There aren't many people like #CharlieMunger. In addition to being one of the world's richest people, Munger is also considered to be one of its greatest thinkers.

Here's a collection of some of his best #advice, which can help you build your own fortune ― and live a good life.

Here's a collection of some of his best #advice, which can help you build your own fortune ― and live a good life.

1. "Spend each day trying to be a little wiser than you were when you woke up."

Munger is a voracious reader. He spends most of his day reading and thinking, all the while strengthening and expanding his mental models across a wide variety of academic disciplines.

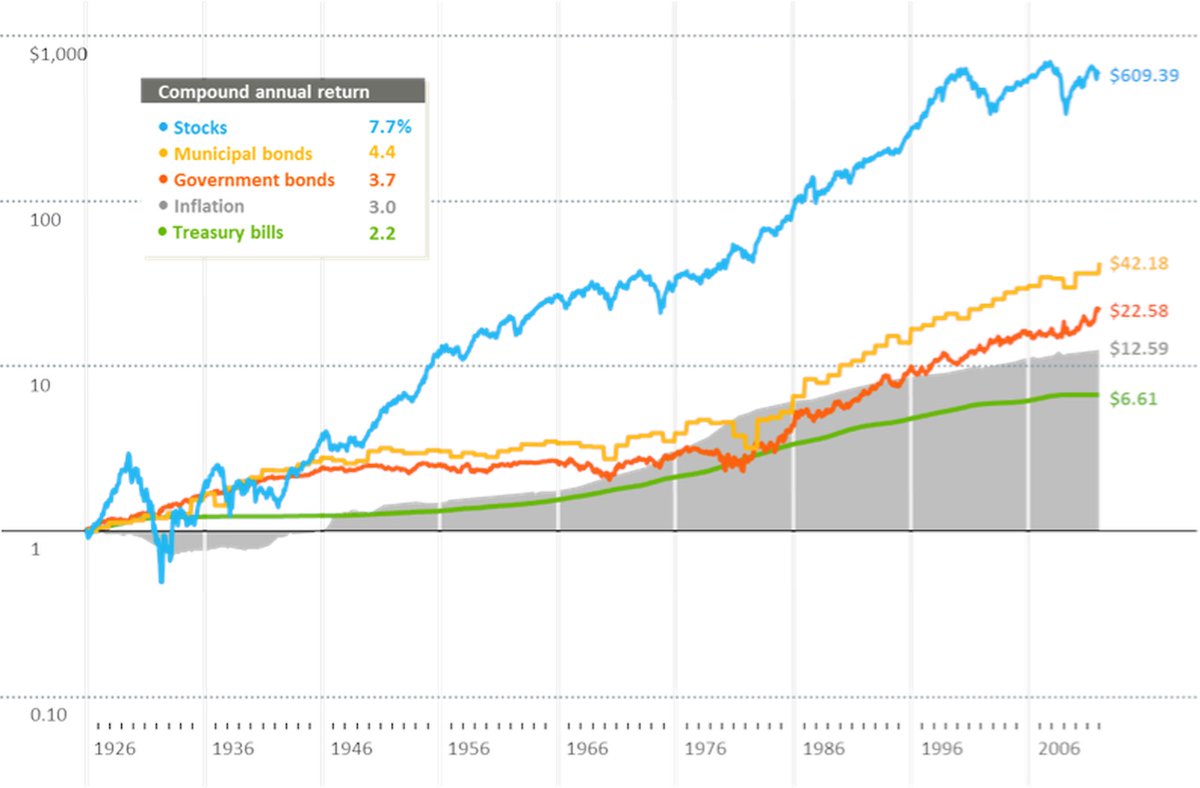

By compounding his knowledge over years and decades, Munger has built an incredible foundation of wisdom from which to draw on when evaluating investments.

2. "Invert, always invert."

Munger likes to look at problems in reverse. By focusing on what we hope to avoid, we can often find the solution to our problems ― and a path to success.

3. "The No. 1 idea is to view a stock as an ownership of the business and to judge the staying quality of the business in terms of its competitive advantage."

Determining which businesses will win — both now and in the future — is a vital component to profitable investing. Network effects, brand loyalty, and low-cost production are examples of competitive advantages that can help make a company successful. There are many others.

4. "All intelligent investing is value investing"

As Munger's longtime business partner Warren Buffett says, "Price is what you pay; value is what you get."

For every business Munger and Buffett purchase ― either in whole or in part ― on behalf of Berkshire Hathaway and its shareholders, they always strive to pay a price below that of the company's intrinsic value.

And by requiring a margin of safety, they tilt the odds of success even more in their favor.

5. "A great business at a fair price is superior to a fair business at a great price."

Price matters, but quality matters even more. Strong businesses can compound wealth at high rates over many years. In contrast, an investor who purchases an average business at a discount will likely be best served by selling it once it reaches its fair value.

6. "We have three baskets for investing: yes, no, and too tough to understand."

Munger values simplicity. He's not afraid to say that a business is too complicated for him to understand. And if it's not obvious that a company is a good investment, he quickly moves on to the next candidate.

7. "The idea of excessive diversification is madness."

Diversification can lessen risk for most investors. Yet for those who put in the time and work to thoroughly understand their investments, Munger believes they will earn the highest returns possible by investing only in their best ideas.

8. "The big money is not in the buying or selling, but in the waiting."

Munger is a long-term investor. Buying great businesses and holding them for many years is the foundation of his approach ― and Berkshire's tremendous success.

9. "You must force yourself to consider opposing arguments. Especially when they challenge your best-loved ideas."

Even as you strive to hold your stocks for the long term, you must remain vigilant to new threats that could derail your investments.

Rather than seek out evidence confirming that your investment thesis is correct ― as many investors are prone to do ― you'll be better served by looking for signs that you're wrong.

10. "Quickly identify mistakes and take action."

If you do come across information that suggests your investment thesis is incorrect, your best course of action is likely to sell sooner rather than later. This is true regardless of whether you are up or down on the position.

It may not be easy, but Munger believes you should sell and invest the capital in a better idea.

11. "Someone will always be getting richer faster than you. This is not a tragedy."

Many investors make the mistake of trying to keep up with the Joneses. This can lead them to take on too much risk, often in the form of leverage. This, in turn, has led to countless calamities, many of which could have been avoided.

12. "Our experience tends to confirm a long-held notion that being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical thing, will often dramatically improve the financial results of that lifetime."

All that is needed for a lifetime of investment success is a few great stocks held over many years.

Live within your means so that you'll have the funds to invest when these opportunities arise — and don't be afraid to invest significant sums when the odds of success are heavily in your favor.

Done well, Munger's strategy can help you create vast amounts of wealth over time.

Done well, Munger's strategy can help you create vast amounts of wealth over time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh