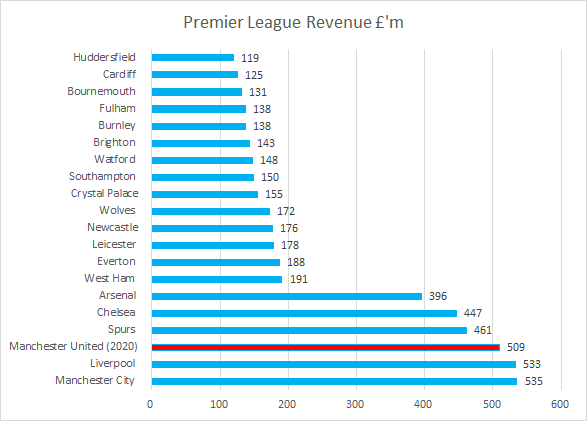

Manchester United's 2020 results have been summarised via a press release, so here's a dip into what we know to date. Total revenue is down 18% due to a combo of Covid and not qualifying for the Champions League, lowest revenue since 2015. #MUFC

Manchester United have had highest revenue in the Premier League for many years. Other clubs have not published 2019/20 figures yet but it will be a battle for top spot, suspect they will maintain their position...just. #MUFC

Matchday income has been very consistent over the last decade. Owners have been criticised over many issues but ST prices have been constant now for many years. Loss of fixtures in front of paying audience & no CL main drivers of £21m fall.

MUFC make about £4m per home game, still 2nd in PL table even when comparing to other clubs for 2018/19. Spurs would have been a possible challenger for matchday given ticket pricing structure & full season at new WHL.

Manchester United broadcast income down £101m due to Champions League taking 80% of UEFA money and so many matches being broadcast in July, which is after the company financial year end. Rebates to broadcasters also had negative impact.

Manchester United broadcast income below that of other 'Rich 6' clubs in terms of their 2018/19 figures, expect that to change once results are out. Those clubs with a 31 July year end might have a boost as will include fixtures towards end of season that the likes of #MUFC don't

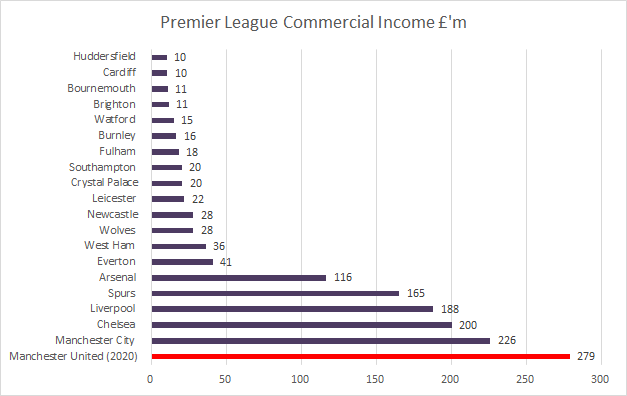

Manchester United commercial income showed first increase since 2017, albeit a small one. Many sponsors locked into long term deals. Chevrolet front of shirt sponsor extended for 6 months to 31 Dec 2021, unsure what this will mean in 2021/22 merchandise if not renewed.

Manchester United still set the gold standard in terms of commercial income, despite a tough year on the back of Covid. Most partners are well known brands in their home markets and so less likely to pull out of deals.

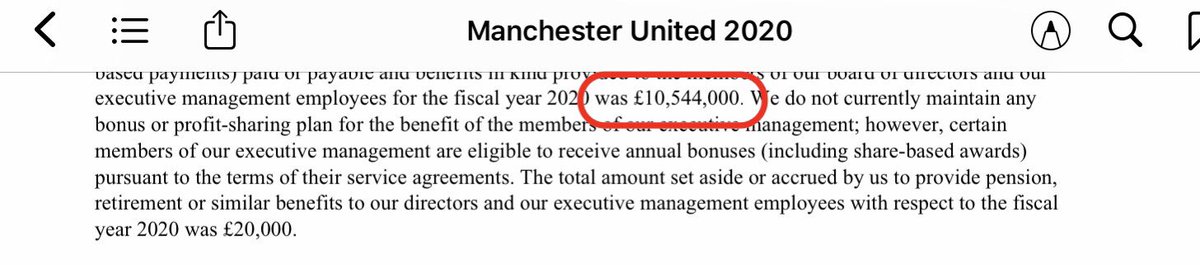

Manchester United wage bill down 14% as no CL bonuses & appearance/target bonuses not paid in year to 30 June as ten fixtures played in July/August. No need for crowdfunding to top up player wage packets though as average wage still £136k a week. Wages £56 for every £100 income

Manchester United down to 4th in wage table but this may change as other rich clubs may also see wages fall as fewer matches in year to 30 June 2020 will impact upon appearance bonuses.

Despite tough trading times Manchester United still have one of the lowest wage/revenue ratios and this could improve further as other club results are published.

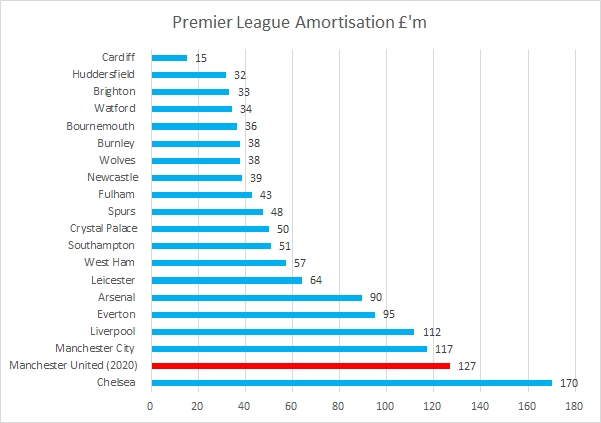

Transfer fee amortisation has remained broadly static for four seasons. Signings of Magure, Wan-Bissake, James & Fernandes offset by disposals of Lukaku etc. #MUFC still spending considerable sums on players on a long term basis.

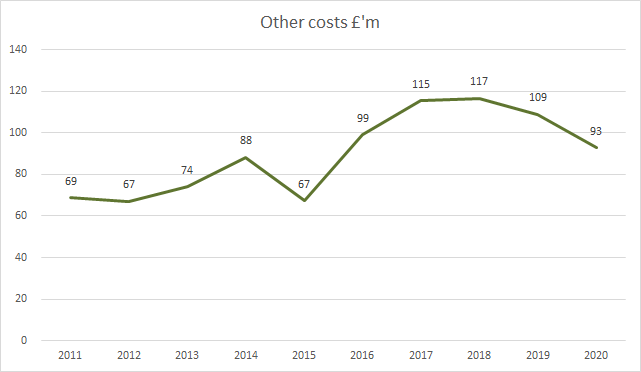

Non-player costs fell in 2020 by 18% as Manchester United were able to reduce overheads as operations such as transport wound down on back of Covid & fewer matchdays.

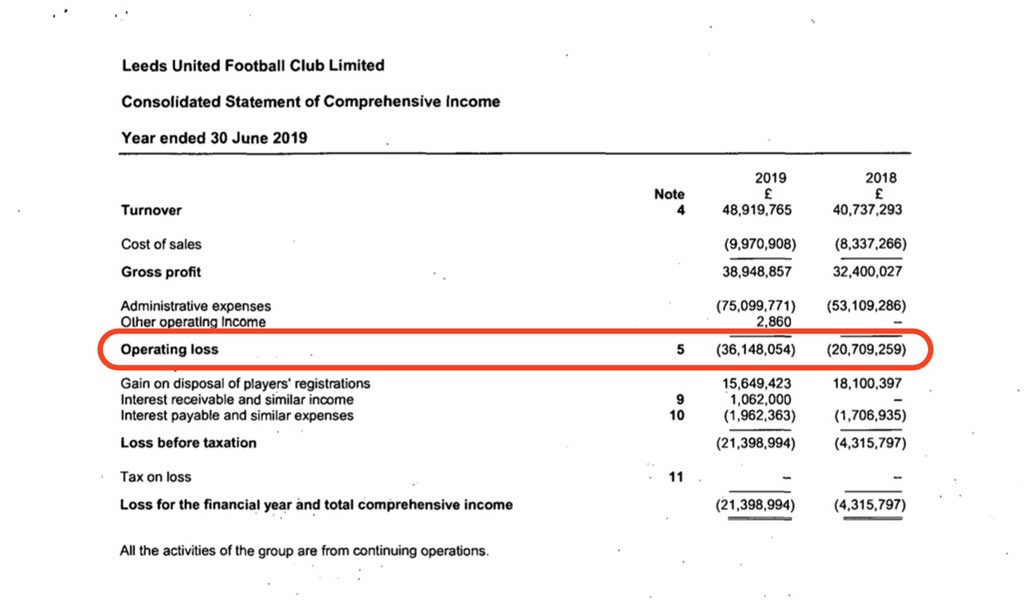

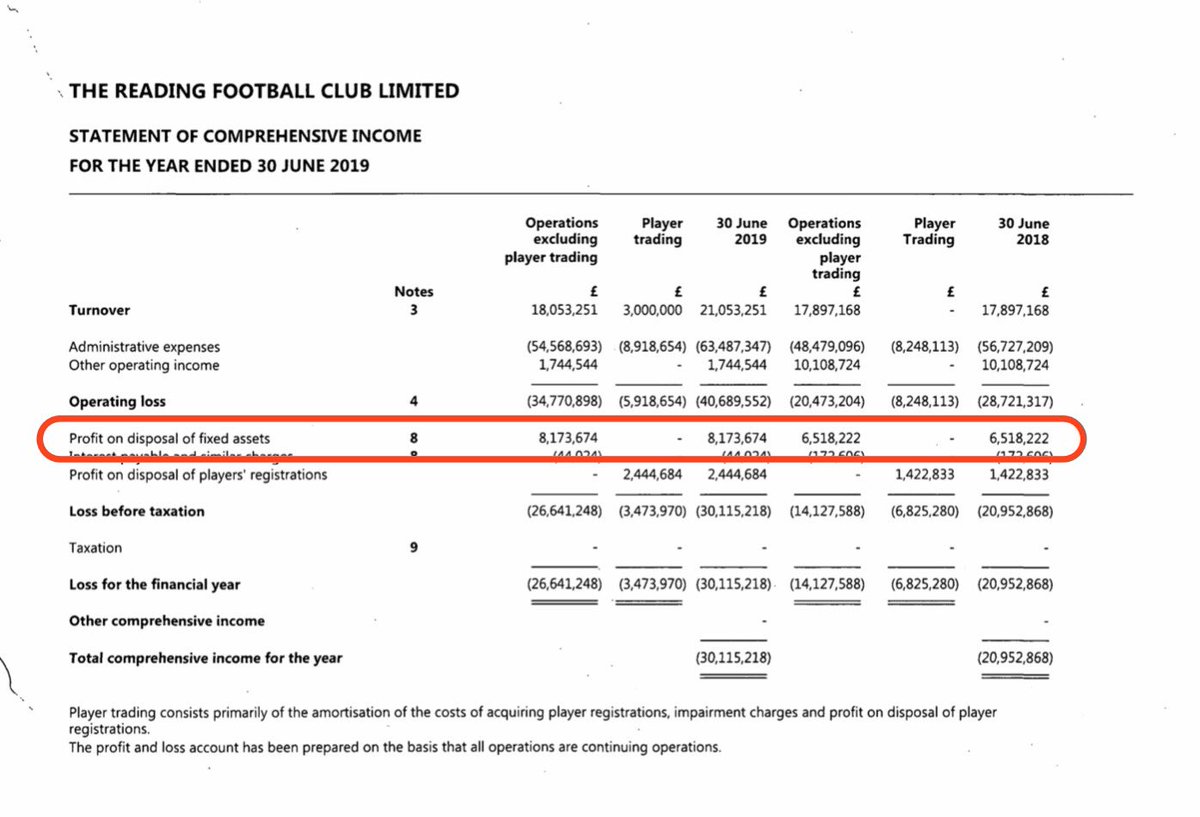

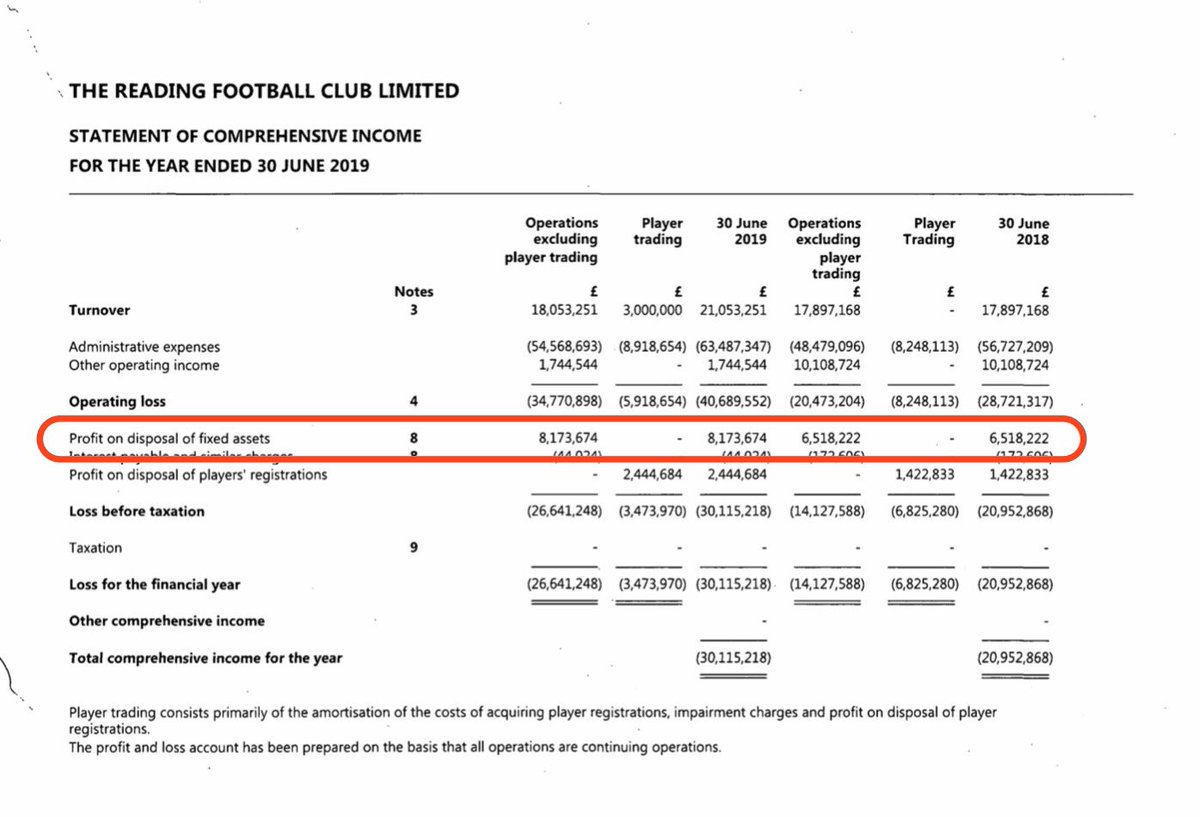

Profit is income less costs. On a day to day basis #MUFC made a loss in 2019/20 for the first time in over a decade.

Compared to other clubs in 2018/19 MUFC still in a relatively good position & expect to see many losses many by other clubs when results published.

Compared to other clubs in 2018/19 MUFC still in a relatively good position & expect to see many losses many by other clubs when results published.

Some concern has been expressed about MUFC having to achieve an EBITDA profit (profit before amortisation & depreciation) of £65m otherwise will suffer financial penalties. Club easily achieved this in 2019/20 despite Covid & Europa League.

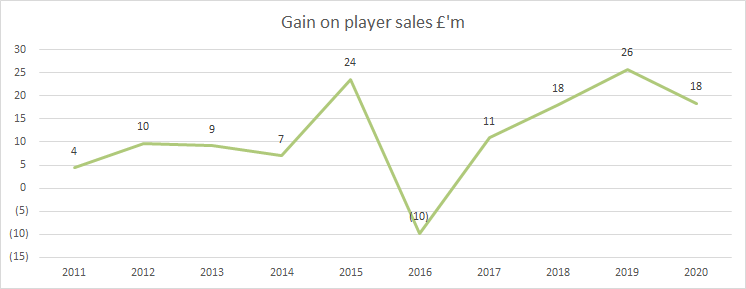

Clubs can reduce losses via player sales. #MUFC made £18m from transfer of Lukaku etc in 2019/20 and £117m in last decade which compares poorly to likes of Liverpool (£315m) and Chelsea (£458m) suggesting the club tends to buy at top of market or keep players.

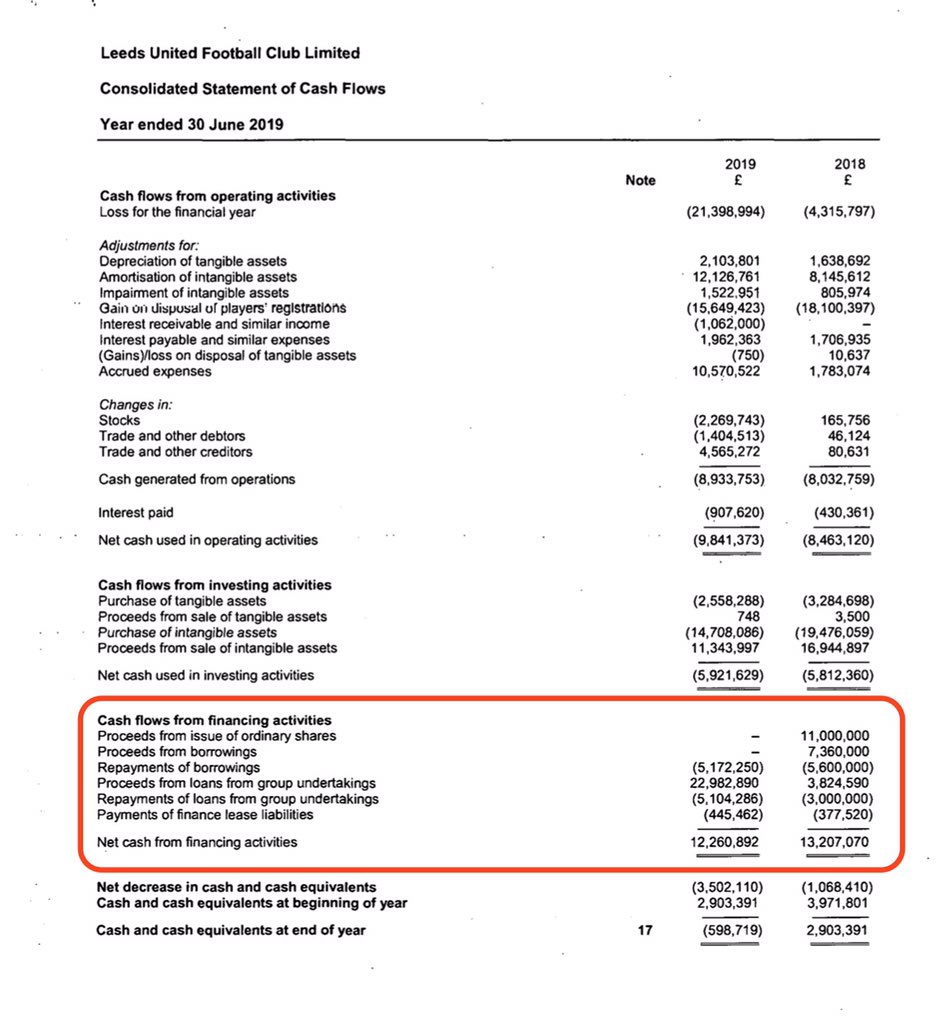

Manchester United paying £1/2m a week in interest in 2019/20. Much lower than in the early Glazer years but total interest cost since the takeover is £837,000,000.

Manchester United net debt (borrowings less cash in the bank) more than doubled to £474 million, highest for a decade but lower than early years of the Glazer ownership. Main reasons were £220m cash spent on signings, £35m propping up share price & £23m in dividends to owners

Despite making a loss in 2020 Manchester United board kept their promise to shareholders to pay dividends, taking total payments to £112m in last five years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh