Enough Covid, let's move back to banks. The Spanish CB published a great Financial Stability Report with extremely interesting data - very useful as we approach a possibly new lockdown. A thread.

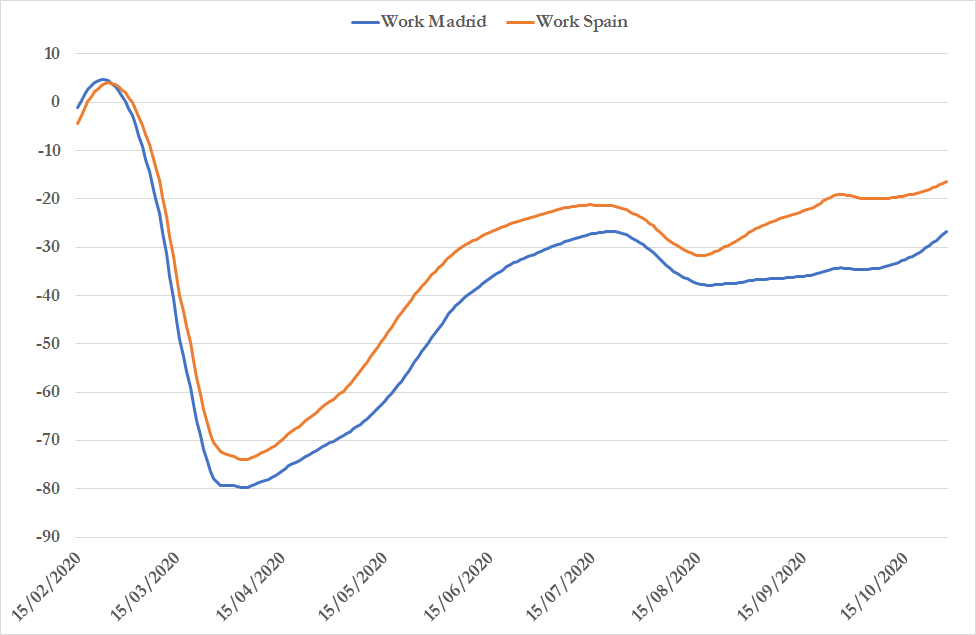

There is a lot about corporate weaknesses due to Covid - we've all heard about it, so I'll just mention this graph.

Blue is pre-Covid, red & orange are baseline and bad macro scenarios.

In hospi/leisure weak forms employ 70% of the total employment of the sector. Really grim.

Blue is pre-Covid, red & orange are baseline and bad macro scenarios.

In hospi/leisure weak forms employ 70% of the total employment of the sector. Really grim.

The BoS has an interesting model to explain who takes loan moratorium. The bad news is that there is a strong skew towards lower quintiles of revenues etc.

This is not very encouraging for when payment holidays stop

This is not very encouraging for when payment holidays stop

The BoS then runs a stress test on banks. This is where it gets very interesting. Here are the two scenarios used.

1) looks very much like most banks' "baseline" for LLP/ECL calculations

2) looks very much like what most use for their "bad" scenarios (again, for ECL/LLP)

1) looks very much like most banks' "baseline" for LLP/ECL calculations

2) looks very much like what most use for their "bad" scenarios (again, for ECL/LLP)

So the results should be consistent with banks' own calculations. Errr. Not really. Here are the results for large international banks (BBVA/SAN)

This is very intriguing because the results are much worse than what the banks expect... but the starting assumptions are almost the same (& before you ask, yes, the BoS takes into account gvt support)

in particular, in an adverse scenario (which is basically worse pandemic and further lockdowns) banks would definitely need a capital raise - under the BoS calculations

For other SSM banks, the results are slightly different: strong in the baseline, but more sensitive to a worse macro outlook;

A very interesting analysis on the impact of support measures: the biggest impact is from ICO guarantees. Good, but when that 30% of losses will have to be covered, expect tough discussions with the government!!!

But the impact is vital for bank: 150bps just in the baseline!

But the impact is vital for bank: 150bps just in the baseline!

Another very interesting chart: the impact of CRR Quick-Fix

You should focus on the very large IFRS9 impact because it's not permanent! So just add a few extra months to the calculations above and the stress test looks even worse...

You should focus on the very large IFRS9 impact because it's not permanent! So just add a few extra months to the calculations above and the stress test looks even worse...

Last one: the BOS contributed a very interesting chart to the debate on buffers: impact of using buffers on GDP, lending, and CET1. The "usual" calculation is that we can see a positive impact on CET1 (that's the "orthodox" CB thinking) +80bps

But the most important thing is the last estimate: what if using buffer leads to a funding crisis? Not unrealistic assumptions... and in this case, CET1 goes further down.

So what's the takeaway: CET1 buffers can be used, but the market needs insurances... MDA reform is coming!!

So what's the takeaway: CET1 buffers can be used, but the market needs insurances... MDA reform is coming!!

Last snippet, an interesting contribution to the dividend debate: they make the point that the potential extension of a dividend ban must go with clear forward guidance (in terms of pandemic metrics) on when dividends can resume.

But what strikes me in the entire report is the massive differences between the banks' own estimates (which rely on similar models) and the Bank of Spain's scenarios.

The inputs are the same, the methodologies should be similar... but the results are vastly different!

The inputs are the same, the methodologies should be similar... but the results are vastly different!

• • •

Missing some Tweet in this thread? You can try to

force a refresh