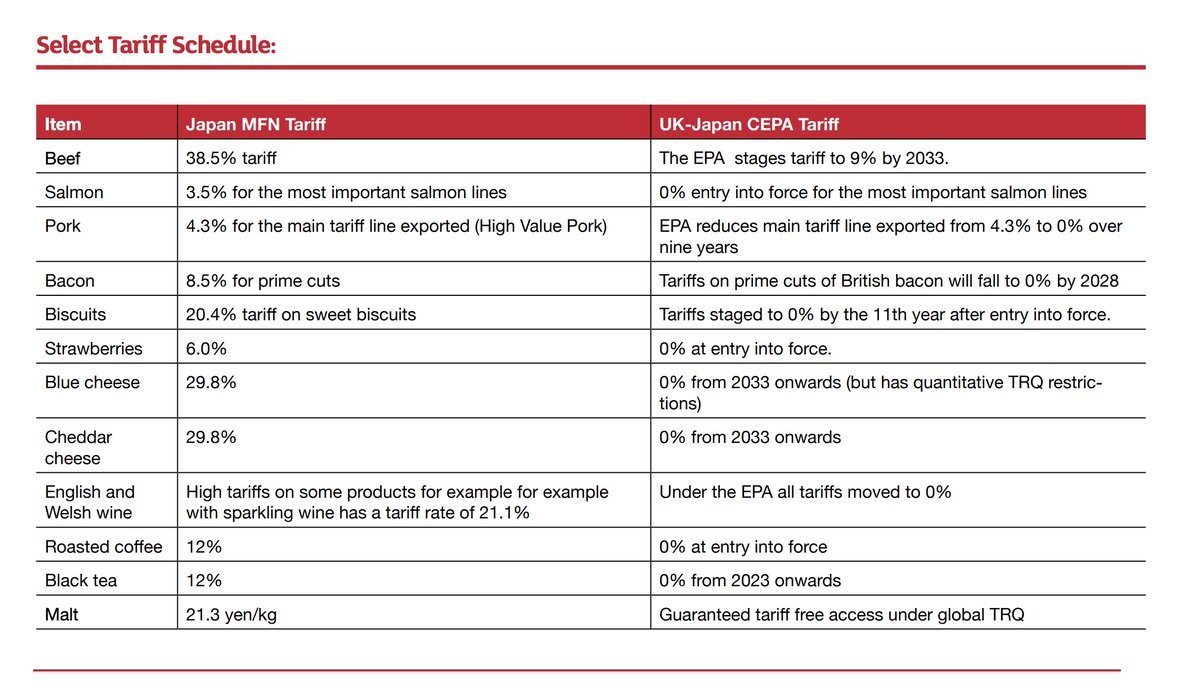

UK-Japan CEPA again.

The DTI have published this guide. A few points.

Obviously, first of all, it's not "reduced" as from now to Dec 31, it's 0% due to the EU EPA. So there's no reducing going on.

But what's this here?

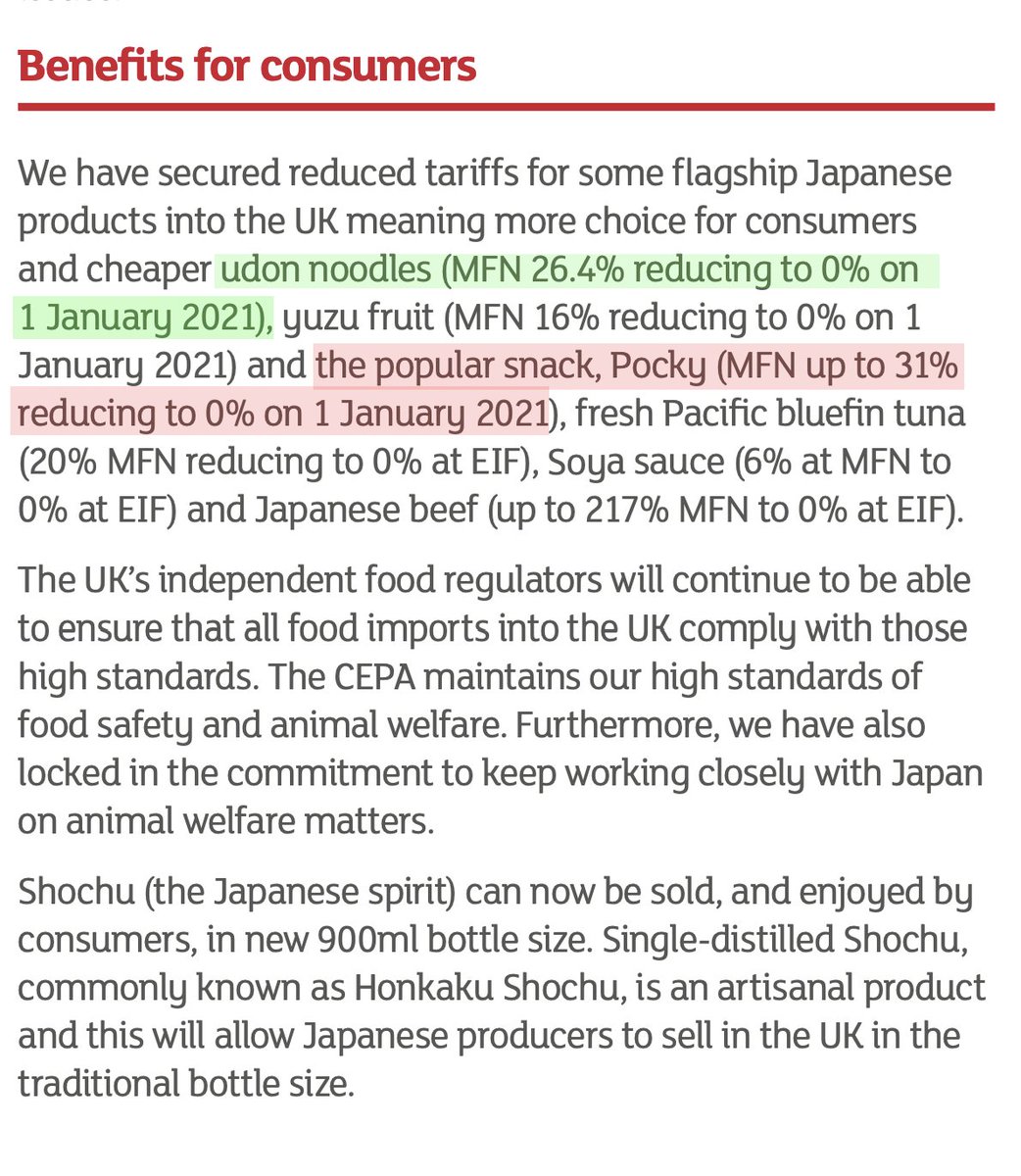

Udon noodles, Pocky etc.

assets.publishing.service.gov.uk/government/upl…

1/5

The DTI have published this guide. A few points.

Obviously, first of all, it's not "reduced" as from now to Dec 31, it's 0% due to the EU EPA. So there's no reducing going on.

But what's this here?

Udon noodles, Pocky etc.

assets.publishing.service.gov.uk/government/upl…

1/5

Lets' do Pocky first.

It's licenced and manufactured in Europe by Modelez as Mikado.

It's made in France.

2/5

It's licenced and manufactured in Europe by Modelez as Mikado.

It's made in France.

2/5

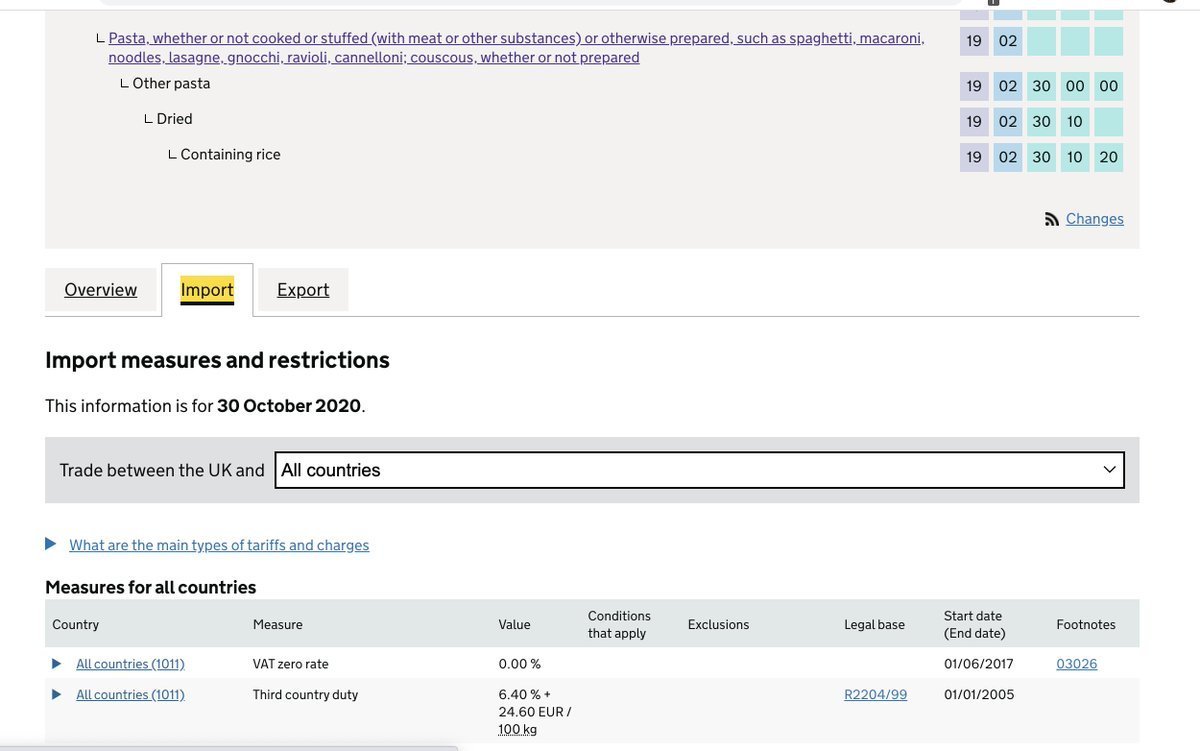

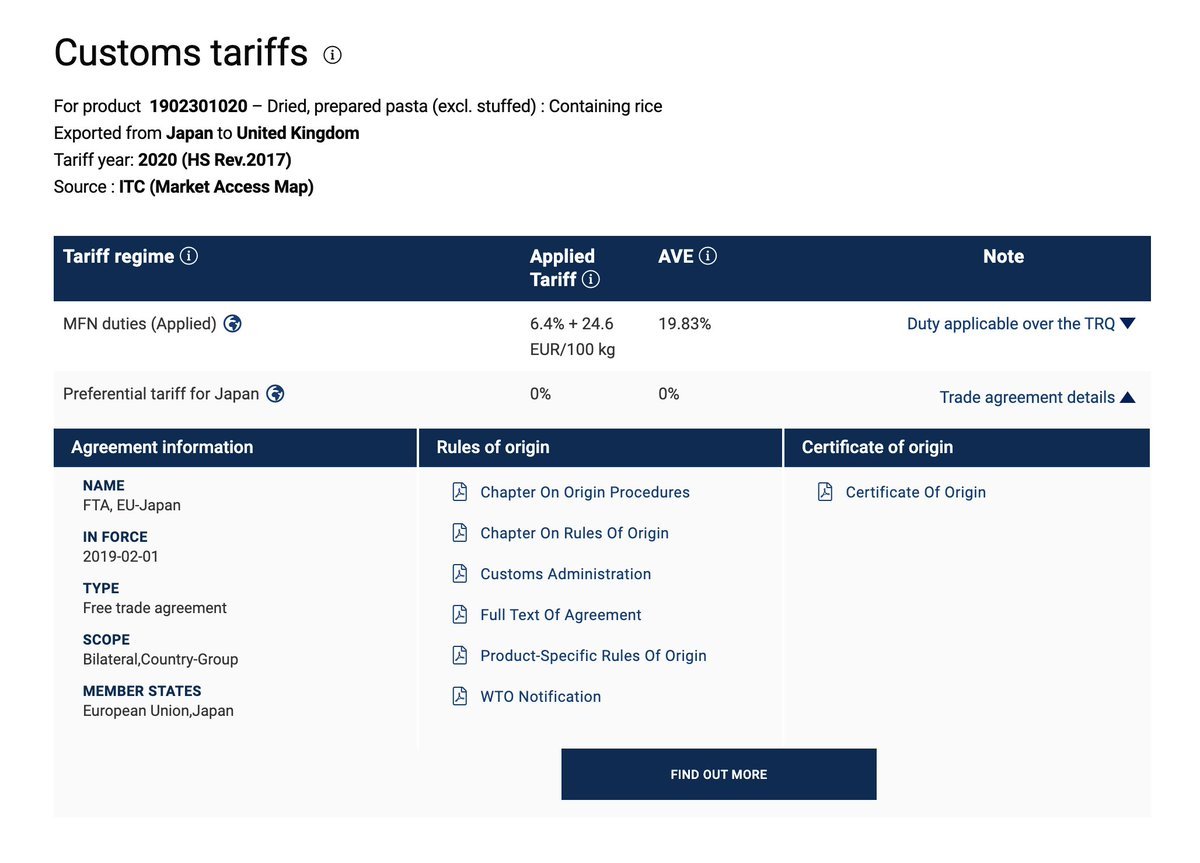

Udon noodles.

It says the MFN tariff on the noodles is 26.4%.

The MFN is not 26.4%.

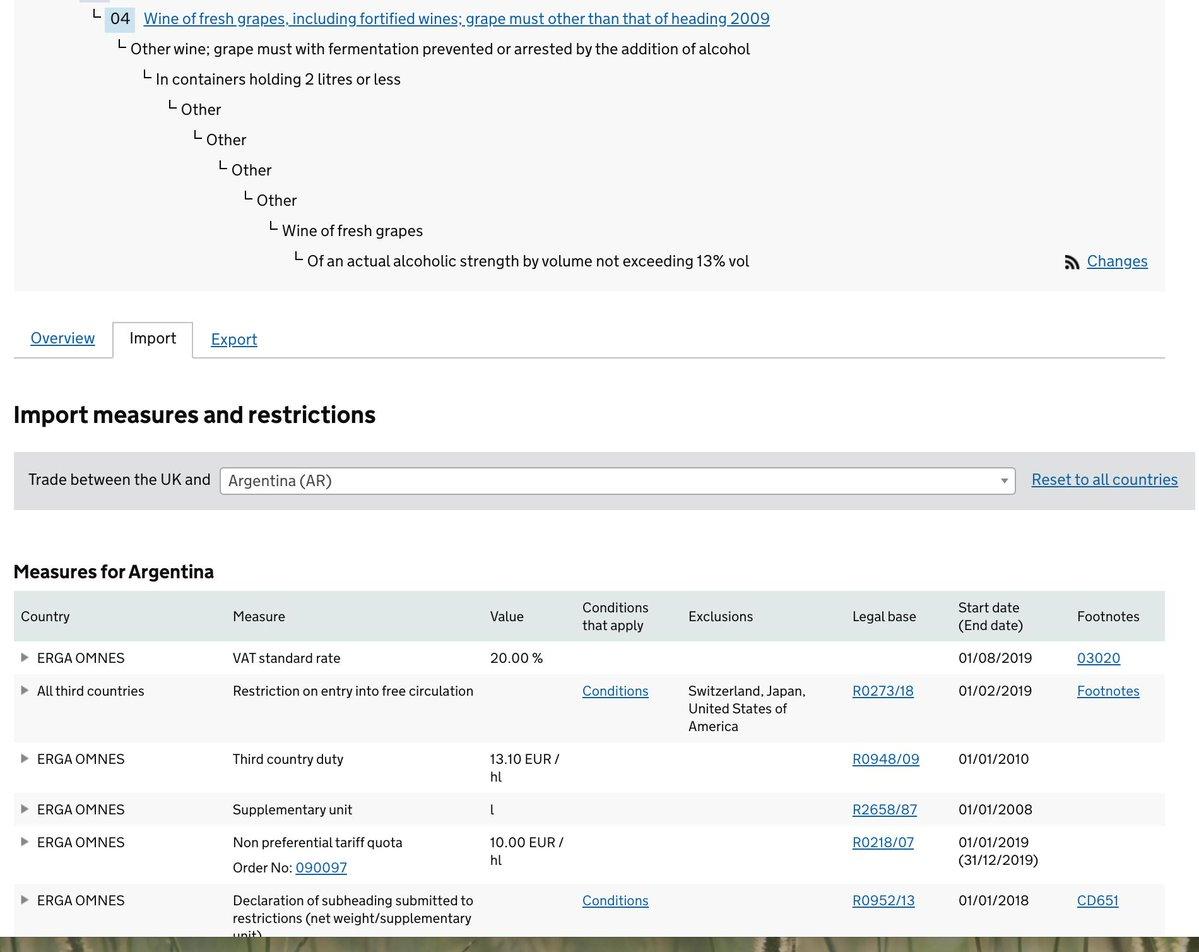

It's 6.4% + €24.60 per 100kg for CN 1902301020

But actually, as you know, zero right now.

3/5

It says the MFN tariff on the noodles is 26.4%.

The MFN is not 26.4%.

It's 6.4% + €24.60 per 100kg for CN 1902301020

But actually, as you know, zero right now.

3/5

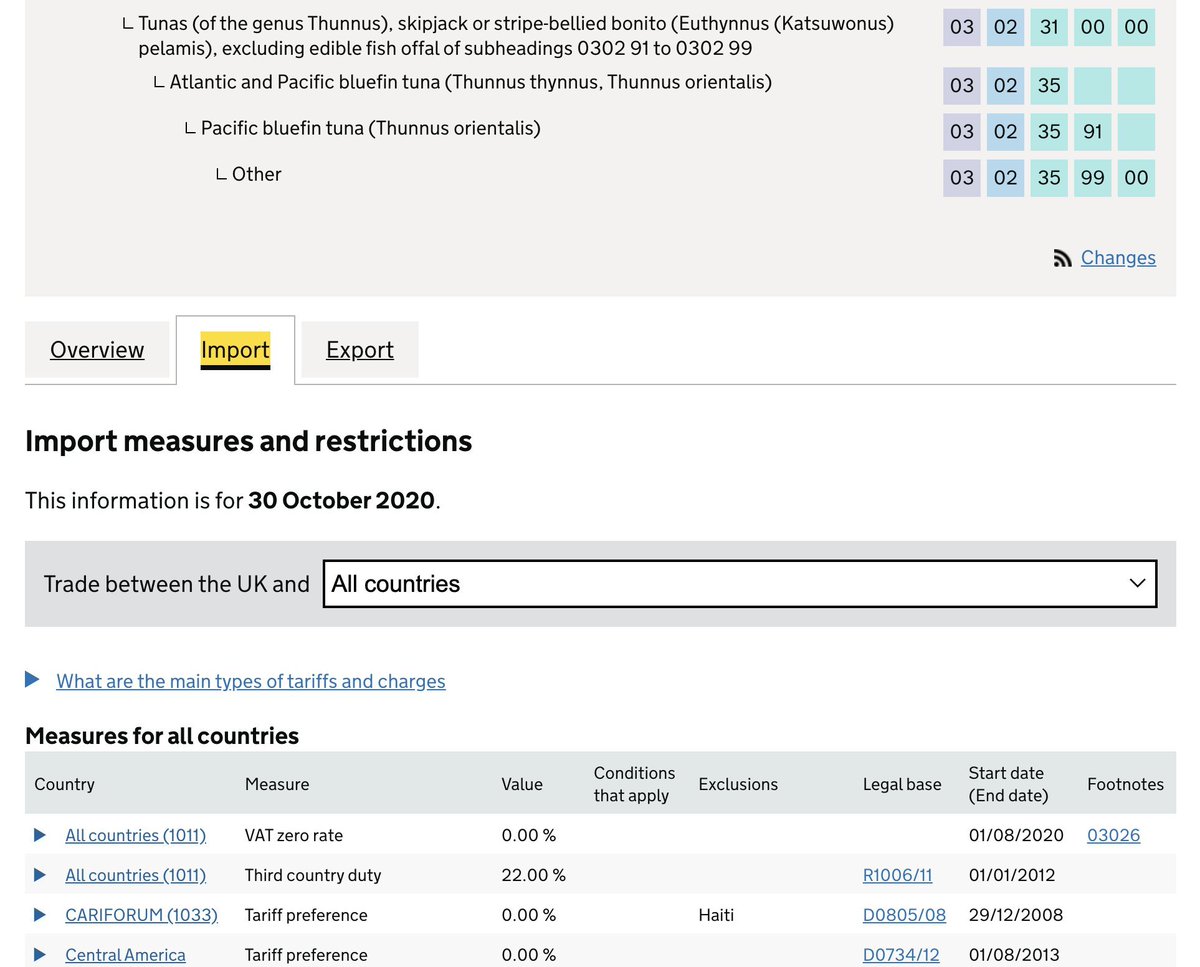

Pacific bluefin tuna. It's endangered.

The MFN tariff is 22%. Not 20%, but of course it is already, and will remain at 0% for Japan.

Here's a profile of the countries we currently import fresh tuna from (all Atlantic and 99% from EU countries mostly via Spain).

4/5

The MFN tariff is 22%. Not 20%, but of course it is already, and will remain at 0% for Japan.

Here's a profile of the countries we currently import fresh tuna from (all Atlantic and 99% from EU countries mostly via Spain).

4/5

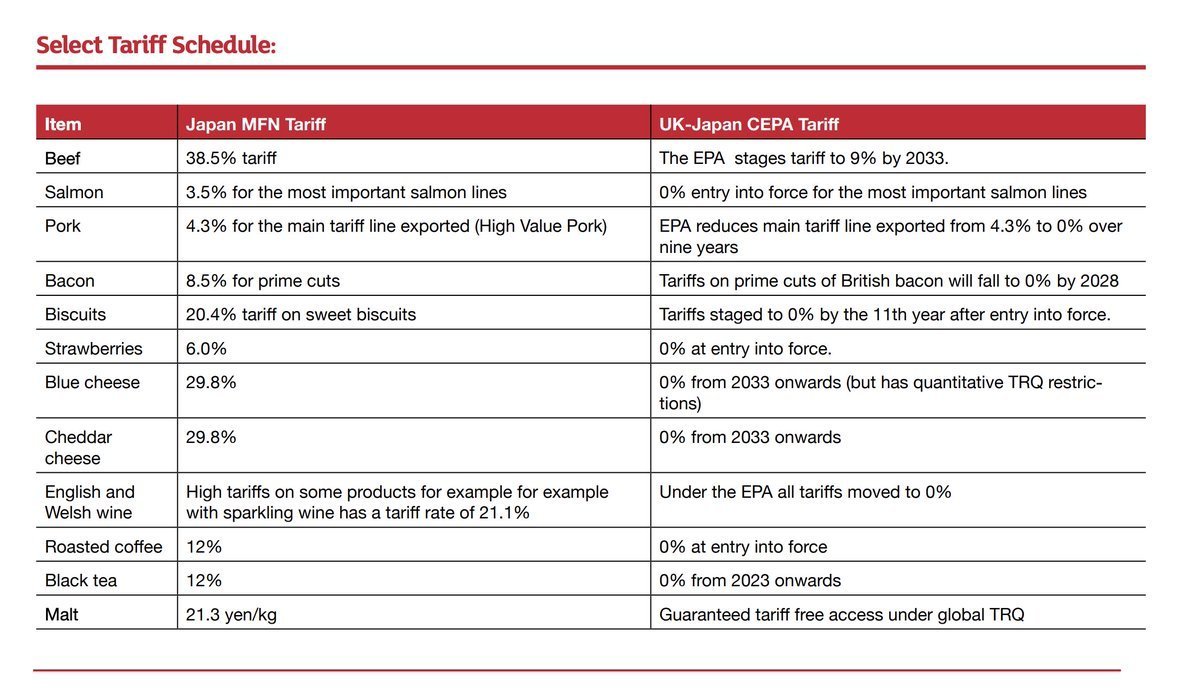

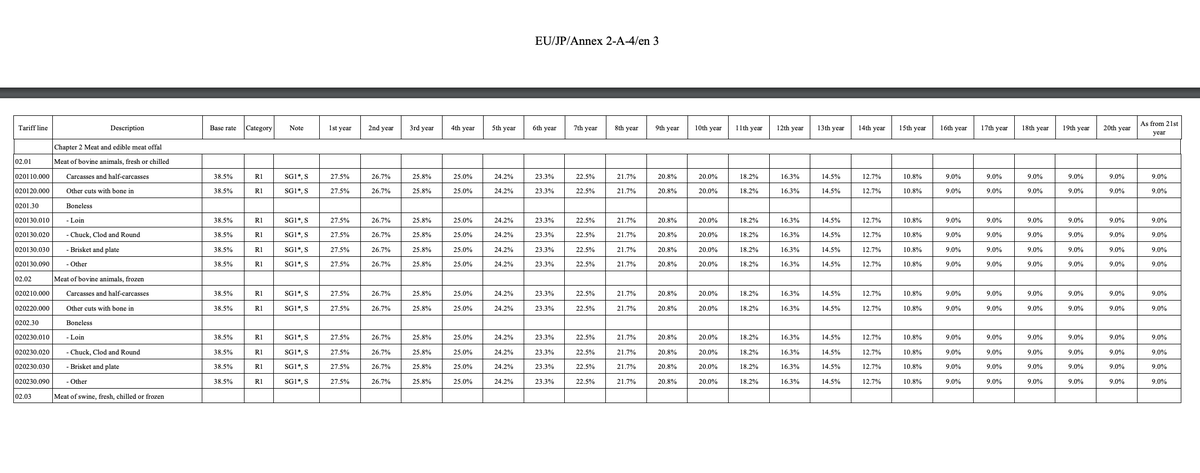

Note these tariff reductions from Japan's MFN are staged. It's only zero for UK beef from 2033.

They're probably the same as the current EU-Japan EPA. I haven't checked. That's too tedious to check even for me right now.

5/5

They're probably the same as the current EU-Japan EPA. I haven't checked. That's too tedious to check even for me right now.

5/5

Addendum

EIF means - comes into effect on the day the FTA comes into effect as opposed to being staged or some delay.

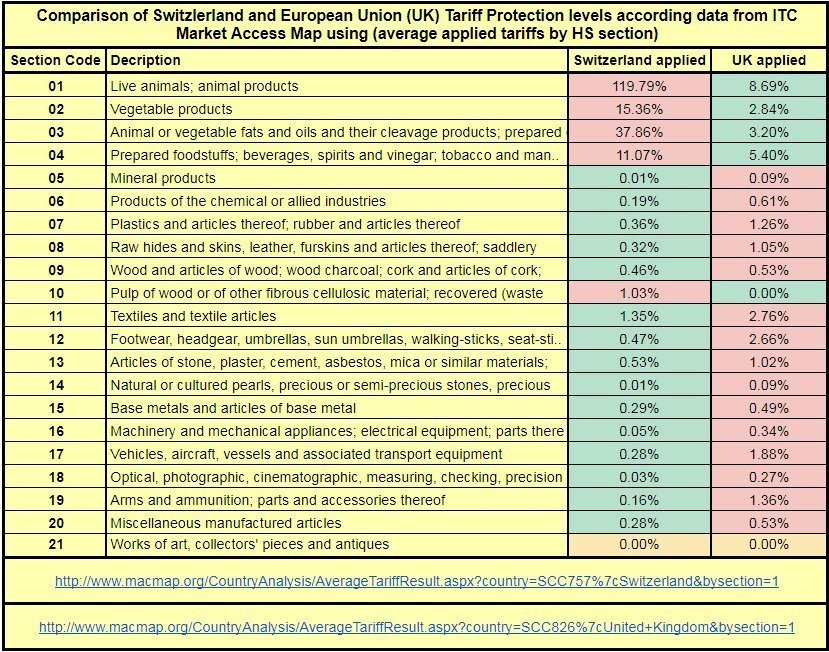

Here's the Ad Valorem Equivalent for that noodle tariff. According to the ITC (which uses a formula of duties/imports) it's 19.83%.

macmap.org/en//query/resu…

EIF means - comes into effect on the day the FTA comes into effect as opposed to being staged or some delay.

Here's the Ad Valorem Equivalent for that noodle tariff. According to the ITC (which uses a formula of duties/imports) it's 19.83%.

macmap.org/en//query/resu…

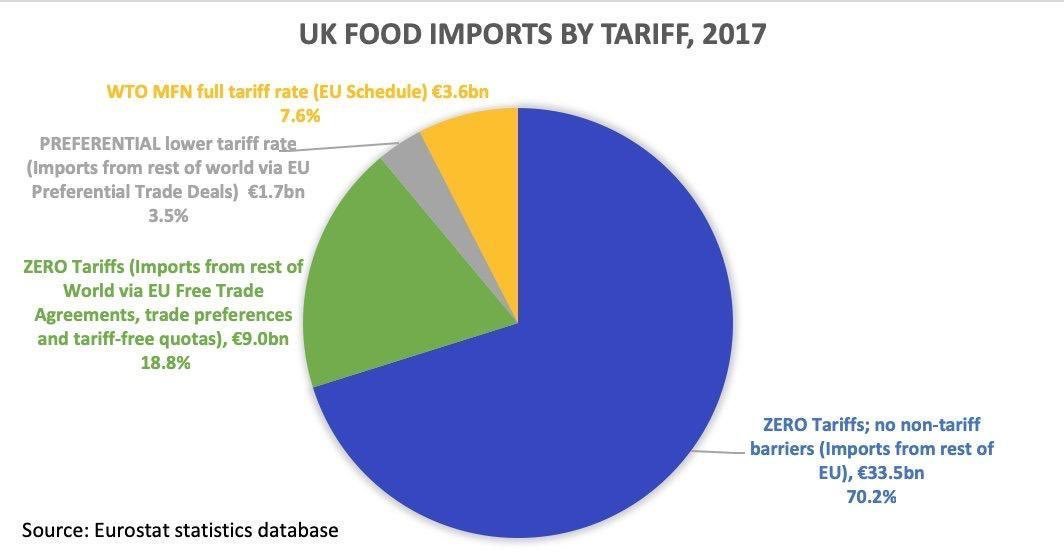

Oh and one more thing. As always these tariffs are applied upon import prices, not retail prices. The consumer wouldn't see those levels of retail price reduction even if it was a genuine reduction from the current situation.

Here's the schedule from the EU-Japan EPA, where beef was reduced to 9%.

The tables in the English language version of the UK-Japan CEPA as published by the UK & Japanese Govts are not searchable.

trade.ec.europa.eu/doclib/docs/20…

The tables in the English language version of the UK-Japan CEPA as published by the UK & Japanese Govts are not searchable.

trade.ec.europa.eu/doclib/docs/20…

@schnoogsl

has OCR'd the original.

So a searchable version can be found here:

newscrawler.eu/100107065_ocr.…

Obviously, we're a couple of years on from the original signing of the EU-Japan EPA.

has OCR'd the original.

So a searchable version can be found here:

newscrawler.eu/100107065_ocr.…

Obviously, we're a couple of years on from the original signing of the EU-Japan EPA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh