I'll keep this brief, I think Magnachip $MX, for good reason, could finally be starting to rerate.

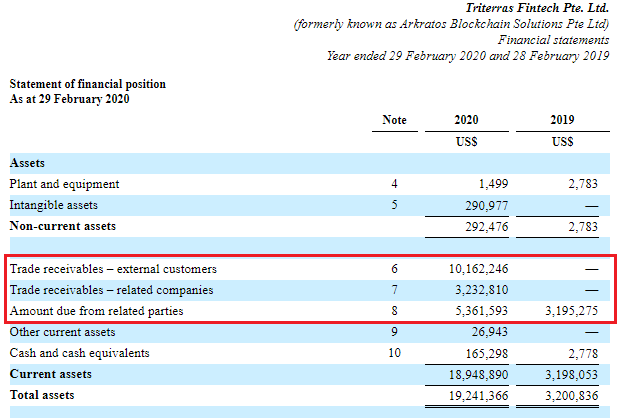

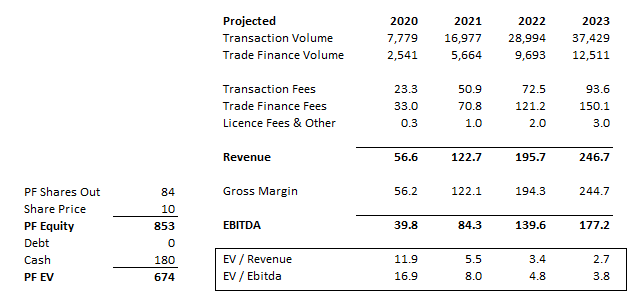

It's the RT below: foundry divestment - now it has hit the balance sheet. Today it's 0.6x EV/FY20 revenues and by 2023 their aim is 8% FCF. This is way too cheap.

It's the RT below: foundry divestment - now it has hit the balance sheet. Today it's 0.6x EV/FY20 revenues and by 2023 their aim is 8% FCF. This is way too cheap.

https://twitter.com/hareng_rouge/status/1244949245263777792

You naturally assume they're a melting ice cube; they're not, they grow. They're reliably prolific in getting design wins and have plenty to look forward to, like the below.

It's still a cyclical end-market business but less so with the boom and bust of foundry gone. Now with the cash in the filings, it can screen cheap. The whole idea is simple: if they hit or even approach the targets, an IP led company doesn't trade at a fraction of revenues.

And next, with almost indecent haste, an activist - Engaged Capital - now appears on the register for $MX

A while ago @subset_member explained his thinking that the new console cycle should drive a spike in OLED TV sales - was a very great call. It's not a clear read-through for $MX given their exposure to power > drivers in TV but certainly an interesting incremental data point

Their main business is making DDIC controllers for OLED screens. What are they?

A computer / phone asks for a certain image displayed on a screen. The DDIC sits between the two. It tells the screen how to make the image: this pixel like this, turn that one off, dim that etc

A computer / phone asks for a certain image displayed on a screen. The DDIC sits between the two. It tells the screen how to make the image: this pixel like this, turn that one off, dim that etc

So the more the frame rate or the more the resolution - ie how quickly the picture updates and how good it needs to be - the bigger the workload on a DDIC.

New gen games on TV screens and phones, 5G driving mobile gaming and movie consumption - it's all only going one way

New gen games on TV screens and phones, 5G driving mobile gaming and movie consumption - it's all only going one way

@subset_member shared this interesting article with me.

There are two things to take away from it:

thelec.net/news/articleVi…

There are two things to take away from it:

thelec.net/news/articleVi…

First: 120Hz for some of the iPhones - an increased frequency so the screen updates more quickly, to my point about things only going one way.

Above 120Hz is where MX start to come into their own

Above 120Hz is where MX start to come into their own

Second: the last call. Does this mean MX are in Samsung? Very probably. Does this mean MX will be putting the DDIC controllers into iPhones? I don't know.

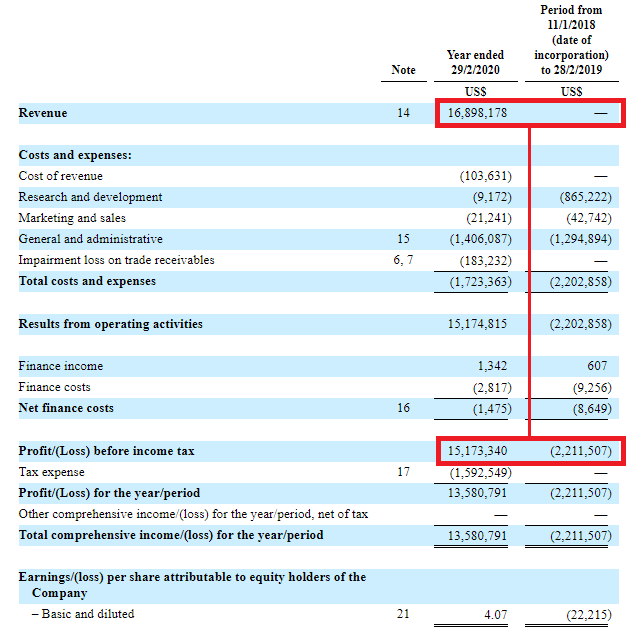

MX recently sold their foundry, it got them out of a super-cyclical area and brought them plenty of cash

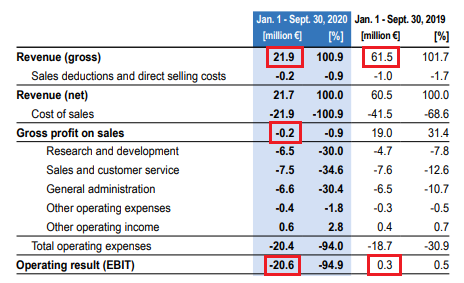

But the left-over work they're finishing up there is screwing with the optics on the financials: it's (literally) zero-margin and brings down the overall gross margin

But the left-over work they're finishing up there is screwing with the optics on the financials: it's (literally) zero-margin and brings down the overall gross margin

That goes away, the numbers look better.

Green box shows how the op income is suffering from all this

Then there were two genuine exceptionals: they had to dump a load of products for Huawei when the ban came in and then a power cut fried a bunch of products they were making.

Green box shows how the op income is suffering from all this

Then there were two genuine exceptionals: they had to dump a load of products for Huawei when the ban came in and then a power cut fried a bunch of products they were making.

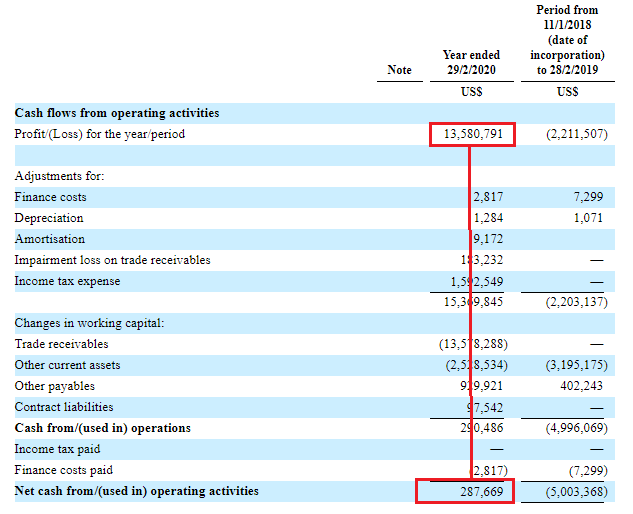

What does this year look like?

Midpoint of guide for Q4 puts revs at $497M all in w/gross margin coming up from Q3's $23% into a range of $25-27% - won't save FY20 but better

Ex-foundry it's ~$460M

With a cap of $481M, cash of $236M, so EV of $245 or 0.5x non-foundry 2020 revs

Midpoint of guide for Q4 puts revs at $497M all in w/gross margin coming up from Q3's $23% into a range of $25-27% - won't save FY20 but better

Ex-foundry it's ~$460M

With a cap of $481M, cash of $236M, so EV of $245 or 0.5x non-foundry 2020 revs

I think it could turn out stronger but let's assume that $460 grows 7% per year into 2023 and reaches $560M

Suppose that happens and they do achieve their targets and exit 2023 with DD growth at 10% adjusted op margins and +8% FCF

What's do you pay for that?

Suppose that happens and they do achieve their targets and exit 2023 with DD growth at 10% adjusted op margins and +8% FCF

What's do you pay for that?

At $45M a FCF yield of 18% would seem too cheap

Calling it 10% would put MX on an EV/Sales ratio of 0.8x or about 22% a year from here to there for that to happen - doesn't seem unreasonable.

Then there's the optionality from that cash: maybe they divi it out, maybe they buy

Calling it 10% would put MX on an EV/Sales ratio of 0.8x or about 22% a year from here to there for that to happen - doesn't seem unreasonable.

Then there's the optionality from that cash: maybe they divi it out, maybe they buy

Sure it's no SPAC rocket but for the industry trends, the Samsung (..and AAPL?) exposure, the numbers cleaning up by themselves, optionalities in execution and M&A - it's decent here

And you never know, maybe their activist gets them bought out instead

And you never know, maybe their activist gets them bought out instead

https://twitter.com/ShortsHoward/status/1344503103580561408?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh