No offense to anyone, we all are human and we make mistakes, just for serious learning.

1st one - euphoria on housing finance

(1/n)

rakesh-jhunjhunwala.in/after-dolly-kh…

(2/n)

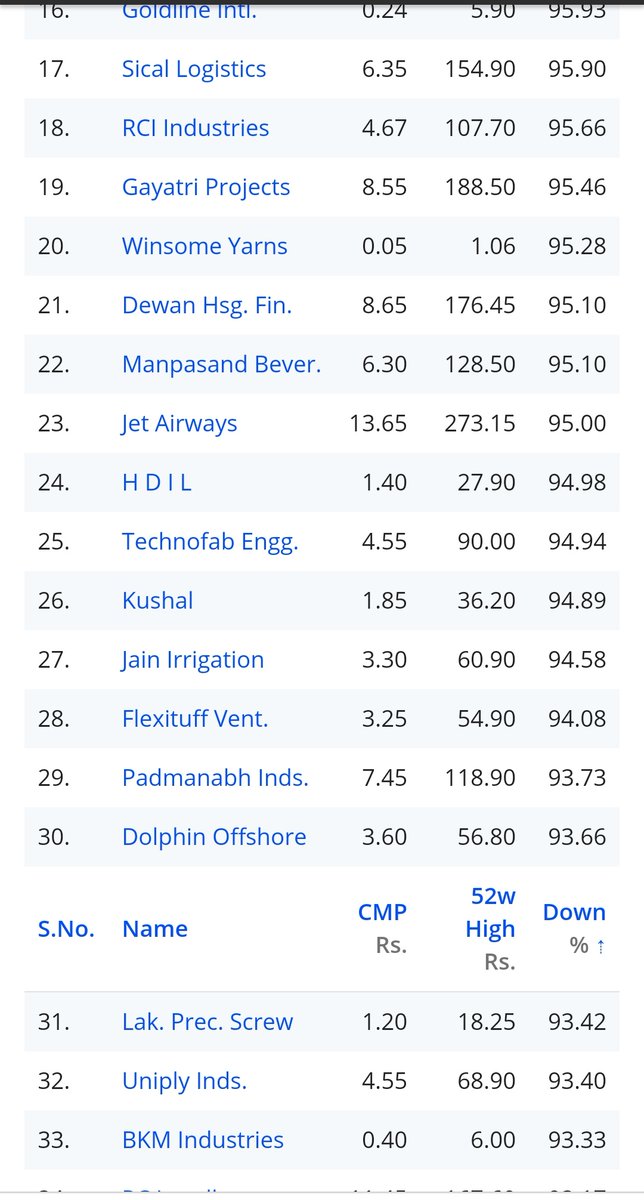

rakesh-jhunjhunwala.in/24-micro-cap-m…

Source: @screener_in

(3/n)

(4/n)

economictimes.indiatimes.com/markets/stocks…

We forgot about sector dynamics, profitability, bureaucracy, black money etc. and jumped

(5/n)

m.economictimes.com/wealth/invest/…

(7/n)

m.economictimes.com/markets/stocks…

(a) Have exit plan in place, know the risks and have objectivity to acknowledge if risks plays out

(b) Leverage + concentration: double edged sword...play carefully, know risks, avoid if possible

(c) Don't pre-empt promoter quality, look for signs

(9/n)

(e) Diversification is extremely important.

(f) Stick to asset allocation, don't deviate even though money making looks easy

(10/n)

(h) Know your risk appetite before entering into something

(I) Nobody is full-proof, media and fellow investors most likely are as soaked into euphoria as you are; Try to cut noise. Go back to basics. Read history

(11/n)