1."Conditional Buy"

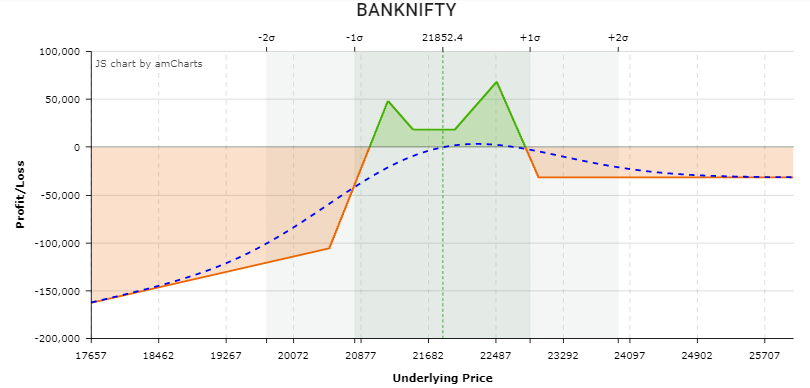

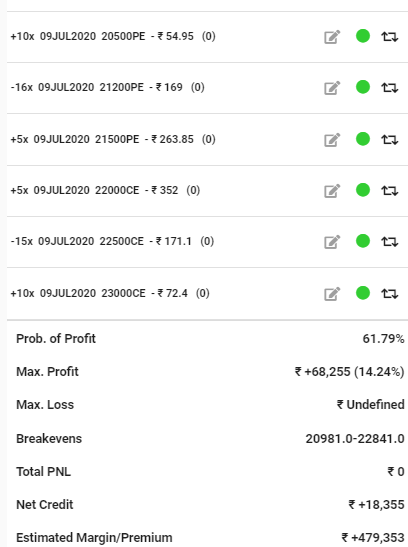

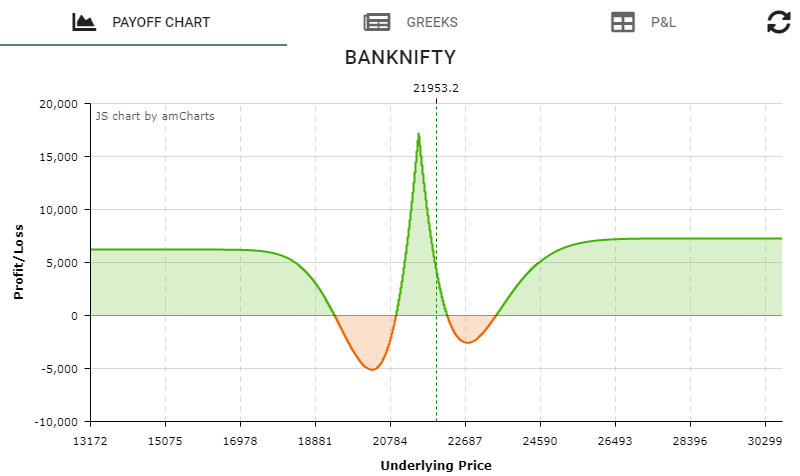

Aim is to capture theta on a day to day basis by selling straddles/strangles.

Instead of putting stops on the sold arms, close contracts are bought to convert naked arms into bull/bear debit spreads if the index is breaking away from a range.

#OptionsTrading

Aim is to capture theta on a day to day basis by selling straddles/strangles.

Instead of putting stops on the sold arms, close contracts are bought to convert naked arms into bull/bear debit spreads if the index is breaking away from a range.

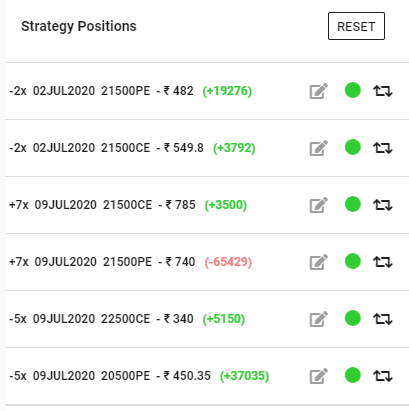

#OptionsTrading

2. Sharing my strategy as I execute it. At around 9:30 AM, I would assess probable demand and supply zones on #banknifty chart. Breach of these zones would lead to quick price movements, which may or may not result in a trend.

#OptionsTrading

#OptionsTrading

3. Now I choose the nearest 500 strike to write a strangle. Eg. #Banknifty closed at 29631 on Friday, 27th Nov. So I would be writing 29000PE and 30000CE Weekly contracts.

a. 29000 PE premium: 184

b. 30000 CE premium: 246

c. Total Premium collected per lot : 430

#OptionsTrading

a. 29000 PE premium: 184

b. 30000 CE premium: 246

c. Total Premium collected per lot : 430

#OptionsTrading

4. Once this is done, I would decide the strikes which would act as hedges if market rallies in any direction. Based on the current chart, I have a view that market has a higher chance of an uptrend than a downtrend in near future. #OptionsTrading

5. Also, because of the strike selection, I am already starting with a negative delta position if I sell equal number of lots. So, while selecting the Buy strikes and price, I would need to keep this in mind.

6. Buy strikes : As I have a positive bias on the market, I would place conditional buy orders on 29700CE and 29200PE. If 29700CE buy is executed, then the resulting spread would be a 300 point debit call spread of 29700- 30000CE as compared to a 29000-29200PE #OptionsTrading

7. ... a 200 point debit put spread on the downside. A 300 point spread would have a higher delta and thus, higher profit generation for every point move.

8. Buy Price : Short strangles/straddles hedge eachother to some extent. Issue starts when prices deviate substantially from equilibrium. A short call has a -ve delta while a short put has a +ve delta. The difference between the two decides how your profitability moves #Options

9. ...with every point move on the index. If the movement in the index is in a narrow range, the differential value does not change much and thus the profitability impact due to delta is low in case of short strangle/straddle. However, as prices blast out in any one direction,...

10. ...delta of the tested arm rises exponentially and so does the differential.

Understand this.

First 100 points move wud hav a marginal impact. May be a Rs200 MTM loss. The next 100 points move would take the MTM lower by Rs1000. #OptionsTrading

Understand this.

First 100 points move wud hav a marginal impact. May be a Rs200 MTM loss. The next 100 points move would take the MTM lower by Rs1000. #OptionsTrading

11. Another 100 point move in same direction, and the loss could be well in the range of Rs5000s+. So, basically we have to avoid getting into that area from where losses just baloons up. #OptionsTrading

12. Two solutions:

1. Place stop loss orders, exit at max bearable loss as per your risk management. It has its pros and cons.

2. Buy ATM or close to ATM strikes and use the trending market to your advantage.

I prefer the second option.

1. Place stop loss orders, exit at max bearable loss as per your risk management. It has its pros and cons.

2. Buy ATM or close to ATM strikes and use the trending market to your advantage.

I prefer the second option.

13. Once I assess the point from where the differential would become severely adverse, I would place my orders on the buy strikes. The price would be based on recent high on that strike. Idea is that the buy should get triggered once the recent highs are taken out on either side.

14. Attached charts show where I would have placed my conditional buys. Once the Buy orders are executed, the strangles would have taken a strong directional view in the direction of current trend. Next decision point would be decided based on the expected strength of the trend.

15. Here, I rely on RSI. I generally use 5 min timeframe (TF), but its better to check higher TFs as well. An RSI above 60 in the direction of trend in both TFs would give a lot of confidence to hold on to the sold untested arm which already is in good profits. #OptionsTrading

16. Once my conditional buy has been triggered and then I feel the trend is not that strong, I may adjust the delta by either (in case of a rally)

i. Squaring off 29000PE - fully or partially

ii. Squaring off 29700CE - Partially

iii. Combination of i & ii.

#OptionsTrading

i. Squaring off 29000PE - fully or partially

ii. Squaring off 29700CE - Partially

iii. Combination of i & ii.

#OptionsTrading

17. Once a decent move is captured, book out and relax.

If all of a sudden, after buy is executed, market takes a U-turn, simply close everything even if its in a loss as managing such market is emotionally draining. #OptionsTrading #Options

If all of a sudden, after buy is executed, market takes a U-turn, simply close everything even if its in a loss as managing such market is emotionally draining. #OptionsTrading #Options

18. Preserving your emotional capital is as important as preserving your financial capital.

Constructive criticism is always welcome.

End of thread.

#OptionsTrading #Options

Constructive criticism is always welcome.

End of thread.

#OptionsTrading #Options

P.S. Benefit of keeping a conditional buy orders in the system is better execution.

- Limit orders limit slippages

- If call buy order is executed, one can take off the put buy order and release the margins.

- Limit orders limit slippages

- If call buy order is executed, one can take off the put buy order and release the margins.

• • •

Missing some Tweet in this thread? You can try to

force a refresh