Co-Founder - MegaServe | Capital Compound | WittyCapital Systematic Options Trader IIM Indore, Ex-Goldman Sachs. Leverage the power of Algos!

How to get URL link on X (Twitter) App

2. In layman terms, FED regulates the flow of dollars in the world. For last many years, after the 2008 crisis, they have been printing dollars recklessly to help US Govt fund several economy stabilizing projects by buying US bonds.

2. In layman terms, FED regulates the flow of dollars in the world. For last many years, after the 2008 crisis, they have been printing dollars recklessly to help US Govt fund several economy stabilizing projects by buying US bonds.

https://twitter.com/vivekthebaria/status/14860526411006156802. If the price action is such that it increases your conviction on the stock upmove, adding naked longs is like pyramiding. After all, if you can't capitalise on favorable moves, then when will you make money?

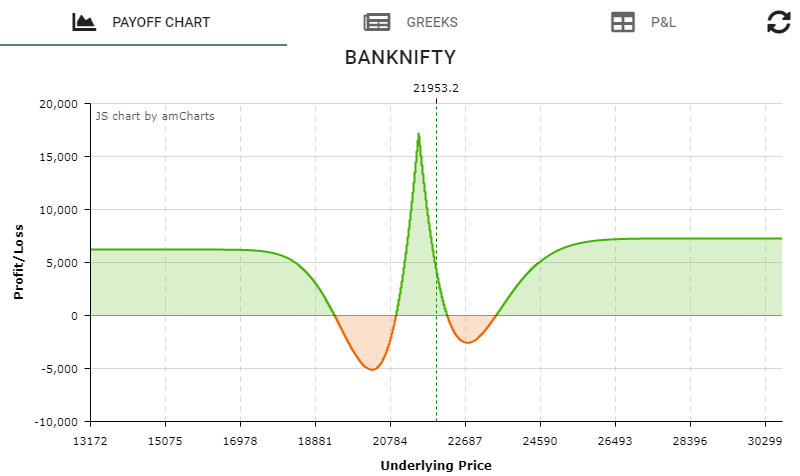

2. Single straddle at 32200 for May 20 expiry : 6Lots

2. Single straddle at 32200 for May 20 expiry : 6Lots

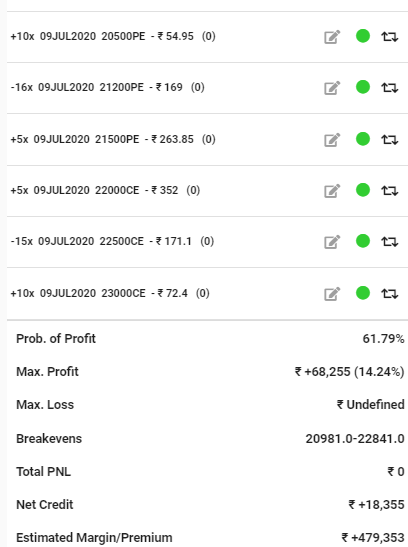

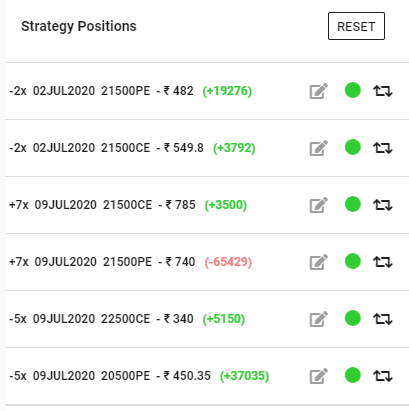

2. Attached are the positions deployed:

2. Attached are the positions deployed:

2. Then today even after a gap up, the rally got sold into and took support around the same levels and bounced back.

2. Then today even after a gap up, the rally got sold into and took support around the same levels and bounced back.

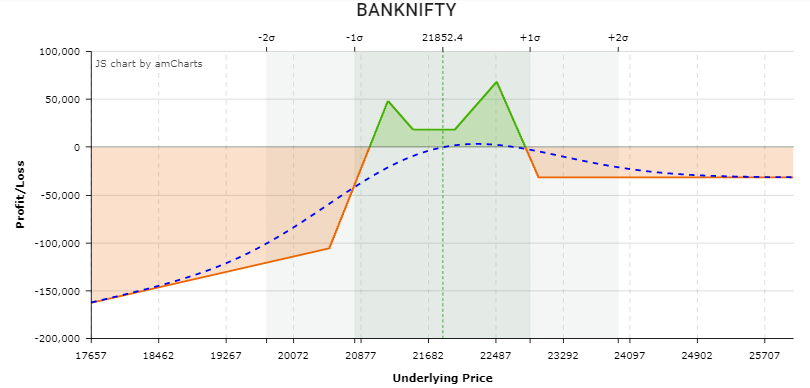

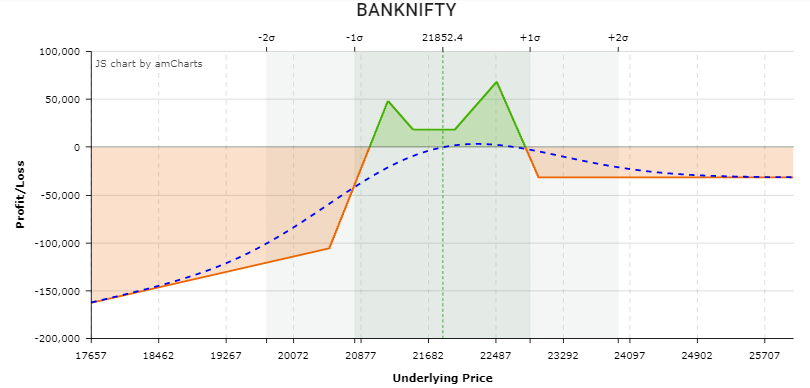

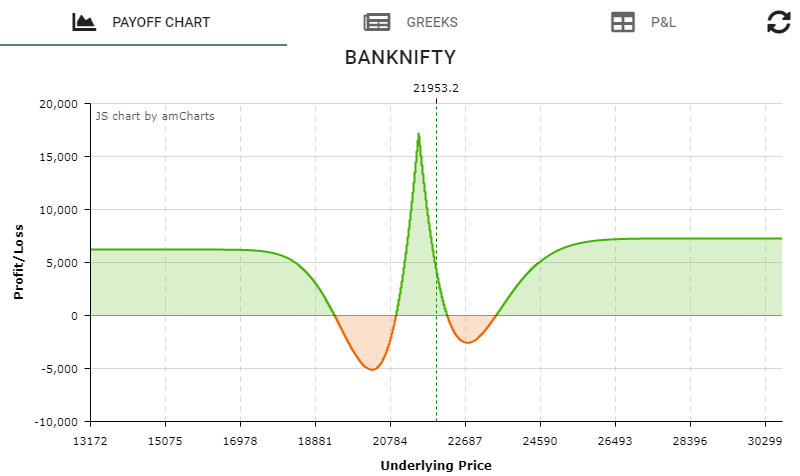

2. As the market rallied hard last week and used last hours of Thursday and whole of Friday to consolidate without giving up crucial zone of 21800 completely,there is a good likelihood of it attempting the recent highs again in the coming week.Thats an assumption I am working on.

2. As the market rallied hard last week and used last hours of Thursday and whole of Friday to consolidate without giving up crucial zone of 21800 completely,there is a good likelihood of it attempting the recent highs again in the coming week.Thats an assumption I am working on.

2. What you see here is a Double Calendar Spread modified to follow trend of the market. If the market is non-trending and stays within 0.5 sigma (standard deviation), it gains due to positive #theta or time-decay. If the market is trending on one side, #gamma gets active.

2. What you see here is a Double Calendar Spread modified to follow trend of the market. If the market is non-trending and stays within 0.5 sigma (standard deviation), it gains due to positive #theta or time-decay. If the market is trending on one side, #gamma gets active.