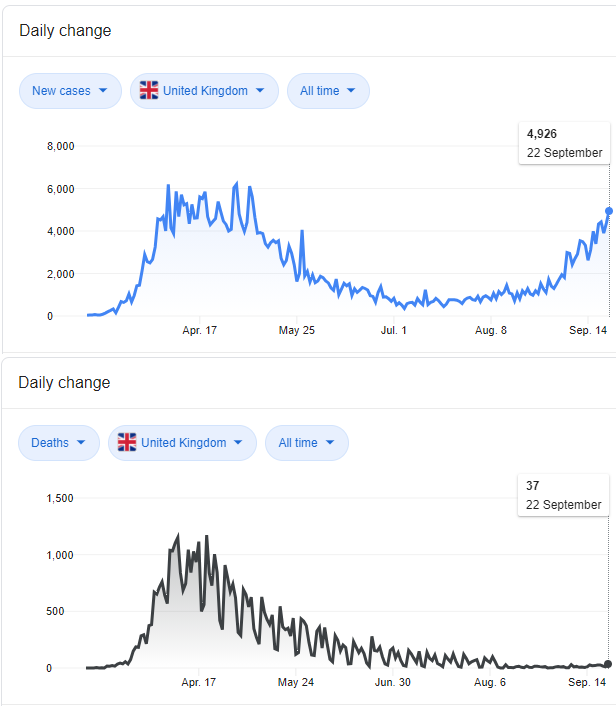

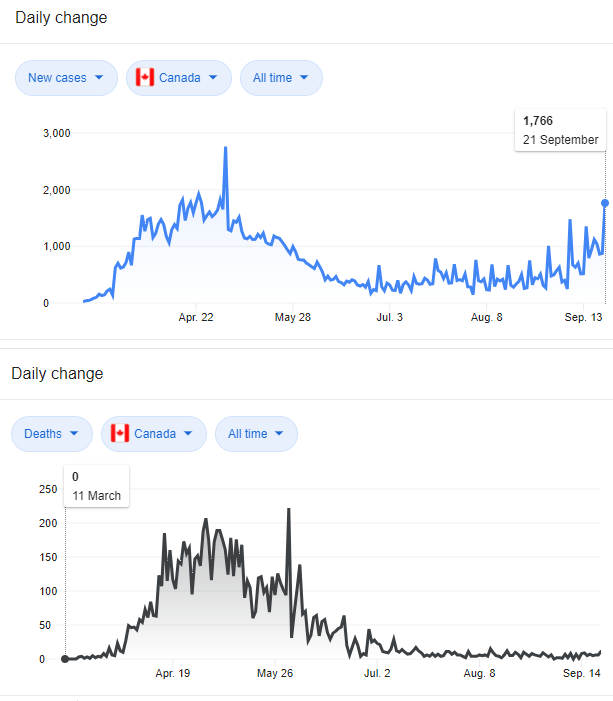

1/ Other Coronaviruses (non-COVID19) vs. #COVID19 in Canada

Comparing %pos by week for past cold seasons vs. the 2019/2020 Novel Coronavirus season.

Three provinces: ONT, QUE, BC

I honestly don’t know how to interpret what I’m seeing but it’s eye popping to say the least...

Comparing %pos by week for past cold seasons vs. the 2019/2020 Novel Coronavirus season.

Three provinces: ONT, QUE, BC

I honestly don’t know how to interpret what I’m seeing but it’s eye popping to say the least...

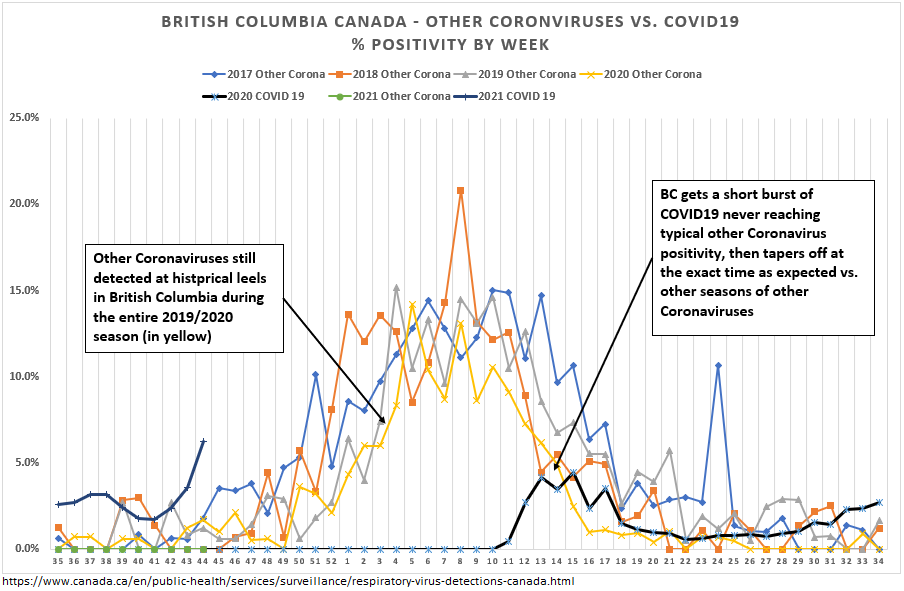

2/ BC…

Appears to have had a normal cold season (other coronaviruses) in 2019/2020 (yellow line) compared to the prior three seasons.

#COVID19 arrives (dark black line, surges weeks 11-14), and declines (seasonally, it would appear).

Appears to have had a normal cold season (other coronaviruses) in 2019/2020 (yellow line) compared to the prior three seasons.

#COVID19 arrives (dark black line, surges weeks 11-14), and declines (seasonally, it would appear).

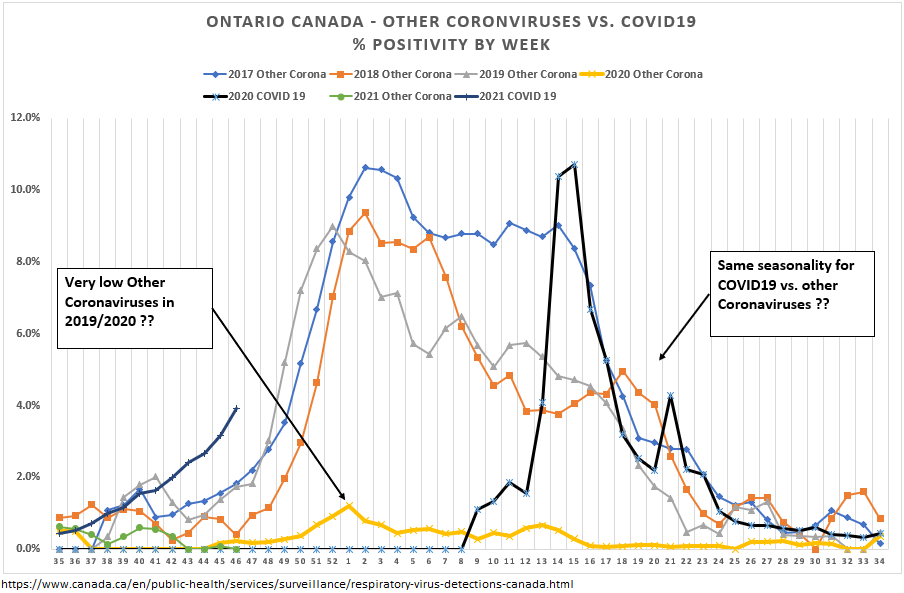

3/ but Ontario and Quebec are way different…

4/ Ontario…

Where are the Other Coronaviruses in the ‘19/’20 season? (yellow line)

% pos does not rise as normally expected, and goes nowhere near the prior three seasons !

Material #COVID19 positives arrive again in week 11, and surge before declining (again, seasonally?).

Where are the Other Coronaviruses in the ‘19/’20 season? (yellow line)

% pos does not rise as normally expected, and goes nowhere near the prior three seasons !

Material #COVID19 positives arrive again in week 11, and surge before declining (again, seasonally?).

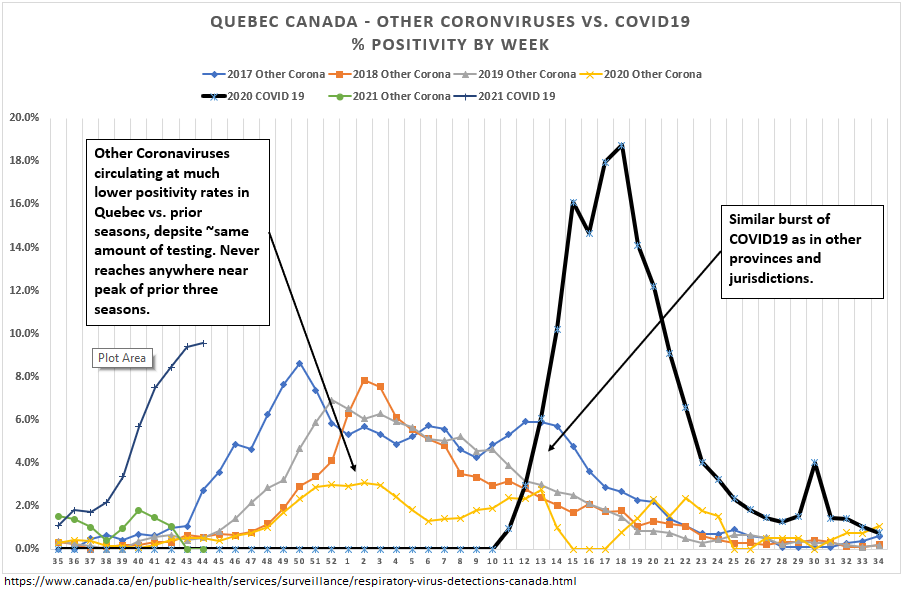

5/ What about Quebec ?

Well, there is some surge in Other Coronavirus % positivity in late 2019, then it plateaus, and it never comes close to prior year peaks.

#COVID19 again arrives in ~ week 11, surges before declining (again, seasonally?).

Well, there is some surge in Other Coronavirus % positivity in late 2019, then it plateaus, and it never comes close to prior year peaks.

#COVID19 again arrives in ~ week 11, surges before declining (again, seasonally?).

6/ This is just the data. Other Coronavirus testing levels were not materially different through the 2019/2020 season.

I have no idea how the above should be interpreted, but the obv Q: why is Other Coronavirus % pos in Ont/Que so low prior to the “official” arrival of #COVID19?

I have no idea how the above should be interpreted, but the obv Q: why is Other Coronavirus % pos in Ont/Que so low prior to the “official” arrival of #COVID19?

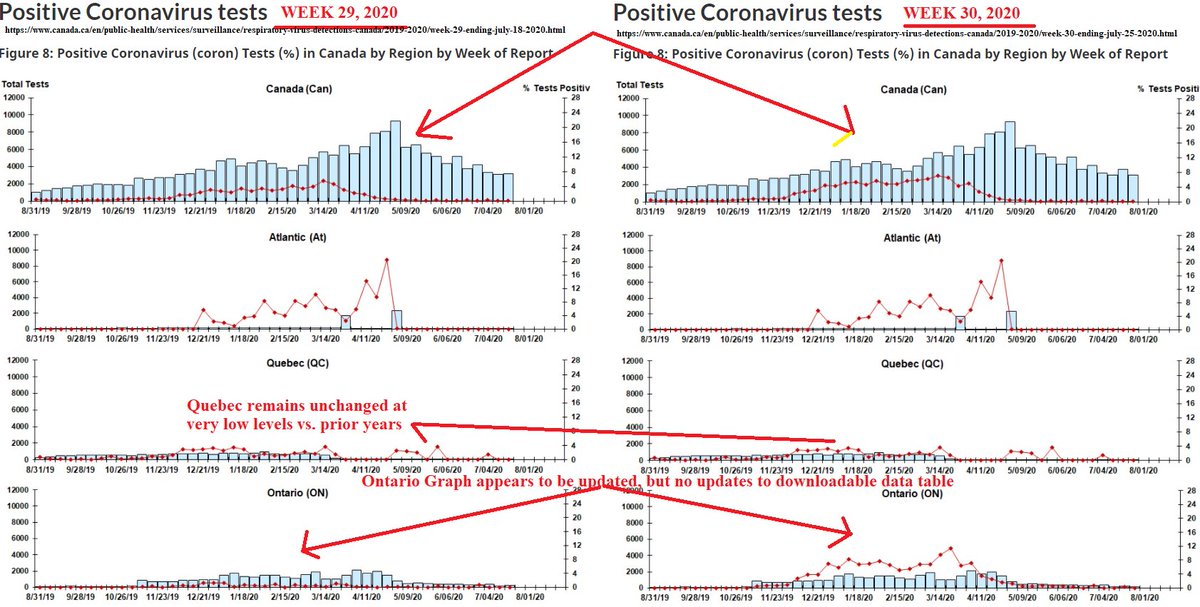

7/ A brief data note: in week 30 (July 25th, 2020), the other coronavirus chart (published weekly) for Ontario appeared to be updated so as to “catch up” previous unreported positives (??). But *no changes* were made to the official data table. And no changes to the Quebec chart.

9/ Fascinating data. End Thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh