Short thread

Anyone who has been paying attention knows that what we’re hearing from a number of economists today was laid out more forcefully more than a decade ago by those they prefer to ignore.

Anyone who has been paying attention knows that what we’re hearing from a number of economists today was laid out more forcefully more than a decade ago by those they prefer to ignore.

What, eg, did Blanchard discover that wasn’t already written up by @stf18 in 2006? papers.ssrn.com/sol3/papers.cf…

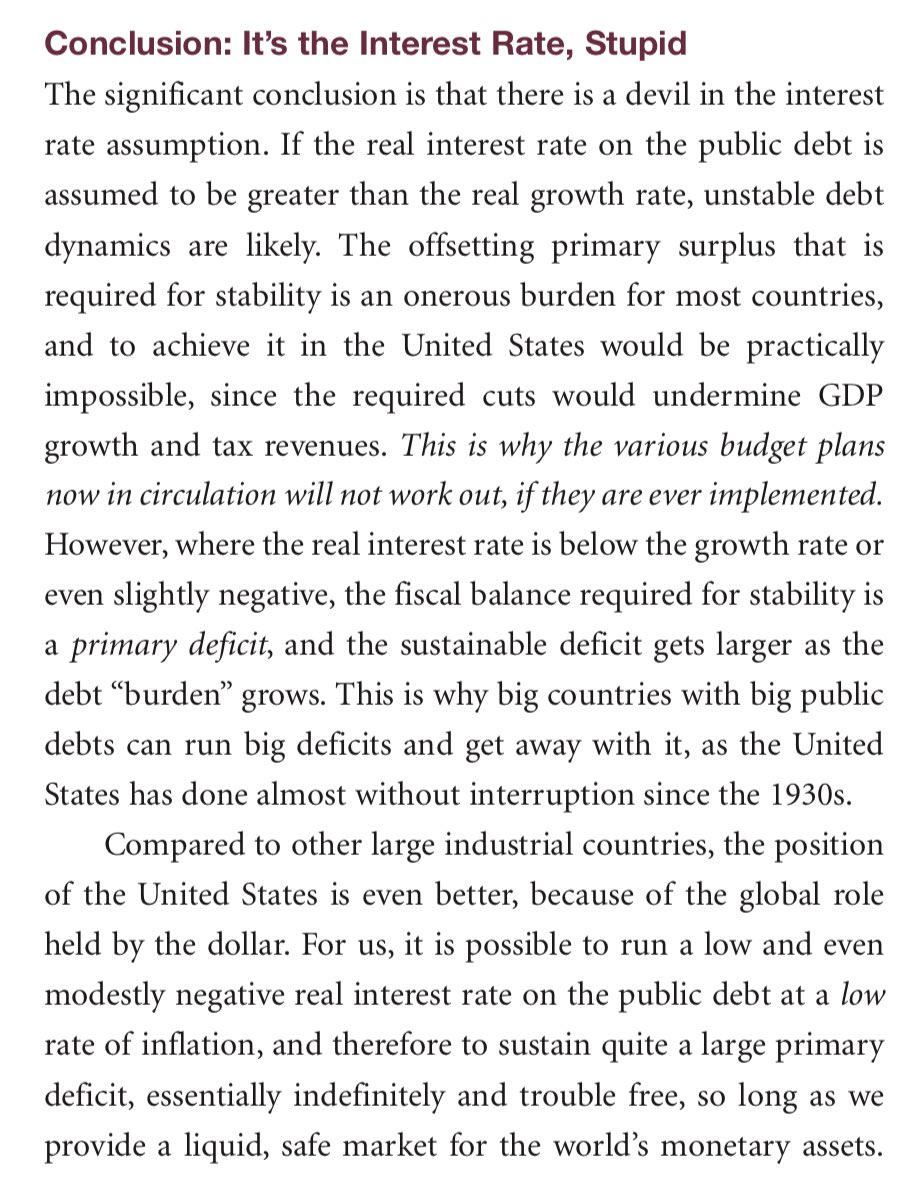

Mainstream econ has arrived at the position that we’re probably OK as long as CBO forecasts re: the future path of interest rates is off. MMT asserts that the future path is a policy choice.

Anyway, there’s an enormous literature—spanning well over a decade—on debt sustainability from an MMT perspective, most of it by @stf18 who always lays things out in extremely detailed fashion. As here neweconomicperspectives.org/2013/01/functi…

Scott Fullwiler’s 2016 paper really fleshes it all out. wer.worldeconomicsassociation.org/files/WEA-WER-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh