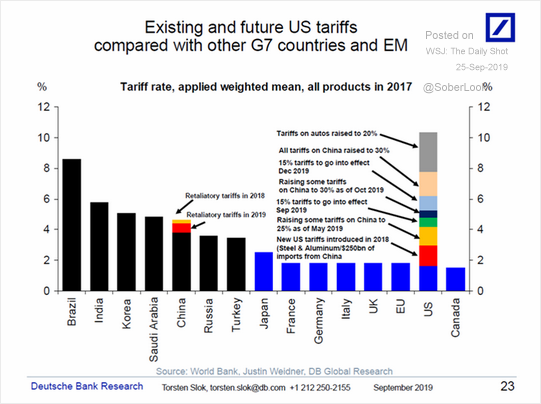

In the House of Commons today Michael Gove was talking about some 0% duties replacing current duties in a no-deal Brexit

He said (among other things which I'll deal with elsewhere) that there will be a 7% reduction in the cost of wine from Argentina.

Let's check, shall we?

Here we go:

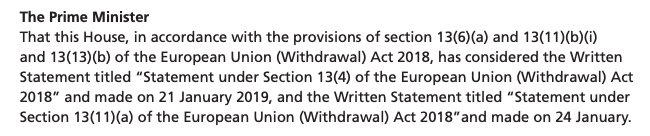

The tariff on bottled red wine containing less than 13% alcohol (CN 2204219811) from Argentina is shown here

The tariff within quota it is €10 per 100 litres.

Above quota it is €13.10 per 100 litres.

trade-tariff.service.gov.uk/commodities/22…

However, wine shipped intercontinentally normally arrives on our shores in a big plastic bubble inside a container like this which is much cheaper to transport.

So in the tariff schedule, it's under a different code; CN 2204299811.

globalfreightforwarders.com.au/commercial-fre…

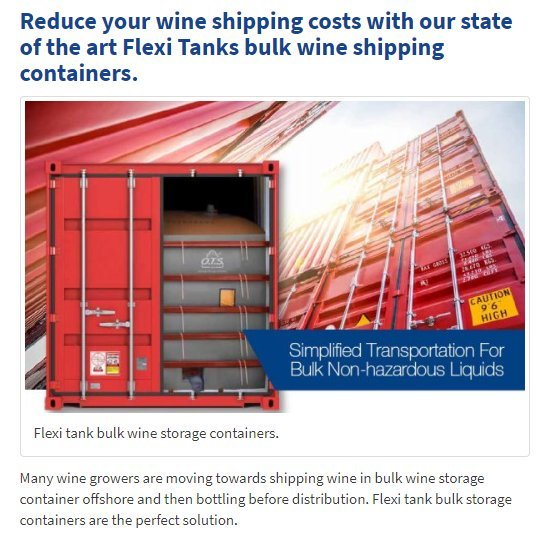

Here's the entry red wine from Argentina with less than 13% alcohol supplied in containers over 10 liters (CN 2204299811)

The tariff within quota it is €8 per 100 litres.

Above quota, it is €9.90 per 100 litres.

trade-tariff.service.gov.uk/commodities/22…

Let's just use this highest figure of €13.10 per 100 litres.

What's that per bottle (750ml)?

300 litres is 400 bottles. So If we multiply by 3 we get €39.30 per 300 litres

Converting to pounds €39.30 = £35.23.

£35.23/400 gives us a tariff of £0.088075 per bottle

~8.8p

If taking that off Michael Gove's Argentinian wine saves 7% then his bottle of wine costs:

8.8p/7*100 = £1.25 per bottle.

£1.25 a fricking bottle.

What sort of pissy Argentian wine is Michael Gove drinking?

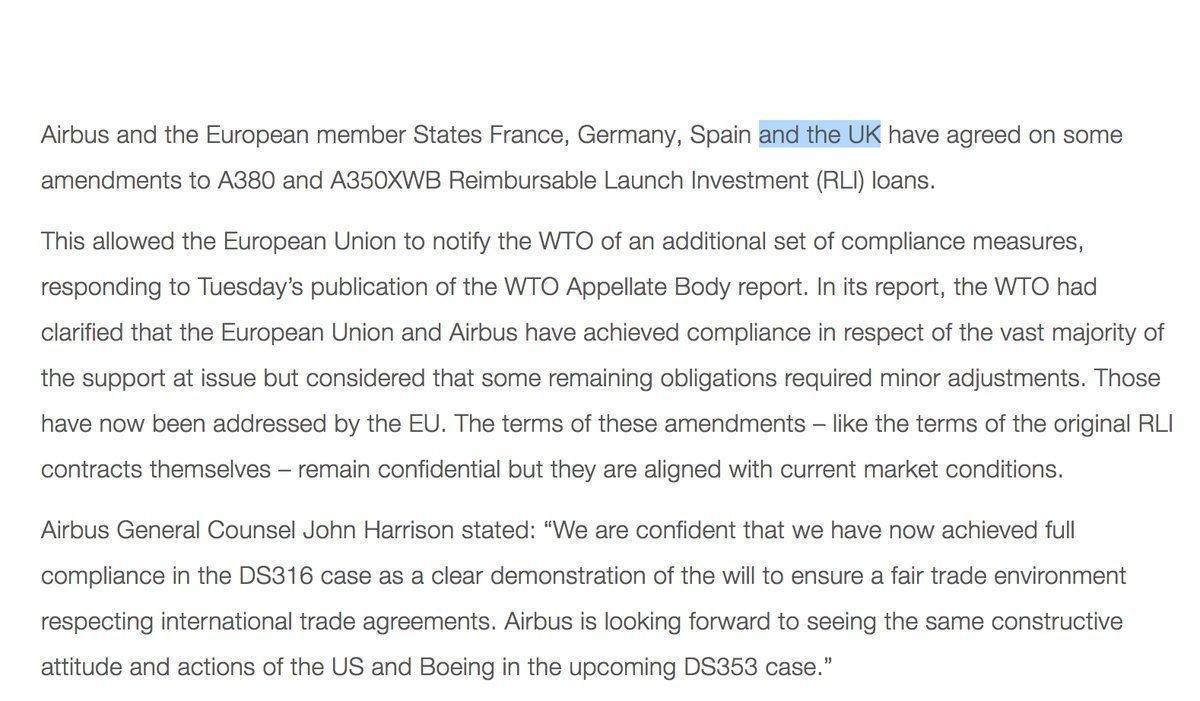

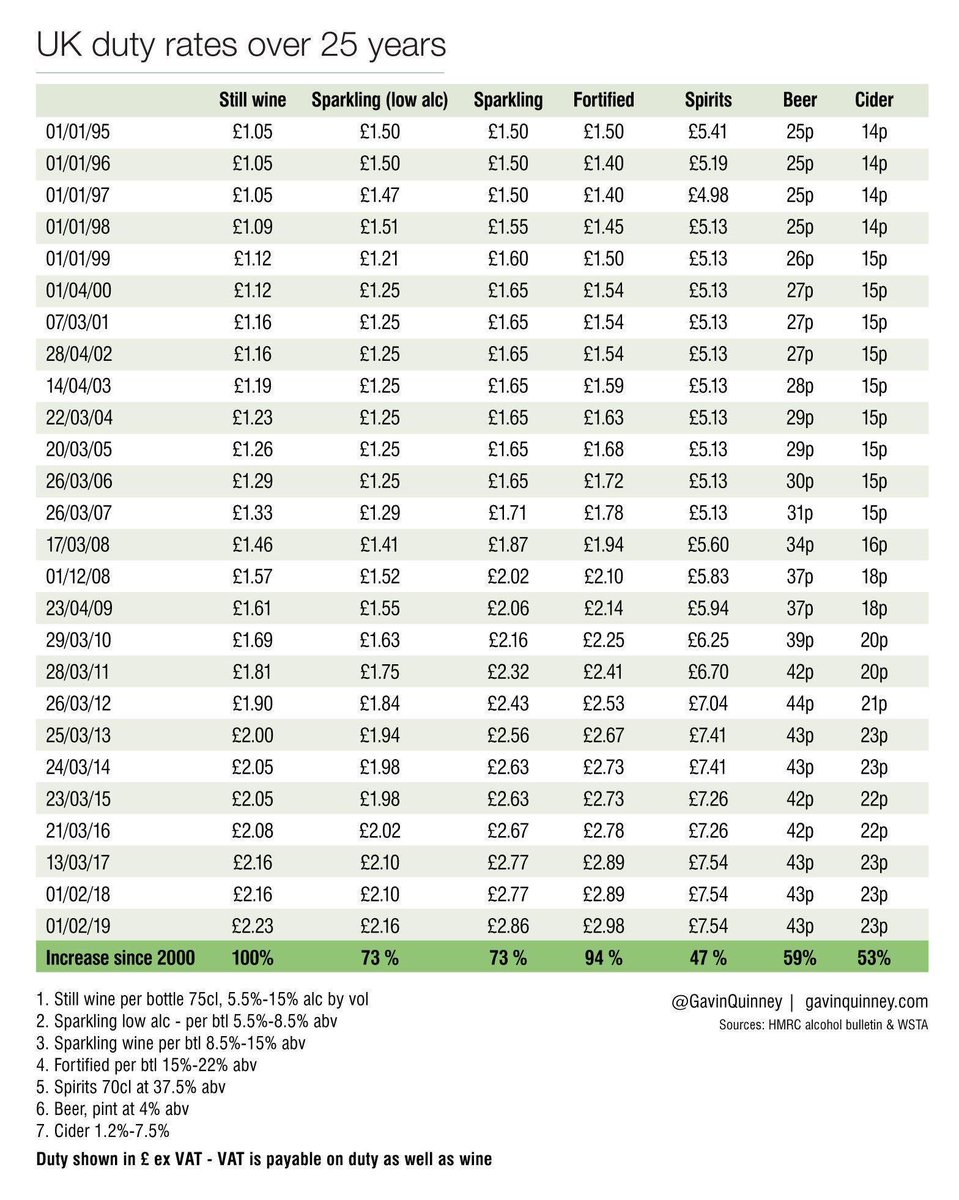

That UK duty equates to £2.23 per bottle and it went up by 7p from £2.16 per bottle in February of this year.

Thank you @GavinQuinney for the table.

Anyway in case you haven't realised it by now Gove's claim about a 7% saving on wine is a load of old cobblers.

Being generous we might suppose that he or someone at some point misread 7p, which is roughly the saving on the duty for the bulk transported wine as 7%.

/END

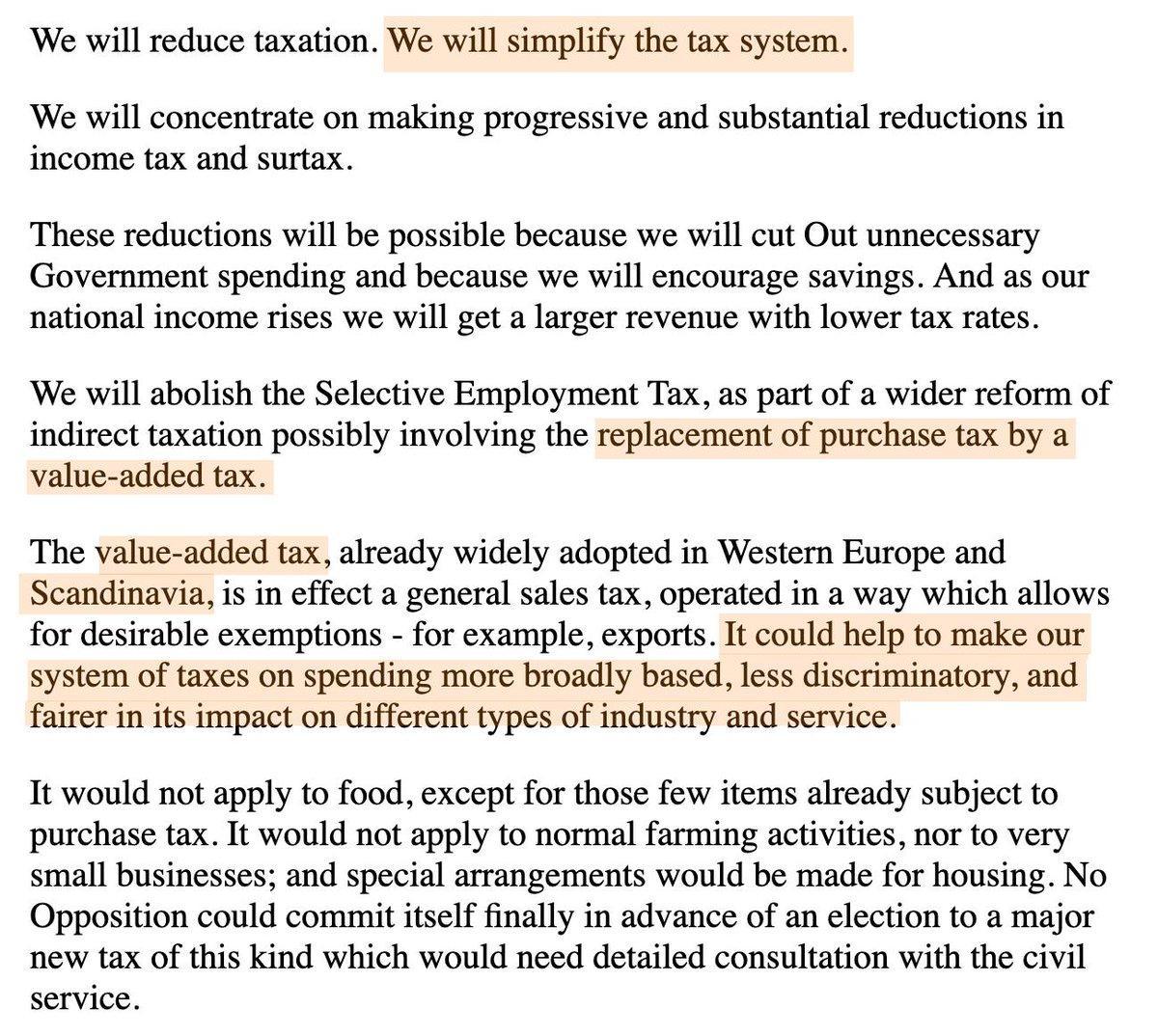

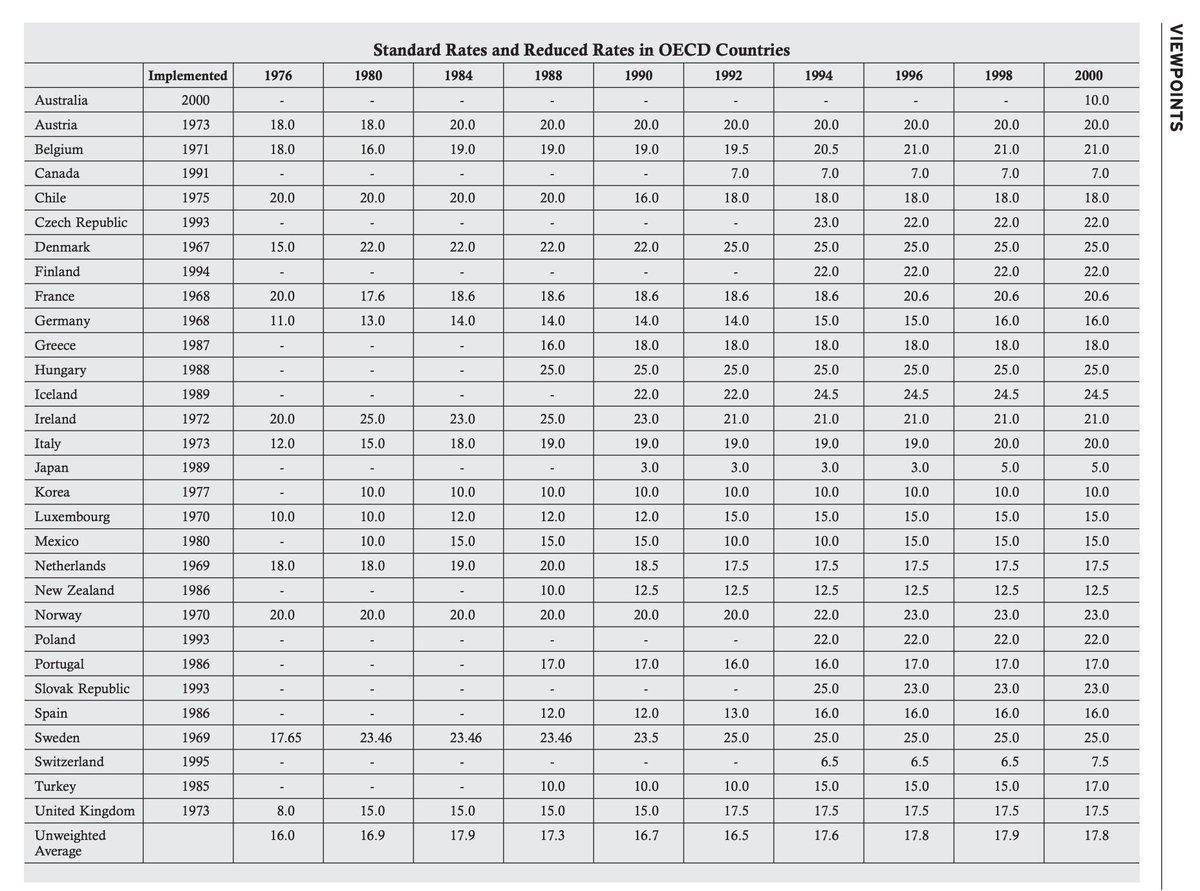

And just to be clear on that here's when the Scandanavians adopted VAT, none of them in the EEC at the time and only Norway planning to join. Now almost every country uses it.

Denmark: 1967

Sweden: 1969

Norway: 1970

oecd.org/ctp/consumptio…

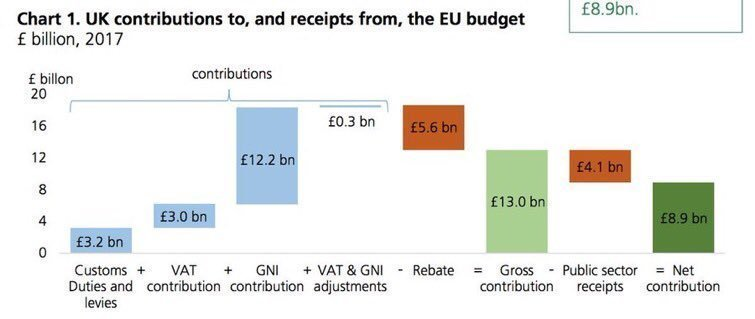

Member states must set it at a minimum of 15% for the base rate and can have 2 or 3 reduced rates including 0% and a special zero-rate for the UK.

ec.europa.eu/taxation_custo…

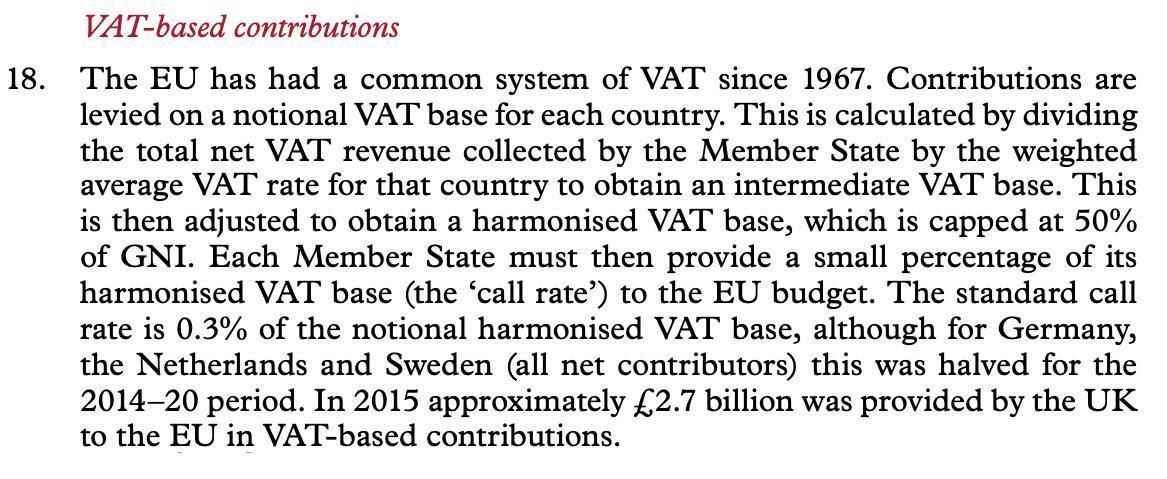

publications.parliament.uk/pa/ld201617/ld…

So I've done a brief update here:

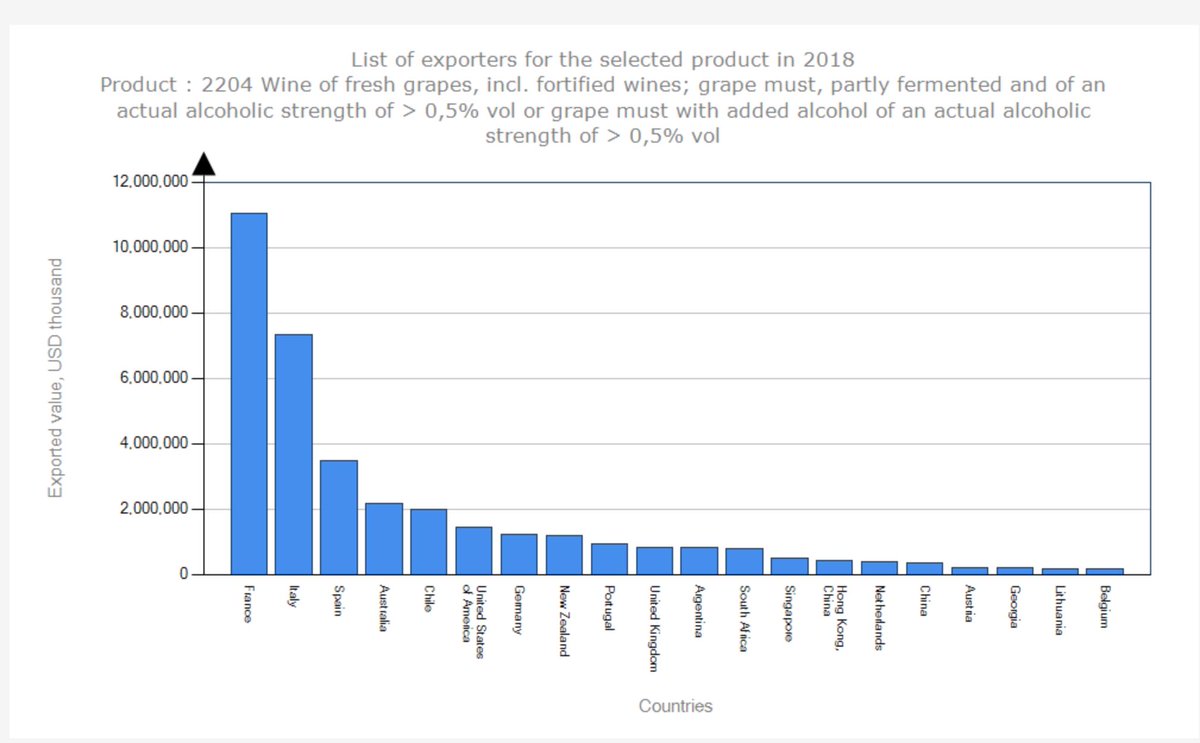

TL;DR I haven't worked out the percentages yet but any claim about Brazilian grapes ia a total red-herring because of Chile!

More detail on this a bit later.

I think I'm done now.

The UK exports more wine (by value) than Argentina. trademap.org/Country_SelPro…