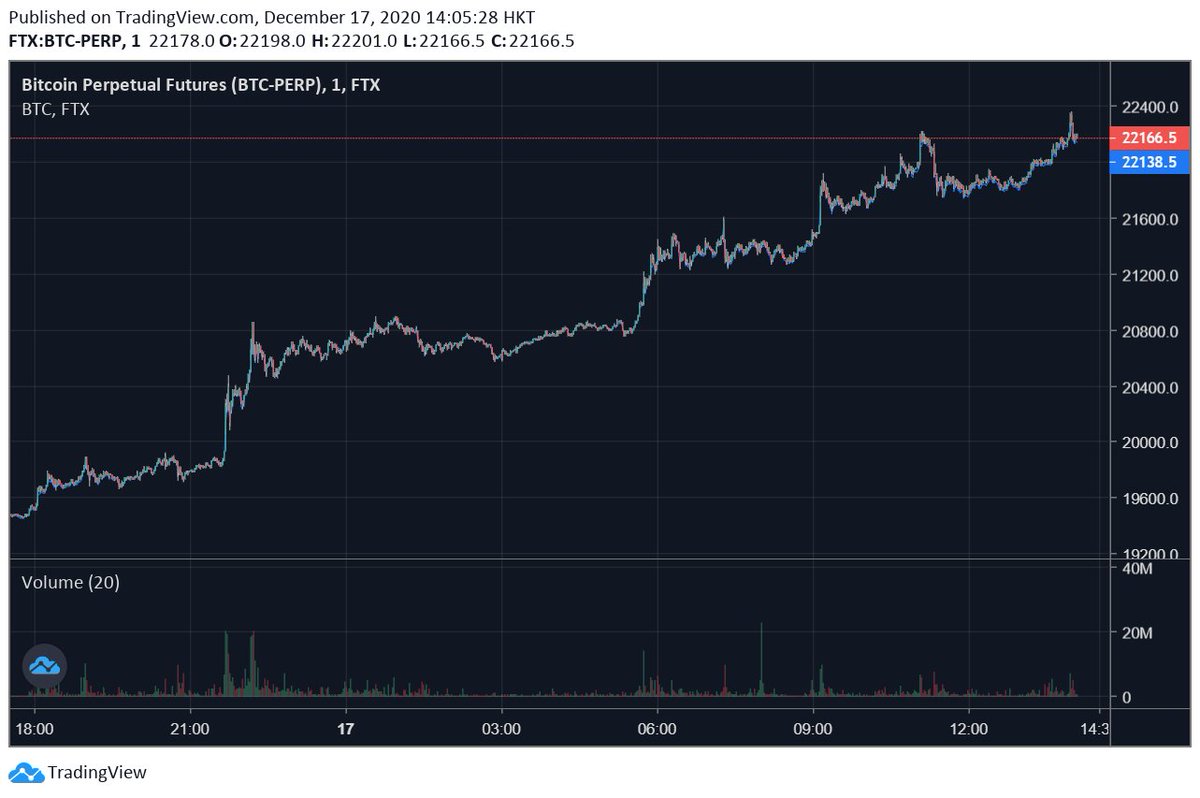

I do wish I had something more "different" to say than: buying kept up into liquidations which dried up around 19900, people sold and the new levered longs got liquidated down to here. But that's pretty much the whole story so far today!

https://twitter.com/AlamedaTrabucco/status/1333412544476659713

It is worth noting that if you noticed the liquidations dried up -- which was pretty possible -- selling was a great trade, because of how much of the pop was due SOLELY to those liquidations. There were a LOT, organic buying did not explain TOO much of this rally.

(At least from 19300 or so on to 19900, anyway -- there was plenty of organic buying before that, but by 19300 it was mostly liquidations.)

And the thing that ALWAYS happens when liquidations end is reversion: how much is unclear, and this is reverting more than is typical because a bunch of new levered longs are getting liquidated, too. But that was also predictable, it literally happened last week near ATH!

On some level this rally to near 20k followed by immediate reversion is like, an actual carbon copy of this one! Trading it the same way basically just worked -- hope you did!

https://twitter.com/AlamedaTrabucco/status/1331613964279582727?s=20

It did recover a bit more this time than it did last time, and it's slipped into a "zone" without a ton of liquidations (given it's been here + all nearby prices recently this makes sense). Unclear which way it will go, has some room before TONS of momentum should pick up again.

• • •

Missing some Tweet in this thread? You can try to

force a refresh