The actuarial profession's CMI has produced its weekly update on mortality during the pandemic. It reports that in the latest week (to 6th Nov) excess deaths were 9% above expectation. Some more context to follow. 1/11

https://twitter.com/actuarynews/status/1328709928639492097

The analysis uses age standardised mortality rates, which adjusts for changes in the size/age dist'n of the pop'n. This gives a better answer than using numbers of deaths - typically you get a lower excess as our population is ageing, so we would expect more deaths each yr. 2/11

This chart compares 2020 with the average of 10-19. Note that as mortality has improved over the decade you would expect more recent years to be lower, and vice versa. Note also how close 20 was tracking to 19 before late March. You can see the line drifting up again now. 3/11

A comparison of each yr with the previous yr helps assess how light mortality in one year (eg a "good flu year") might translate to heavy mortality the next yr. The speed and size of the shock we saw in the first wave is clearly unprecedented with anything that went before. 4/11

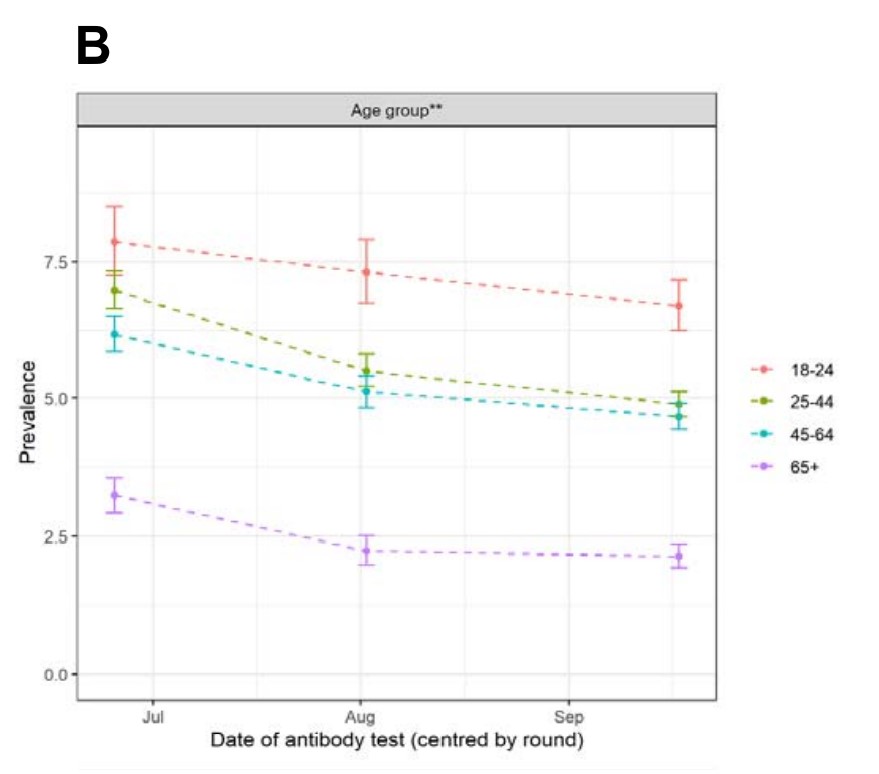

You can see that it's not just the very old who are dying. Excess mortality is up at all ages. And besides, once you reach 80, your expectation of life is still several years from that point, probably with some comorbidities, as that comes with the territory at that age. 5/11

The paper sets out how the 9% is derived and why 2019 is the preferred comparison (though it's also the same compared with 15-19 this week). The disparity between M (11%) and F (9%) is clear. You can see that the excess has risen from 6% to 9% in a week, a 50% jump. 6/11

The paper estimates the latest view of overall excess deaths as 57k for E&W and 63k for the UK. It also gives a foretaste of next week's numbers, with 26% more COVID deaths for the w/e 13/11 being reported by PHE currently. 7/11

To those wondering whether 9% additional deaths represents statistically significant excess mortality, PHE reports weekly on this point, and its latest report clearly states that the last four weeks (including W45) show excess mortality. 8/11 assets.publishing.service.gov.uk/government/upl…

The CMI has been studying mortality since the 1920s, in support of the life and pensions industry. Its suite of reporting is a standard methodology, though reporting has been stepped up for COVID and attracts a wider audience. But the graphs earlier are not newly developed. 9/11

In line with the Actuaries' Code, the CMI's work is independent, impartial and is not subject to bias. With so much misinformation, selective quoting of statistics etc regarding COVID, it's worth remembering this. There is no "agenda" in its paper or methodology. 10/11

So in summary, we are now in a period of increasing statistically significant excess mortality, which we can expect to continue for at least the next couple of weeks given leading indicators. 11/11 END

• • •

Missing some Tweet in this thread? You can try to

force a refresh