Resolution: no drink and no showing how I read accounts, so grab a bottle of absinthe and let's look at $TRIT

A mysterious stranger appears from a foreign land.

"Play me the music of your people", you ask

It's like nothing you've ever heard but it's everything you've ever felt

A mysterious stranger appears from a foreign land.

"Play me the music of your people", you ask

It's like nothing you've ever heard but it's everything you've ever felt

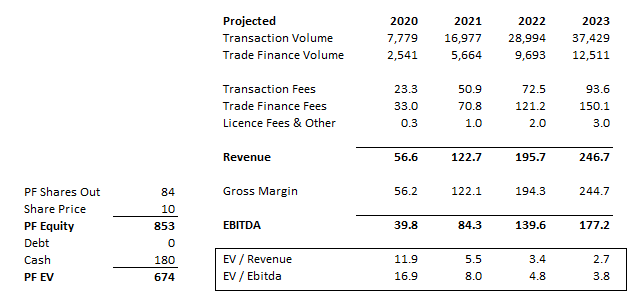

"Oh stranger", you cry, "let us SPAC this bitch up"

Narrator: time passes, they have come public and they are *flying*

Narrator: time passes, they have come public and they are *flying*

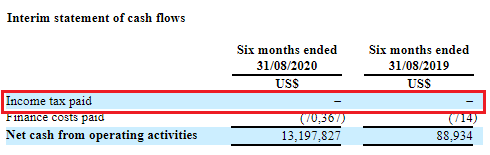

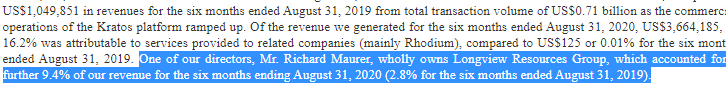

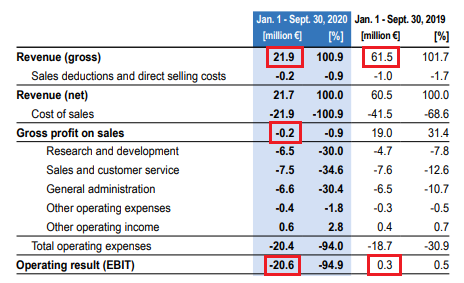

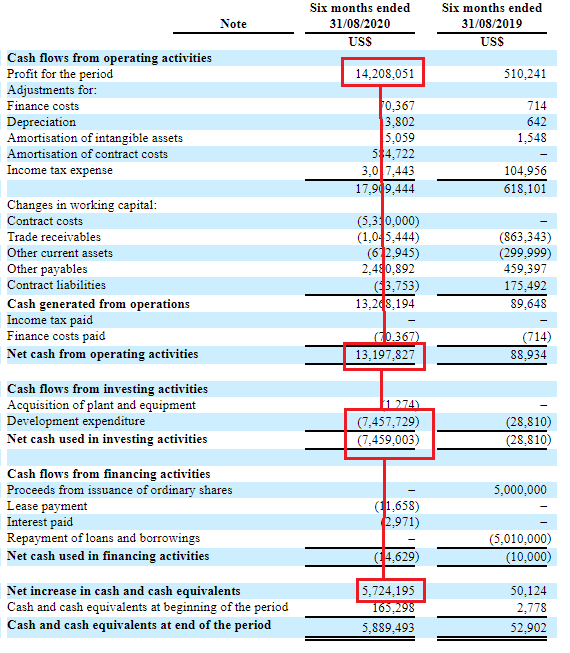

You've pulled a 180 and got everyone to start paying.

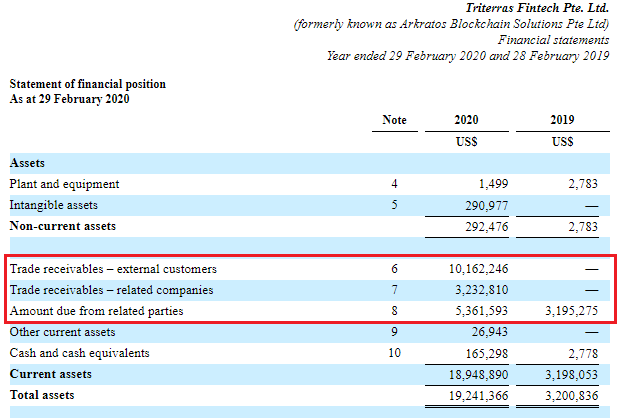

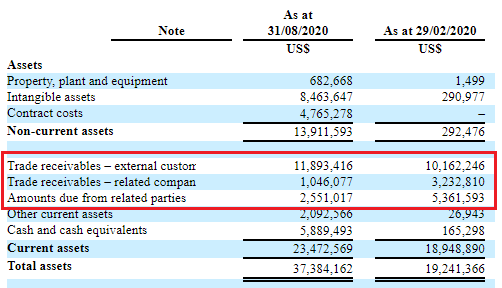

Your receivables drop from $18.7M to $15.4M

Balance sheet: golden

Your receivables drop from $18.7M to $15.4M

Balance sheet: golden

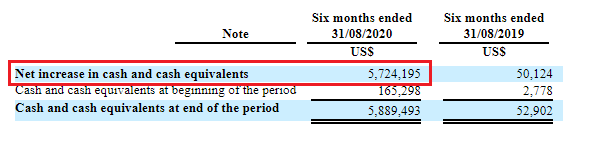

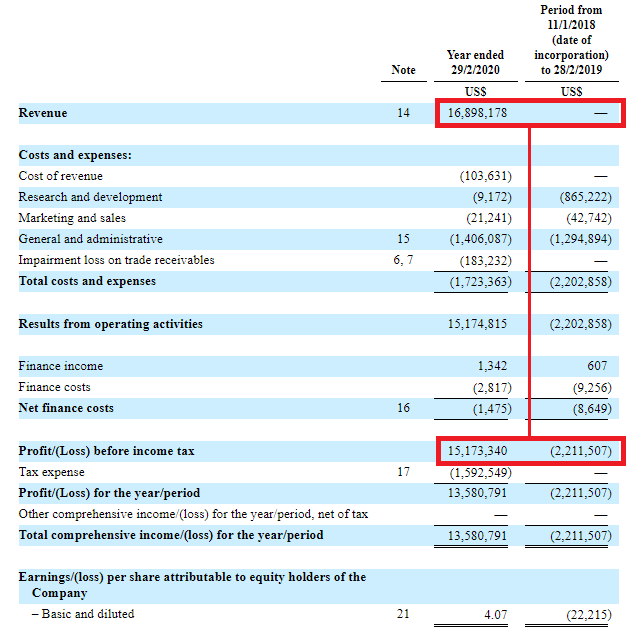

Sure there's a bit of leakage but your business is blowing up in the good way: you've turned those profits into $5.7M more cash.

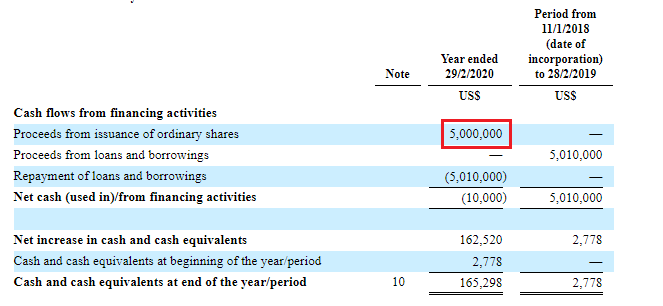

But you do now have $5M more than you did when you started.. so?

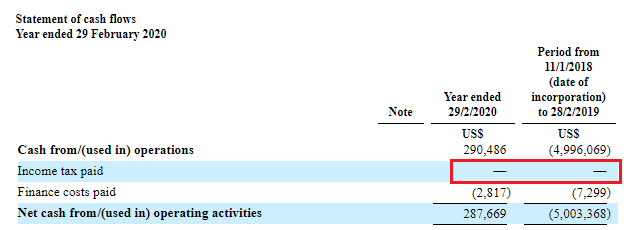

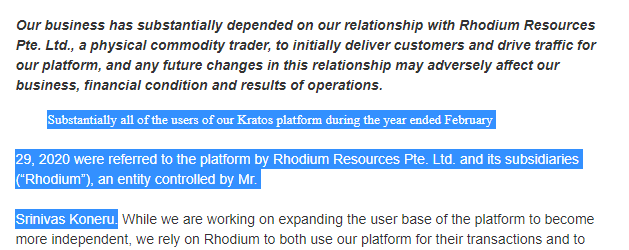

Ok, focus on the details and don't worry about this.

Ok, focus on the details and don't worry about this.

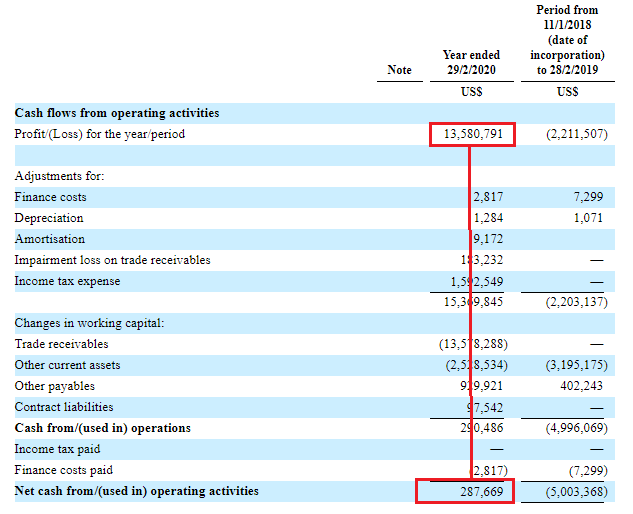

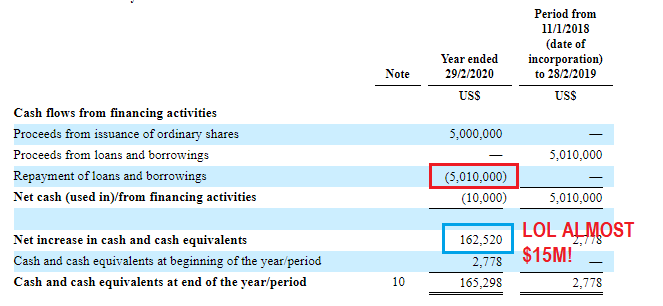

Instead. Cast your mind back to the previous period - the one where the cashflow didn't *quite* match the profit

1 of 3: Issue "debt" of $5M

1 of 3: Issue "debt" of $5M

Narrator: there are no related party issues here

• • •

Missing some Tweet in this thread? You can try to

force a refresh