1/ "The goal is to transition to an active piece of IT infrastructure, empowering the document to communicate with external resources such as data feeds, payments infrastructure, ERP, and CRM systems" -@tgonser, founder of @DocuSign

A #Chainlink thread 👇

artificiallawyer.com/2020/10/23/doc…

A #Chainlink thread 👇

artificiallawyer.com/2020/10/23/doc…

2/ Refresher on #DocuSign crumbs

In 2003, Tom Gonser founded @DocuSign and made e-signatures the industry standard for legal contracts

In 2019, Tom joined @Chainlink as an official advisor to the project, and gave a legendary talk with Sergey

blog.chain.link/sf-fireside-ch…

In 2003, Tom Gonser founded @DocuSign and made e-signatures the industry standard for legal contracts

In 2019, Tom joined @Chainlink as an official advisor to the project, and gave a legendary talk with Sergey

blog.chain.link/sf-fireside-ch…

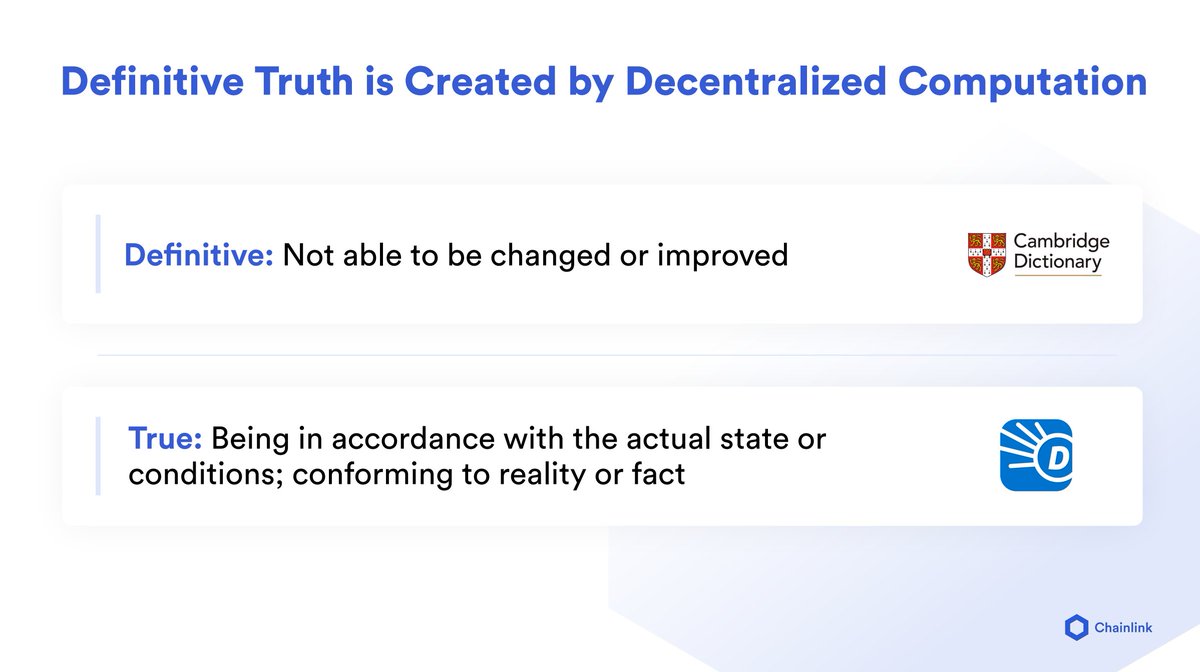

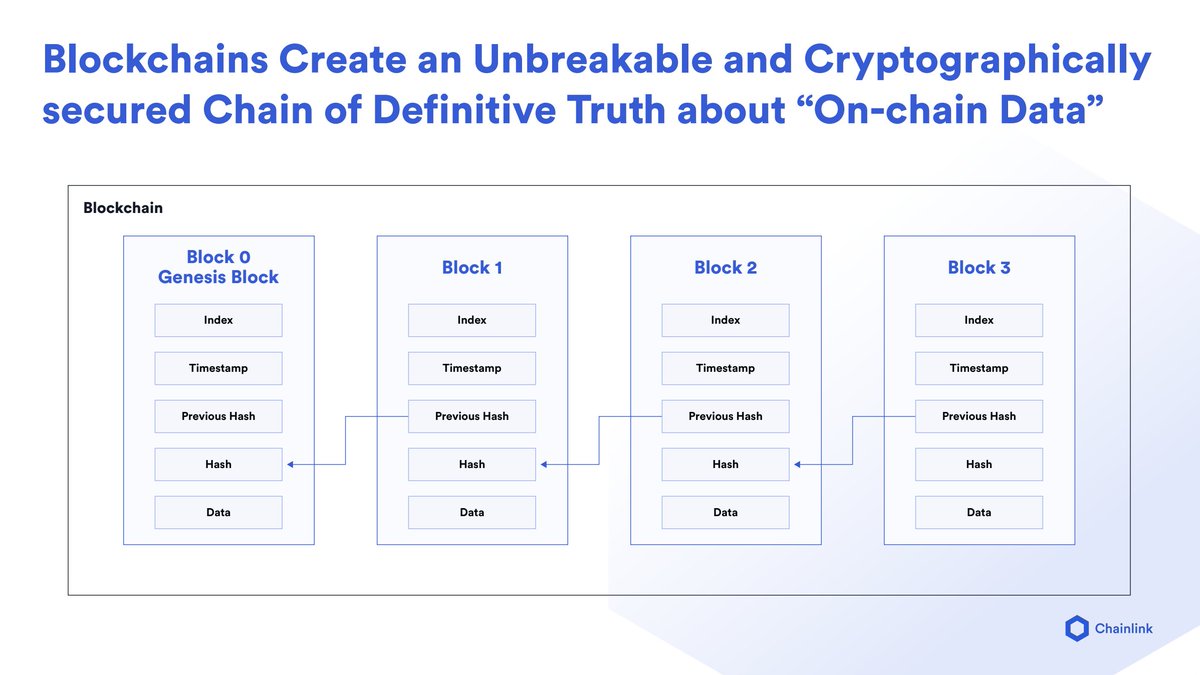

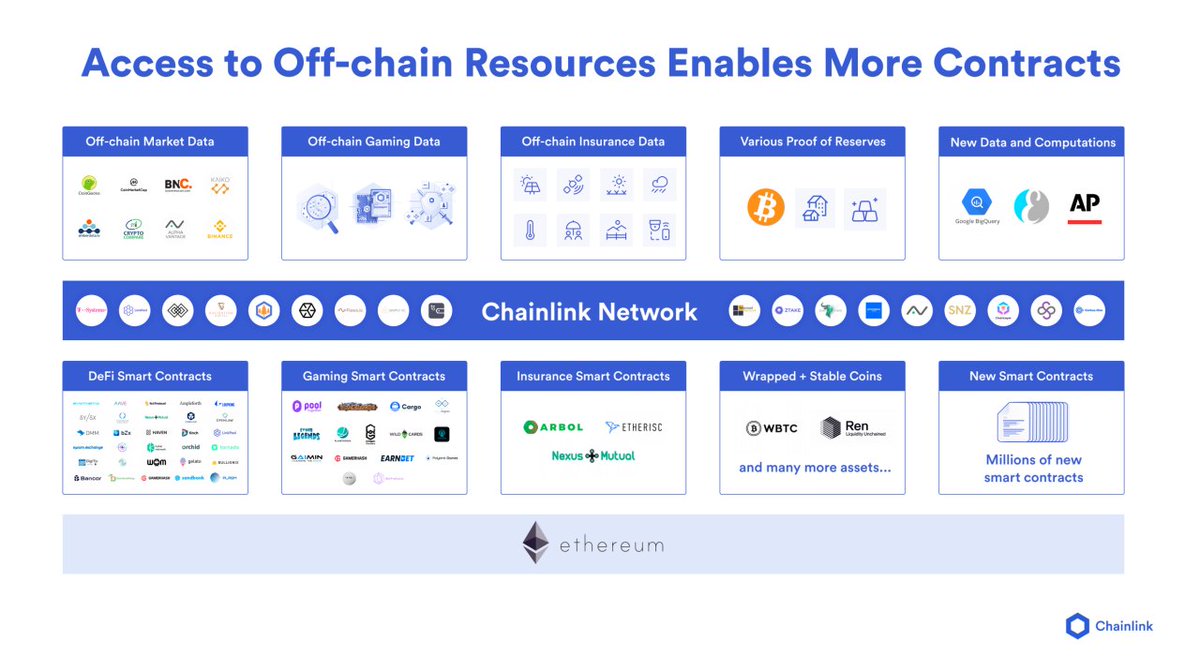

3/ Tom understands the value of smart contracts and the importance of secure oracles to connect these contracts to real world data, events, and payments

Take a listen for yourself

In fact, DocuSign has been interested in smart contracts since 2015

Take a listen for yourself

In fact, DocuSign has been interested in smart contracts since 2015

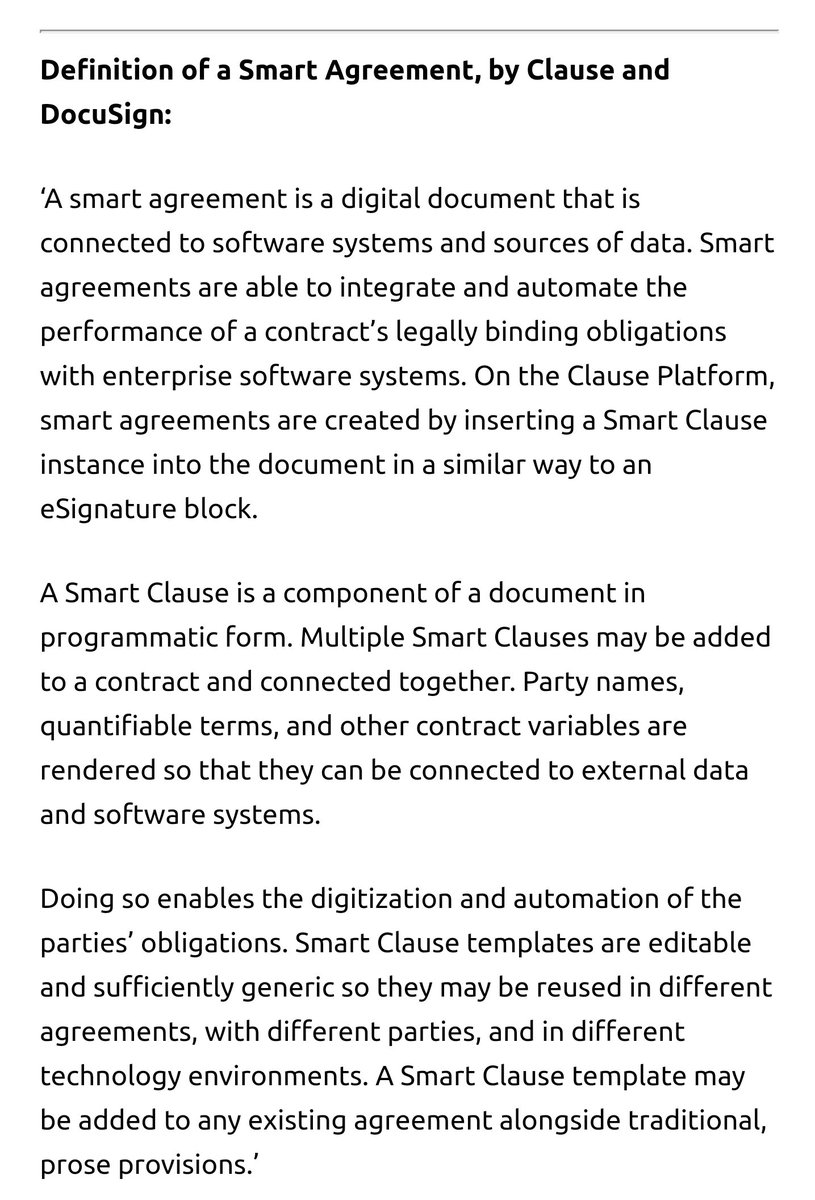

4/ Both #Chainlink and #DocuSign are members of the @AccordHQ Project 👀

Accord is a consortium of some of the largest law firms and created a framework for legal smart contracts

DocuSign already stated their smart contracts will need an oracle solution

Accord is a consortium of some of the largest law firms and created a framework for legal smart contracts

DocuSign already stated their smart contracts will need an oracle solution

https://twitter.com/ChainLinkGod/status/1180651714845827073?s=20

5/ Also of note, Accord was created by @ClauseHQ, a smart contract platform funded by @DocuSign in 2019

Ultimately, DocuSign aims to do for smart contracts, what they did for e-signatures

Bring it to the mainstream and push it to become the global industry standard

Ultimately, DocuSign aims to do for smart contracts, what they did for e-signatures

Bring it to the mainstream and push it to become the global industry standard

6/ The implications of this cannot be understated

Contractual agreements and business itself will be changed at the DNA level

Know what's even better? Legal smart contracts are just yet another vertical for the #Chainlink Network to power

$LINK

Contractual agreements and business itself will be changed at the DNA level

Know what's even better? Legal smart contracts are just yet another vertical for the #Chainlink Network to power

$LINK

• • •

Missing some Tweet in this thread? You can try to

force a refresh