Very hairy: this company was going down the toilet even before covid; it's now a wreck - and even better, it's enormously exposed to Chinese solar. BK isn't off the cards and the upside may not even be that great. Chart is back to Jan 2017. Singulus from Germany #SNG.DE

It's a German maker of high end capital goods for solar, semi and life sciences: glass and wafer deposition / polishing, that kind of area.

How it started:

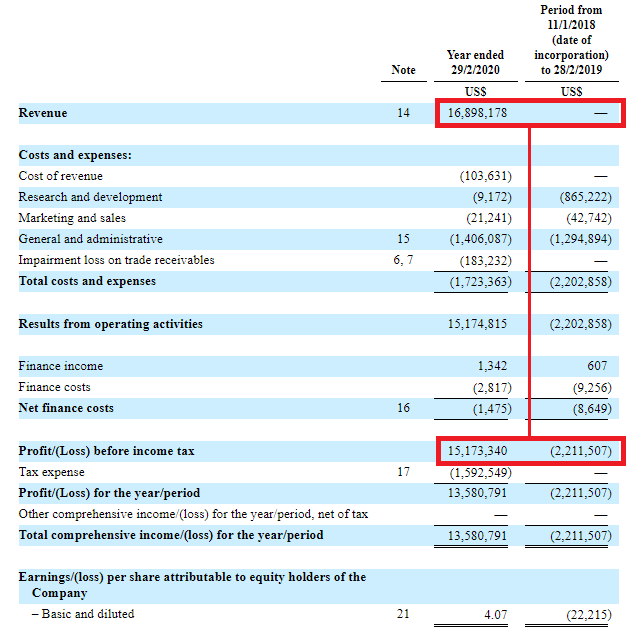

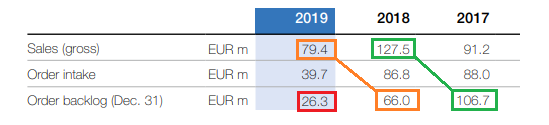

Revenues & Ebit

2017: €91m & -€1.2m

2018: €127m & +€6.8M

2019: €79M & -€8.0M

How it started:

Revenues & Ebit

2017: €91m & -€1.2m

2018: €127m & +€6.8M

2019: €79M & -€8.0M

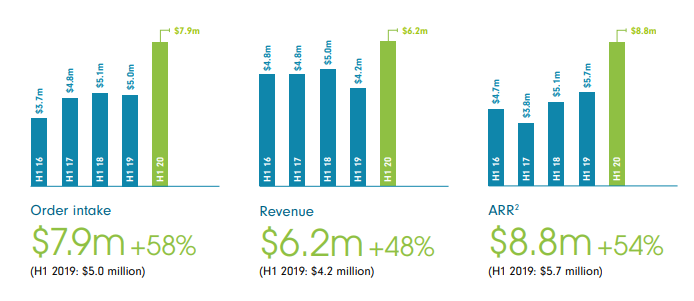

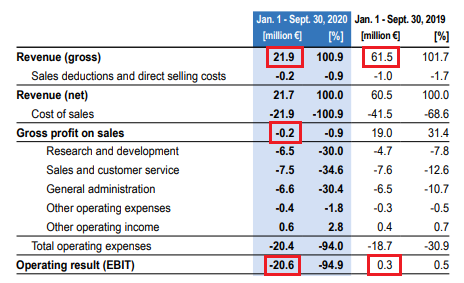

And in all it's glory, here's how it's going:

Revenues in 9M20 YTD a third of an already bad 2019. Goes from breakeven to -€20M loss and even achieves a negative gross margin, quite the achievement.

Revenues in 9M20 YTD a third of an already bad 2019. Goes from breakeven to -€20M loss and even achieves a negative gross margin, quite the achievement.

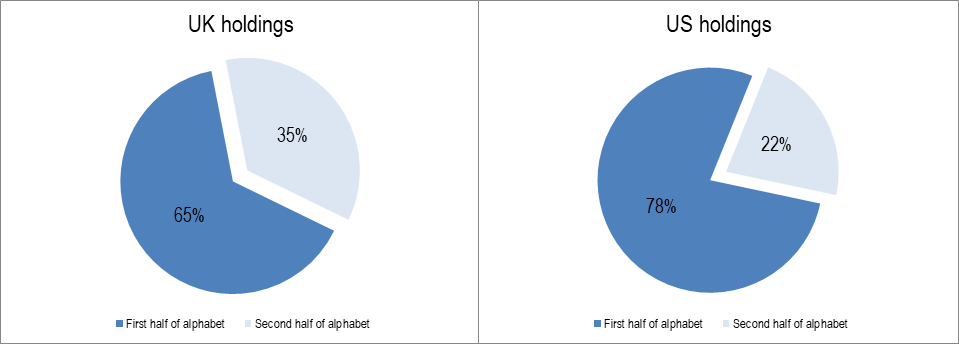

A little over half the business is Solar - capital goods to China and it's mainly into CNBM a Chinese solar giant who are also a shareholder in Singulus (yes it does keep getting better)

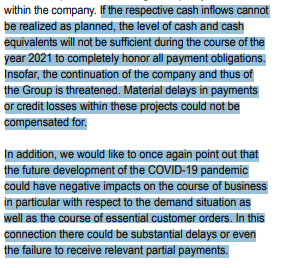

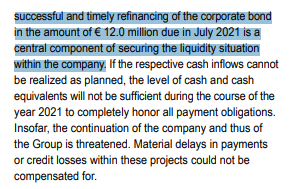

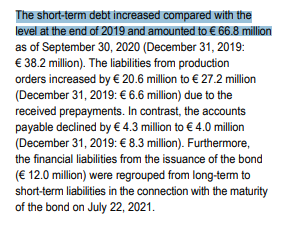

There's €12.5M of unrestricted cash on the balance sheet right now and "€66.8M of short-term debt". Market cap is €37M. The 9M report also contains plenty of ominous warnings about existence and needing the cash to come through the door.

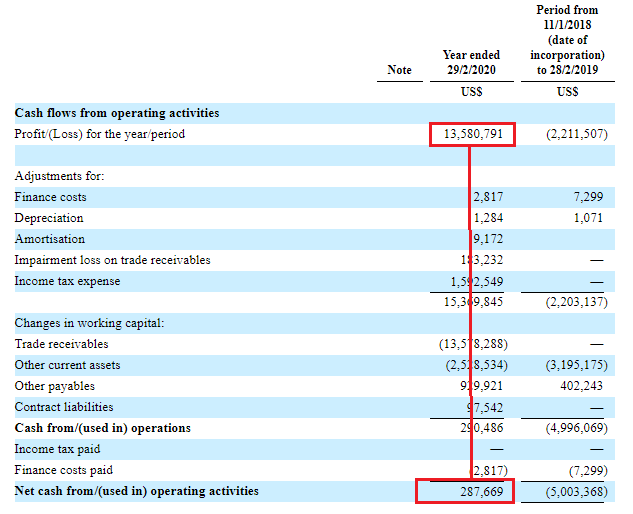

Here's where things get a little better. Remember this is German. The German word for debt is "shuld" and it also means blame, guilt, fault, liability and trespasses; they tot up every penny they owe anywhere and call it debt - this is what we're dealing with. Actual debt: €16M

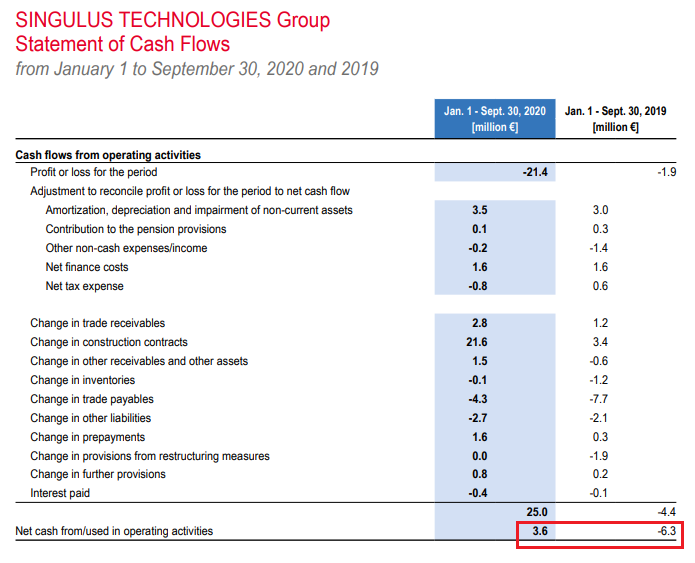

Sure they're paying up the wazoo for it but it's not €66M. Now here's the cashflow. Quite a bit better than I'd expected.

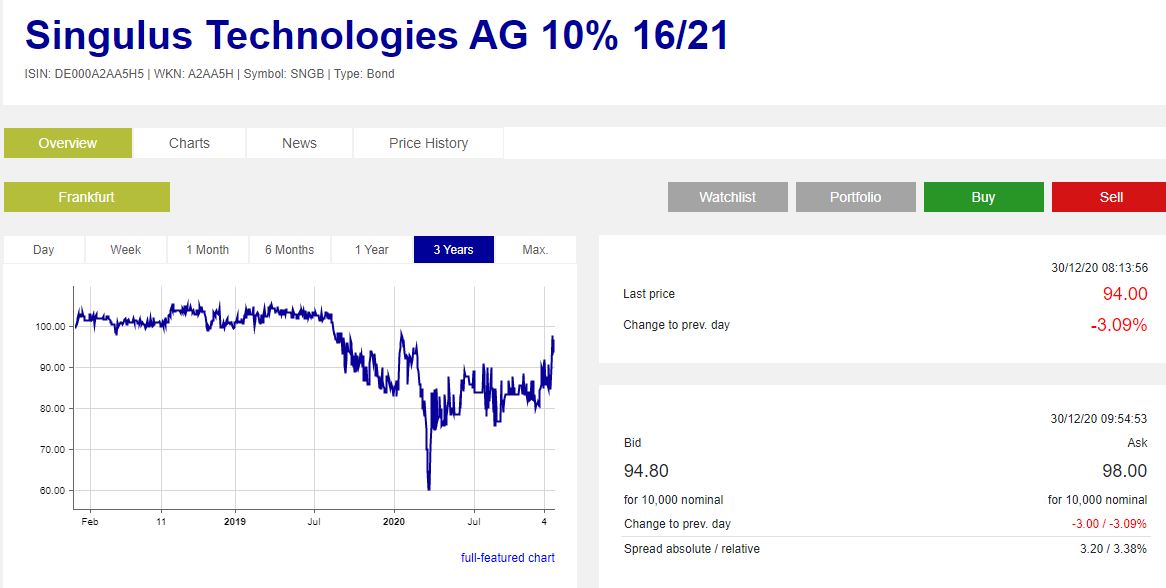

But the bond market is so over it: it's at 94 (and as @RodriGo_ethe has pointed out, you could go long the equity and short the debt here)

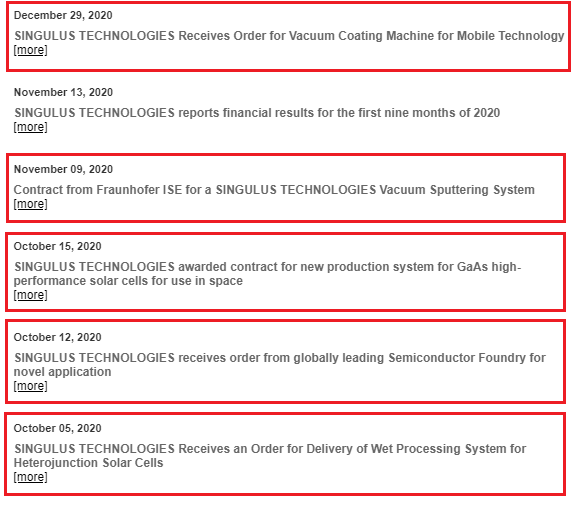

And since period end.. they're pouring in

And note how semiconductor is coming back, this looks more broadly based than just the solar.

And note how semiconductor is coming back, this looks more broadly based than just the solar.

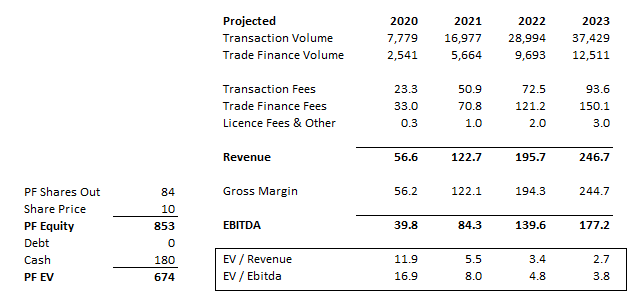

I think semi capex spending generally looks set for a very strong 2021 but it's almost certainly not enough to carry the company. The question is what kind of upside there is here. In 2018 the market was willing to pay 1.2-1.3x EV/sales when it was growing and turning profitable

But at an EV of ~€40M, it's now 4x less than then, with an order backlog at end Sept of €75M - and in reality, it's perhaps even a bit closer to what it was the glory days running into 2018 than this figure suggests. It might be enough here to hang around and see what happens

• • •

Missing some Tweet in this thread? You can try to

force a refresh