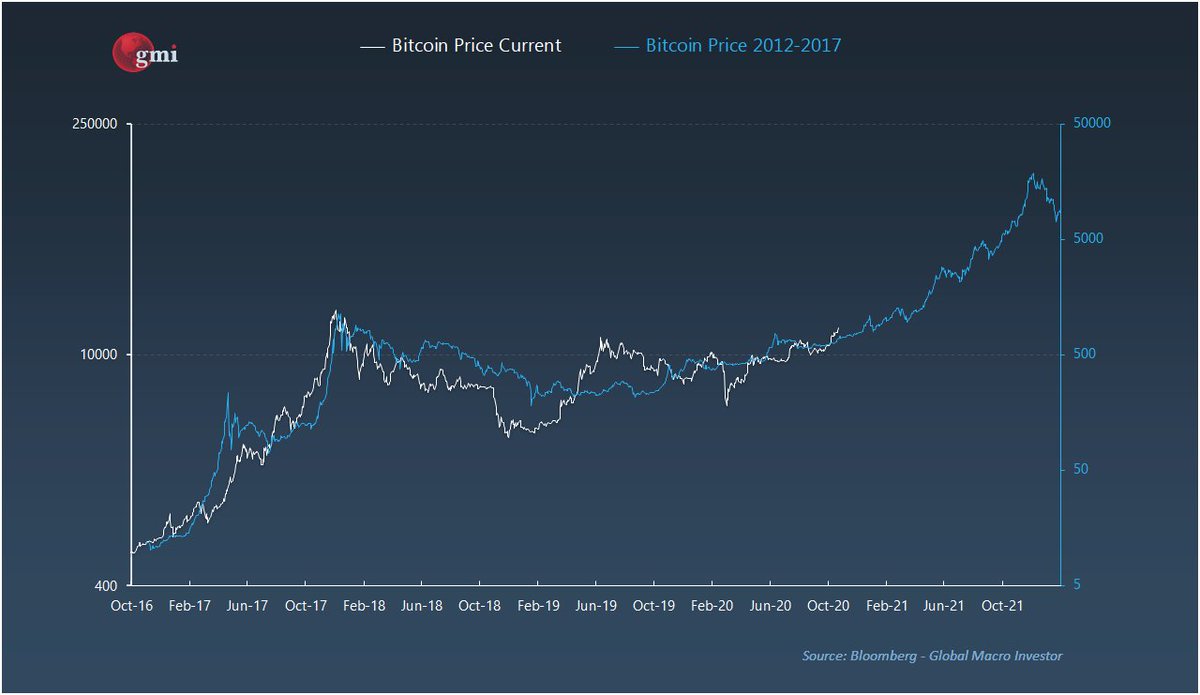

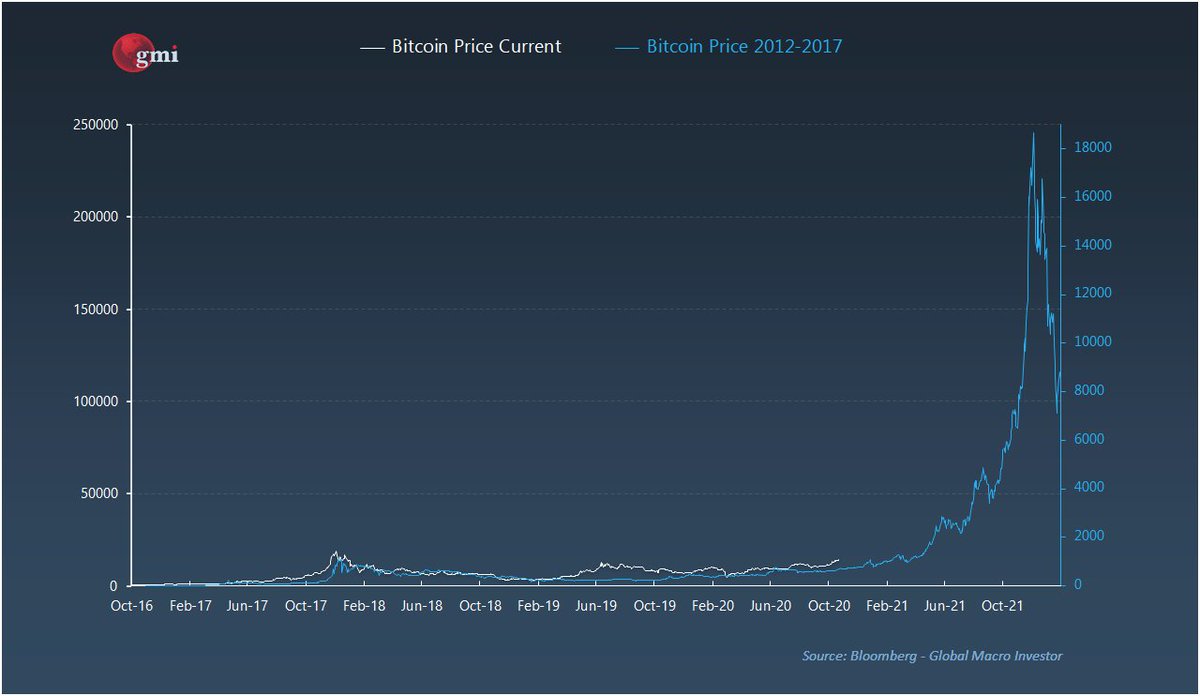

Bitcoin is potentially facing some serious technical headways... the daily DeMark is showing a cluster on 2 13's and a 9 and tomorrow might put in ANOTHER 13!

This all puts the odds of a larger correction in play, not a certainly, but top patterns across 3 time series are something to take seriously and if you are not a long-term HODLer, you might consider some caution in merited.

Let's see...

Let's see...

• • •

Missing some Tweet in this thread? You can try to

force a refresh