Think the framing on this WSJ story is backwards -- real question is how long can China rely on the (weak) rest of the world to drive its own recovery

Net exports have been supporting Chinese growth in q2 and q3, not the other way around

1/x

wsj.com/articles/china…

Net exports have been supporting Chinese growth in q2 and q3, not the other way around

1/x

wsj.com/articles/china…

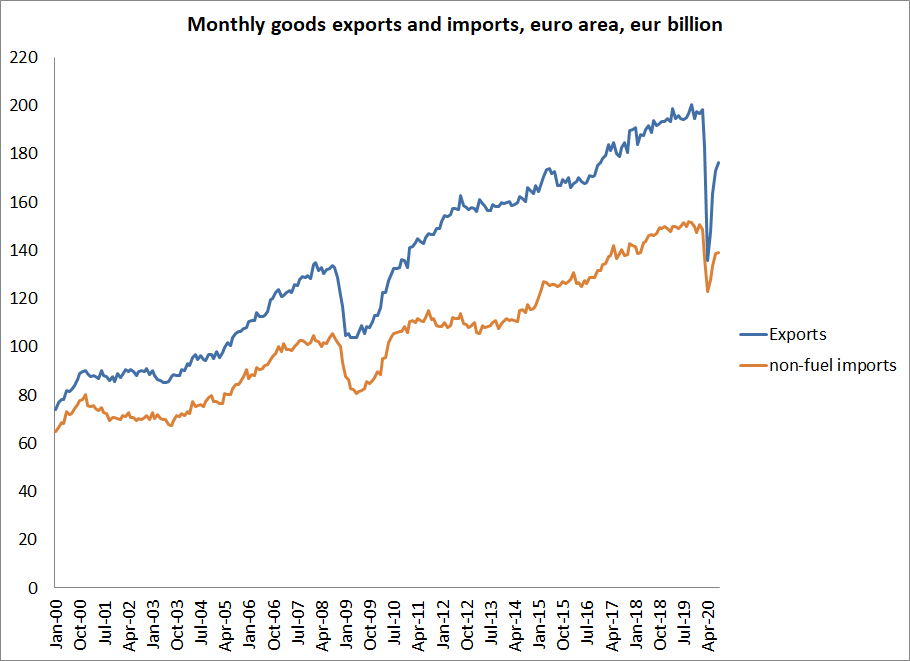

China's contribution to global growth is at least in part a function of whether it imports more than it exports.

And right now China is exporting more to the world (i.e. drawing on trading partners demand to support its growth) than it is importing

2/x

And right now China is exporting more to the world (i.e. drawing on trading partners demand to support its growth) than it is importing

2/x

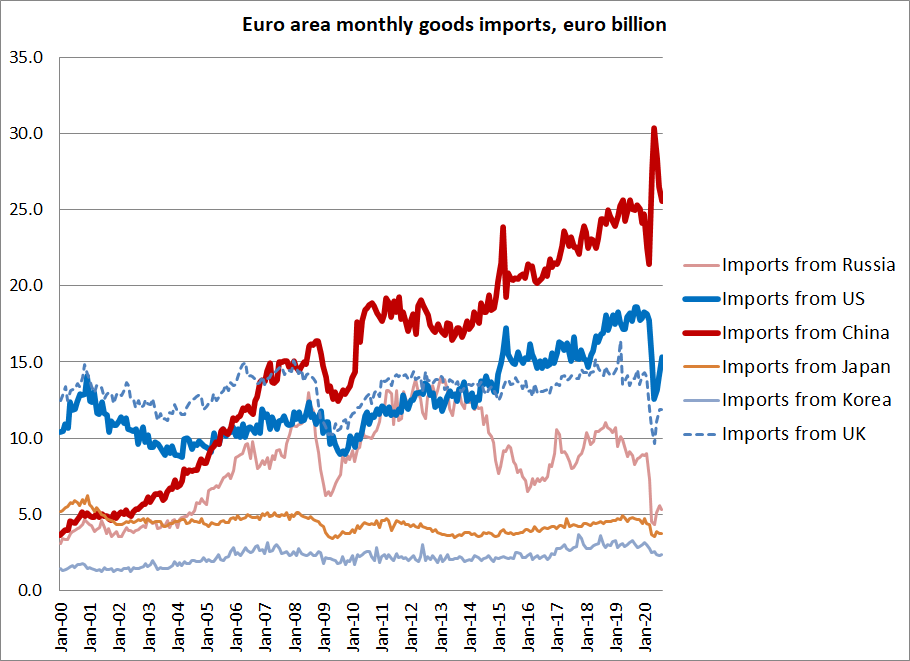

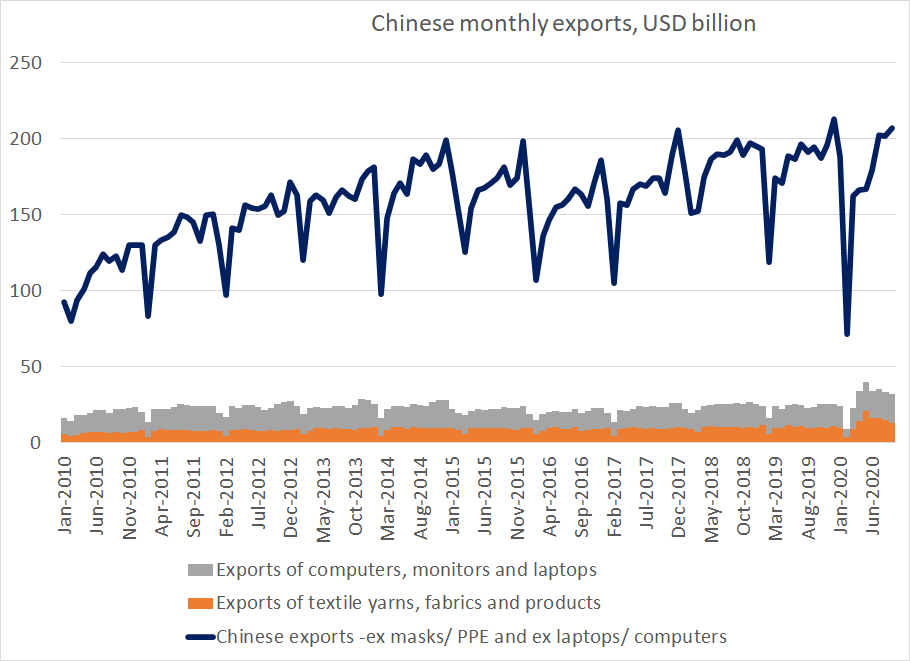

The common notion that China's export boom is a function of PPE exports and increased demand for laptops to work from home understates the breadth of China's export recovery ...

3/x

3/x

Laptops and PPE drove the initial rebound in China's exports in q2, but in q3 exports were up 5% even excluding the categories that pick up PPE exports (textile and textile products) and laptops (ADPs and parts)

4/x

4/x

The story here is not whether or not China will support the global recovery (it isn't right now, and there is no sign it will, apart from helping to meet global demand for PPE). Rather it is how long can China continue to grow rapidly without stronger domestic consumption)

5/x

5/x

+ 5% y/y growth when retail sales are down 5% or more (going into q4) and there is no real government policy set to support consumption is a stunning gap --

implies that recovery is coming from exports (i.e. other countries' demand, investment and inventories )

6/x

implies that recovery is coming from exports (i.e. other countries' demand, investment and inventories )

6/x

p.s. while I think the Journal article didn't go far enough in noting that the world is supporting China's recovery right now, the story itself is actually quite good. It does push back against the (lazy) notion China can drive the global recovery

wsj.com/articles/china…

wsj.com/articles/china…

• • •

Missing some Tweet in this thread? You can try to

force a refresh