Some Questions on Laurus (I totally respect everyone else's view, these are just mine, not arguing but engaging in civilized debate like humans used to do)

Watson: Laurus has been using aggressive accounting policies and in the H1FY21 bunching of inventories has led to CFO/EBITDA deteriorating

Sherlock: Such a question was expected from you, Watson! (mockingly) Let's take a longer time horizon and check the CFO/PAT & CFO/EBITDA

Sherlock: Such a question was expected from you, Watson! (mockingly) Let's take a longer time horizon and check the CFO/PAT & CFO/EBITDA

CFO/EBITDA for the past years

2016: 55%

2017: 75%

2018: 77%

2019: 80%

2020: 61%

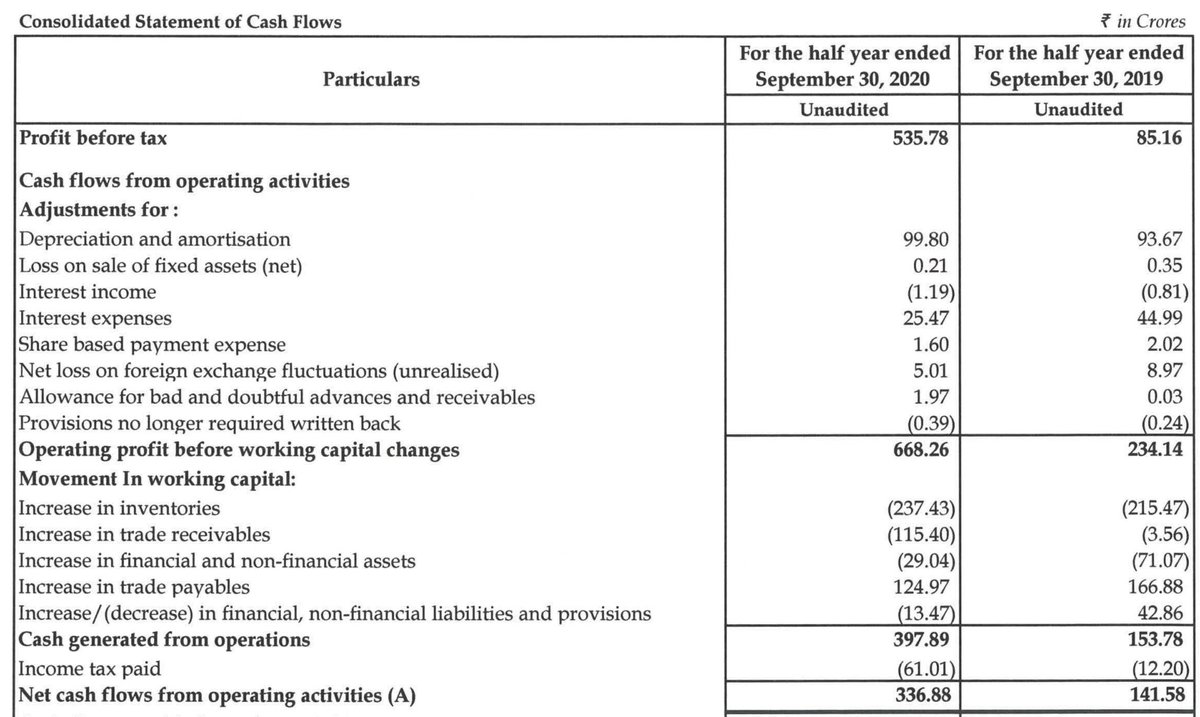

in the first half of 2020, this has fallen to somewhere around 50%. A bystander would consider this to be a red flag, however in growing companies (whenever the growth is rapid and especially

2016: 55%

2017: 75%

2018: 77%

2019: 80%

2020: 61%

in the first half of 2020, this has fallen to somewhere around 50%. A bystander would consider this to be a red flag, however in growing companies (whenever the growth is rapid and especially

B2B businesses) incremental cash sometimes gets stuck in working capital. For instance Watson: Vinati organics CFO/PAT ratio deteriorated to 71% in 2019 as incremental cash flow was stuck in receivables, now there is a very good reason for this to happen. Watson would you care

to check screener and tell me the sales growth of Vinati in 2019.

(Watson opens screener and types in Vinati organics, which has been one of the cleanest and the best performers on the bourses since the last decade)

Watson: it is somewhere close to 60%.

Sherlock: Exactly. What

(Watson opens screener and types in Vinati organics, which has been one of the cleanest and the best performers on the bourses since the last decade)

Watson: it is somewhere close to 60%.

Sherlock: Exactly. What

happens when a B2B business grows at such pace?

Watson: some amount of deterioration in working capital.

Sherlock: Exactly, but what happened in 2020? The CFO/PAT which was at 71% in 2019 went up back to above 100% (old receivables-recovered). Receivables and inventory

Watson: some amount of deterioration in working capital.

Sherlock: Exactly, but what happened in 2020? The CFO/PAT which was at 71% in 2019 went up back to above 100% (old receivables-recovered). Receivables and inventory

were bloated majorly due to 2 reasons : First their major competitors Lubrizol exited the market and second Vinati saw this opportunity for winning market share which led to hyper-growth.

Watson: something similar could be happening in H1FY21 CFO/EBITDA (or cfo/pat) for Laurus?

Watson: something similar could be happening in H1FY21 CFO/EBITDA (or cfo/pat) for Laurus?

Indeed Watson, as Trade receivables have gone up, since Laurus is growing at a very fast pace. It is important to understand the context of the business before understanding the ratios. One without the other is meaningless. Check at the end of the year or in 2 year horizons

Watson: okay Sherlock understood this. Now answer this, Laurus capitalized its FDF facility much before it started generating revenues. Were the pre-operating expenses capitalized?

Sherlock: Watson it seems you have never read the concall and annual reports. Laurus has never

Sherlock: Watson it seems you have never read the concall and annual reports. Laurus has never

Watson: (starting to think he's being proven wrong and proceeds to ask undeterred) Okay Sherlock. Another question which I have had is that Laurus is putting in a to of money in capex, are those Fixed assets verified by the auditor or are there any lapses?

Sherlock: Lets check

Sherlock: Lets check

Watson: (Agreeing with Sherlock apprehensively). I had one last question, Sherlock. Why are the cash balances so low for the last 4 years?

Sherlock: Watson I am a little tired of answering all your questions. Instead of telling you this, a friend of mine who's a fantastic

Sherlock: Watson I am a little tired of answering all your questions. Instead of telling you this, a friend of mine who's a fantastic

has already posted this year, please care to go through it once forum.valuepickr.com/t/laurus-labs-…

Hope this answers all your questions.

Hope this answers all your questions.

Some general thoughts: it is important to incorporate disconfirming evidence while analysing businesses and be open to all type of views. Do remember that buying on someone else's conviction is deadly due to these reasons. Since, the person who has borrowed the conviction doesn't

the real insights about the business. Forgets, that stock markets are volatile in nature. Whenever price drops randomly, his mind starts looking for reasons to sell since the conviction wasn't his own in the first place and starts actively looking for people/opinions which make

agree with him. This is what Graham has to say “Individuals who cannot master their emotions are ill-suited to profit from the investment process". Research, be independent in thinking don't fall for what anyone including me says on Twitter. At the end it is your hard-earned

Capital.

by @Ankit090287

• • •

Missing some Tweet in this thread? You can try to

force a refresh