Important Thread:

If you don't think Central Bank Digital Currencies are coming, you are missing the big and important picture. This is going to be the biggest overhaul of the global financial system since Bretton Woods.

If you don't think Central Bank Digital Currencies are coming, you are missing the big and important picture. This is going to be the biggest overhaul of the global financial system since Bretton Woods.

Talking of Bretton Woods, this IMF article alludes to a huge change coming but lacks real clarity outside of allowing much more fiscal stimulus via monetary mechanisms.

imf.org/en/News/Articl…

imf.org/en/News/Articl…

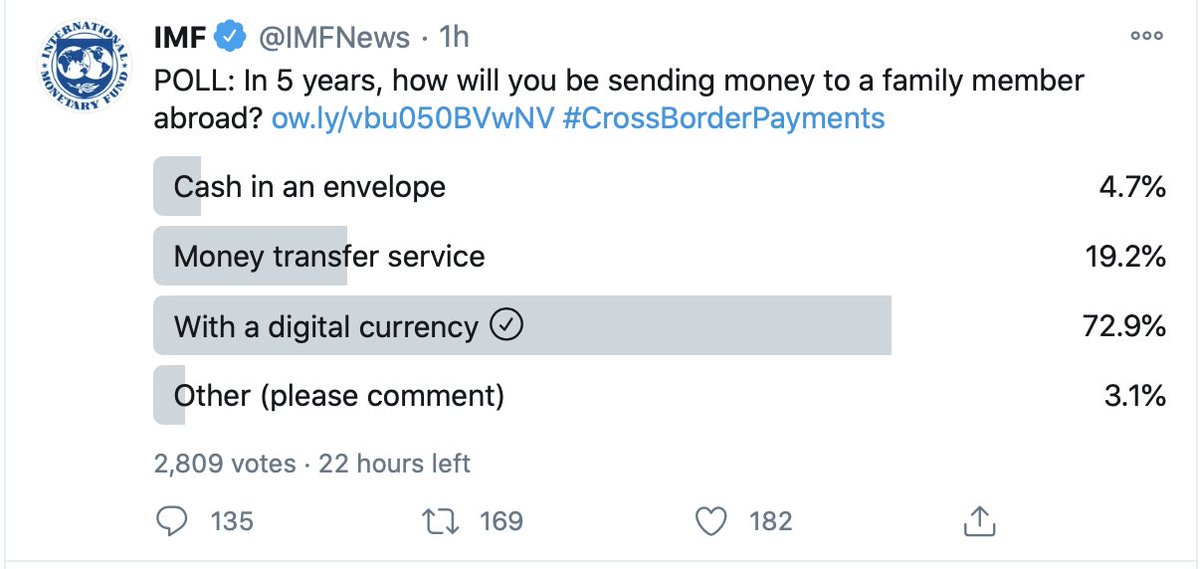

And tomorrow, the IMF holds a conference on digital currencies and cross-border payment systems..

meetings.imf.org/en/2020/Annual…

meetings.imf.org/en/2020/Annual…

But it's not just the IMF. This was first floated by Mark Carney at the Bank of England over a year ago and set the course for a new system...

bankofengland.co.uk/-/media/boe/fi…

bankofengland.co.uk/-/media/boe/fi…

His big idea is a move away from the dollar, using CB digital currencies so its affects on world trade, flows and debts was not so pronounced.

bankofengland.co.uk/-/media/boe/fi…

bankofengland.co.uk/-/media/boe/fi…

The ECB weighed in many times in the last year but the latest is clear - CBDC's are coming..and soon.

ec.europa.eu/finance/docs/l…

ec.europa.eu/finance/docs/l…

Next up was the regulatory changes in the US, allowing for bank custody of digital assets, especially bitcoin. i.e the acceptance that digital assets are not going away and in fact are the future.

And recently the Cleveland ref added their thoughts.

clevelandfed.org/~/media/conten…

And recently the Cleveland ref added their thoughts.

clevelandfed.org/~/media/conten…

On Monday, Jay Powell gives his input on central bank digital currencies at the IMF talk listed above.

Central Bank digital currencies are coming and they will change everything...

They are coming under stealth of X-border payments but it means so much more...

Central Bank digital currencies are coming and they will change everything...

They are coming under stealth of X-border payments but it means so much more...

They allow the CB's to circumvent the banking and fiscal system and give or take money (tax or transfer payments) directly.

That completely changes monetary vs fiscal policy for ever. CB's will now be able to manage fiscal policy, outside of governments balance sheets.

That completely changes monetary vs fiscal policy for ever. CB's will now be able to manage fiscal policy, outside of governments balance sheets.

They can give, for example, restaurant owners a direct payments for stimulus whilst at the same time, charging negative interest rates on larger savers.

They can create direct tax payments too, in the rails of the payments system. No more IRS?

They can create direct tax payments too, in the rails of the payments system. No more IRS?

Multi-interest rates set centrally will be the norm. No one needs to allow the banks to set interest rates based on capital availability or risks. CB's can now create a defined cost of capital to whomever they please (if they get the powers by the Governments, which will come).

Don't forget, it absolves any spending responsibility in a crisis from governments and after 2008 and 2020, they are desperate for it..

It also will push behavioural economics to the forefront based on big data and real time activity data. CB's can now create incentives directly as rewards, or punishments. They can affect human behaviour in a way that is much less blunt than traditional monetary and fiscal policy

There are enormous downsides and there are enormous upsides too too all of this. Many will say it's taking even more freedoms away and in someways it is. It also gives those disadvantaged by lack of available capital a better chance - a key problem.

Right now it has to be via debt at punitive rates but this changes all of that. Poor can get direct transfer payments with the debt in the CB balance sheet. Its the key step towards UBI, which too is good and bad....

And the reality is we don't really have any freedoms from governments or central banks if we operate in the main system (i.e. ex-gold and bitcoin) and the big tech firms already have perfected behavioural economics as a way of changing human behaviour.

BUT, the key part here outside of a totally revolutionary way to collect taxes, give incentives and overhaul the entire system is an implicit agreement at IMF level that central banks can run unlimited balances sheets if they combine forces...

The move eventually (in late say 3 to 5 years) away from the dollar towards a basket of currencies (the LIBRA idea, which was the lightbulb moment), then they can all agree to increase balance sheets together to avoid single countries getting penalised via FX.

Again, there will be huge benefits to the new system but it can only mean a further debasement of the ENTIRE fiat currency system. Can it create structural inflation? I don't know (Im sure the debate will be HUGE) but I doubt it due to secular pressures but...

Fiat globally will be worth less versus hard assets.

And that means that gold and in particular #Bitcoin will become THE way to circumvent the system of ever lower value.

It also create incentives systems for other nations to opt into a hard currency system to attract capital.

And that means that gold and in particular #Bitcoin will become THE way to circumvent the system of ever lower value.

It also create incentives systems for other nations to opt into a hard currency system to attract capital.

This paves the way for global regulatory arbitrage. Yes, there is a chance that CB's will try to suppress #bitcoin in the further future but much like suppressing gold, it is highly unlikely to work due to the incentive value of owning it.

In the end, we have lived with gold as an opt-out for millennia and we will live with Bitcoin too. Im not concerned and its a story for another day.

Right now, the positive impact on Bitcoin and gold is extraordinary. Regulation globally is opening up to acceptance.

Right now, the positive impact on Bitcoin and gold is extraordinary. Regulation globally is opening up to acceptance.

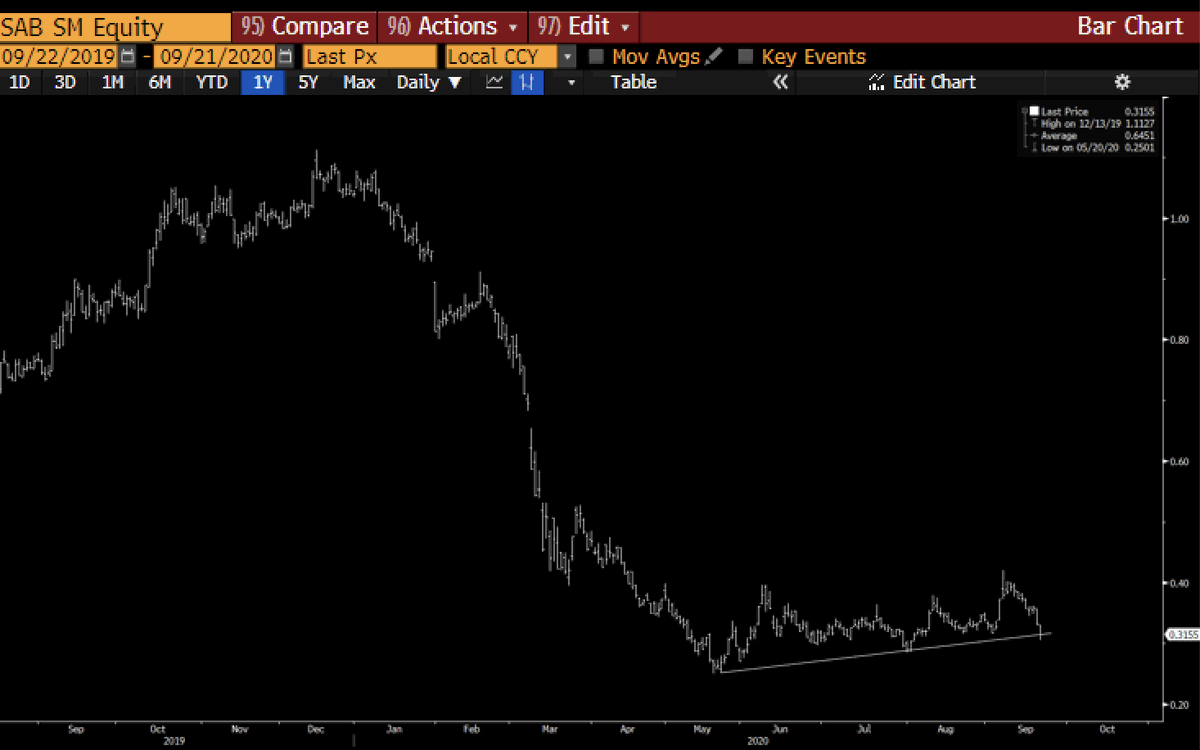

This is bad news for the banks who are about to be attacked by CB's, FinTech and Crypto. The are losing their role in the financial system over time. Short the banks, long bitcoin (as @APompliano ) likes to say. And he is dead right.

The Wall of Money is coming.

Bitcoin is protection as a pristine reserve asset. Bitcoin is freedom. Bitcoin is future value and bitcoin is THE future.

Everything is changing and its changing fast.

I'm #irresponsiblylong and its seeming more and more responsible by the day.

Bitcoin is protection as a pristine reserve asset. Bitcoin is freedom. Bitcoin is future value and bitcoin is THE future.

Everything is changing and its changing fast.

I'm #irresponsiblylong and its seeming more and more responsible by the day.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh