#SaaS week, Ep7⃣. Ending the SaaS week with this excellent document "Transforming your SaaS Business" from KPMG, that deep-dives into lot of related concepts and metrics. 👏

@Gautam__Baid @saxena_puru @richard_chu97 @BrianFeroldi @FromValue

assets.kpmg/content/dam/kp…

@Gautam__Baid @saxena_puru @richard_chu97 @BrianFeroldi @FromValue

assets.kpmg/content/dam/kp…

It's probably the best & most comprehensive/useful SaaS document I've come across so far.

Although it's geared towards the operating Co's, it also has tons of goodies to learn for Public Mkt investors who are heavily invested in this Sector or wants to learn more. 👍

Although it's geared towards the operating Co's, it also has tons of goodies to learn for Public Mkt investors who are heavily invested in this Sector or wants to learn more. 👍

Some of it is too much information for individual investors, but it pays to learn more about this promising sector, than just the isolated Co's Products and Financial statements/Valuations.

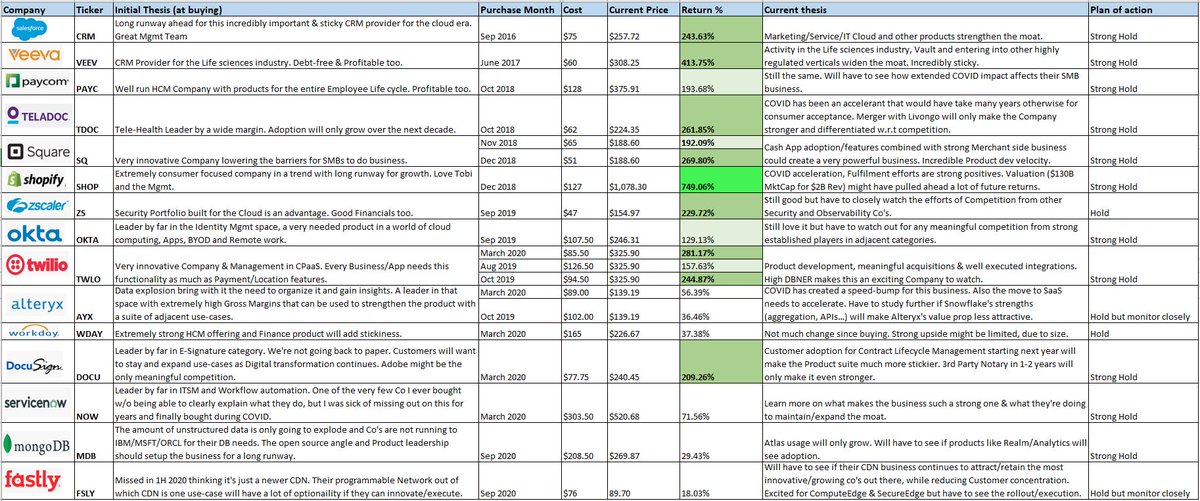

Yes, the run-up over the last 6 months for most names in this Sector will bring in elevated risk of Sector rotation (if/when COVID impact fades away) or when the individual Co's cannot deliver growth (and path to profitability) due to Competitive, execution or other risks.

However, the best & more innovative Co's in this sector when they fully leverage the SaaS Delivery/Operational/Financial model can still bring a lot more gains to investors over the next 5-10 yrs.

Good Luck. 👍

/END.

Good Luck. 👍

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh