💥

Some unbelievable memories of Market fall n rise during Covid captured in pictures..

LIFETIME LEARNINGS

Do share if you have any..

How fast times change...

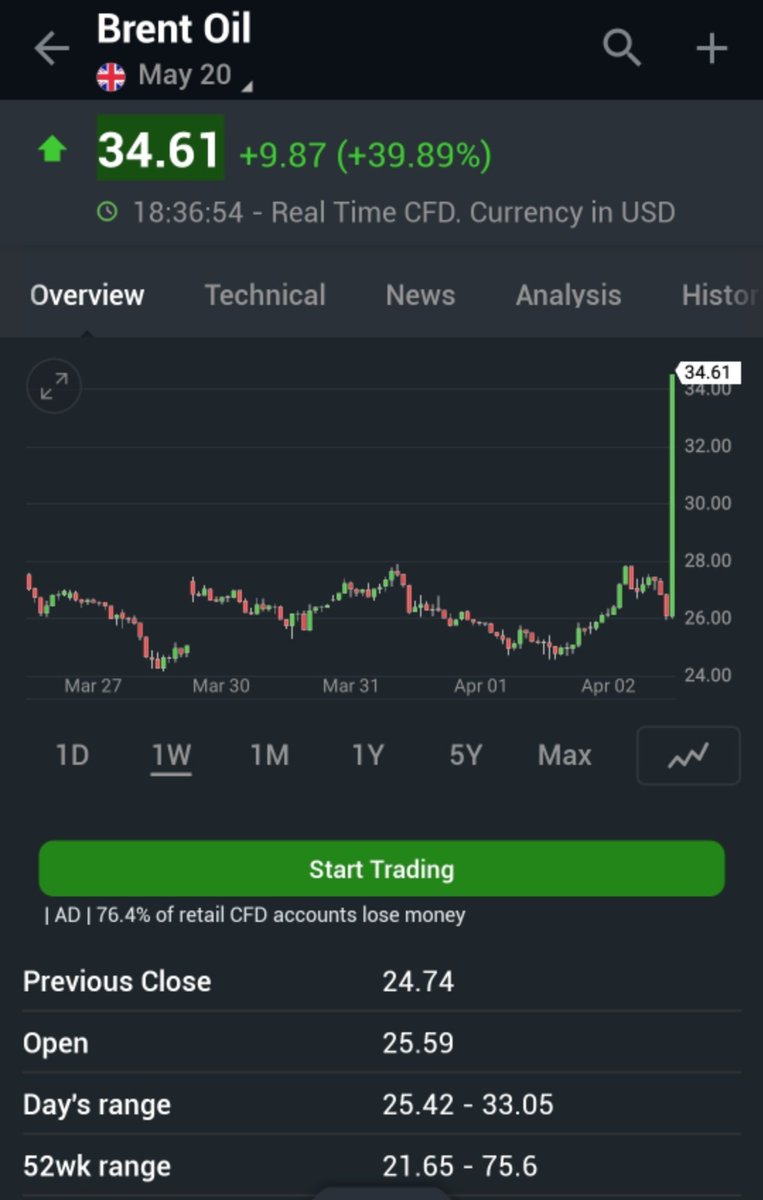

1. Brent spiked >40% in a day..

(1/n)

#investing

Some unbelievable memories of Market fall n rise during Covid captured in pictures..

LIFETIME LEARNINGS

Do share if you have any..

How fast times change...

1. Brent spiked >40% in a day..

(1/n)

#investing

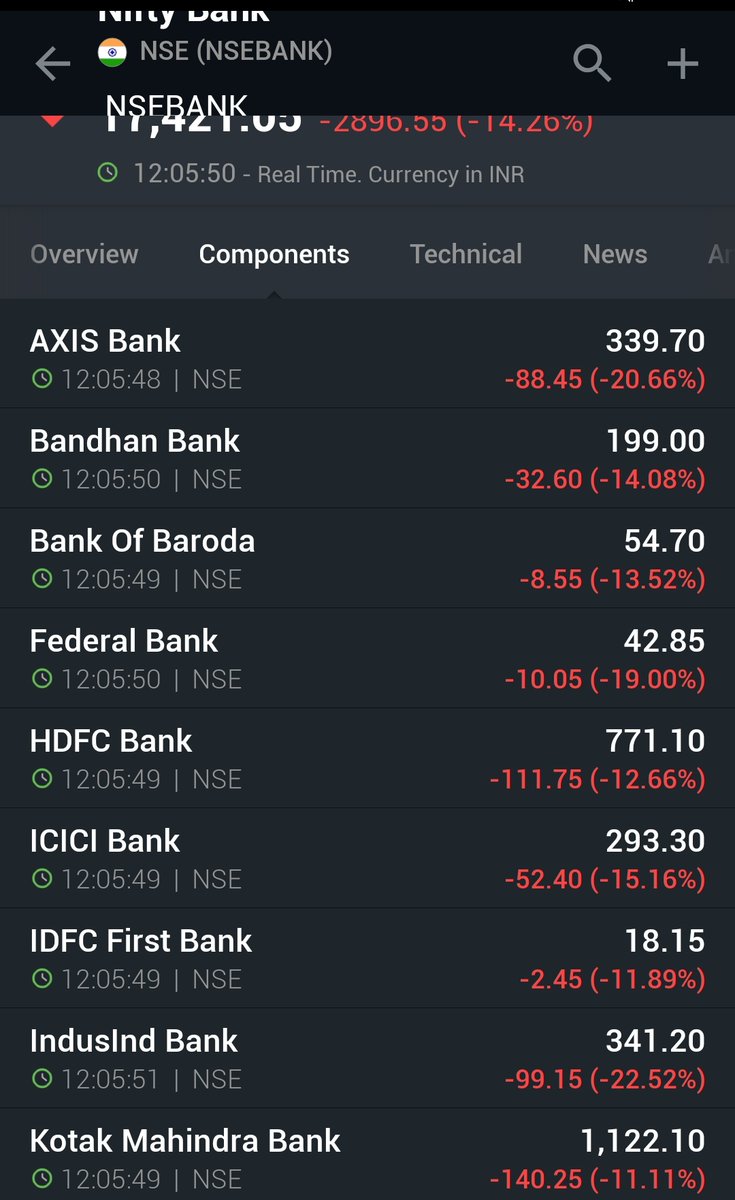

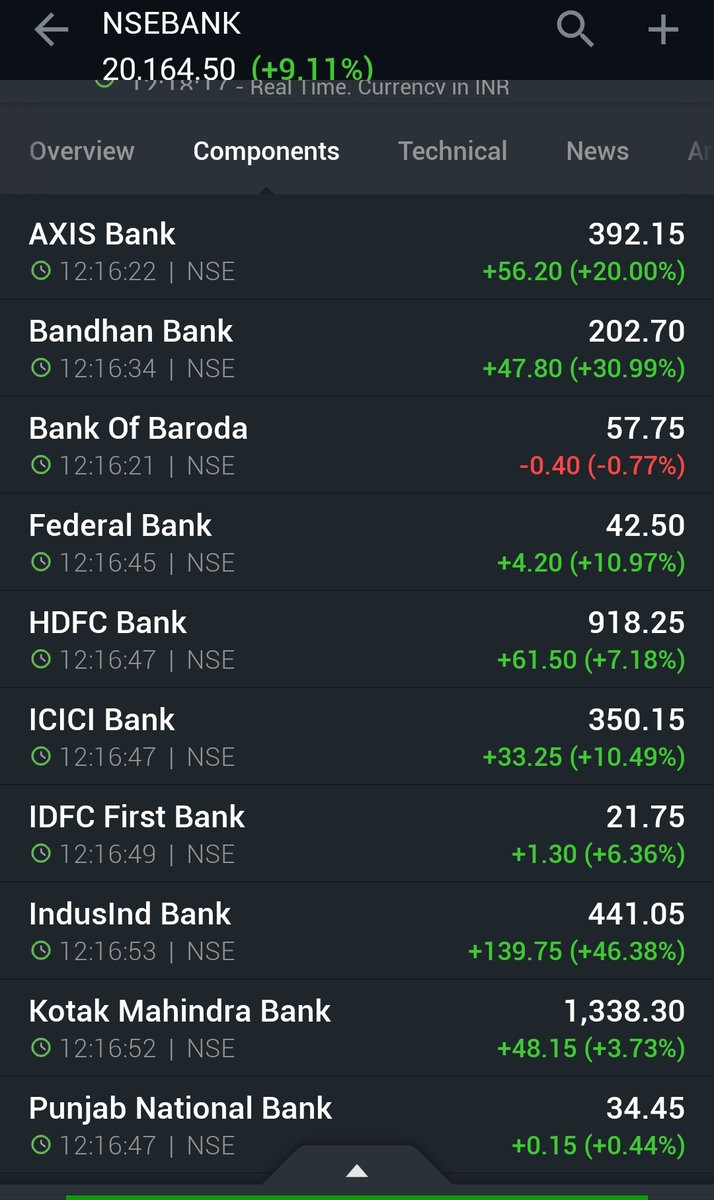

3. This was bloodbath in Indian Banking sector...

Who said value investing is easy? How many value investors could buy here

@suru27 @Longterm_wealth

(3/n)

Who said value investing is easy? How many value investors could buy here

@suru27 @Longterm_wealth

(3/n)

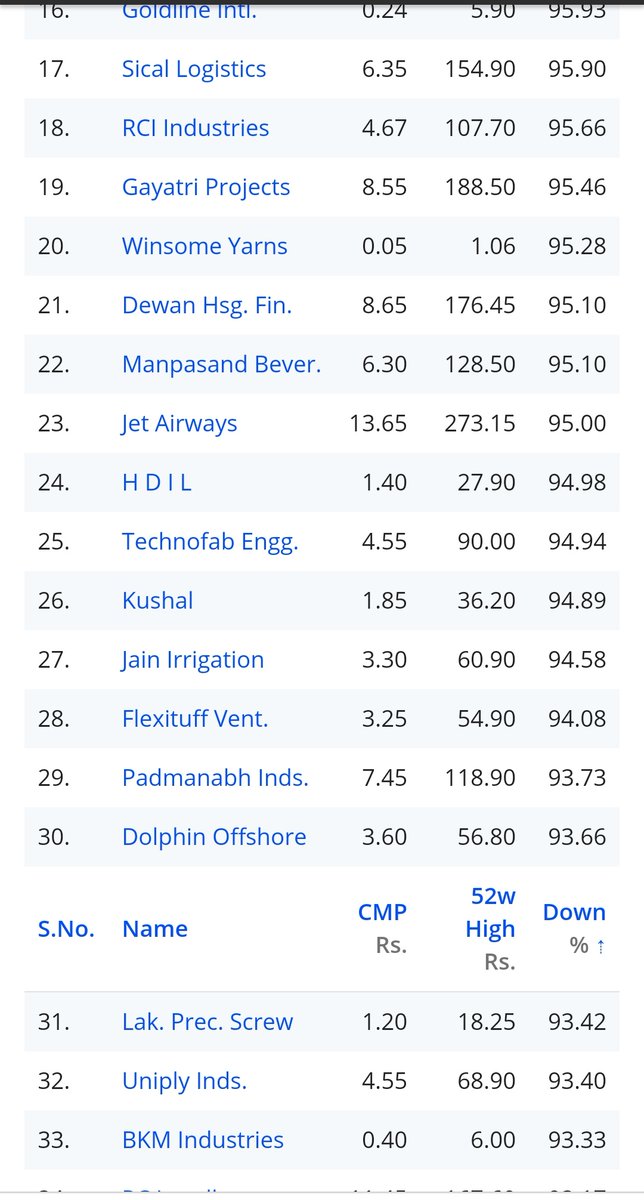

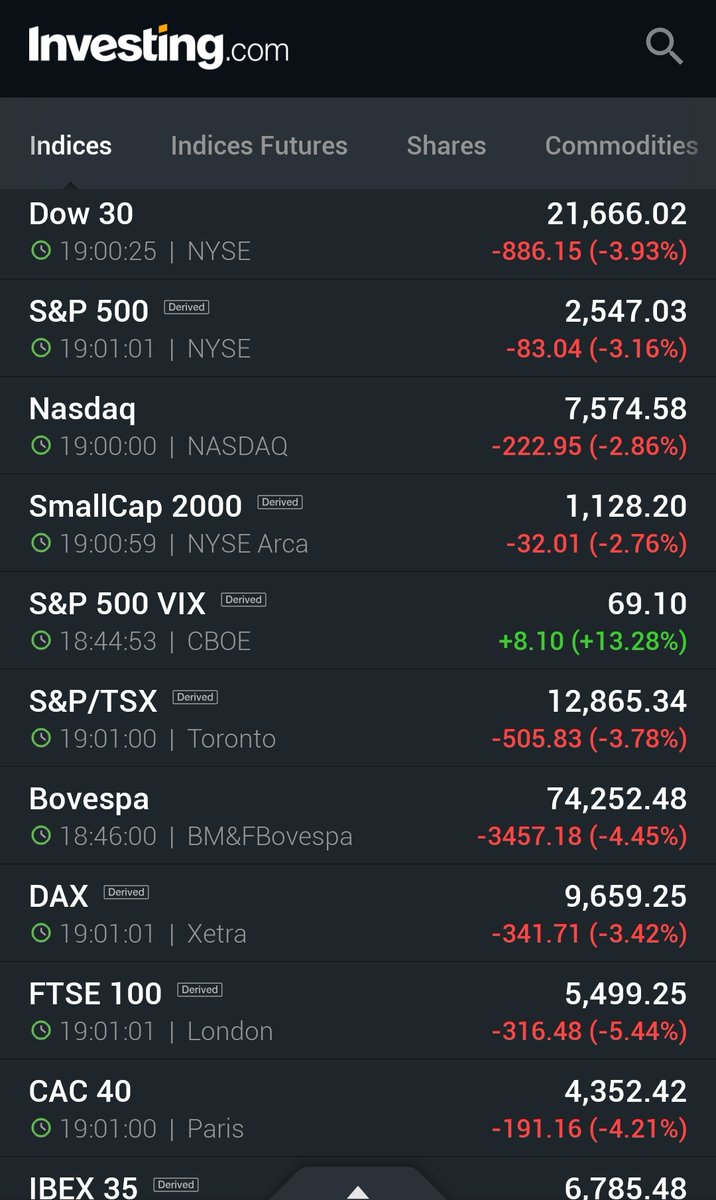

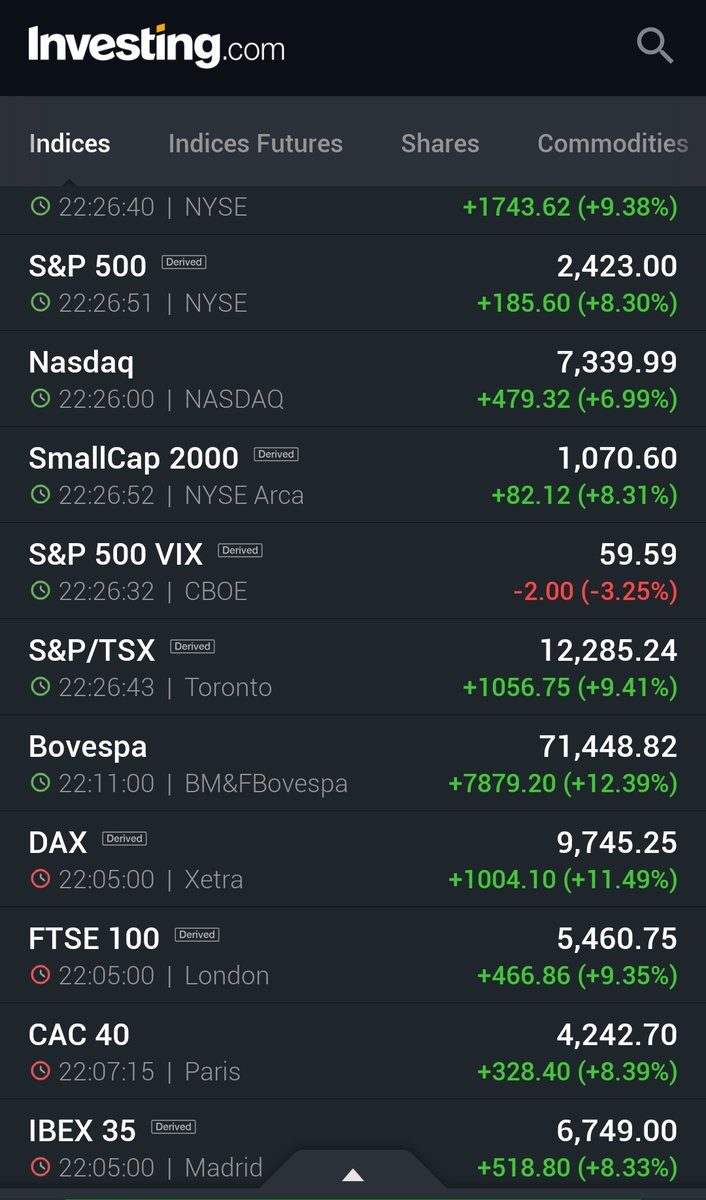

4. We all fall down...

Global markets shaken all around..

Who said global diversification reduces risk?

(4/n)

Global markets shaken all around..

Who said global diversification reduces risk?

(4/n)

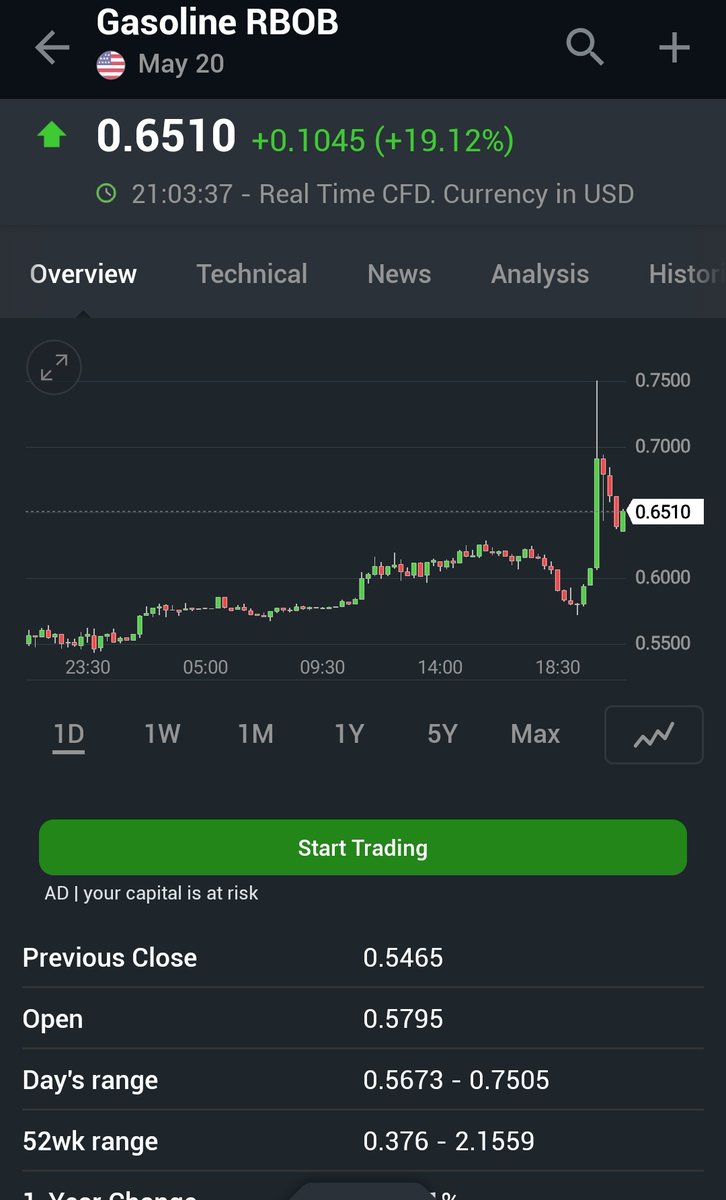

5. That GUT WRENCHING fall in crude...

Who said long-only positions are not risky?

@jitenkparmar

(5/n)

Who said long-only positions are not risky?

@jitenkparmar

(5/n)

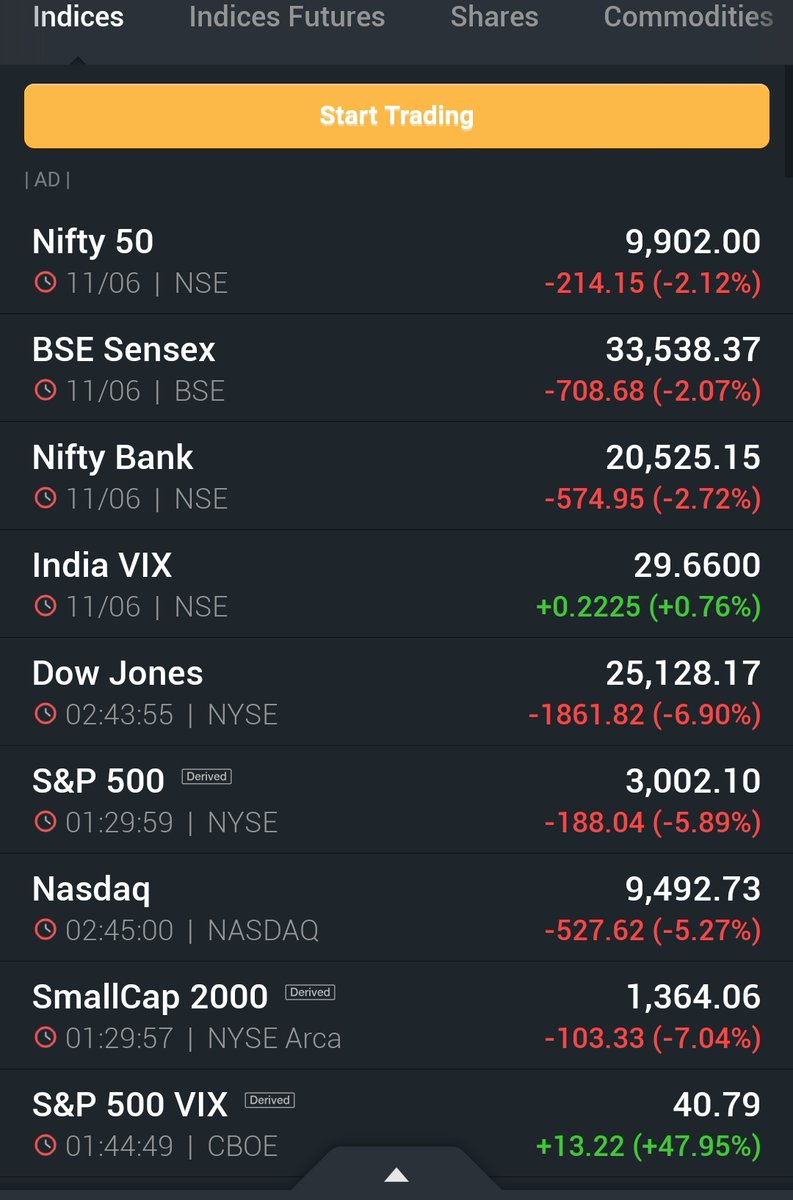

7. Deadly volatility...~48% spike in S&P 500..

Frame this and share with your kids 😀

Who said option selling is easy?

@Vishvesh03

(7/n)

Frame this and share with your kids 😀

Who said option selling is easy?

@Vishvesh03

(7/n)

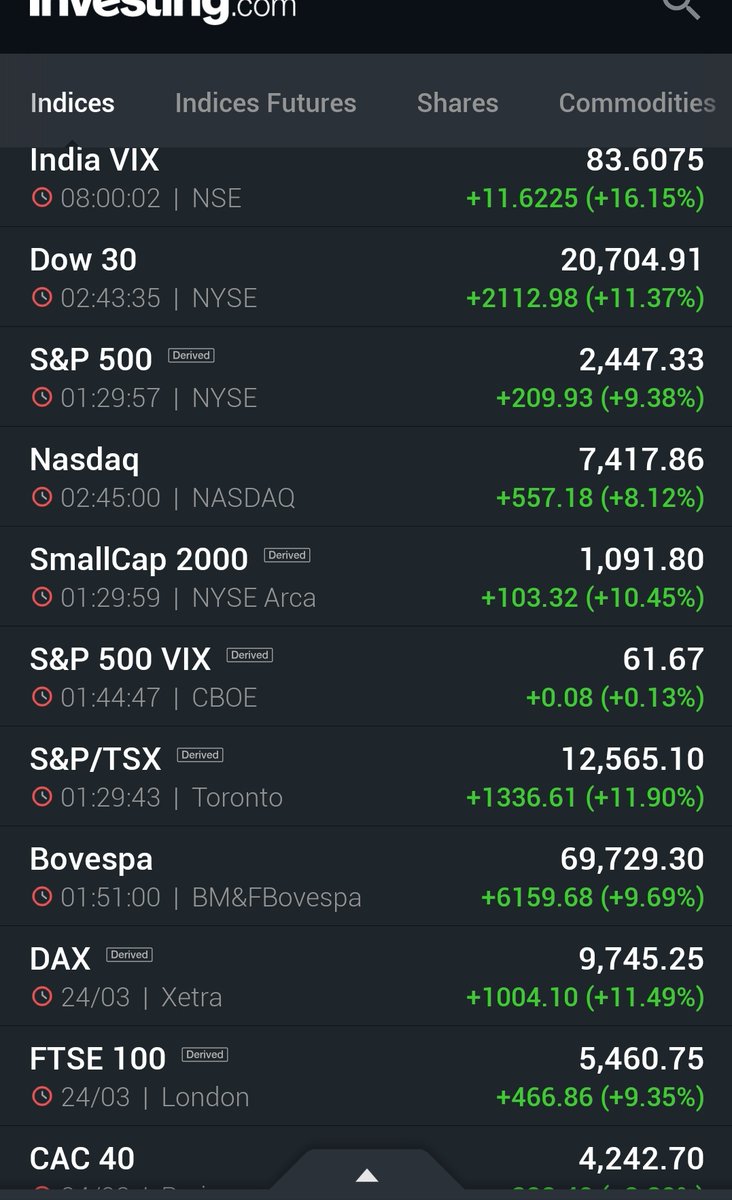

8. And this was the comeback..

Who said investing is not rewarding? 😀

@dmuthuk @Vivek_Investor

(8/n)

Who said investing is not rewarding? 😀

@dmuthuk @Vivek_Investor

(8/n)

These are all memories to be cherished..lessons to be remembered..

Do share how you felt and share such interesting pictures...

To keep learning with me..

t.me/TechnoFunda_In…

Investing is simple but not easy..!!

🙏🙏

Do share how you felt and share such interesting pictures...

To keep learning with me..

t.me/TechnoFunda_In…

Investing is simple but not easy..!!

🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh