ECB QE data is out!

Bulk of PEPP still in public debt securities (93% of the €700bn so far).

A chartstorm 👇

Bulk of PEPP still in public debt securities (93% of the €700bn so far).

A chartstorm 👇

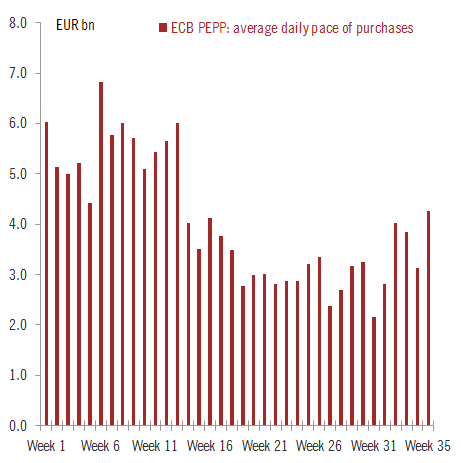

Before we dig into monthly QE across countries and markets, last week's PEPP purchases were the largest in almost 6 months (€21.3bn).

Could be catch-up, could be that the ECB wanted to send a signal ahead of this week's meeting, but more likely front-loading before Xmas break.

Could be catch-up, could be that the ECB wanted to send a signal ahead of this week's meeting, but more likely front-loading before Xmas break.

ECB QE monthly data: stabilising ahead of Christmas break.

Average monthly PEPP was €66bn in Oct-Nov, of which €70bn per month in public debt (as CP holdings declined by €8bn).

Average monthly PEPP was €66bn in Oct-Nov, of which €70bn per month in public debt (as CP holdings declined by €8bn).

ECB PEPP deviations from capital keys were the smallest since the start of the programme, a sign of lower pressure on the ECB to act.

🇮🇹 The share of Italy (17.4%) was only slightly above its capital key (17%) in Oct-Nov.

🇮🇹 The share of Italy (17.4%) was only slightly above its capital key (17%) in Oct-Nov.

From PEPP to APP (€20bn QE + €120bn Temporary Envelope), this is where all the action took place in November. Let's not overreact as the usual caveats apply: large redemptions + front-loading + reinvestment smoothed over 12 months.

Still, largest APP deviations ever!

Still, largest APP deviations ever!

When it comes to the APP one hsould look at the bigger picture as monthly data can be very volatile, so here are the *cumulated* deviations since 2015:

- Germany back to broadly in line with ECB capital keys

- Italy, France, Spain still largely over-purchased

- Germany back to broadly in line with ECB capital keys

- Italy, France, Spain still largely over-purchased

Which brings me to my favourite topic, issuer limits. They might still come back to haunt the ECB.

There could be several reasons why Germany was overpurchased that massively in the APP in November, most of them unrelated to limits. But at the same time, German debt rose a lot.

There could be several reasons why Germany was overpurchased that massively in the APP in November, most of them unrelated to limits. But at the same time, German debt rose a lot.

German debt issuance surprised to the upside including €140bn in taps directly with the Treasury. This has helped the German share in ECB PSPP to *decline* in 2020, from 30% to around 26%, in turn making room for @bundesbank overpurchases in November.

https://twitter.com/fwred/status/1326829211122798599

I'll post my final ECB QE limits chart in a separate tweet but the bottom line is that the ECB and NCBs are likely to prepare for some shifts in 2021, including larger PEPP vs APP, smaller deviations, higher share of Supras and corporates, etc. (/end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh