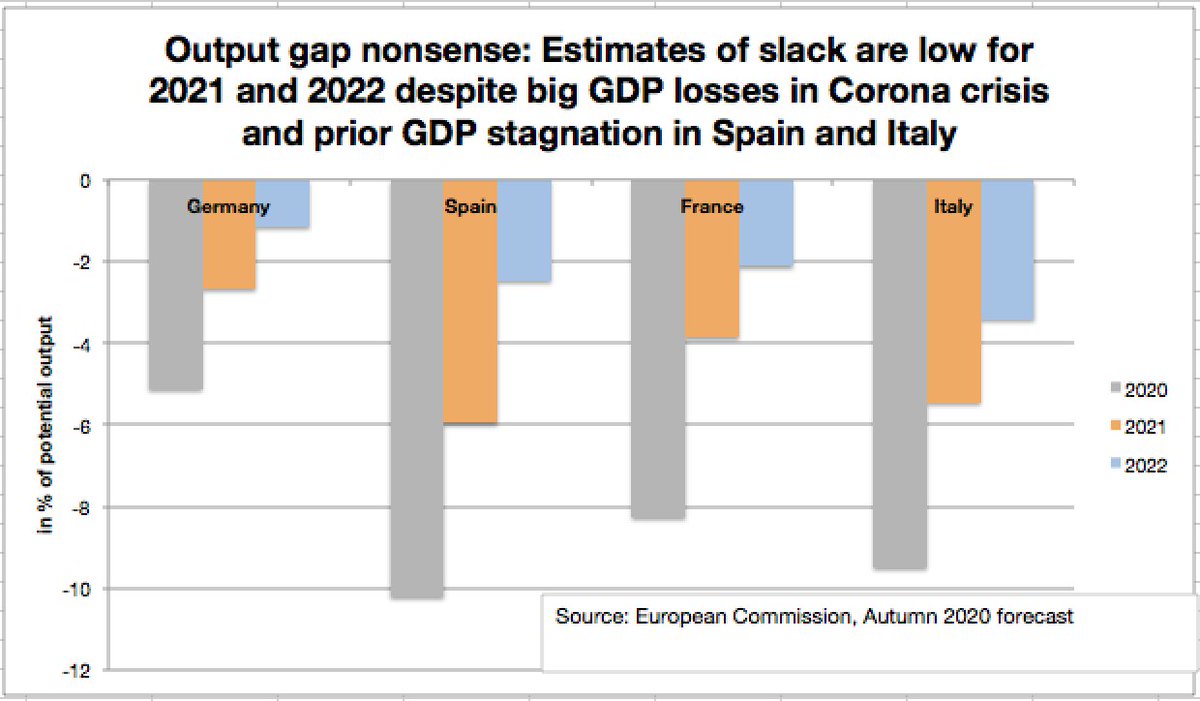

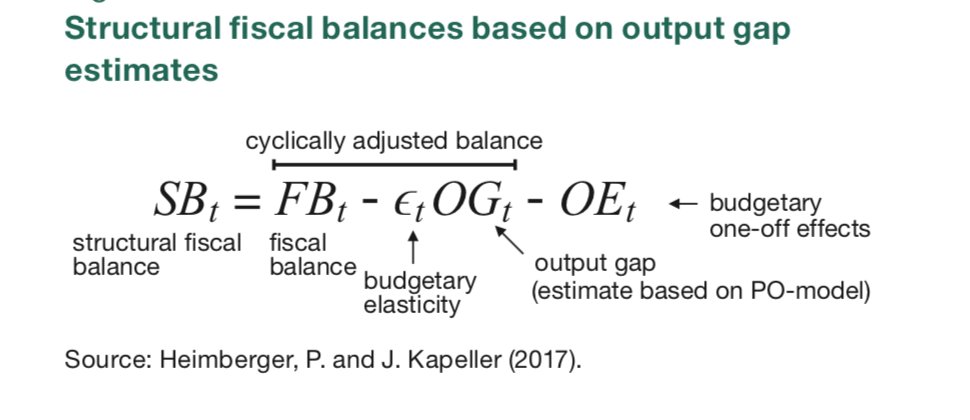

Output gap nonsense: European Commission is doing it again in its most recent forecast: producing crisis-driven, pro-cyclical downward estimates in economic slack (measured in terms of output gaps). This will reduce fiscal space once the fiscal rules are reactivated. A thread: /1

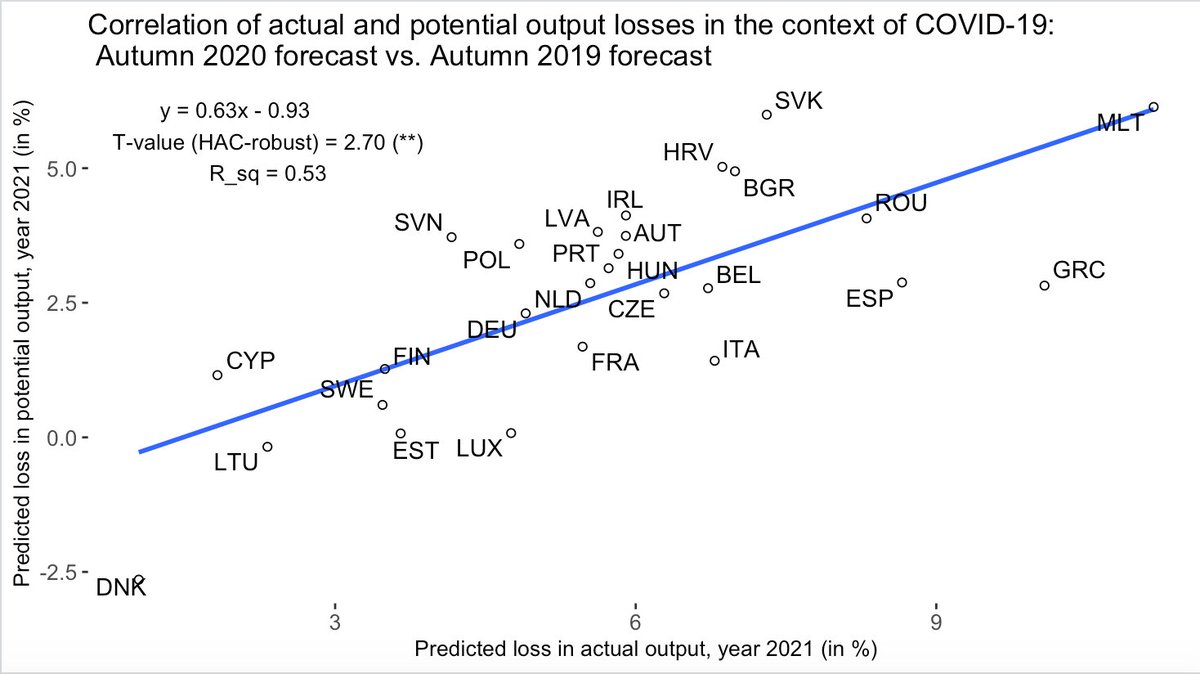

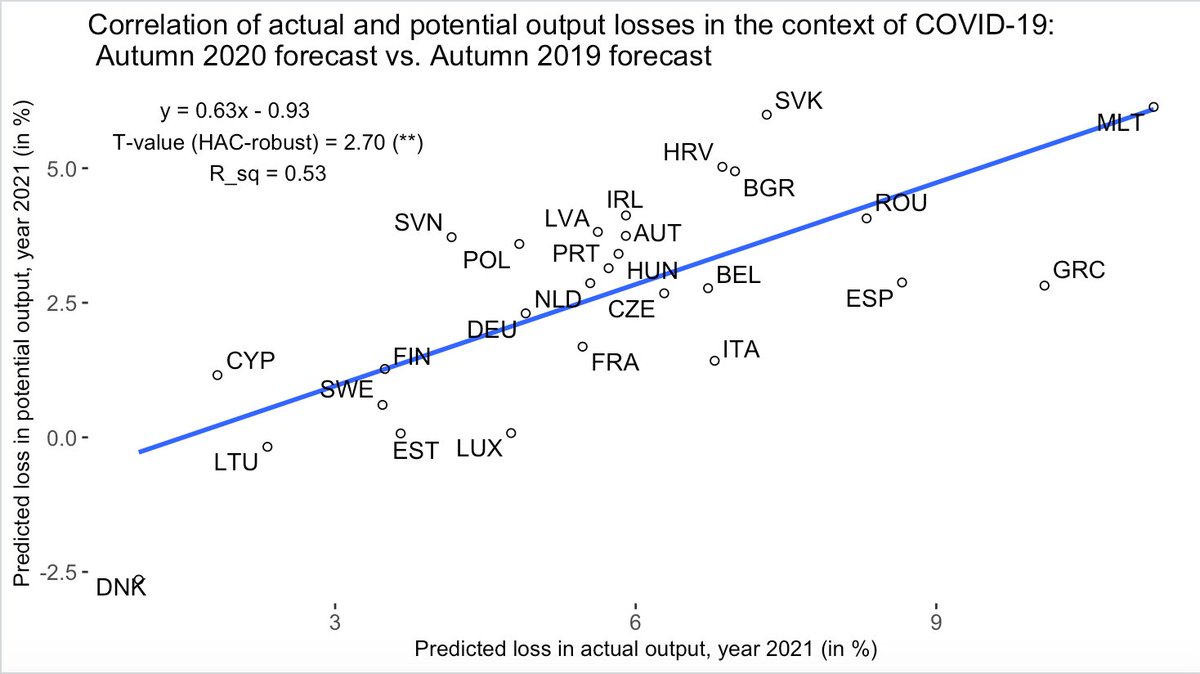

How does the COVID-19 shock affect the European Commission’s potential output estimates? In its Autumn 2020 forecast, the Commission systematically reduced its potential output forecast to a larger extent in countries that are predicted to suffer from a larger drop in GDP. /2

One additional percentage point in predicted losses of actual output is associated with a loss in potential output of about 0.6 percentage points (on average), suggesting that the revisions in PO-model estimates are again strongly related to changes in economic activity. /3

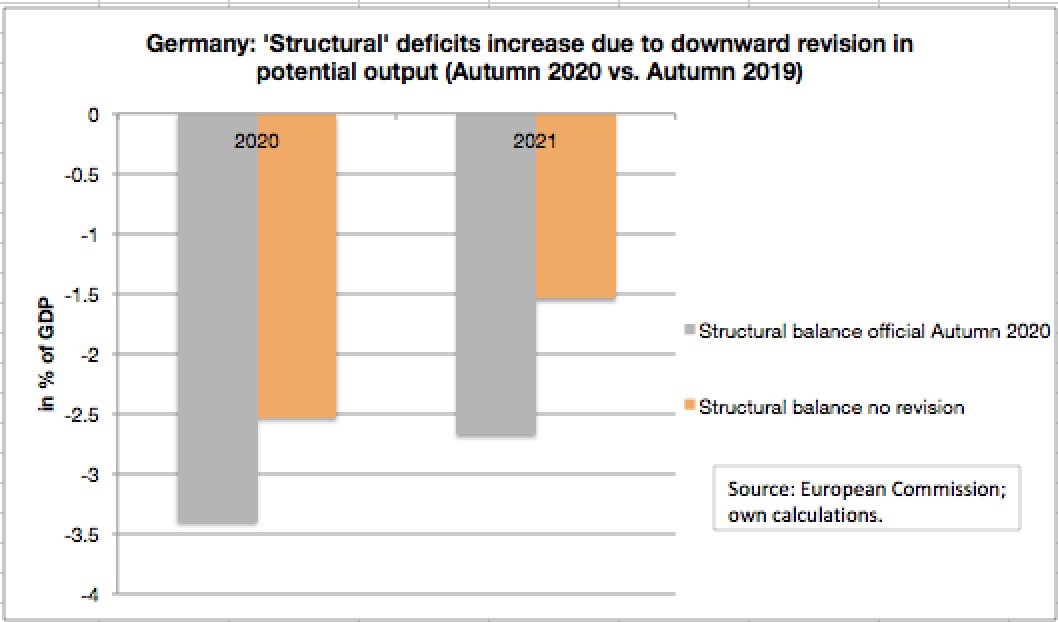

Downward revisions in potential output translate into higher ‘structural’ deficits, which will again become important once the temporary suspension of the EU’s fiscal rules is lifted. Countries such as Germany are now also affected by this. /4

intereconomics.eu/contents/year/…

intereconomics.eu/contents/year/…

Model-based estimates of 'structural' deficits are used for evaluating and supervising member states’ fiscal performance and underlie recommendations related to medium-term budgetary objectives. Larger 'structural' deficits will require more fiscal consolidation down the road. /5

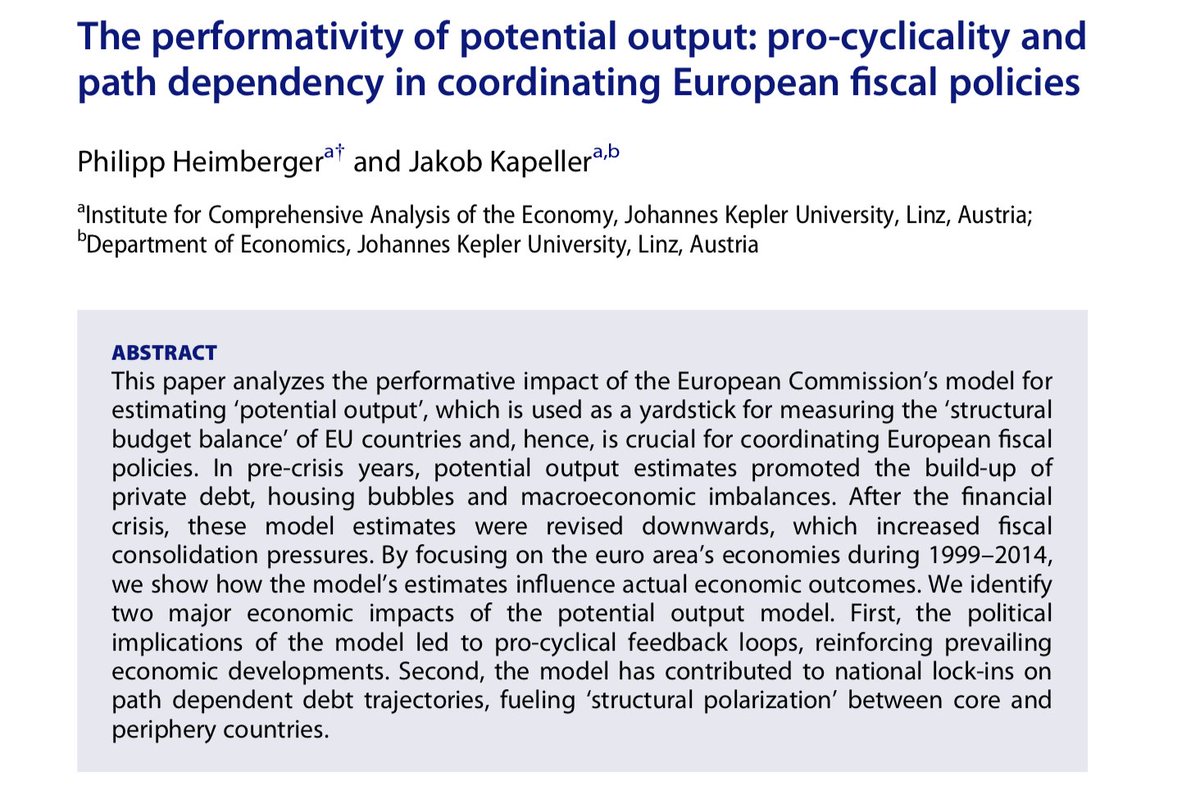

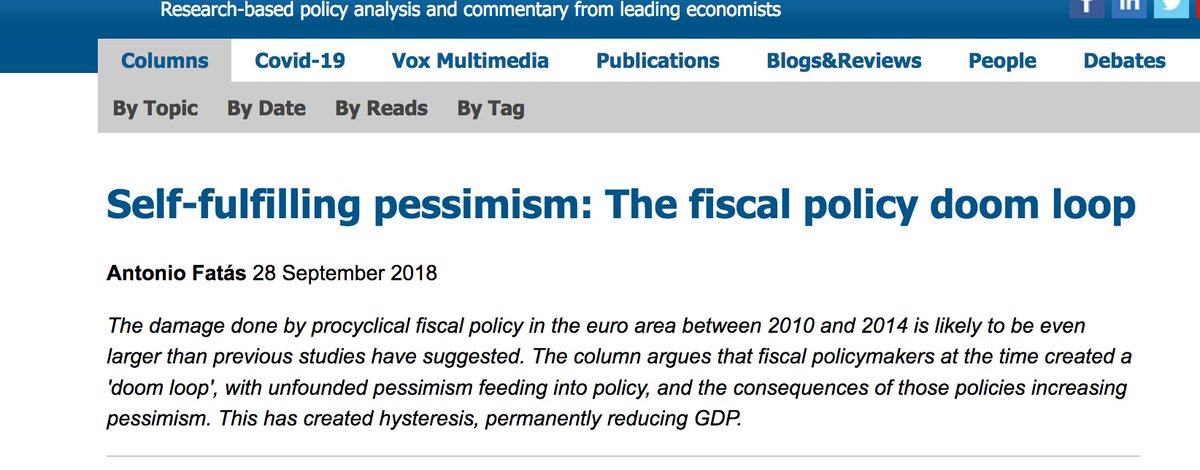

Especially for the period 2010 to 2014, there is ample evidence that the reliance on pessimistic views of potential output triggered pro-cyclical adjustments in fiscal policy with negative economic growth effects and path dependency in public debt.

jakob-kapeller.org/images/pubs/20… /6

jakob-kapeller.org/images/pubs/20… /6

Fiscal consolidation caused hysteresis effects, leading to successive rounds of downward revisions in potential output that partly validated the original pessimistic potential output forecasts and, in turn, caused further fiscal consolidation requirements. /7

We need to avoid that this self-defeating process is repeated after Corona. Improve estimates of potential output (account for hysteresis and low core inflation!). Reform the EU's fiscal rules. Do not reactivate the status quo, it would lead to counterproductive austerity. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh