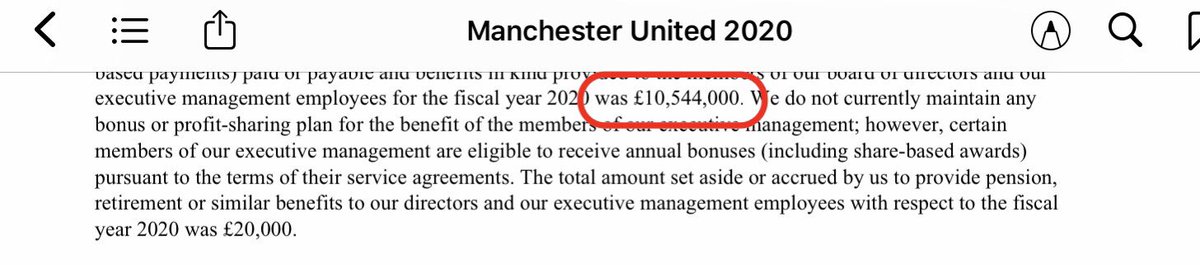

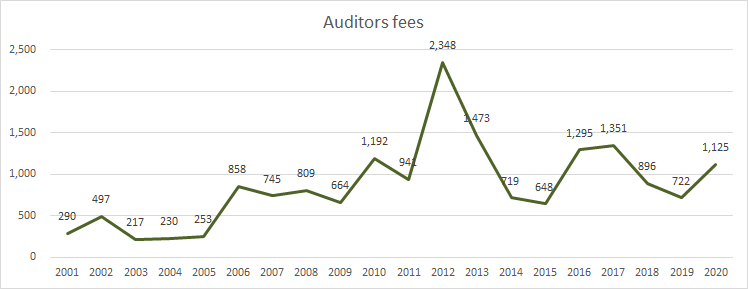

Manchester United’s audited accounts were published overnight. Here are a few random snippets from the 782 page document that weren’t in the headline figures a few days ago. Auditors picked up over £1.1m including £446k for tax avoidance advice. #MUFC

75% of Class ‘A’ shares owned by four investment funds. These carry 1 vote each. Glazers own all of the Class ‘B’ shares that carry 10 votes each. Ed Woodward owns shares worth £7.8 million.

Manchester United bought players & extended contracts for £101 million post 30June 2020 and had sales of £6 million. A new overdraft facility of £50 million was arranged in October.#MUFC

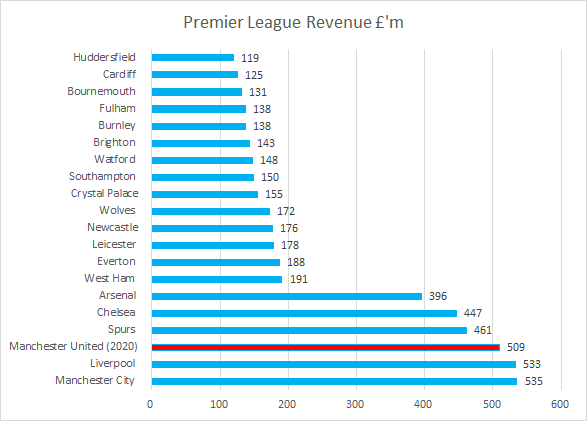

£248 million of #MUFC revenue comes from 3 customers. Mysteriously these are not named but @paddypower have very short odds on them being Premier League, Adidas & Chevrolet.

Total cost of #MUFC squad was £831 million at 30 June, this was before signing of De Beek etc.

Employee numbers at #MUFC continue to rise.

Manchester United are owed £57m from other clubs for transfer fees, suspect a lot of this is Lukaku related.

Manchester United owe other clubs £149 million for transfer fee instalments. This is down from £258 million a few years ago.

Cayman Island registered Manchester United have taken advantage of Covid-19 UK tax rules to delay paying VAT of £15 million until March 2021.

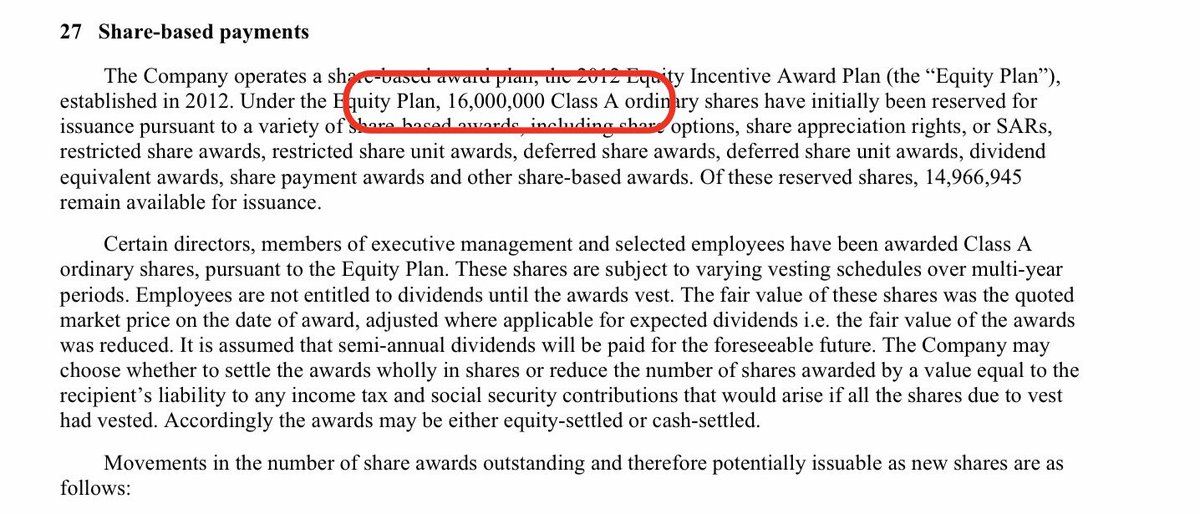

Manchester United can issue up to 16 million shares worth at present prices £229 million to senior staff.

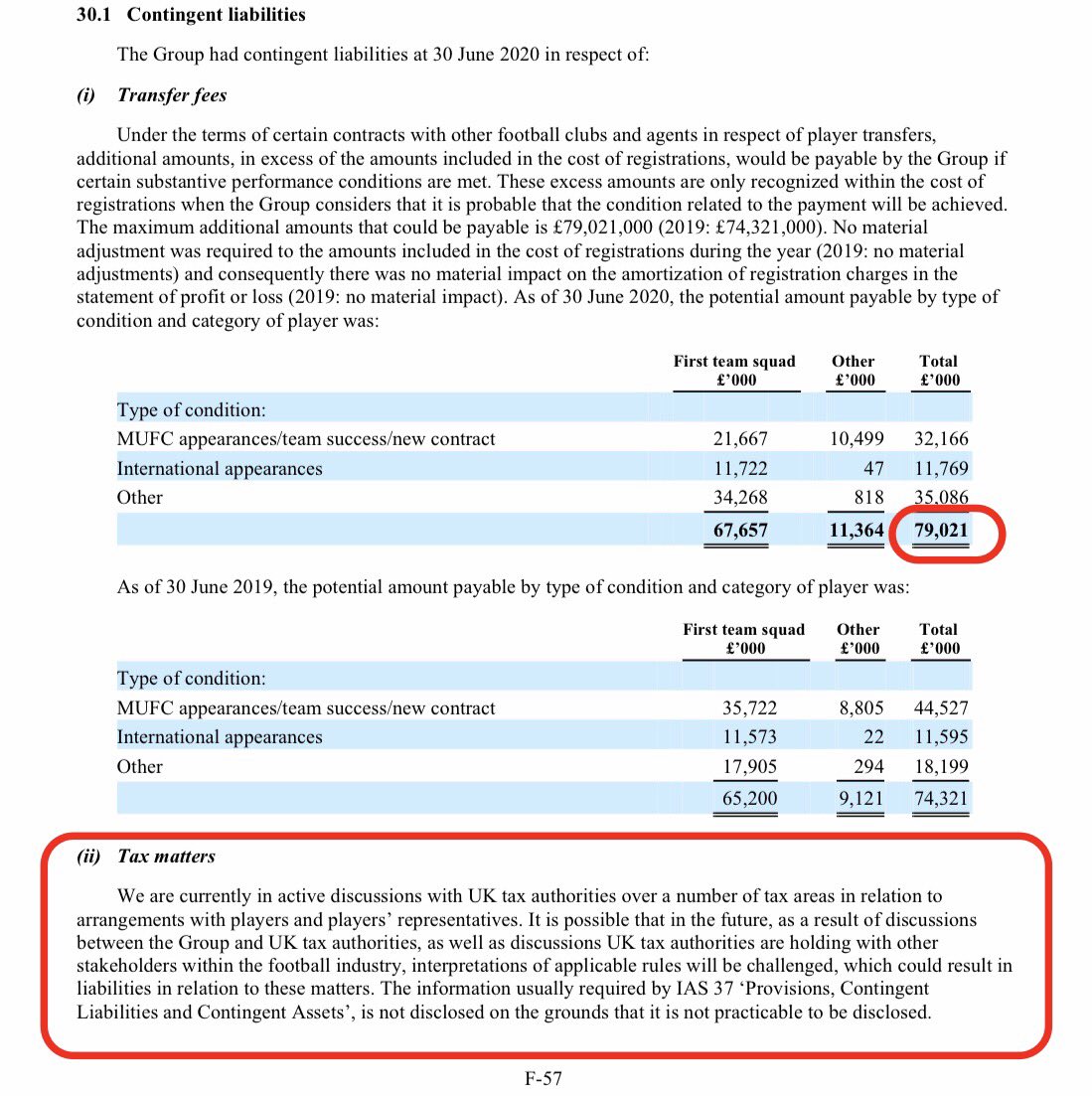

Manchester United May have to pay up to £79 million, mainly to players & other clubs, if certain targets achieved. Can also earn £4m from sell on clauses

Manchester United are in ‘active discussions with UK tax authorities in relation to ‘arrangements’ with players and representatives’ which ‘could result in liabilities in relation to these matters’

Manchester United spent over £21 million in cash buying back its own shares from the stock market March-May 2020

• • •

Missing some Tweet in this thread? You can try to

force a refresh