0/ [NEW] Monthly Delphi Research Recap

A monthly digest highlighting some of our research team’s top reports and content.

Free access to the first edition here: delphidigital.io/reports/best-o…

Highlights 👇

A monthly digest highlighting some of our research team’s top reports and content.

Free access to the first edition here: delphidigital.io/reports/best-o…

Highlights 👇

1/ If you like what you see, we're offering a limited time discount on ALL our memberships.

Just use the code "DELPHIRECAP" at checkout to lock in a 50% discount on your 1st month OR a 20% discount on any of our annual plans!

(FYI: This won't last long!)

delphidigital.io/subscription-p…

Just use the code "DELPHIRECAP" at checkout to lock in a 50% discount on your 1st month OR a 20% discount on any of our annual plans!

(FYI: This won't last long!)

delphidigital.io/subscription-p…

2/ This edition includes:

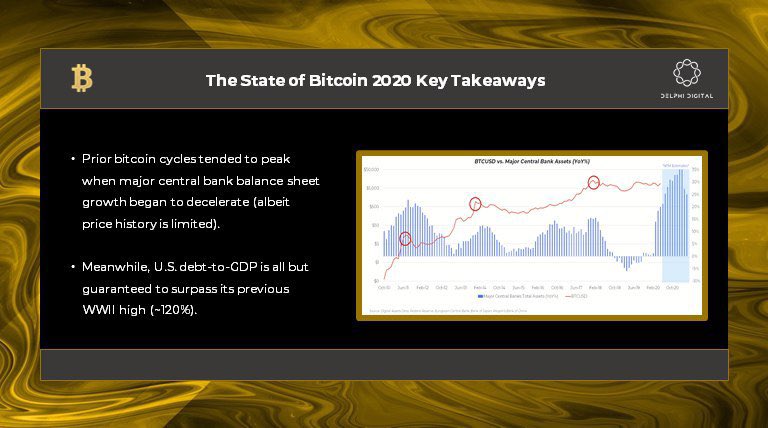

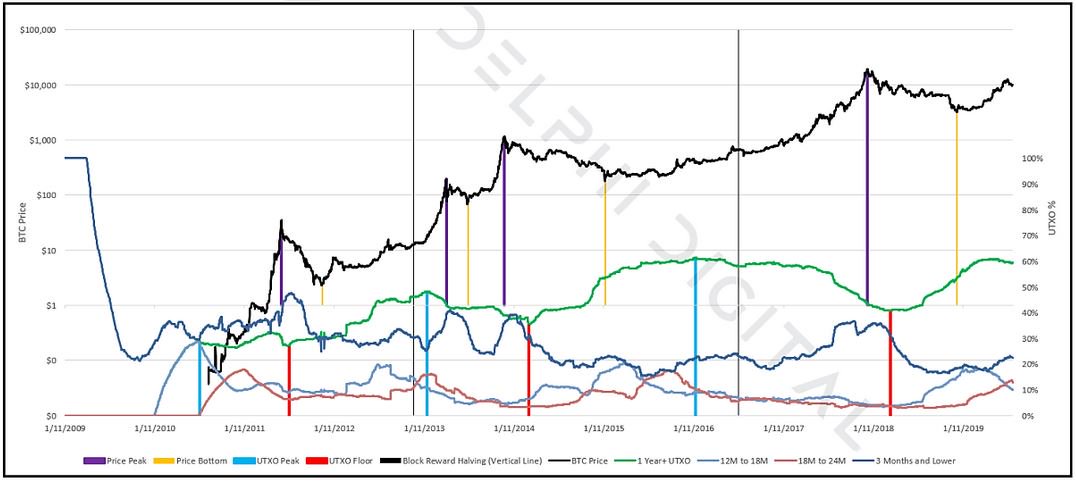

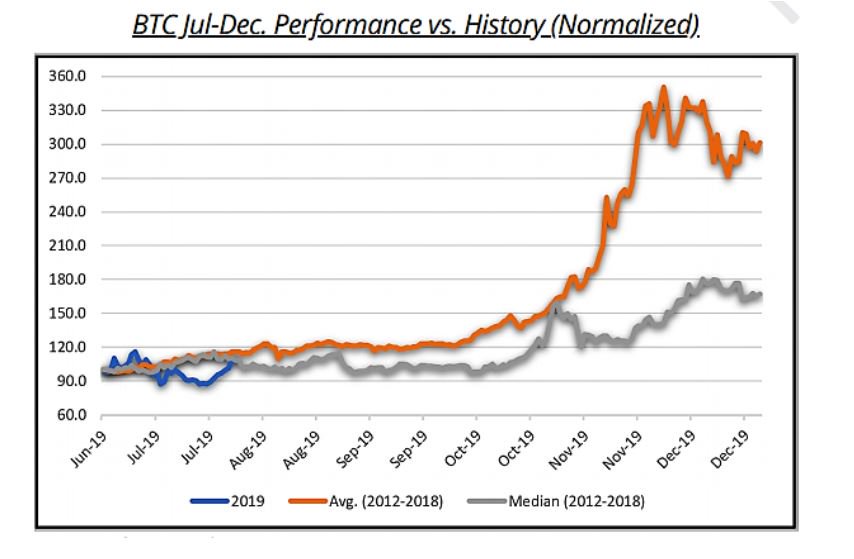

🔸 Setup for #Bitcoin & key on-chain metrics $BTC

🔸 Analysis on Ethereum's evolving ecosystem $ETH

🔸 Crypto taxation

🔸 Relationship between Yearn & Curve $YFI $CRV

🔸 In-depth notes on $NXM, smart stablecoins, impact of vested rewards, & more!

🔸 Setup for #Bitcoin & key on-chain metrics $BTC

🔸 Analysis on Ethereum's evolving ecosystem $ETH

🔸 Crypto taxation

🔸 Relationship between Yearn & Curve $YFI $CRV

🔸 In-depth notes on $NXM, smart stablecoins, impact of vested rewards, & more!

4/ Once again, you can view the full report at the link below.

Be sure to take advantage of the 'DELPHIRECAP' discount code we're currently offering. You'll receive full access to our Member Portal and more!

delphidigital.io/reports/best-o…

Be sure to take advantage of the 'DELPHIRECAP' discount code we're currently offering. You'll receive full access to our Member Portal and more!

delphidigital.io/reports/best-o…

• • •

Missing some Tweet in this thread? You can try to

force a refresh