Peaceful protesters said #EndSARS. What was the response?

1. CBN froze bank accounts in Oct, then court gave 90-days freeze order (law says order should only be 7 - 14 days)

2. IGP told Police to respond with force & that they can deprive citizens of their right to life

1. CBN froze bank accounts in Oct, then court gave 90-days freeze order (law says order should only be 7 - 14 days)

2. IGP told Police to respond with force & that they can deprive citizens of their right to life

3. Moe was stopped at airport and passport detained

4. Detention of persons (including infants) in Lagos on charges of looting (without evidence). Reported to be as much as 700, without feeding.

5. 6 non-violent persons remanded in Abuja till January 2021 & bail denied.

4. Detention of persons (including infants) in Lagos on charges of looting (without evidence). Reported to be as much as 700, without feeding.

5. 6 non-violent persons remanded in Abuja till January 2021 & bail denied.

7. Reports of a Eromosele Peter Adene picked up from his house in Lagos today and taken away. No one can confirm his location so far.

8. Lagos State & Police issued statement outlawing protests. That is a contravention of right to assembly & association in Nigeria’s constitution

8. Lagos State & Police issued statement outlawing protests. That is a contravention of right to assembly & association in Nigeria’s constitution

9. No prominent prosecution of any of the persons accused of police brutality (eg James Nwafor)

10. No public information on psychological evaluation of members of SARS

11. Instead, training of a new SWAT team despite public opposition to speed and lack of information.

10. No public information on psychological evaluation of members of SARS

11. Instead, training of a new SWAT team despite public opposition to speed and lack of information.

12. NHRC still has no governing council.

13. Unclear how many protesters may still be detained in several states

14. Some States have announced a compensation fund, but there is presently no announcement of a federal compensation fund. Size of individual compensation unclear.

13. Unclear how many protesters may still be detained in several states

14. Some States have announced a compensation fund, but there is presently no announcement of a federal compensation fund. Size of individual compensation unclear.

15. 29 states & FCT have set-up judicial panels. Next step (eg prosecution, compensation) after judicial panel is unclear.

16. Unclear how announcement on police welfare/reforms will be implemented.

17. Police in some states have ceased responsibilities in defiance to protests

16. Unclear how announcement on police welfare/reforms will be implemented.

17. Police in some states have ceased responsibilities in defiance to protests

18. Legal Aid Council of Nigeria noted that Lagos detained suspected looters, boys and girls as young as 15 years and men and women as old as 70. They requested a list of all suspects. Unclear if that demand has been complied with.

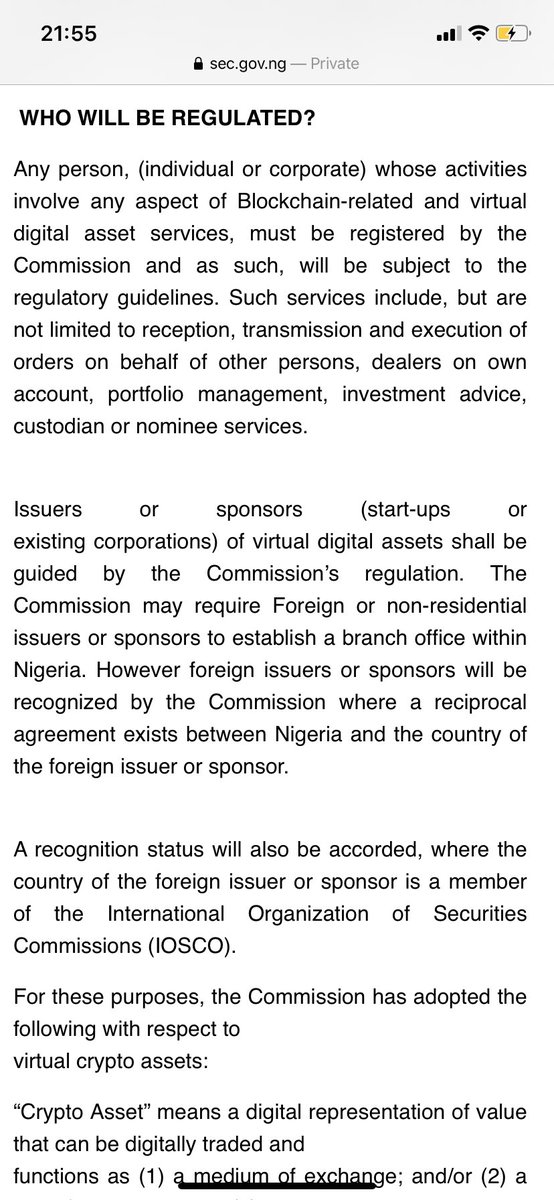

19. Rise in talks of Social media regulations.

19. Rise in talks of Social media regulations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh