The Palindrome (Soros) broke FX factors down into simple logic statements (the below example is taken from "The Alchemy of Finance"). He did this in an effort to gain a better understanding of the drivers of a trend and the sustainability of that trend... /1

2/ These drivers shifts over time, from regime to regime. This is one of the reasons why the FX is notably hard to forecast. Players often key off the thing that worked during the last cycle while missing what’s driving the current one.

3/ The most recent USD bull market that kicked off in 11’ was driven by an equation that looked something like this.

DXY = US V > RoW V (rest-of-world) = ↑(i+e+m) → s↓ → e↑

US growth was stronger on a relative basis (accounting for the US premium) than RoW (US V > RoW V).

DXY = US V > RoW V (rest-of-world) = ↑(i+e+m) → s↓ → e↑

US growth was stronger on a relative basis (accounting for the US premium) than RoW (US V > RoW V).

4/ As a result, the dollar benefited from numerous positive feedback loops that boosted its Total Return Equation, which is the most important factor in driving speculative flows.

5/ A number of factors are no longer supportive of the positive USD feedback loop; such as rel growth, trend in yield spreads, plus a deteriorating trade balance (T↓) and widening budget deficit (B↓). So the $DXY equation looks like this:

DXY = ↕(i+e)+↑(m)→ s↕ → e↕

DXY = ↕(i+e)+↑(m)→ s↕ → e↕

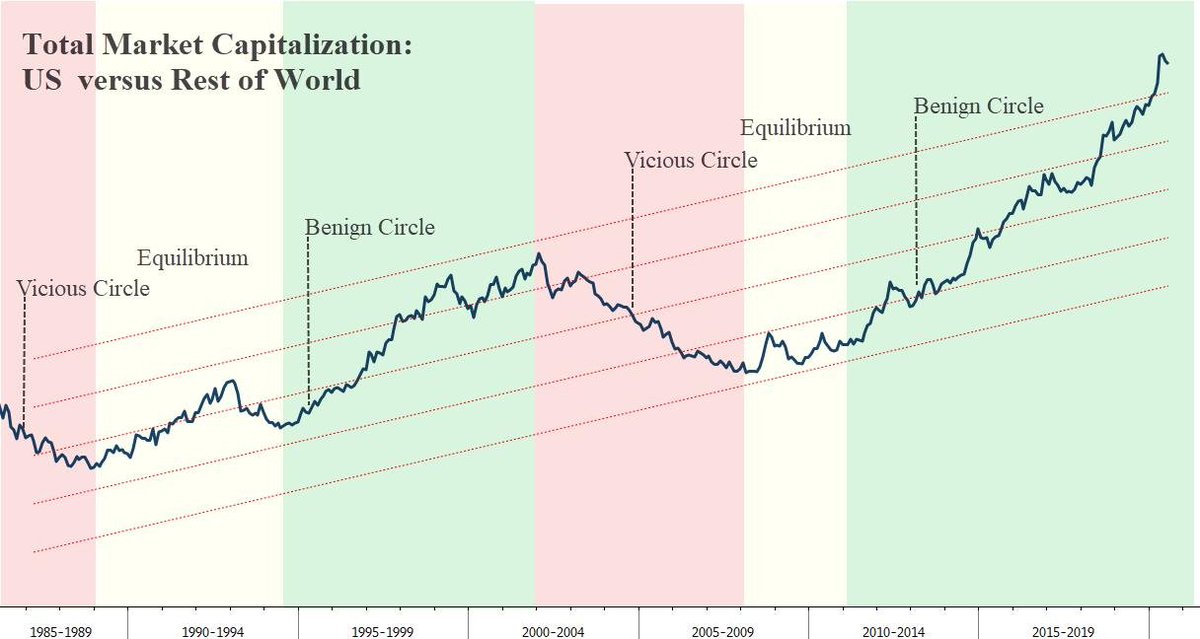

6/ So the now dollar only has relative market performance (m) working in its favor. But this sole-remaining USD bull pillar of relative market performance is historically stretched. Capital concentration in the US is at all-time highs.

7/ $DXY is oversold and near long-term support w/ crowded short positioning. Odds favor a strong bounce in the interim but longer-term the supportive drivers of the USD bull have been taken down one-by-one and we're likely moving into a cyclical bear.

8/ If you'd like to read more about Soros' currency framework, click this link here

👇

macro-ops.com/george-soros-c…

👇

macro-ops.com/george-soros-c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh