1/ the scale of FinTech in China is mind blowing

in one year, Ant Group originated loans to 500 million consumers

this is unsecured lending, done 100% via mobile, with Ant providing the origination and servicing and banks underwriting the loans

wsj.com/articles/jack-…

in one year, Ant Group originated loans to 500 million consumers

this is unsecured lending, done 100% via mobile, with Ant providing the origination and servicing and banks underwriting the loans

wsj.com/articles/jack-…

2/ Ant takes none of the capital risk, but takes 30-40% of the interest on the loans for providing the technology and servicing

capital is no longer a competitive advantage!

lending as a service is coming, and FAST

capital is no longer a competitive advantage!

lending as a service is coming, and FAST

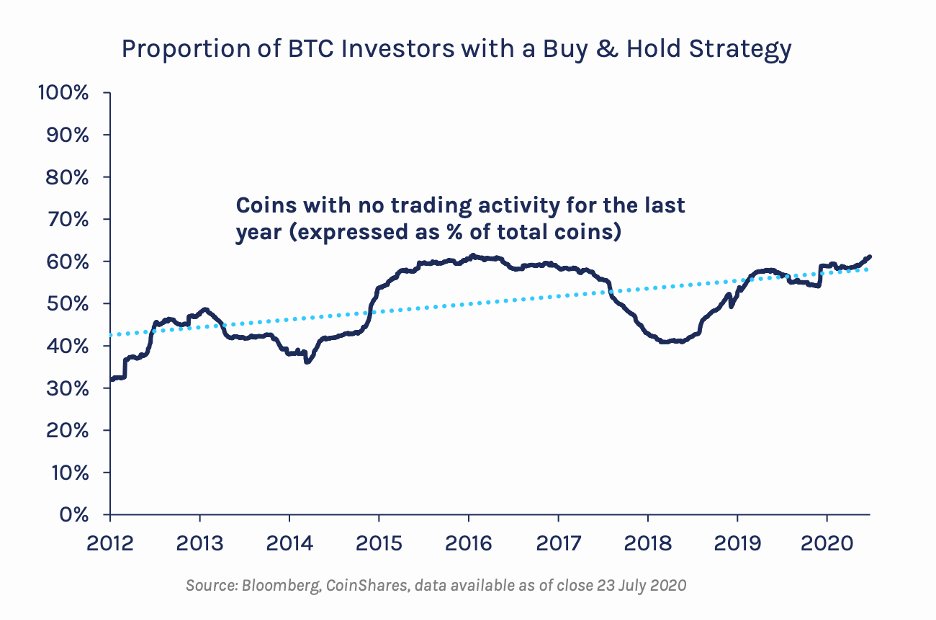

3/ as covered in our @CoinSharesCo #CryptoCreditSummit, the crypto ecosystem has figured out securitization and is now figuring out lending

while crypto lending today is 100% collateralized (backed by assets), unsecured lending is coming!

learn more: coinshares.com/insights/crypt…

while crypto lending today is 100% collateralized (backed by assets), unsecured lending is coming!

learn more: coinshares.com/insights/crypt…

4/ whether CeFi, DeFi, or CeDeFi 🙃 - there are only a handful of levers lenders can use to drive higher net interest margins in lending

- reduce cost of customer acquisition

- reduce cost of capital

- increase lending volume through taking more risk

- reduce cost of customer acquisition

- reduce cost of capital

- increase lending volume through taking more risk

5/ in the next decade, we'll see trillions of dollars in loans originated, serviced, and settled entirely on-chain, with increased democratization in the underwriting process, which allows interest to be paid to providers of capital instead of institutions who custody capital

• • •

Missing some Tweet in this thread? You can try to

force a refresh