$SNX vs $SYN thoughts:

1) Not a war. I like them both

2) I think they can coexist (at least for a time)

3) $SYN will be on ETH's main chain

4) $SNX will be on an L2... at least until ETH 2.0 fully launches

1) Not a war. I like them both

2) I think they can coexist (at least for a time)

3) $SYN will be on ETH's main chain

4) $SNX will be on an L2... at least until ETH 2.0 fully launches

https://twitter.com/detritus99/status/1337569729486184448

5) $SYN = a very simple way to get leverage. It's literally like buying a leveraged ETF in your brokerage account. not such how it could possibly be any easier

6) $SNX = more sophisticated & will prob cater to more pro traders. it will be faster and may have a range of leverage

6) $SNX = more sophisticated & will prob cater to more pro traders. it will be faster and may have a range of leverage

7) Both projects face big risks ($SYN dev is anon + contracts unaudited)

8) Both projects could lead to big rewards

9) Sometimes, simplicity wins

10) $SNX is far from a newcomer... Check out why I like it so much...

8) Both projects could lead to big rewards

9) Sometimes, simplicity wins

10) $SNX is far from a newcomer... Check out why I like it so much...

https://twitter.com/redphonecrypto/status/1274821955875635201?s=20

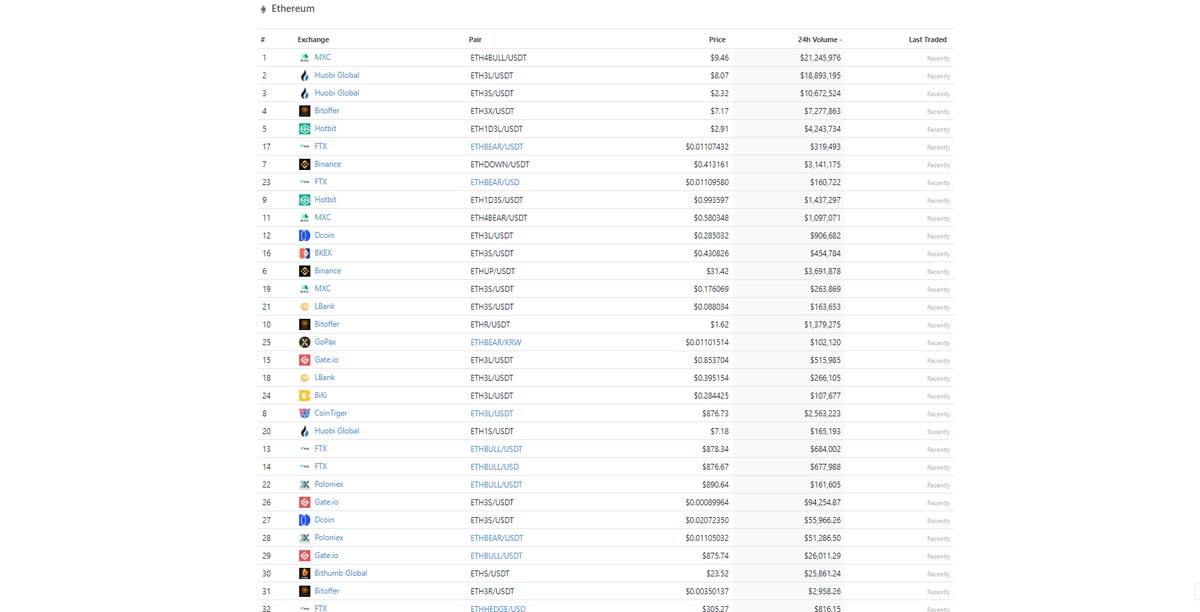

11) All that said, there is a sea of leveraged #eth products in #cefi (see attached). There will be many in #defi... at least for a time

• • •

Missing some Tweet in this thread? You can try to

force a refresh