The Council on Foreign Relations' graphics team has put together some good charts to support my recent piece warning about a loss of momentum in the global recovery.

cfr.org/article/global…

cfr.org/article/global…

Plotting output relative to its 2019 average immediately puts the q3 recovery into context.

A look at the (still incomplete) data for a broader set of countries also highlights just how much of an outlier China's reportedly near complete recovery really is

A look at the (still incomplete) data for a broader set of countries also highlights just how much of an outlier China's reportedly near complete recovery really is

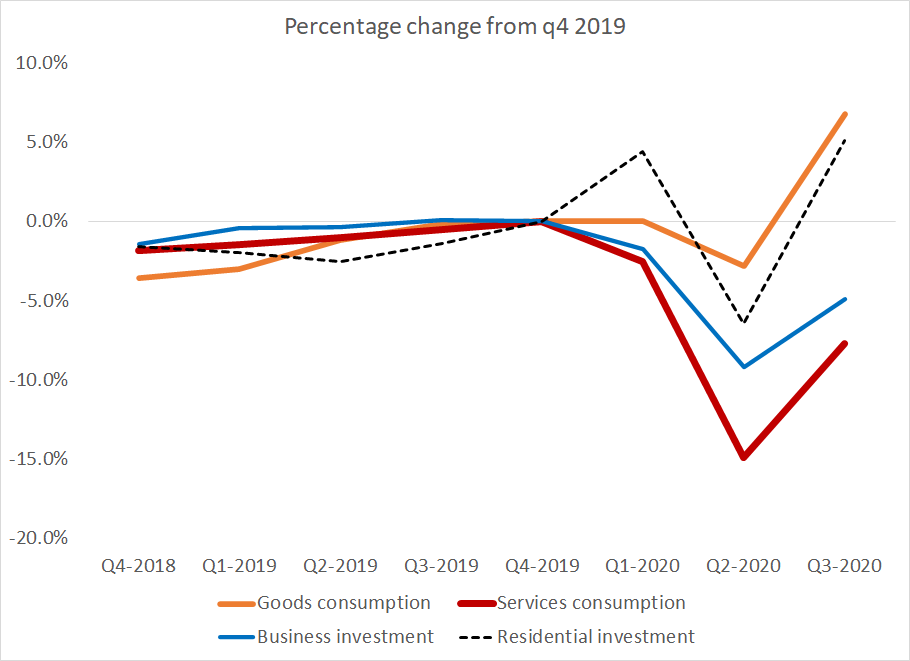

A plot of (estimated) monthly US output highlights how the pace of the recovery slowed over the course of the third quarter (as the large initial stimulus was not sustained).

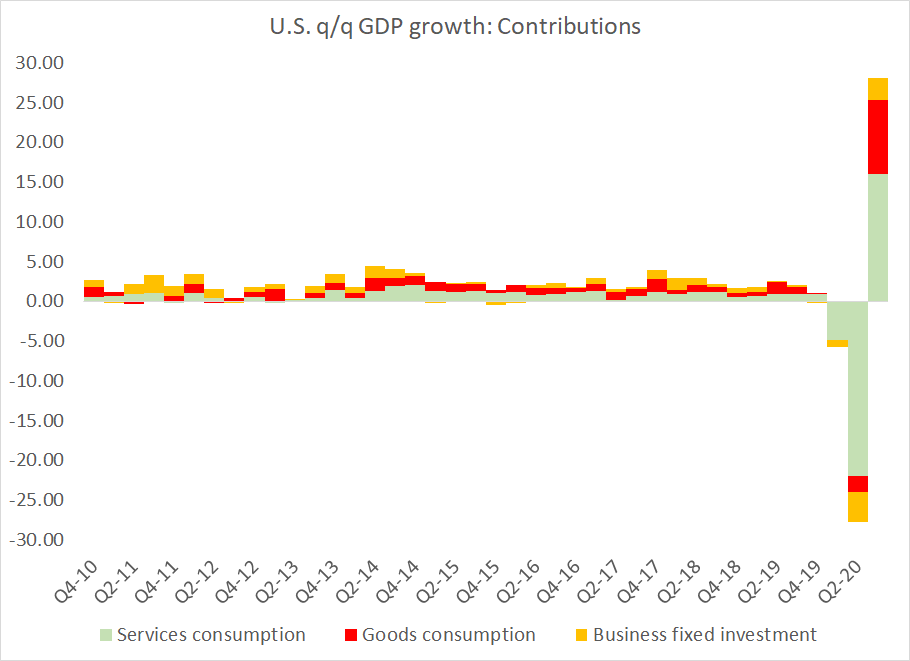

The chart also shows how services led this particular downturn

The chart also shows how services led this particular downturn

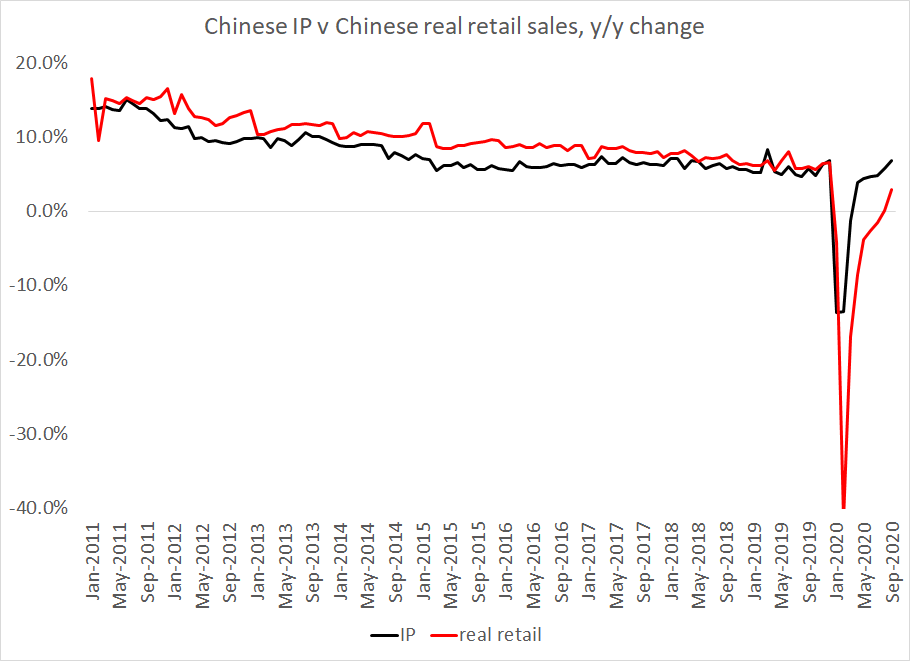

We also plotted China's industrial production against U.S. industrial production, to illustrate how China's recovery has been led by the rebound in its factories more than a rebound in consumption. China has coasted in a sense thanks to the surge in global goods demand

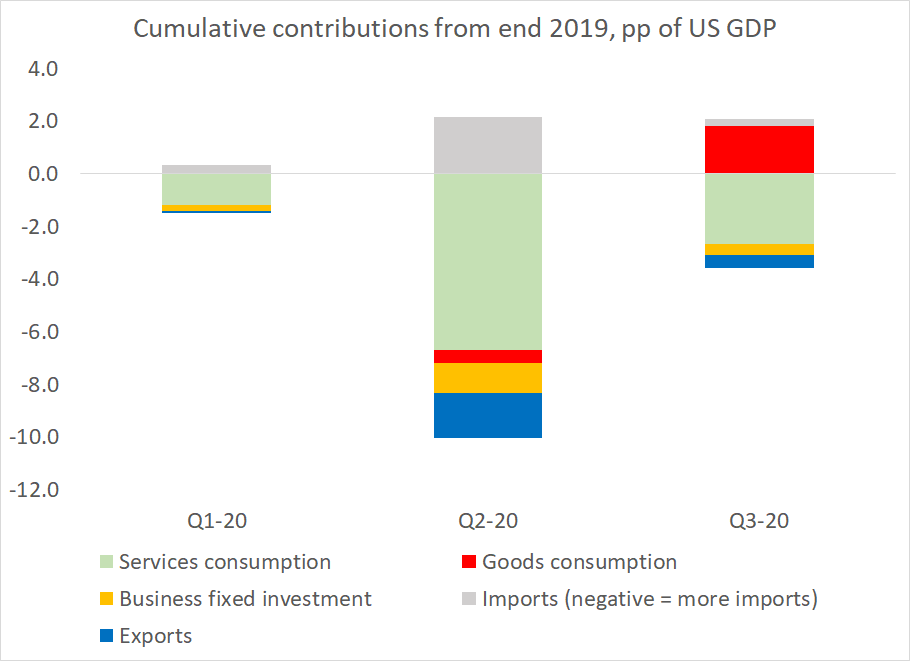

I wanted to expand a bit on the last point. The U.S. has seen a stronger rebound in real retails sales (because of goods demand) than in industrial production

China of course is the mirror image of the U.S.. Chinese industrial production has rebounded more strongly than Chinese consumption. That's due in part to another investment focused stimulus, but also due to the rise in China's exports

One theme of my piece (written prior to the U.S. election) is irritation at headline writers who think that China's faster growth means it is "supporting" the global recovery even as China's rising trade surplus implies it is drawing on global demand

The shift in global demand towards goods (and China's strength in PPE production) has meant that China's recovery has in fact been supported by the recovery in goods demand outside China, not the other way around

Yes, it is strange to argue that the large economy with the strongest global recovery has been drawing on demand from weaker economies ...

But that's what the combination of rapid growth, a near complete recovery in real output and a rising trade surplus implies.

But that's what the combination of rapid growth, a near complete recovery in real output and a rising trade surplus implies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh