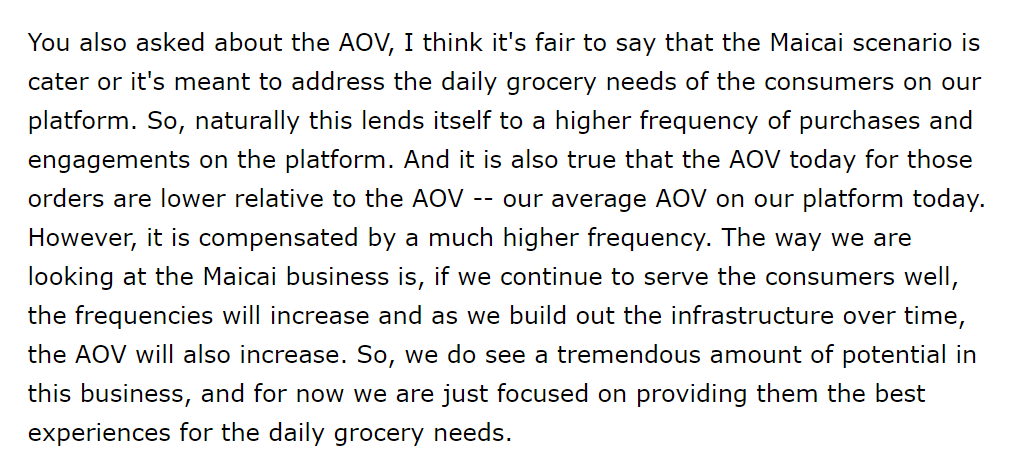

Pinduoduo recently launched Duo Duo Maicai, which lets customers pick-up online orders from local shops. It was all analysts talked about on its Q3 earnings call last week and its stock jumped 30% the following two days.

Quick thread:

Quick thread:

A pick-up ecommerce model pools multiple last mile delivery legs into one trip. 20 orders becomes just one delivery.

This lowers logistics costs significantly, which unlocks ecommerce for lower priced products, new behaviors, and makes it more accessible for low income consumers

This lowers logistics costs significantly, which unlocks ecommerce for lower priced products, new behaviors, and makes it more accessible for low income consumers

A pick-up model also drives foot traffic to local shops. It's not a stretch to think one day we'll will bid on ecommerce pick-up traffic like digital ads.

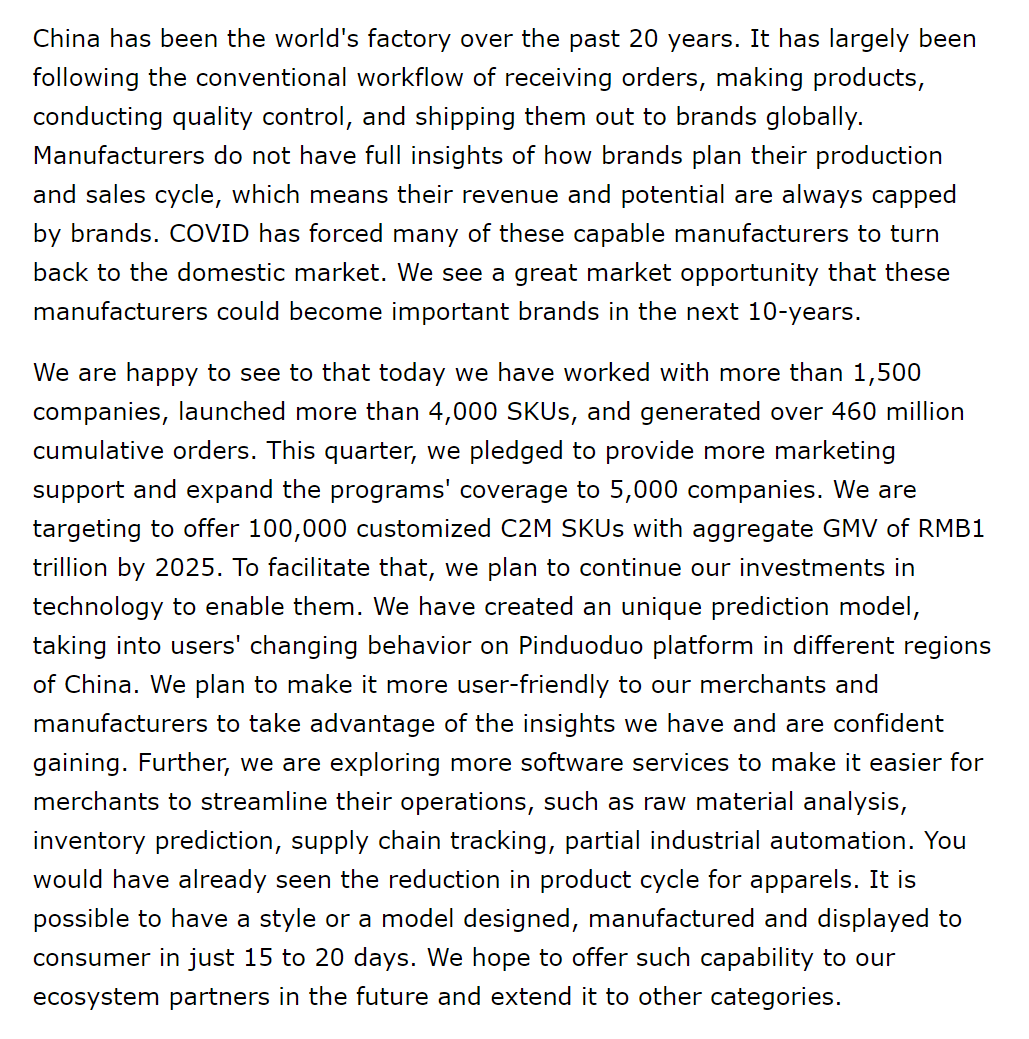

An ad network like Pinduoduo's spanning manufacturers, consumer app, and in-person trips will likely be very, very valuable.

An ad network like Pinduoduo's spanning manufacturers, consumer app, and in-person trips will likely be very, very valuable.

Picking up an online order seems counterintuitive, but it can fit into most consumers' day (and shifts the cost) if done correctly.

It's also a new channel to compete against incumbents as most ecommerce platforms don't have networks of local businesses serving as pickup points.

It's also a new channel to compete against incumbents as most ecommerce platforms don't have networks of local businesses serving as pickup points.

Anyone who wants to compete will have to blitz scale supply.

The pick-up model will likely be copied, but the best locations will not only be convenient for consumers, they may also lower CAC by driving additional word of mouth downloads and usage.

The pick-up model will likely be copied, but the best locations will not only be convenient for consumers, they may also lower CAC by driving additional word of mouth downloads and usage.

Wish (US), Snackpass (US), Pinduoduo (China), Shihuituan (China), and Facily* (Brazil) are just a few platforms starting to build out pick-up networks for general ecomm, restaurants, and groceries.

Going to be fun watching the pick-up model play out!

* @GeltVC portfolio company

Going to be fun watching the pick-up model play out!

* @GeltVC portfolio company

• • •

Missing some Tweet in this thread? You can try to

force a refresh