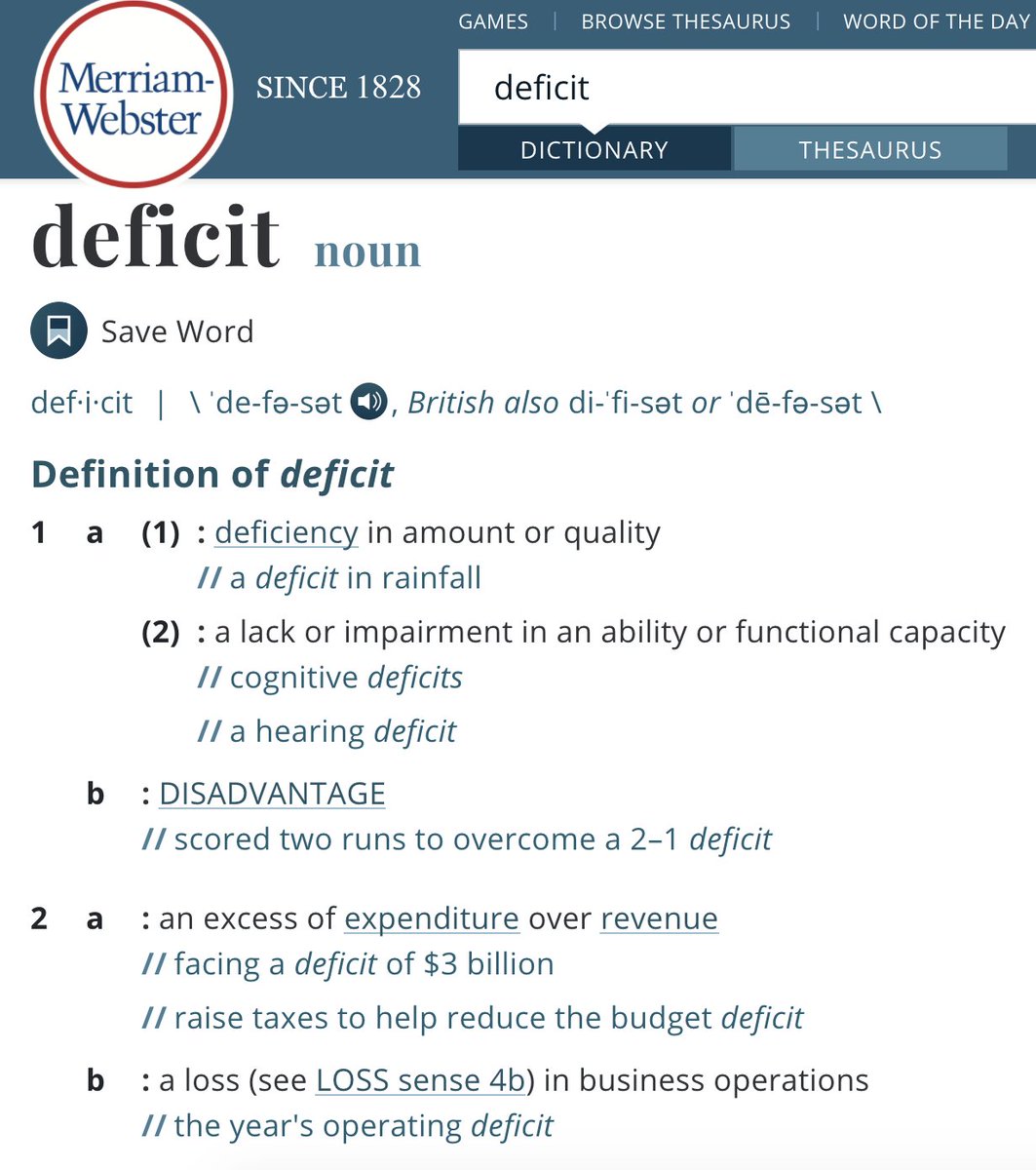

MMT: The Clock that Keeps on Ticking

bloomberg.com/opinion/articl…

I’ll put the MMT record up against the stopped clock mainstream Keynesian record any day. Exhibit A brookings.edu/wp-content/upl…

bloomberg.com/opinion/articl…

I’ll put the MMT record up against the stopped clock mainstream Keynesian record any day. Exhibit A brookings.edu/wp-content/upl…

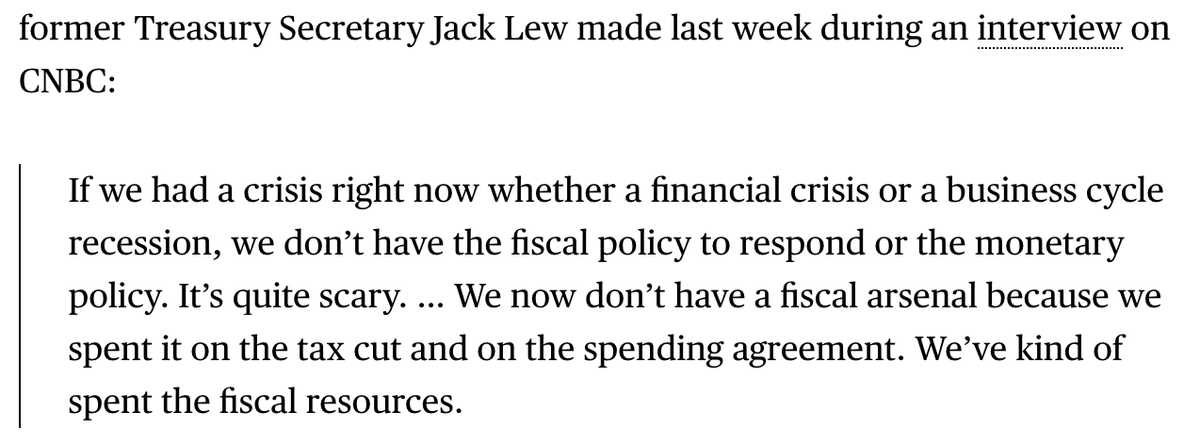

If you’ve followed the headline Keynesians over the years, you know that they have twisted themselves into knots, trying to justify their ever-shifting views on fiscal sustainability.

They counseled Congress (and Obama) to steer clear of a bigger relief package, paving the way for an abysmal “recovery.” They leaned into Simpson Bowles and went on to warn that “A debt crisis is coming.” washingtonpost.com/opinions/a-deb…

They’ll hobble the incoming administration too, if they have the chance. They got the big stuff wrong when it mattered. And there’s no evidence they’ve figured out why they had it so wrong for so long. All they’ve got is “some hand-waiving about a “global savings glut”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh