1/ I've been getting e-mails "encouraging" me to vote one way or the other... this is how I've responded:

There is a lot of research over the past sixty years suggesting that people think prediction is much easier than it actually is (for both sides of the political spectrum).

There is a lot of research over the past sixty years suggesting that people think prediction is much easier than it actually is (for both sides of the political spectrum).

2/ We anchor on pieces of information that are easy to remember because we've seen them in the news, but those are not a randomly chosen sample (so unsuitable for making predictions). They are also such a small sample that it's hard to draw statistically significant conclusions.

3/ "The problem is that it *feels* like a random sample and *feels* like a large enough sample, so the more information that people receive, the more overconfident they become, and (ironically) the worse their predictions get.

4/ "It's worst for experts, who have the most information and are the most overconfident.

For predictions, experts underperform both their own students and models based on simple algebra.

The work is significant enough to have won a Nobel Prize in 2002:

en.wikipedia.org/wiki/Daniel_Ka…

For predictions, experts underperform both their own students and models based on simple algebra.

The work is significant enough to have won a Nobel Prize in 2002:

en.wikipedia.org/wiki/Daniel_Ka…

5/ It's also been featured in a book by Michael Lewis:

https://twitter.com/ReformedTrader/status/1317876706414227457

6/ It seems wise not to get too confident about who would make a good president.

Prediction is hard: think about 2017, when almost everyone, including me, was expecting market volatility after the election. We got the calmest market in history instead:

Prediction is hard: think about 2017, when almost everyone, including me, was expecting market volatility after the election. We got the calmest market in history instead:

https://twitter.com/ReformedTrader/status/1316557697693544449

7/ This is not to support Trump (as I've said numerous times, I don't actually do that).

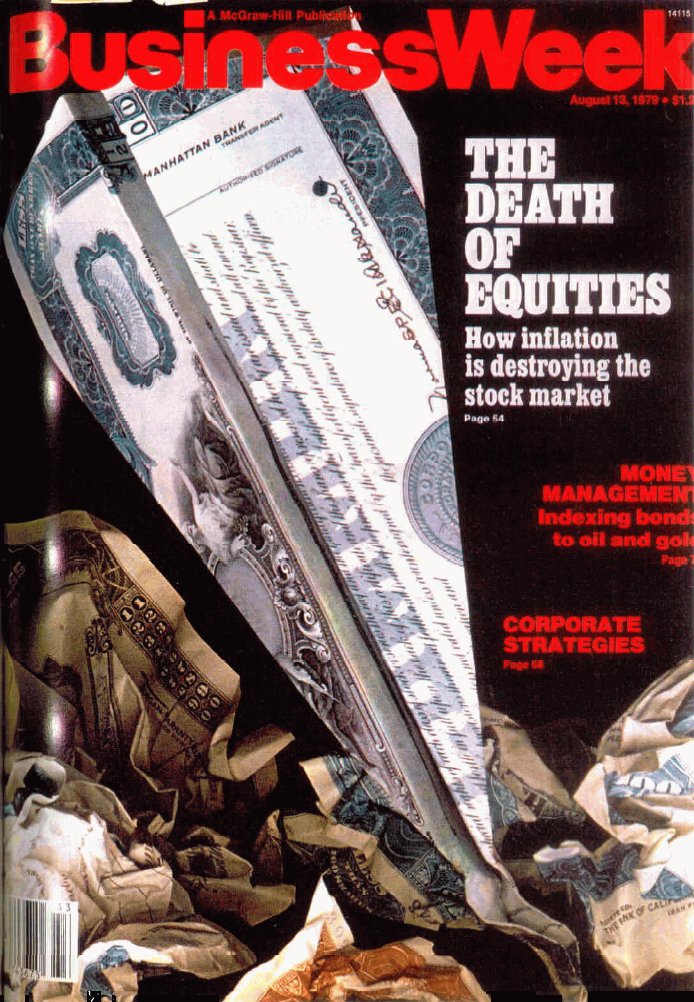

It's just to make the point that the world is counterintuitive and tends to do the opposite of what the crowd predicts will happen.

Here are some examples:

It's just to make the point that the world is counterintuitive and tends to do the opposite of what the crowd predicts will happen.

Here are some examples:

8/ When markets price in a crisis, we tend to get calmer markets and higher returns.

Conversely, when the market is pricing in calmness, the risk of a crisis actually goes up:

Conversely, when the market is pricing in calmness, the risk of a crisis actually goes up:

https://twitter.com/ReformedTrader/status/1234252308155731968

9/ It's historically been profitable to sell the stocks that highly-paid analysts say to buy and to buy the stocks that the analysts say to sell. This is a highly statistically significant effect and shows up in the data when measured in multiple ways.

https://twitter.com/ReformedTrader/status/1270823751106478080

11/ One possible explanation is that when everyone feels one way, it's easier for events to play out in the opposite fashion. A crisis (crash, high inflation, recession) can be triggered by the crowd being wrong about something and having to dump their positions at the same time.

12/ More on sentiment as a trading indicator:

So the extent that the news reflects how the country as a whole feels, how analysts feel, and how the crowd has its financial bets positioned, it tends to pay to lean in the opposite direction.

https://twitter.com/ReformedTrader/status/1284561910193467394

So the extent that the news reflects how the country as a whole feels, how analysts feel, and how the crowd has its financial bets positioned, it tends to pay to lean in the opposite direction.

• • •

Missing some Tweet in this thread? You can try to

force a refresh