An Italian drama could unfold in the next few weeks, with substantial consequences. And, again and again, it's about the (probably not) oldest bank in the world, Monte dei Paschi. What is it about? A quick thread

It all started to unfold when the former CEO & Chairman were convicted earlier this month for accounting fraud (related to the infamous Alexandria etc transactions, worth a thread on their own - btw check who was governor at the BoI back then).

The bank is not directly liable for the conviction of the former CEO & Chairman, but there are many litigations ongoing against Monte Paschi & some of them are related to the capital increases that happened back in the time.

The "litigation" section on Monte annual report is longer than the one in Deutsche Bank's !!!

So what was the consequence? Because of the decision, the bank had to reclassify some of the claims as "likely"... which, under IFRS rules, means some provisions!

So what was the consequence? Because of the decision, the bank had to reclassify some of the claims as "likely"... which, under IFRS rules, means some provisions!

How much are we talking about? Last July they said €10bn risk: €4.8bn threatened litigation, €2.1bn of probable loss, €1.7bn of "possible" loss and €1.4bn of "remote" loss.

So now all the talk is about a capital increase (1.5bn to 2.5bn) to cover that loss. But this will be VERY hard to swallow for the market. So what? State aid again? Precautionary recap?

This is where it gets very interesting. Under "normal" state aid rules, precautionary recap means more or less wiping out subordinated debtholders. Ouch. The bonds would be worth 0. EXCEPT we've had the Covid communication from the EC back in March

This says that if a bank needs a recap state aid because of Covid then burden-sharing isn't necessary. This was a very strong support for bank subordinated bonds.

So how will it play out? Will the EC pretend to ignore the truth and say that the recap is because of Covid?

So how will it play out? Will the EC pretend to ignore the truth and say that the recap is because of Covid?

Or play hardball and say that obviously, this is all because of claims that are way older than Covid and demand a wipeout of bondholders?

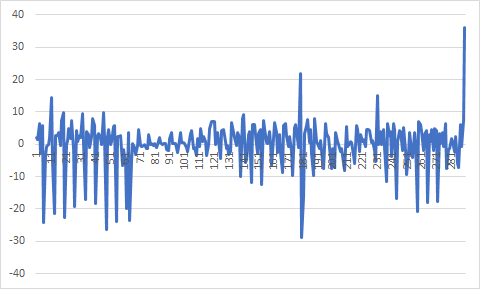

So far, the market looks a bit puzzled as you can see in the Tier 2 price action over 5 days - most people think burden-sharing won't happen, but for no good reason other than political... and you don't really want to bet the farm on that?

So far, the market looks a bit puzzled as you can see in the Tier 2 price action over 5 days - most people think burden-sharing won't happen, but for no good reason other than political... and you don't really want to bet the farm on that?

• • •

Missing some Tweet in this thread? You can try to

force a refresh