#MarketUpdate THREAD

The most organic pump I've seen in years.

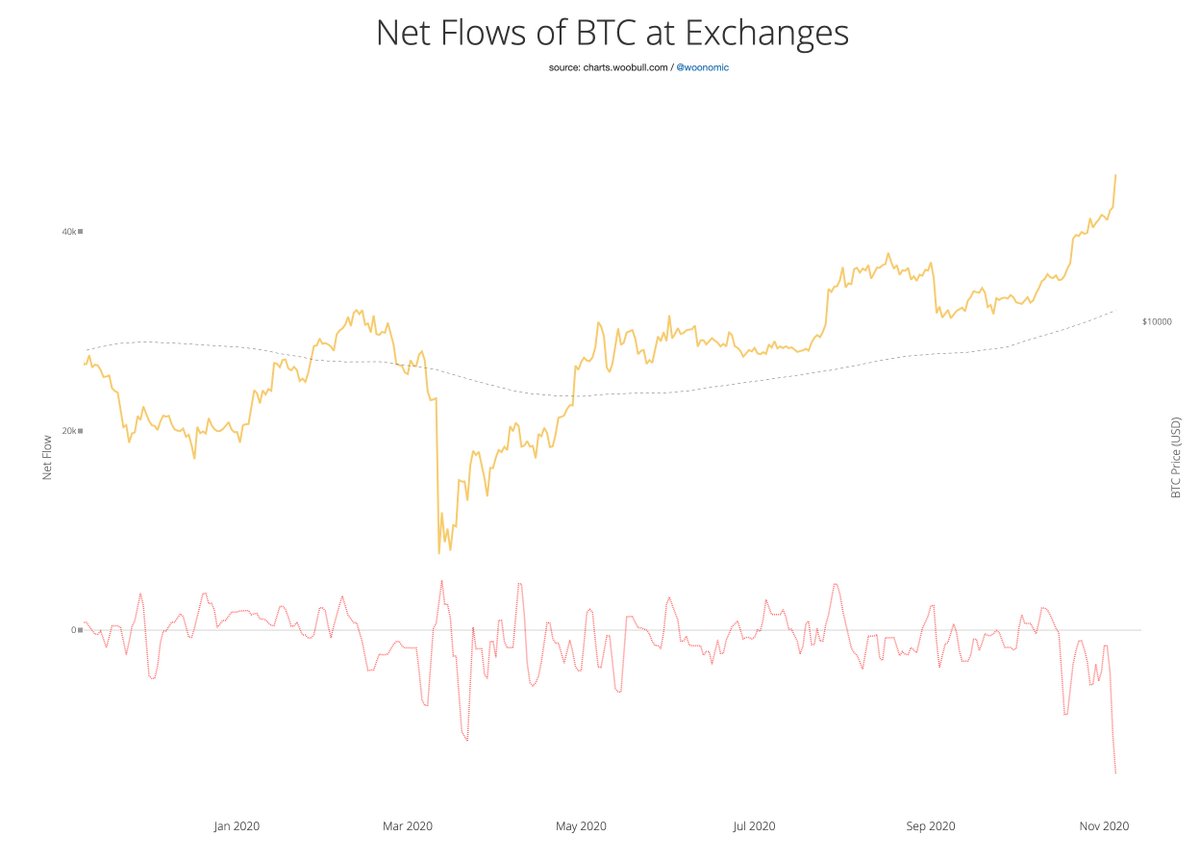

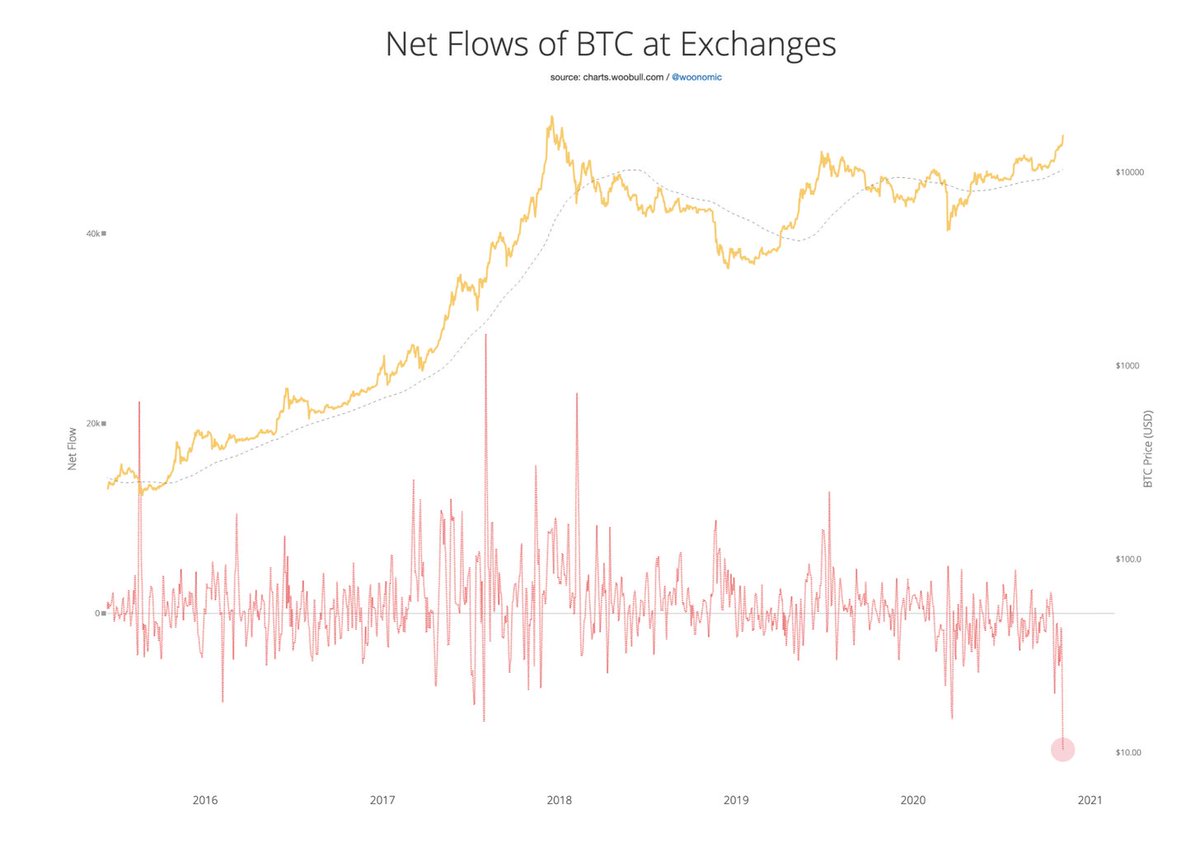

This was not a squeeze from derivatives traders but from solid organic buying.

The most organic pump I've seen in years.

This was not a squeeze from derivatives traders but from solid organic buying.

Exhibit B:

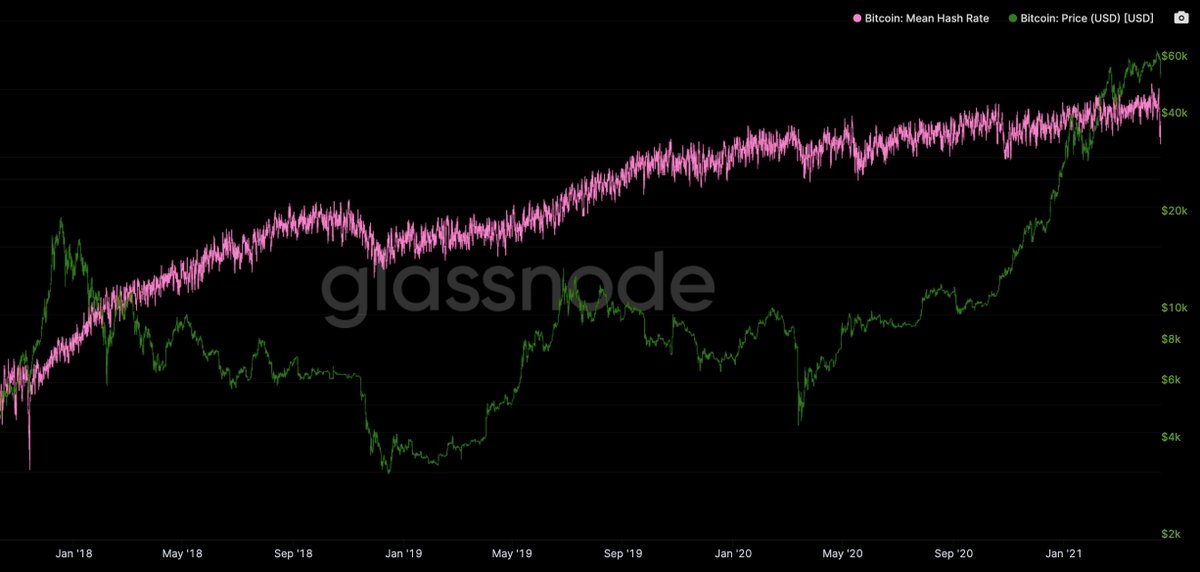

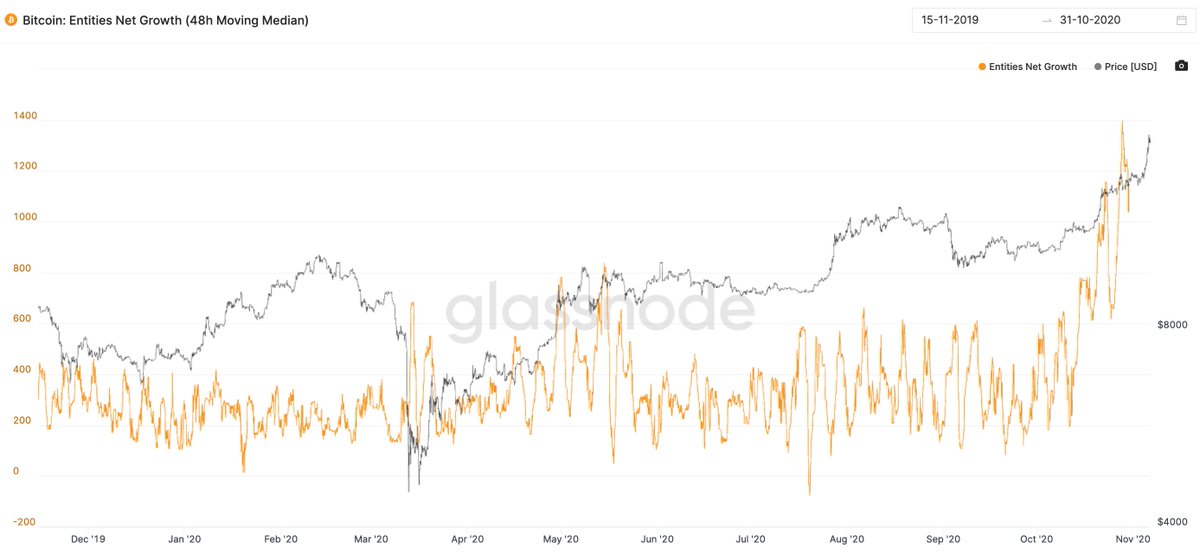

Prior to this pump, the influx of new HODLers seen on the blockchain was going through the roof.

(clusters of new wallet addresses holding BTC from new unique participants that were unseen before)

Prior to this pump, the influx of new HODLers seen on the blockchain was going through the roof.

(clusters of new wallet addresses holding BTC from new unique participants that were unseen before)

Repeat, through the roof, I'm not kidding. 🚀

This size of uptake was last seen in October 2017; that was one month before BTC entered its 2017 mania phase.

(We are nowhere near mania right now, we haven't even broken the prior all-time-high)

This size of uptake was last seen in October 2017; that was one month before BTC entered its 2017 mania phase.

(We are nowhere near mania right now, we haven't even broken the prior all-time-high)

A decent amount of investors took profit according to SOPR. It's in the region that typically halts an immediate further rise.

SOPR = the ratio of profit for coins moving between investors.

SOPR = the ratio of profit for coins moving between investors.

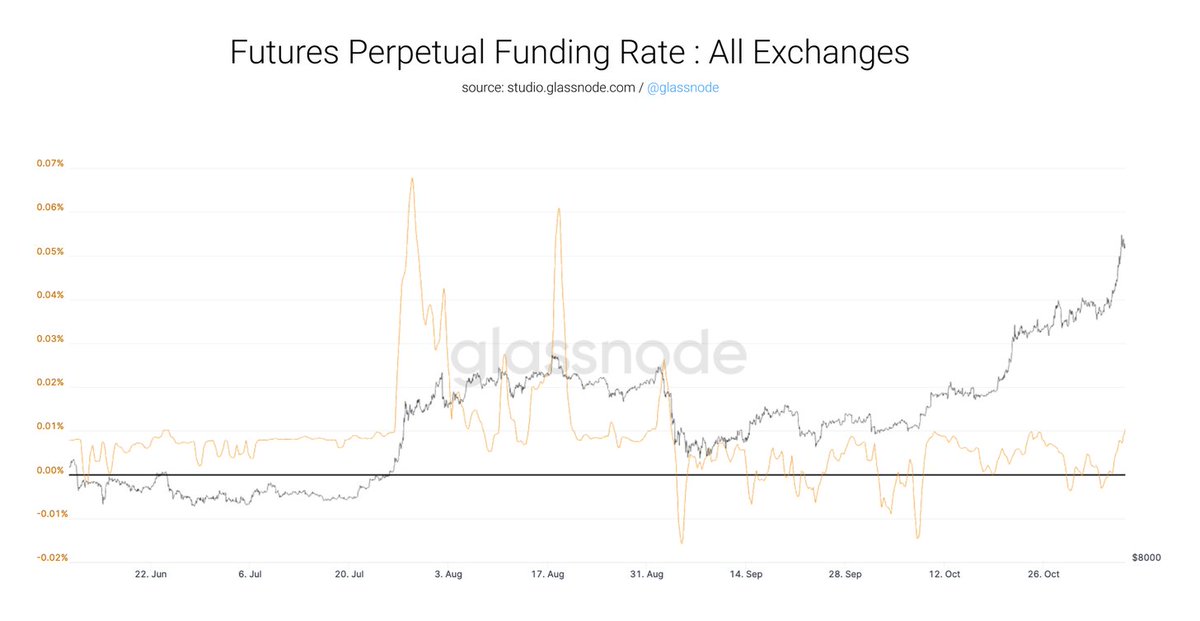

Also derivative funding rates are high-ish, providing headwinds for further climbs.

Average PERP funding across all exchanges pictured here by @glassnode

Average PERP funding across all exchanges pictured here by @glassnode

Overall conclusion: Not expecting a blow off top. Waiting for a consolidation to complete, then more bullish action.

For a further, more detailed breakdown, I've made this latest edition of The Bitcoin Forecast free to all.

willywoo.substack.com/p/the-organic-…

⭐️Reminder, there's 4 days left to sign up to get in during the launch month special.

willywoo.substack.com/p/the-organic-…

⭐️Reminder, there's 4 days left to sign up to get in during the launch month special.

Thanks to @glassnode for supporting this analysis by sponsoring the on-chain data.

Also to my paid subscribers who made this possible. 🙏

🚀🚀🚀

Also to my paid subscribers who made this possible. 🙏

🚀🚀🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh