The WSJ (Cezary Podkul and Megumi Fujikawa) on the search for global yield from Japan's financial institutions -- through the lens of Nochu's (Japan's financial cooperative for fishers and farmers) purchases of US CLOs

wsj.com/articles/how-a…

wsj.com/articles/how-a…

Podkul and Fujikawa allude to the centrality of the Caymans in the global flow of CLOs -- something the Fed highlighted last year

federalreserve.gov/econres/notes/…

federalreserve.gov/econres/notes/…

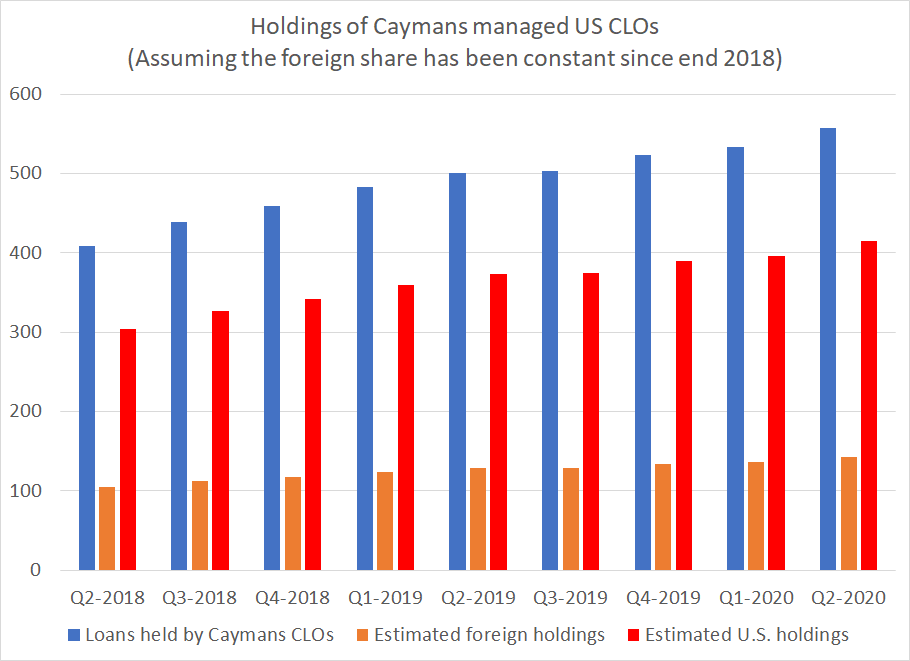

The accounting here is interesting as it illustrates the role of tax centers in a range of capital flows, and illustrates the difference between gross and new flows too.

The Fed started categorizing US managed. Caymans domiciled CLOs as "foreign" in 17 and 18

The Fed started categorizing US managed. Caymans domiciled CLOs as "foreign" in 17 and 18

As a result, corporate loans suddenly appear to be an important source of BoP financing for the United States ...

And this really is "just the Caymans --

That's where all the loans are technically being originated (for accounting purposes). They are of course managed by American institutions.

(see the Fed note)

That's where all the loans are technically being originated (for accounting purposes). They are of course managed by American institutions.

(see the Fed note)

The bulk of the CLOs backed by these loans though have been sold back to US investors --

What appears as a foreign loan from the Caymans is really just the accounting for a CLO that has bought a bunch of US loans and repackaged those loans (mostly) for sale back to US investors

What appears as a foreign loan from the Caymans is really just the accounting for a CLO that has bought a bunch of US loans and repackaged those loans (mostly) for sale back to US investors

That's a lot of the world's gross flows --

US holdings of bonds (CLOs technically are bonds) issued in the Caymans are rising, as are loans from the Caymans to the US

US holdings of bonds (CLOs technically are bonds) issued in the Caymans are rising, as are loans from the Caymans to the US

Of course foreign investors (especially Nochu) have bought a portion of these CLOs too --

Good story highlighting what concretely the global reach for yield by Japanese institutional investors means

wsj.com/articles/how-a…

Good story highlighting what concretely the global reach for yield by Japanese institutional investors means

wsj.com/articles/how-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh