One serial entrepreneur grew up in foster care and started his first business while living out of his car.

He overcame the odds to build multiple businesses, amassing a net worth of over $3 billion in the process.

Who's up for a story?

👇👇👇

He overcame the odds to build multiple businesses, amassing a net worth of over $3 billion in the process.

Who's up for a story?

👇👇👇

1/ John Paul DeJoria was born in 1944 in Los Angeles, California.

He faced adversity from a young age, as his parents divorced when he was just two years old.

Watching his mother struggling to make ends meet, at age 9 he started working odd jobs to help support the family.

He faced adversity from a young age, as his parents divorced when he was just two years old.

Watching his mother struggling to make ends meet, at age 9 he started working odd jobs to help support the family.

2/ Sadly, when his single mother was no longer able to care for them, he and his brother were placed in foster care in East LA.

Growing up in this challenging environment, DeJoria struggled to find his purpose.

He joined a street gang as a teenager and headed down a bad path.

Growing up in this challenging environment, DeJoria struggled to find his purpose.

He joined a street gang as a teenager and headed down a bad path.

3/ But when his high school math teacher told him he would never succeed at anything in life, a switch inside the young DeJoria flipped.

He was determined to clean up his act.

Upon graduating high school, he joined the Navy, where he served for two years.

He was determined to clean up his act.

Upon graduating high school, he joined the Navy, where he served for two years.

4/ After leaving the Navy, without money for college, he held a series of jobs, including janitor and encyclopedia salesman.

But he found his passion in an unexpected place: the hair care industry.

He took sales roles at Redken, Fermodyl, and Trichology, learning all he could.

But he found his passion in an unexpected place: the hair care industry.

He took sales roles at Redken, Fermodyl, and Trichology, learning all he could.

5/ Fired from all without good reason, he decided to go out on his own.

So in 1980, while living in the back of a car, he took out a $700 loan and partnered with hairdresser Paul Mitchell to form John Paul Mitchell Systems.

For John Paul DeJoria, it was time to bet on himself.

So in 1980, while living in the back of a car, he took out a $700 loan and partnered with hairdresser Paul Mitchell to form John Paul Mitchell Systems.

For John Paul DeJoria, it was time to bet on himself.

6/ The focus of the new company was on developing products designed to improve the efficiency of professional stylists.

With Paul Mitchell's insider knowledge and DeJoria's salesmanship, John Paul Mitchell Systems was destined to break through.

It was just a matter of time.

With Paul Mitchell's insider knowledge and DeJoria's salesmanship, John Paul Mitchell Systems was destined to break through.

It was just a matter of time.

7/ With no outside funding, they struggled to make business ends meet and pay their suppliers.

But as sales ramped up, they found a way to scrape together the money to keep the suppliers happy and get the product out to the salons.

By 1983, they had done $1 million in sales.

But as sales ramped up, they found a way to scrape together the money to keep the suppliers happy and get the product out to the salons.

By 1983, they had done $1 million in sales.

8/ With an innovative product, unique selling strategy focused on stylists, and a great price point, John Paul Mitchell Systems took off.

They rapidly expanded into new markets.

By 1986, with 27 employees and a large non-employee salesforce, sales were pushing $100 million!

They rapidly expanded into new markets.

By 1986, with 27 employees and a large non-employee salesforce, sales were pushing $100 million!

9/ Sadly, soon after, tragedy struck.

Paul Mitchell was diagnosed with pancreatic cancer and passed away in 1989.

But his legacy would live on, as DeJoria continued to build the John Paul Mitchell Systems empire.

Paul Mitchell was diagnosed with pancreatic cancer and passed away in 1989.

But his legacy would live on, as DeJoria continued to build the John Paul Mitchell Systems empire.

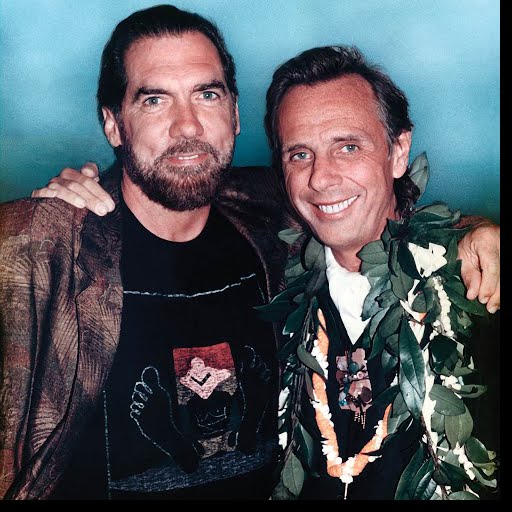

10/ Around this time, with his hair care juggernaut on auto-pilot, John Paul DeJoria began diversifying into other businesses.

He partnered with a friend, Martin Crowley, to make and sell the smoothest tequila in the world.

The Patron Spirits Company was officially born.

He partnered with a friend, Martin Crowley, to make and sell the smoothest tequila in the world.

The Patron Spirits Company was officially born.

11/ The product was expensive - much more expensive than most tequila at the time - but they knew the customers would flock to it.

After appearing in Clint Eastwood's "In the Line of Fire," sales of the product took off.

Patron quickly became a true pop culture sensation.

After appearing in Clint Eastwood's "In the Line of Fire," sales of the product took off.

Patron quickly became a true pop culture sensation.

12/ Today, John Paul Mitchell Hair Systems is a global business with over $1 billion in revenues and Patron Spirits Company is believed to generate over $250 million annually.

DeJoria has many other successful businesses, including House of Blues and several energy companies.

DeJoria has many other successful businesses, including House of Blues and several energy companies.

13/ John Paul DeJoria has achieved incredible success, made even more impressive by his challenging start in life.

@Forbes estimates his net worth at ~$3 billion.

Importantly, he has used his platform give back, winning @Variety Philanthropist of the Year in 2017.

@Forbes estimates his net worth at ~$3 billion.

Importantly, he has used his platform give back, winning @Variety Philanthropist of the Year in 2017.

14/ Not bad for a guy who started his first business while living out of the back of his car!

I hope you enjoyed this inspiring story as much as I did.

For more, check out the links below:

nbcnews.com/know-your-valu…

variety.com/2017/biz/news/…

archive.fortune.com/2012/04/24/sma…

I hope you enjoyed this inspiring story as much as I did.

For more, check out the links below:

nbcnews.com/know-your-valu…

variety.com/2017/biz/news/…

archive.fortune.com/2012/04/24/sma…

15/ And for more inspiring and educational stories on business, finance, money, and economics, check out my meta-thread below! Turn on post notifications so you never miss a thread.

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh