Bitcoin is eating the world...

It has become a supermassive black hole that is sucking in everything around it and destroying it. This narrative is only going to grow over the next 18 months.

You see, gold is breaking down versus bitcoin...and gold investors will flip to BTC

It has become a supermassive black hole that is sucking in everything around it and destroying it. This narrative is only going to grow over the next 18 months.

You see, gold is breaking down versus bitcoin...and gold investors will flip to BTC

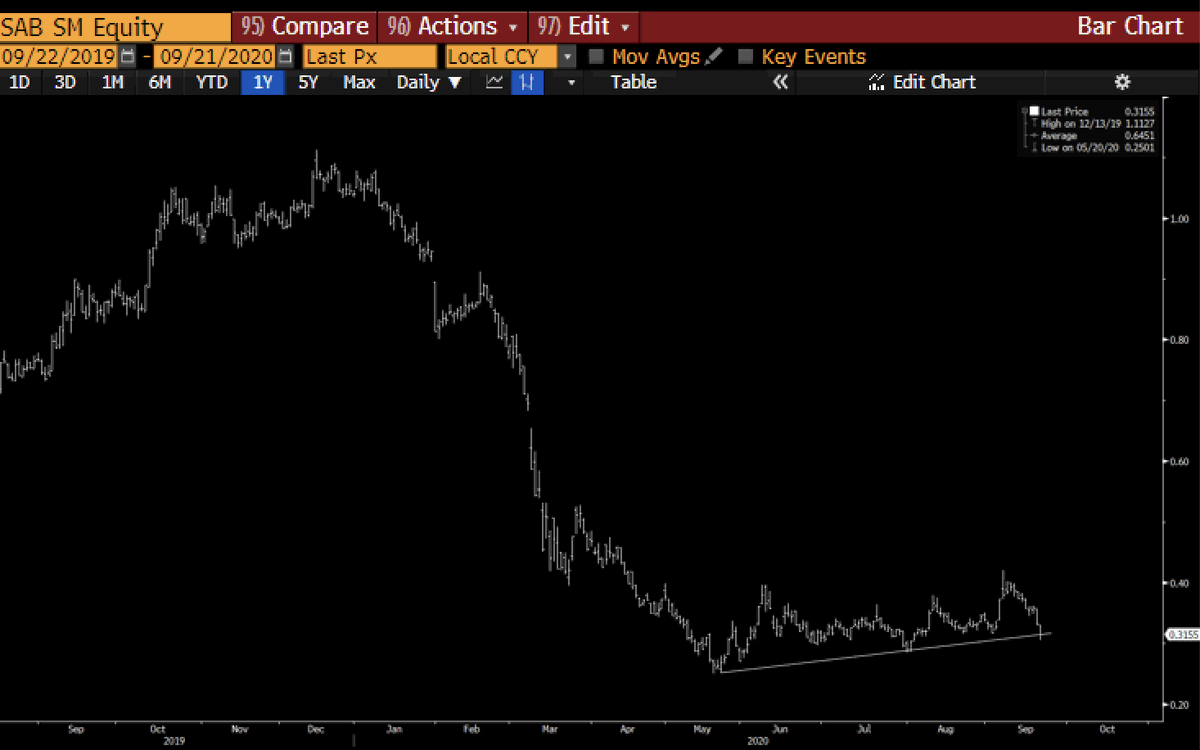

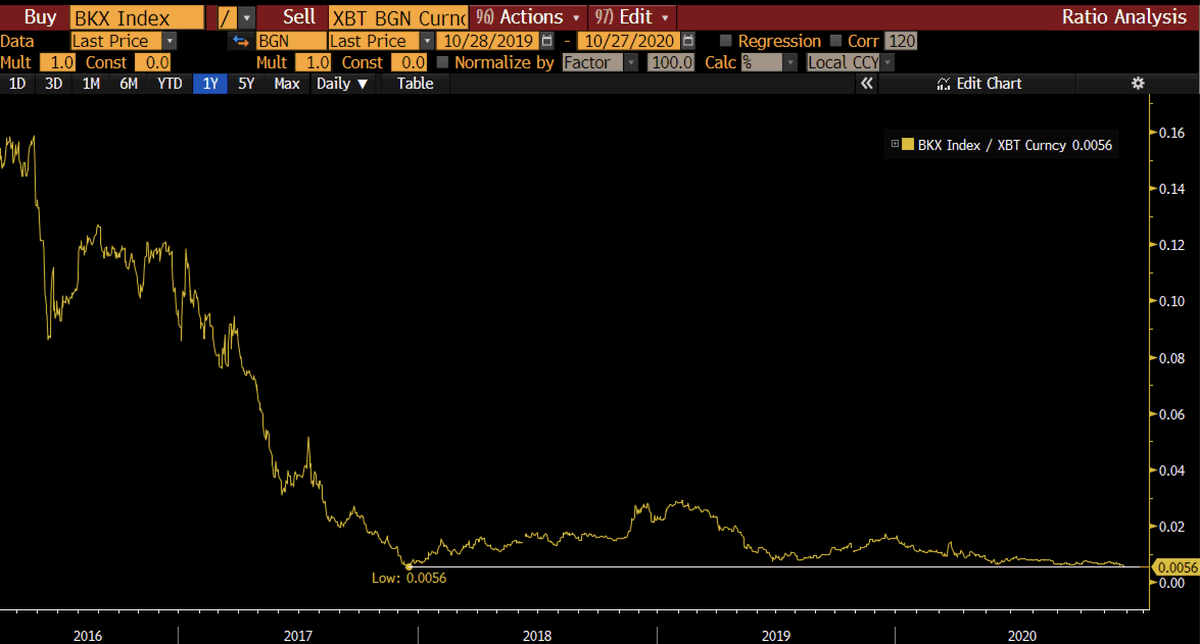

It has already destroyed the banks... they are now at their all time low versus our digital currency hero...

Bonds - one of my favourite trades for years... dead in the water versus the super hero of all assets...

G4 Central Bank Balance sheet - the other super power... still just about outperforming in last 2 years but about to lose the fight to bitcoin...

Bitcoin's performance is SO dominant and SO all-encompassing that it is going to suck in every single asset narrative dry and spit it out.

Never before in my career have I see a trade so dominant that holding any other assets makes almost no sense.

Never before in my career have I see a trade so dominant that holding any other assets makes almost no sense.

The macro, flows, technology, demography and societal strains have all converged to this moment in time and the definite answer from markets is - #bitcoin

I get this sounds a little evangelical but Im struggling to see it any other way right now.

I get this sounds a little evangelical but Im struggling to see it any other way right now.

The supermassive black hole is going to suck in everything.

Again, this is there best trade/investment and future opportunity I have EVER found and it has the power to give the little guy a chance to grab their share of the wealth creation before Wall Street does. Grab it.

Again, this is there best trade/investment and future opportunity I have EVER found and it has the power to give the little guy a chance to grab their share of the wealth creation before Wall Street does. Grab it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh