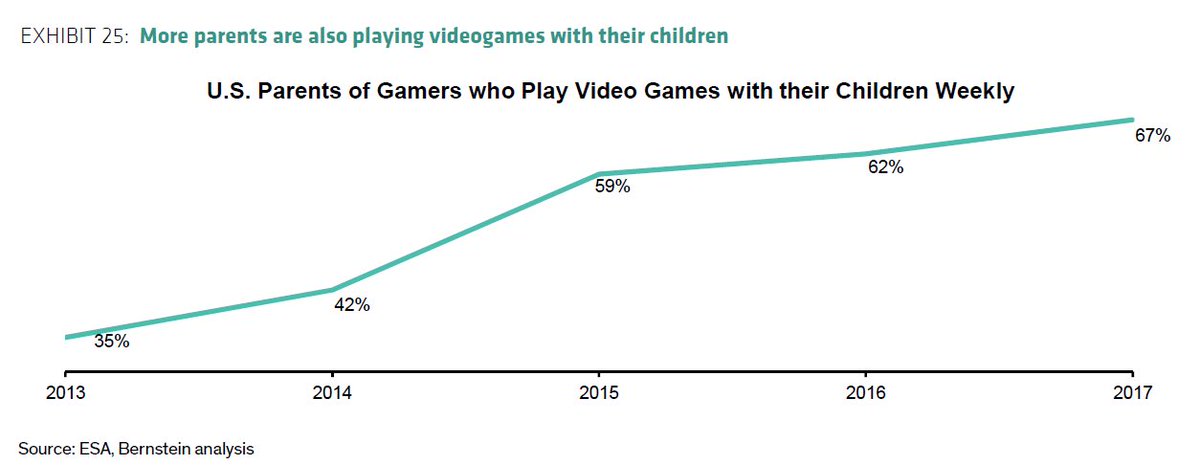

The big inflection in video game end markets is first generation of people who grew up as gamers are now parents. So the whole family games and it is no longer seen as a “vice” for young kids.

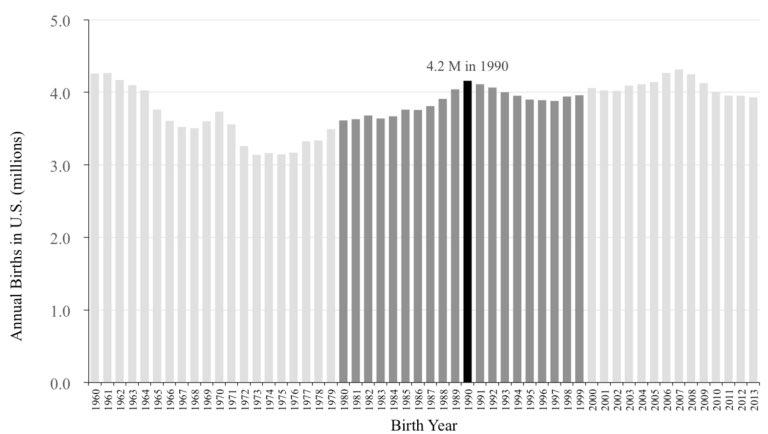

If you were born in 1980 you were 5 when Super Mario came out. But 1990 was peak birth year for Millennial Generation. So we have a decade of rising number of gamer-parents ahead of us.

The point of “play” is to prepare children for adulthood. What is better way to prepare for adulthood in a digital world than playing video games? Our long $ISRG (robotic surgery) thesis depends on surgeons having played video games as children! pubmed.ncbi.nlm.nih.gov/17309970/

The military feels the same way. airspacemag.com/daily-planet/c…

Those of us in our 40s entered workforce and saw senior executives not fluent in computers and weak at typing. In a decade GenZ will look at us as having significant productivity handicap due to limited video game time as children as we hopelessly navigate VR/AR work environments

What investments other than Nintendo align with this theme; parents as gamers and games as preparation for adulthood? intrinsicinvesting.com/2020/07/14/nin…

For those of you enjoying this thread, a question: why do many people insist you must be a gamer to be a legitimate investor in the space but when someone pitches Boeing no one says “Bro, do you even build airplanes?!” cc @GavinSBaker

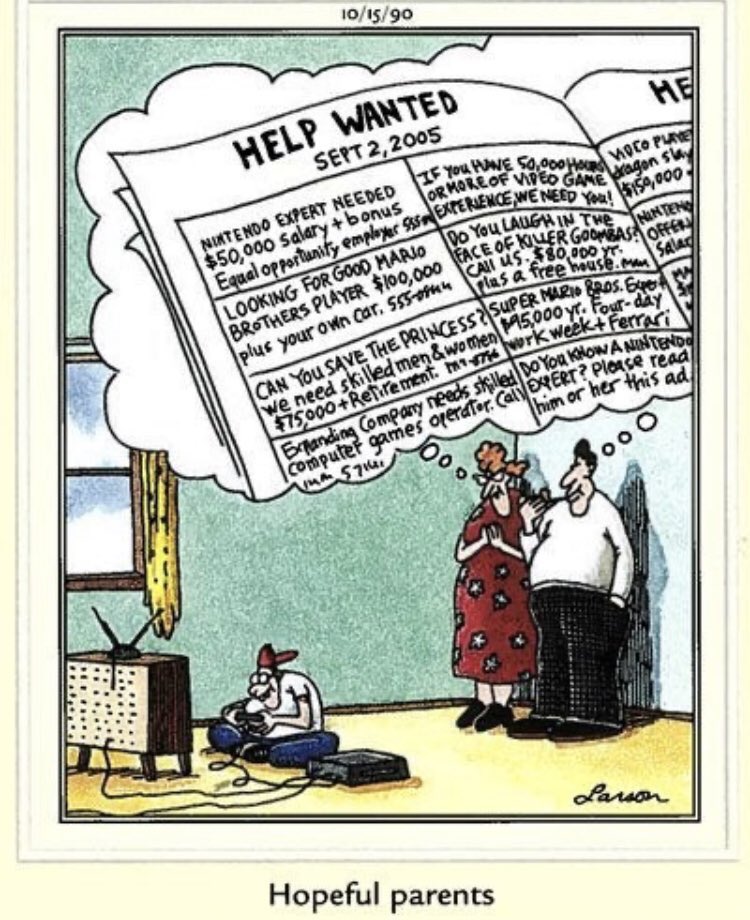

This comic was published in 1990, peak year for Millennial births. Turns out the comic was “right” except they underestimated how much gamer kids would earn as working adults. @wolfejosh says to buy anything that people say “will rot your brain!” How right he is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh