Suddenly, everything changed... here is some thinking from my last GMI (Global Macro Investor) report:

I think we have now clearly started the transition from Hope phase to Insolvency phase (as per my Unfolding video and this update):

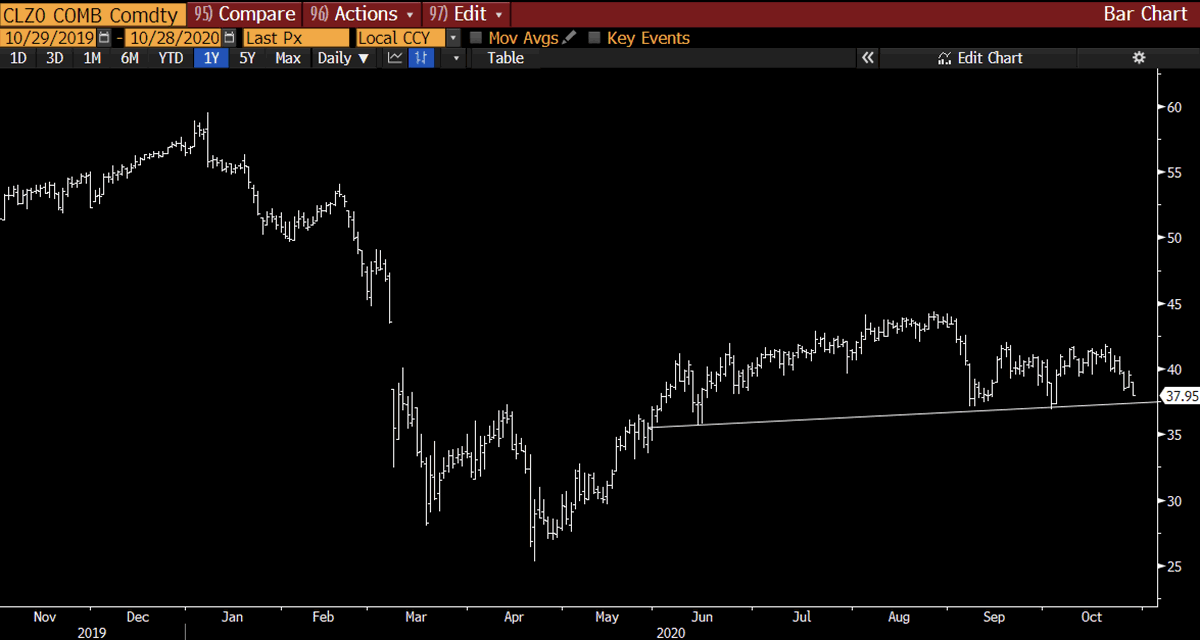

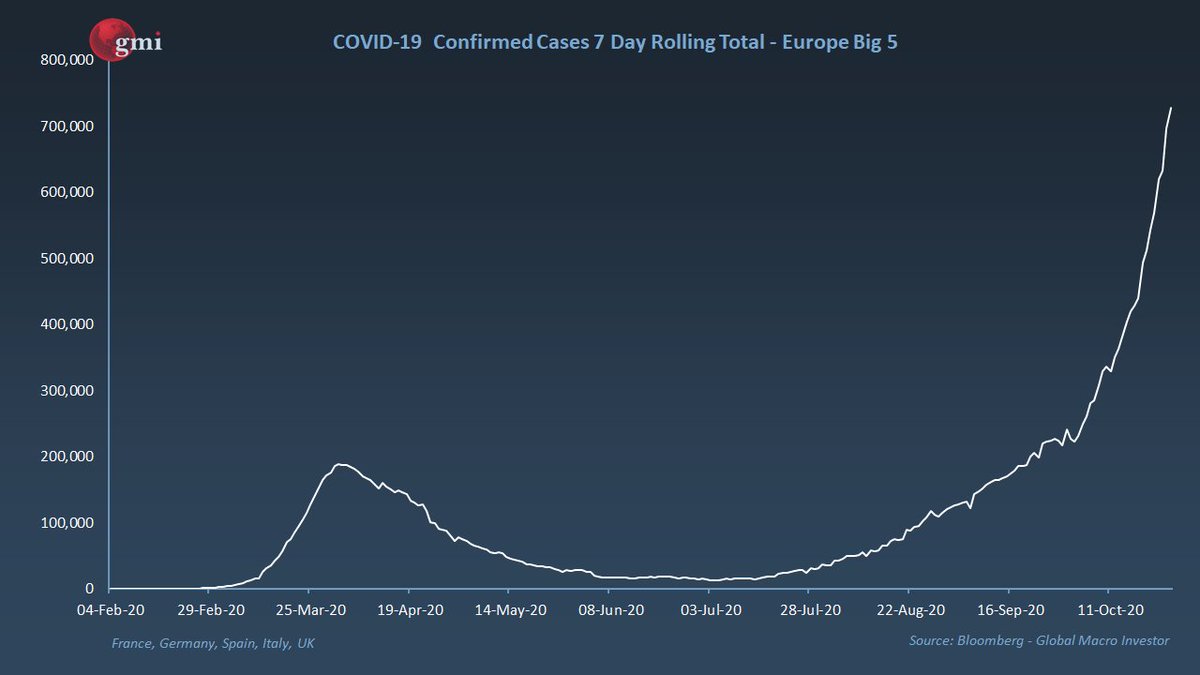

The big rise of the Covid in Europe, the US and Canada is about to exert economic pressures and extinguish the Hope phase of reflation dreams. Growth will not yet recover and a true economic recovery will take more than a post-election stimulus in Jan.

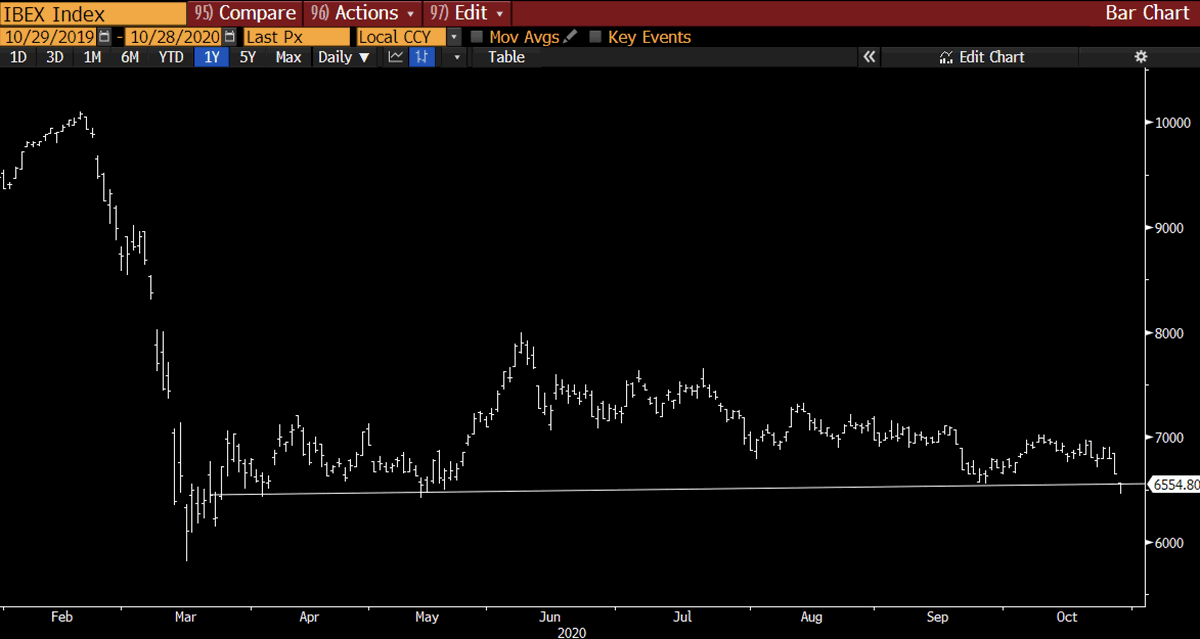

And markets have begun to take notice... the Ibex in Spain, where the economy is in dire straights, is breaking down...

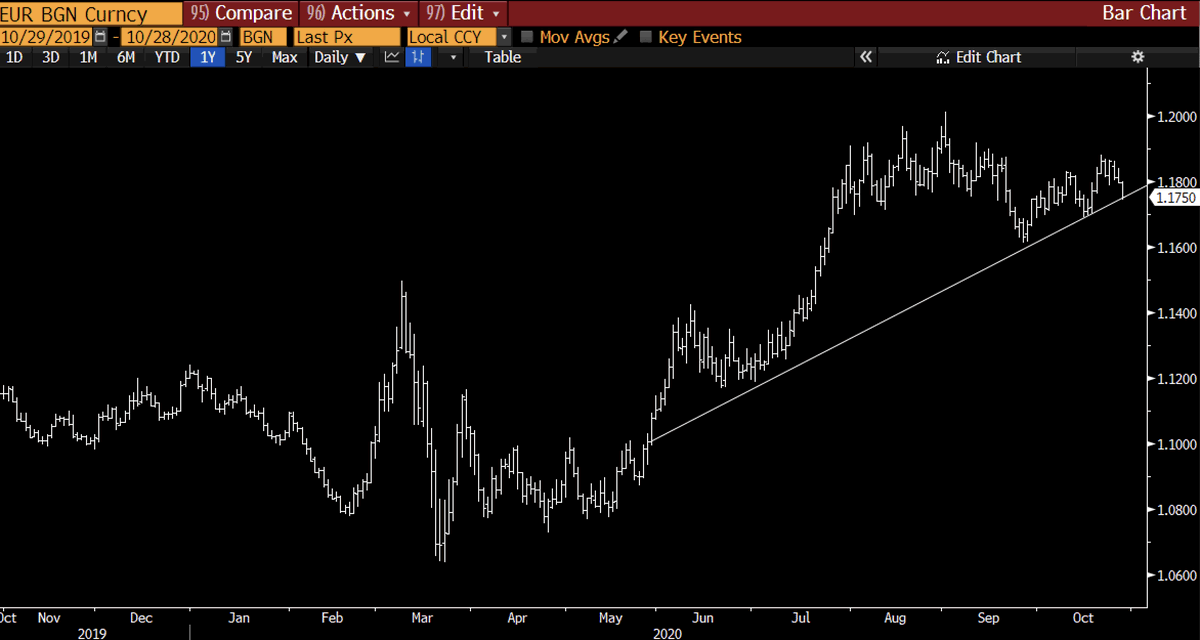

The same with the Euro. It's a pretty clear GMI Crash Pattern (sharp fall, fails to make new highs, breaks lower - even more sharply) but needs to break Sept low to confirm.

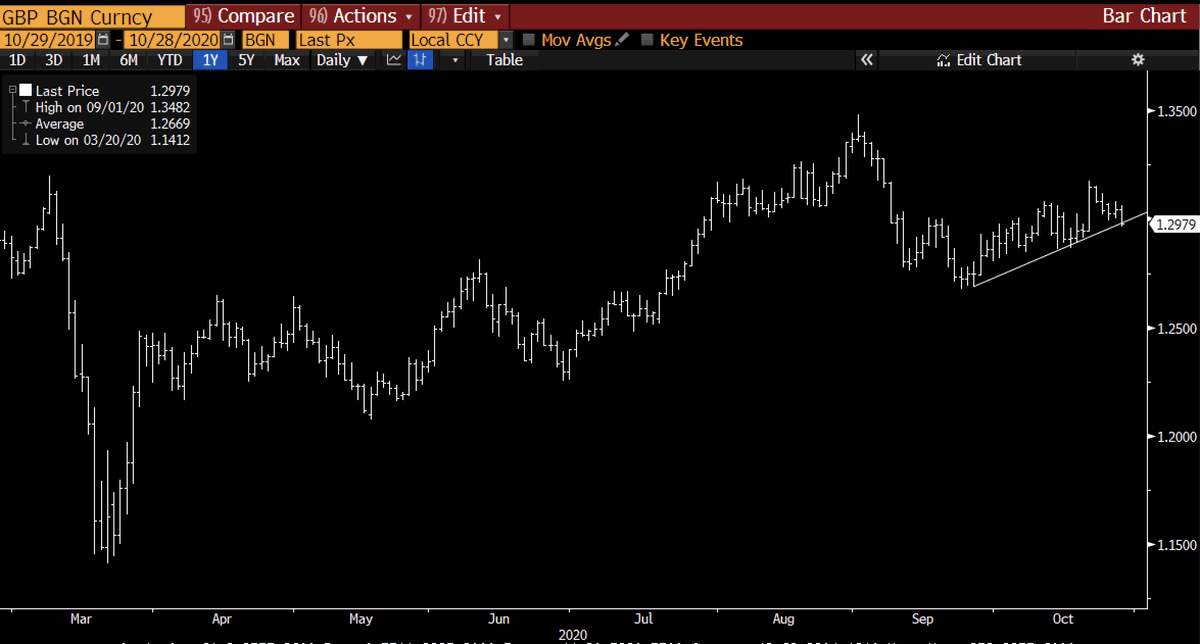

The Pound with the heady cocktail of virus + BREXIT shit show is potentially a GMI crash pattern too...

Remember - everyone is near record short the dollar...

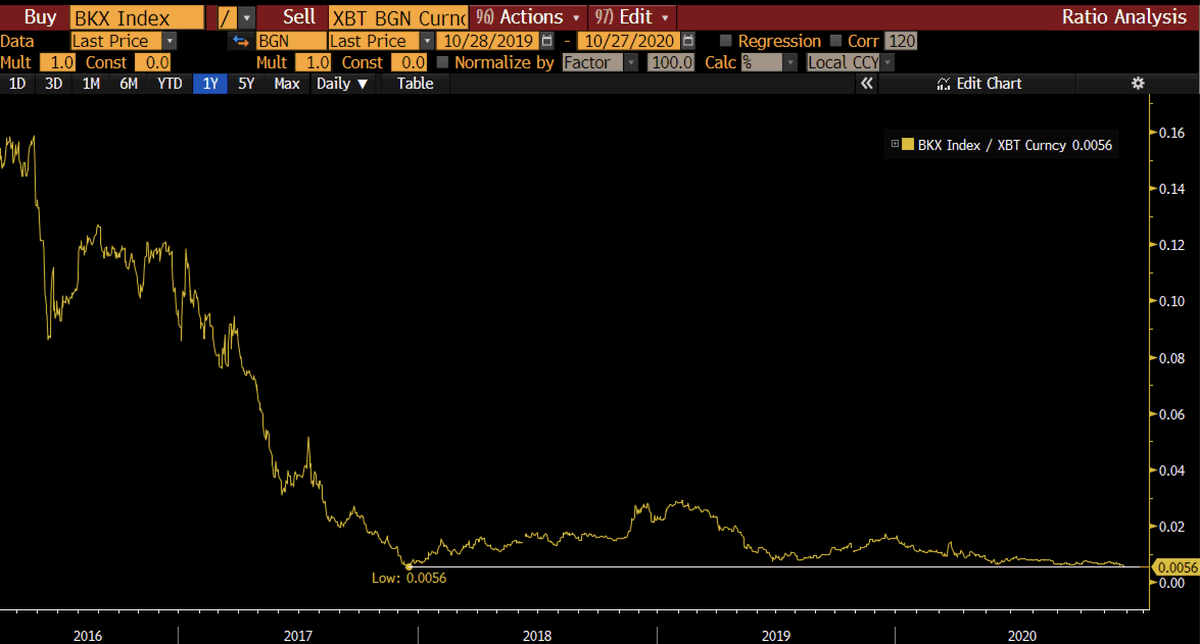

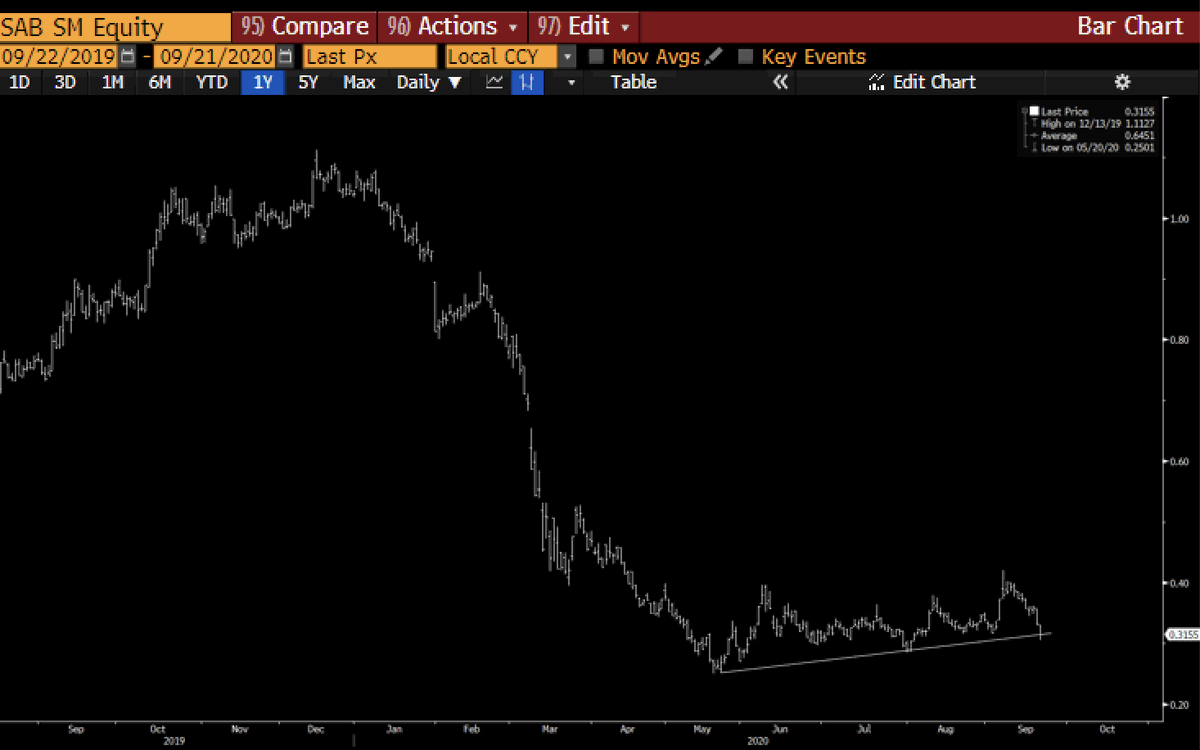

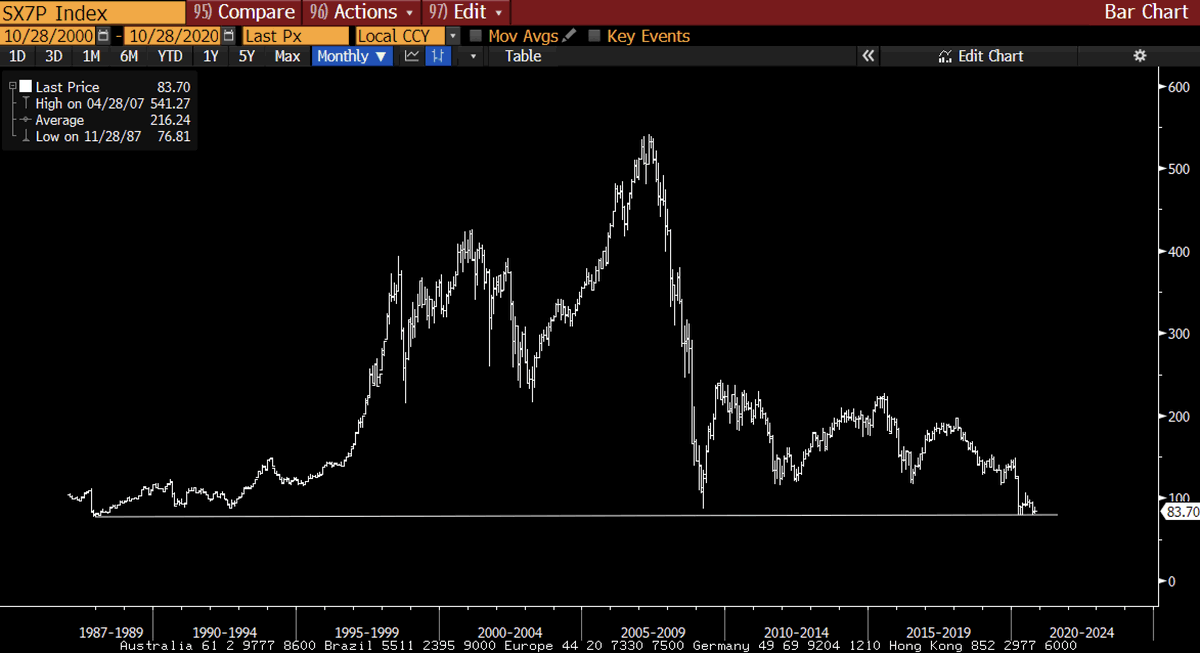

The Pan-European bank index (including UK, EU and Switzerland) also is headed towards its last support...

And when I say last support, that line is the ALL TIME low... (nationalization, bad banks, bail outs are coming).

In the US, there are similar signs - AT&T, the worlds most indebted company, is very very close to breaking a gigantic GMI crash pattern...

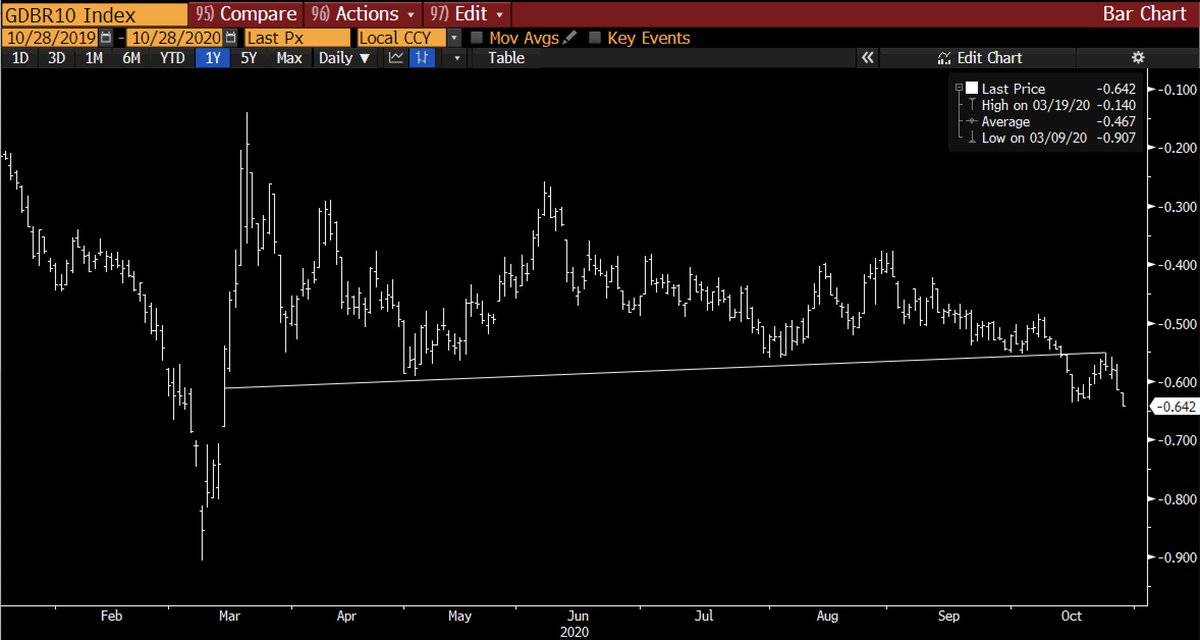

And 30 yr bonds are about the break the Hope Phase up trend. Remember - short positions in 30 years are the LARGEST in all history. Ruh roh.

You can buy bonds and dollars or you can take the life raft - Bitcoin.

Or to dampen the volatility of a risk-off event (we can and will see sharp BTC corrections), you can have all 3 for a near perfect portfolio for this phase...

Good luck. See see how it plays out...

Or to dampen the volatility of a risk-off event (we can and will see sharp BTC corrections), you can have all 3 for a near perfect portfolio for this phase...

Good luck. See see how it plays out...

• • •

Missing some Tweet in this thread? You can try to

force a refresh