1.1/x On value creation & dynamic capital allocation, @thirdpoint’s Daniel Loeb sent an insightful letter to $DIS prodding management to double down on its Disney+ direct to consumer (DTC) streaming business

bit.ly/35LbUWe

bit.ly/35LbUWe

2.2/x He argues $DIS should permanently stop dividends & reinvest cash into accelerated content creation & make Disney+ 1st landing site for all $DIS content instead of 2nd after box office, potentially forgoing $B’s in lost box office revenue (moot for now)

3.3/x Making Disney+ first drop for new franchise blockbuster content would fuel subscriber growth to scale into $NFLX league of 100MM’s of subscribers quickly, while bringing accelerated content velocity would keep them engaged, lowering churn

4.4/x We think this is exactly what $DIS needs to do in order to fulfill the strategy it has embarked upon to earn a relevant position among the global scale media businesses that $NFLX has been leading since innovating the model nearly a decade ago

5.5/x Former CEO @RobertIger made the initial bold decision to pivot $DIS media towards DTC (in the nick of time!) with large capital investments necessary and a deft and humble strategy that learned from the one $NFLX developed to great success

bit.ly/3muPm2N

bit.ly/3muPm2N

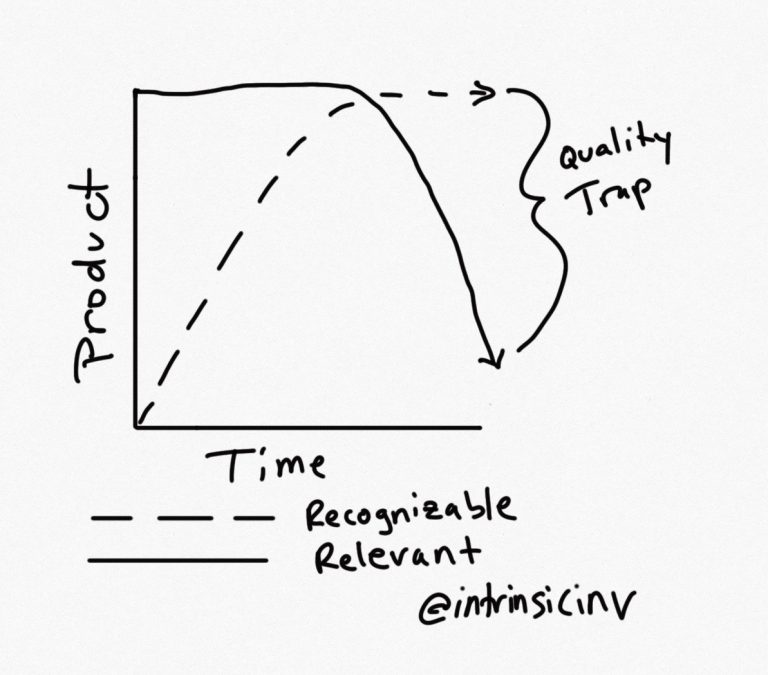

6.6/x Disney+ launched to great initial success in its first year, garnering as many subscribers as plan called for in its 5th year target of 60-90MM. But its current content catalog, lined with high quality franchise IP, is limited risking an engagement gap

7.7/x Newly appointed CEO Bob Chapek has the responsibility to drive that initial momentum forward, with uneasy tradeoffs to make in a challenging time

8.8/x Effective value creation is the goal of all profit enterprise; management’s most important function is to coordinate the capabilities & resources of an enterprise to sustainably do so over long term, followed by dynamic capital allocation in its service

9.9/x The way a company pursues this is full of trade-off decisions management makes characterized by company’s life stage, mission, capabilities, resources, industry dynamics, customer expectations, value proposition, technological change, relevance, etc.

10.10/x A framework we have developed is the idea of visionary & optimizer spectrum of leader types, each personality type having its strengths & weaknesses in delivering for an organization’s mission & constituents in a given period bit.ly/31P6Dfa

11.11/x $NFLX led disruption by focusing on the global DTC streaming opportunity Internet created, leveraging break in growth limits changing industry scale dynamics, from physical (wired) regional to virtual (wireless) global, & economics.

bit.ly/37OKVvL

bit.ly/37OKVvL

12.12/x Most media incumbents’ role will only diminish for lack of scale, cultural inflexibility, & subpar capital allocation, which emphasized capital return vs reinvestment, leaving them unprepared for impending slow-boil tech threat they unwittingly seeded.

13.13/x Optimizing managers, focused on jockeying for relative share, while squeezing customers’ surplus to return to shareholders (influenced by traditional activist financial engineering playbook to “unlock value”), who rewarded management for doing so

14.14/x Needed were more visionary leadership capable of recognizing/adapting to changing industry structure, by reinvesting in content scale + direct 2-way customer relationships, as their expectations shifted due to changing tech & behavior…shaped by $NFLX

15.15/x $DIS team came to understand changes just in time, pivoting hard and on its way to being the standout among traditional peers, making the leap towards DTC in a smart, committed way

16.Contrast that with Time Warner (pre-AT&T) with its earlier but half-hearted HBO NOW launch and CBS with a premium priced, low scale service that doomed it to be a niche offering bit.ly/3mufAm6

17.17/x We were shareholders of $TWX before switching sides to $NFLX in 2016, after concluding $TWX was not fully committed to capitalizing on its assets & redirecting capital allocation as necessary after management began “rewarding” of shareholders again

18.18/x The plan Loeb lays out makes complete sense relative to our view of the strategy that Netflix has developed and pursued to great success:

19.19/x New CEO Chapek still plotting path beyond initial strategic plan in transformation between 2 monetization models - transactional, segmented vs inclusive subscription, as (unsuccessful experiment) PPV of new Mulan demonstrates bit.ly/31SYzdr

20.20/x There are hard choices to make that involve business & financial model and impacts to all stakeholders including customers, employees, (historic) partners, creditors, & shareholders in the middle of an unclear & disrupted pandemic impacted world

21.21/x With $DIS’ initial huge success in growing subs in its first year, the visionary leadership team could use that proof point & momentum to increase its commitment & investment to DTC – focus on shaping future consumer experience & business model

22.22/x Loeb calls for faster velocity in new content production to drive growth, engagement, & lower churn. We can see the difference in net content investment historically, as Netflix has organically pursued velocity and scale of content production

23.23/x Content investment underpins NFLX continued scaling of subscribers from 30MM to 200MM, expanding across genres & geos with increasing mix of local content produced locally, viewed globally - to be so successful at scale of quantity x quality is amazing

24.24/x Minimum level of scale & velocity required to keep subs engaged & not churning excessively to underwrite this scale of growth. The more value & more habituated/engaged subs get, more room created for increasing pricing & profitability beyond min scale

25.25/x Disney+ scale requires effective reinvestment of capital via forgone high margin revenue from 3rd party licensing (already committed) & theater licensing (Loeb’s ask on higher DTC commit), while raising costs for higher content production velocity

26.26/x It’s a tough pill to swallow given its near term hits from COVID, some of which include (forced) costs of reinvestment already, but $20B cash cushion helps as well as open capital markets

27.27/x $DIS was smart to offer large discounts up front for annual & 3-yr promotional subscriptions (as low as $3.88/month), because it dampens monthly churn in immediate horizon, but leaves open excess churn further out if engagement falls short

28.28/x Blockbuster franchise IP draws audience to sign up but there’s a limit to how many times adults will watch Marvel/Star Wars, while Cinderella & Sleeping Beauty’s cultural relevance (unlike their beauty) are fading

29.29/x Loeb correctly points out, higher velocity of content creates higher value via higher engagement rather than further discounting a low price. This is $NFLX playbook

30.30/x LT scaling of content costs requires increasing budget over time to be competitive at global scale, which is accelerated by high value engagement, growth, & conviction in future of revenue sustainability (issue of current cash costs vs content obligations)

31.31/x Indeed, when it comes to committing to dividends, management must know when to “hold’em and when to fold’em”, as history of great brands demonstrates… and this is a time to cut dividends & reinvest in success of future opportunity bit.ly/2JgUJEE

32.32/x Set against a backdrop of ~$15T of negative yield debt & ZIRP, capital is plentiful but productive uses are scarce. Shareholders don’t need capital returned, but smartly reinvested in productive opportunities bloom.bg/3oH2S5h

33.33/x This a unique moment for Chapek, Iger, & team at $DIS to do just that by extending $DIS reach & scale while leveraging ZIRP environment to aggressively finance future scale as $NFLX’s astute @reedhastings & bold team have done over past decade

34.34/x Clearly #NoRulesRules culture has an advantage in effecting change quickly, but $DIS unique culture could potentially do same for its business, but there may be more work to be done as power dynamics between constituents in industry shift bit.ly/3kBO85y

35.35/x We think there is a large, growing market for 3-5 media companies at global scale, with a world hungry for affordable new & quality content. At least half of the 1B wired and 5B wirelessly connected consumers comprise a very large TAM to be unlocked

36.36/36 $NFLX clearly the leader & furthest in unlocking that TAM with 200MM+ subscribers expected by YE 2020, growing 20-30MM annually, but consumer appetite for content leaves plenty of opportunity for $DIS, $AMZN, $GOOGL, $AAPL with right strategy & investment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh