1/ Short-Term Momentum (Almost) Everywhere (Zaremba, Karathanasopoulos, Long)

"Contrary to stock-level evidence, we find a short-term momentum pattern in five major asset classes: the most recent month’s return positively predicts future performance."

papers.ssrn.com/sol3/papers.cf…

"Contrary to stock-level evidence, we find a short-term momentum pattern in five major asset classes: the most recent month’s return positively predicts future performance."

papers.ssrn.com/sol3/papers.cf…

2/ Asset classes: Equities, bonds, bills, commodities, and currencies

Sample period: 1800-2018

Data converted to U.S. dollars

For commodities, *spot* prices are used

"The aggregate number of assets increases gradually from 16 in January 1800 to more than 250 in the final years."

Sample period: 1800-2018

Data converted to U.S. dollars

For commodities, *spot* prices are used

"The aggregate number of assets increases gradually from 16 in January 1800 to more than 250 in the final years."

3/ Short-term momentum (SMOM) = asset return in month t-1

For control variables: "Due to our data limitations, we must be able to derive the variables using only price information, i.e., without any additional use of accounting data, investor positions, credit ratings, etc."

For control variables: "Due to our data limitations, we must be able to derive the variables using only price information, i.e., without any additional use of accounting data, investor positions, credit ratings, etc."

4/ Based on equal-weighted quintile portfolios, "the only asset class that does not exhibit momentum is bonds."

However, "shorting many positions in our asset universe was difficult or impossible, and we do not consider borrowing or storage costs."

However, "shorting many positions in our asset universe was difficult or impossible, and we do not consider borrowing or storage costs."

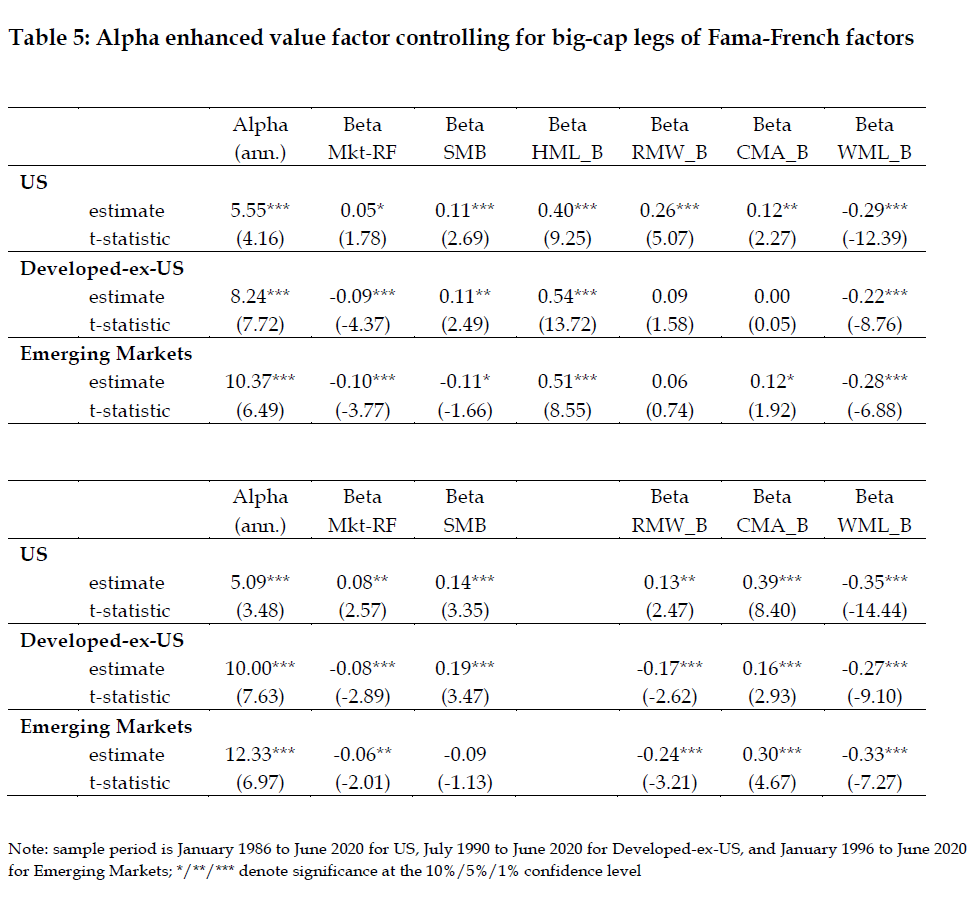

5/ "The two strategies implemented in the multi-asset framework produce very high and significant positive intercepts.

"For none of these datasets are the established factor strategies able to explain the abnormal short-run momentum returns."

"For none of these datasets are the established factor strategies able to explain the abnormal short-run momentum returns."

6/ "Time-series spanning test to all five portfolios from one-way sorts.... We supplement with the GRS test with the null that alphas on the five portfolios are simultaneously equal to zero and each other.

"Abnormal profits cannot be explained by established pricing factors."

"Abnormal profits cannot be explained by established pricing factors."

7/ "Even after accounting for MOM, SMOM still significantly predicts future returns in the cross-section.

"Panel D focuses on the cross-sectional regressions applied to risk-adjusted returns. Here, SMOM displays a positive and significant coefficient for bonds."

"Panel D focuses on the cross-sectional regressions applied to risk-adjusted returns. Here, SMOM displays a positive and significant coefficient for bonds."

8/ "The performance from two-way sorts displays strong and robust predictive abilities of short term momentum. All the long-short portfolios formed on SMOM generate positive and significant average returns and alphas within the tertiles formed on all of the control variables."

9/ "Returns are positively and significantly correlated among the short-term strategies implemented in equities, bonds, bills, and currencies.

"The exception is commodities. This suggests that the source of the correlation may be linked to country-specific risks or factors."

"The exception is commodities. This suggests that the source of the correlation may be linked to country-specific risks or factors."

10/ "Short-term momentum strategies in equities, bonds, bills, and currencies display significant exposure to other asset class returns. For instance, the equity short-term momentum appears to be linked to bond short-term momentum."

11/ "Short-run momentum is not present from 1800–1880. However, in later years, it is strong and robust across virtually all asset classes in all subperiods.

"The reason might lie in the small number of assets available in early years, resulting in smaller return dispersions."

"The reason might lie in the small number of assets available in early years, resulting in smaller return dispersions."

13/ "The magnitude of the phenomenon is similar in the different market states, though it is markedly stronger in the times of high return dispersion. In fact, this observation corresponds with the insignificant short-term momentum profits in the early years of our sample."

14/ Alternative approaches

Time-series = sign of previous month's return

Volatility-adjusted divides by five-year trailing volatility

"Both yield consistent results and lead to significant short-term momentum profits. We find no major qualitative difference in the results."

Time-series = sign of previous month's return

Volatility-adjusted divides by five-year trailing volatility

"Both yield consistent results and lead to significant short-term momentum profits. We find no major qualitative difference in the results."

15/ The alternative asset universe uses "commodity futures rather than spot prices, as in our baseline sample. (Chaves and Viswanathan reported differences in the performance of momentum and reversal in spot and futures markets.)

"The results confirm our baseline findings."

"The results confirm our baseline findings."

• • •

Missing some Tweet in this thread? You can try to

force a refresh