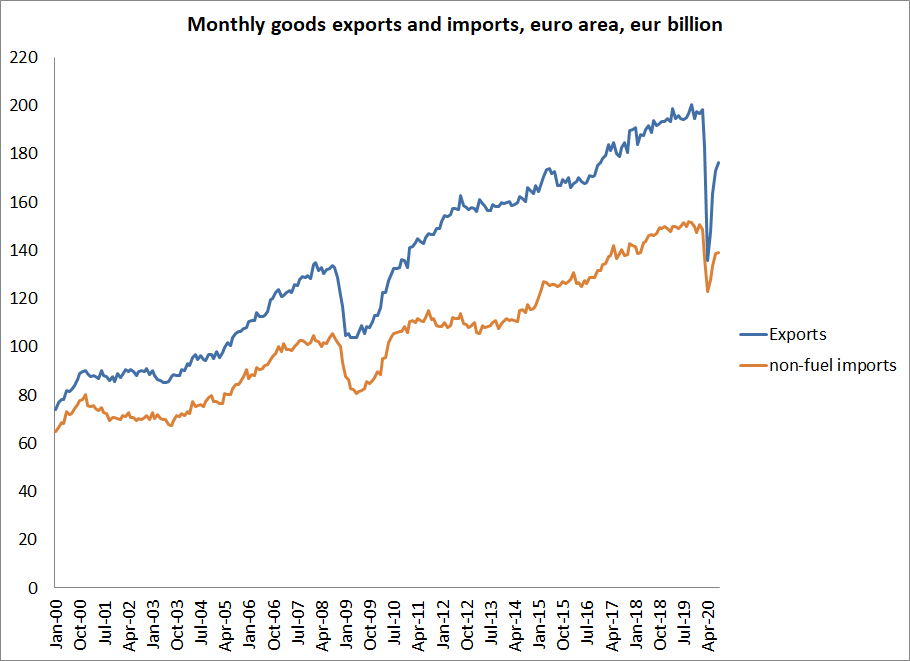

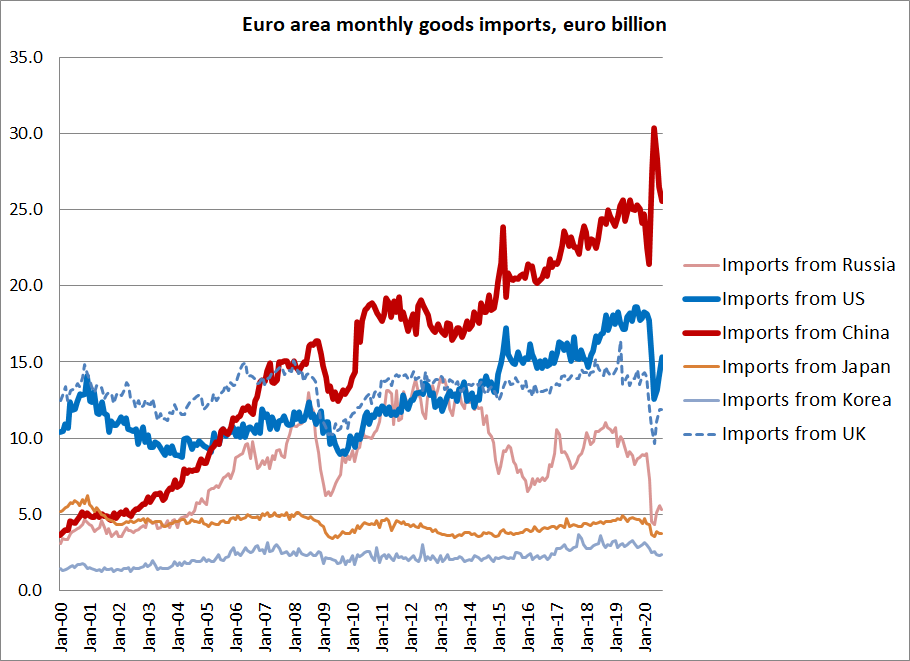

But it still is an amazing contribution from net exports for a country that has to export to world that is doing much less well than it is -- Chinese exports are up even when trading partner demand is WAY down

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh