Yeah, among other problems with this analysis, it also just TOTALLY ignores the main reason that a company like Alameda (which does trades from all of these buckets all day every day) might have for trading net in one direction in a day on one market:

https://twitter.com/austerity_sucks/status/1337723078785327106

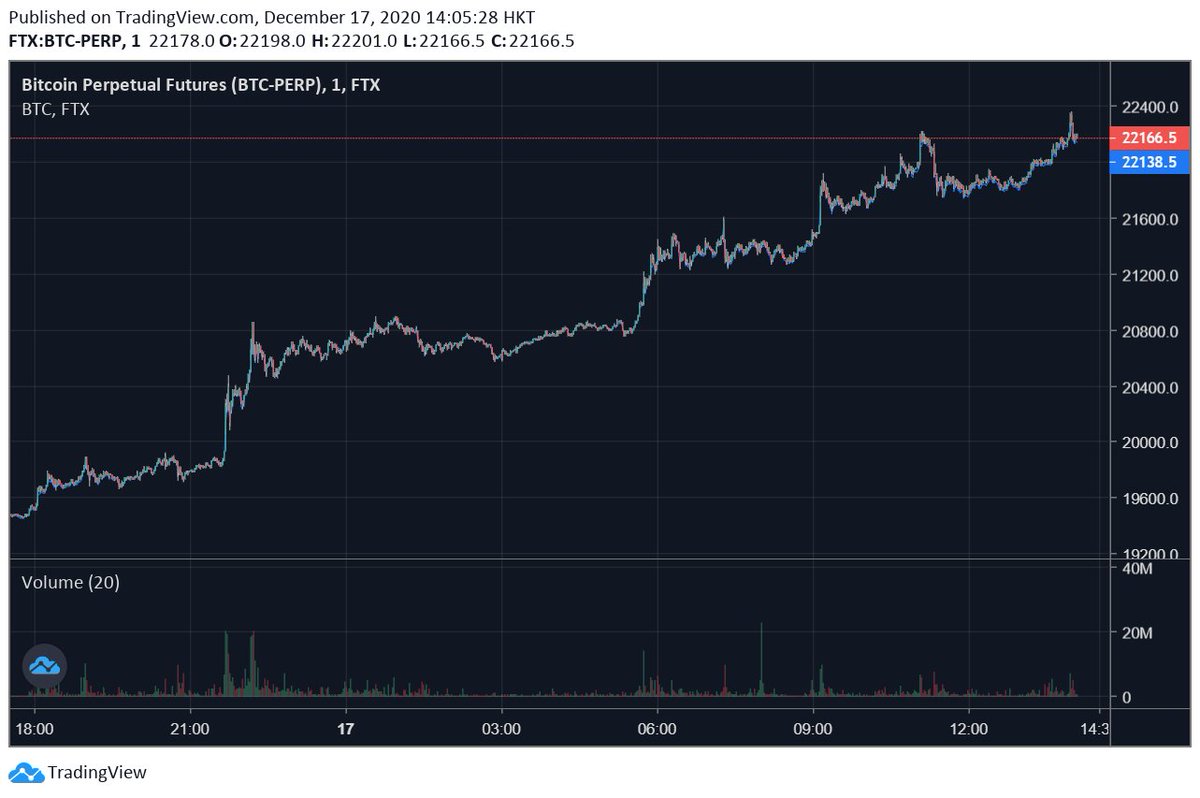

... and that reason is: it's out of line with some other market(s)! For instance, let's just take today: I just checked, and it looks like in the 12 hours I've been trading today, Alameda has net bought 100 BTC or so on the OKEx BTC/USDT market.

Why is this? Well, during this time, we were also fairly flat BTC deltas (as we quite often are), so the reason *surely* was not, as this report might have you claim, that we were net buying BTC today!

And it quite rarely is. No, in this case, the real reason was that OKEx's BTC/USDT market was, on average (at the times we executed), a) one of the richer spot BTC markets (and USDT has been trading >$1, so this makes sense) b) one of the "better" BTC markets overall to buy.

What does "better" mean? It's complicated, but let's take a look at a section of one of Alameda's tools traders use to monitor the markets: our premium viewer.

This displays the current premium of 3 BTC futures expiring in March, as well as how they've changed in the past 30s, 2m, 15m, 1h, and 6h. They're all at close to 2.5-3% premia to spot, and they've risen in the past few hours.

Since USDT is trading >$1, this sort of just suggests that -- margin considerations and whatnot being equal -- we'll *likely* want to be buying BTC/USDT and selling futures, to lock in a spread.

Now, margin is not equal, there exist other products, and really you wanna compare the products to their expected short-term moves, not holding til March. But the premia are up recently and USDT isn't down, suggesting it's likely not *crazy* we prefer buying BTC/USDT to futures.

Amd, FWIW, there are other little idiosyncratic effects at play, too. Alameda sometimes might do a large OTC deal, buying a bunch of USDT for cheap -- that means we have to slowly sell out of it, meaning we're gonna be *slightly* more apt to do some things than normal ...

... like buy BTC on the OKEx BTC/USDT market -- meaning that doing that on net might have actually, literally 0 to do with either net buying BTC or even thinking something specific about the OKEx BTC/USDT market. We might just have USDT.

The more general lesson here: it's really hard to try to draw robustly good conclusions with incomplete data, and especially with data that's incomplete in predictably biased ways. Knowing about 1% of a trader's trades tells you almost *nothing* about what they're doing.

And that's especially true for traders putting on lots of spreads -- which the traders who do the most volume quite often are doing! That's how volume is up and also BTC doesn't just move 50% in a week -- they're not doing something directional, on average.

And using biased data is often WAY worse than doing nothing at all! I think that, in reality, close to all sized traders acted in close to the same way during the period this article analyzed -- which is a lot closer to the reasonable prior, anyway.

• • •

Missing some Tweet in this thread? You can try to

force a refresh